- within Corporate/Commercial Law, Finance and Banking and Family and Matrimonial topic(s)

- in United States

- with readers working within the Utilities industries

In today's times, should we still struggle to determine if Corporate Governance (CG) is a myth or a reality?

The word Governance is derived from the latin word Guvernare which means to steer or to control. The importance of CG in today's era can no longer be questioned. The Professional body Institute of Chartered Secretaries and Administrators (ICSA) of UK is now known as the Chartered Governance Institute of UK and Ireland (CGI); Chartered Secretaries are now known as Chartered Governance Professionals. This in itself demonstrates the level of importance being attributed to CG globally and in fact, CG has now mutated into ESG with the scope widened to also cover the Environmental and Social aspects of doing business in addition to Governance, and which are now very much at the top of the CG landscape.

As per the CGI, good governance is key to how organisations in all sectors achieve their purpose. It is equally essential whether that purpose is commercial, charitable, or to provide public services.

Organisations that have good governance use clear decision-making processes, behave openly by reporting on their activities, actively engage with their stakeholders, eectively manage the risks they face, and take responsibility for controlling and protecting their assets, including their reputation. Each of these areas of governance activity contributes to an organisation's success through making the latter responsible and accountable to the stakeholders and communities they serve. We also increasingly expect organisations to uphold high ethical standards, be good employers and be mindful of their environmental impact. Governance supports the setting of these organisational

standards and maintains the board's focus on implementing those and ensures that the management team operates along these principles.

An effectively run company that bases its structure and corporate culture on good corporate governance principles helps prevent major disasters like the fall of Enron, Satyam, Cadbury, Wal-Mart & Xerox which proved catastrophic for those companies.

Mauritius upholds the value of CG to a great extent. There is a National Committee on CG in place under whose responsibility a National Code of Corporate Governance ('the Code') was first published in 2003 and then revamped in 2016 and which applies to:

Other companies are also encouraged to give due consideration to the application of this code, insofar as the principles are applicable.

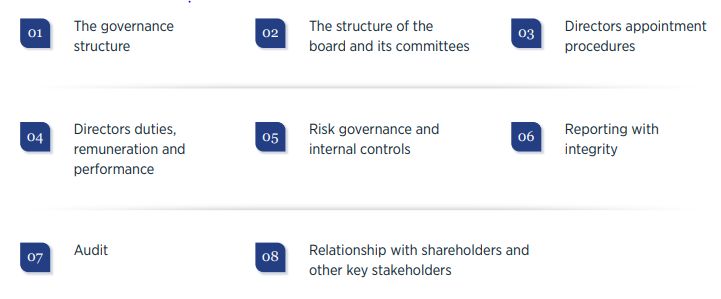

The code comprises a set of 8 principles and guidance aimed at improving and guiding the governance practices of organisations within Mauritius and encompasses the following:

The Code is well regarded both locally and internationally and the Mo Ibrahim Foundation has recognised Mauritius as having one of the highest standards of corporate governance in Africa, and the World Bank Group has commented favourably on the Code in its governance evaluation of the country.

The recent trend is that more and more companies are placing increasing pressure on themselves to implement best practices for CG principles in their organisational framework. CG disclosures are now becoming a regular feature on websites and annual reports. This is not only due to the increase in awareness of the importance of CG and by extension ESG but also to meet the increasing demand and expectations from investors and other stakeholders who are now assessing a company's viability and sustainability on the basis of its governance structure. These factors are provoking a rethinking of the boards' decision making processes and challenging the traditional models of governance that have guided boards until now. Strong governance gets noticed by shareholders, stakeholders, employees and customers alike and has a strong bearing on a company's reputation. The strength of a company's CG principles can potentially lead to either a higher or a lower valuation of a company.

Shareholder activism and a move towards public accountability has moved the relationship between CG and social responsibility, sustainability and broader societal issues to the top of the agenda on an international scale.

The experience gathered during the COVID-19 pandemic has also brought about a change in the modus operandi of all organisations globally and accelerated the trend of integrating ESG factors into decision making by bringing into focus both the role of business in confronting wider societal and environmental issues and the need for strong CG. Board and Annual meetings are now no longer held exclusively in person but also carried out virtually setting a new trend which is here to stay. This shift brought major challenges as well as opportunities in the CG framework and landscape. Going virtual, not only allows cost savings on travelling and other ancillary expenses but also allows for a higher attendance of board members and enables the Board to spread the net wider to include the best international talent with the right exposure and experience to join the Board as well as being an enabler for Corporate Board diversity. Similarly, by oering a chance for investors to attend remotely, it increases shareholder engagement and attendance. The legislative framework has also been amended in many jurisdictions to allow for virtual Annual Shareholder meetings.

These emerging trends in CG has led to a greater awareness of where the priorities and focus from the board room should lie, and the future is set to be more collaborative and transparent leading to better alignment and value creation for all stakeholders.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]