- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Banking & Credit and Law Firm industries

- within Corporate/Commercial Law topic(s)

- within Antitrust/Competition Law, Government and Public Sector topic(s)

- with readers working within the Utilities industries

1. Legal and regulatory framework

1.1 Which laws and regulations govern initial public offerings (IPOs) in your jurisdiction?

In Switzerland, primarily financial services laws and stock exchange regulations must be considered with respect to IPOs. The public offer of securities in Switzerland is regulated in:

- the Financial Services Act; and

- the Financial Services Ordinance.

Moreover, the regulations of the SIX Swiss Exchange (SIX), respectively, BX Swiss (BX) include the Listing Rules (LR) as well as additional rules and regulations which are relevant for the listing and trading of securities.

In addition, Switzerland has a special exchange for digital assets: the SIX Digital Exchange (SDX), with its SDX Listing Rules and additional rules and regulations. Switzerland also has a distributed ledger technology (DLT) trading facility which is authorised by the Swiss Financial Market Supervisory Authority (FINMA), on which digital assets can be admitted to trading: BX Digital. BX Digital is governed by the BX Digital Admission Rules and its additional rules/regulations.

1.2 Do any other regional, national or supranational rules or regulations have relevance in this regard?

Yes. Trading venues, disclosures of shareholdings, insider trading and market manipulation are regulated by:

- the Financial Market Infrastructure Act; and

- the Financial Market Infrastructure Ordinance.

Furthermore, International Financial Reporting Standards, Swiss General Accepted Accounting Principles or other accepted accounting rules may be required depending on:

- the trading venue; and

- the segment of the listing or admission to trading.

In addition, for cross-border offerings related to the European Union, the EU Prospectus Regulation (2017/1129) must be considered.

Moreover, bilateral agreements with the European Union or the United Kingdom or corresponding foreign regulations may be relevant, particularly concerning the equivalence of stock exchanges. The European Union and the United Kingdom have recognised Swiss exchanges as equivalent.

1.3 Which bodies are responsible for regulating IPOs in your jurisdiction? What powers do they have?

The following bodies are responsible for regulating IPOs in Switzerland:

- SIX Exchange Regulation AG (SER): The SER regulates and monitors issuers and exchange participants on SIX. In addition, the Regulatory Board:

-

- decides on:

-

- the admission of securities to trading; and

- the allocation of securities to the individual exchange standards for equity and debt securities;

- monitors the fulfilment of the information duties for listed companies, such as ad hoc publicity and reporting obligations; and

- is responsible for related enforcement procedures.

- The SER also acts as a prospectus office and has the power to:

-

- approve prospectuses; and

- examine listing requirements and ongoing obligations for SIX-listed companies.

- SDX Trading AG: The SDX is regulated similarly to SIX, and the SDX rules and regulations are modified versions of those of SIX (and reference them subject to certain modifications).

- BX Swiss AG:

-

- issues the BX listing rules and regulations; and

- examines listing requirements and ongoing obligations for BX-listed companies.

- The Admission Board:

-

- decides on the admission of securities; and

- monitors issuers' compliance with their obligations during the listing.

- In its function as a prospectus office, BX has the power to approve prospectuses.

- BX Digital AG: The Admission Board:

-

- decides on the admission of issuers and DLT securities; and

- monitors compliance with the issuers' obligations during admission.

The following bodies are also worthwhile mentioning in this context:

- FINMA: FINMA is the main financial market regulator in Switzerland. However, it is not the competent authority for approving prospectuses or listings/admissions to trading, which is the responsibility of the prospectus offices (ie, exchanges/DLT trading facilities).

- Swiss Takeover Board: The Takeover Board:

-

- enacts rules on public takeovers and share buybacks; and

- supervises compliance with such rules.

- Federal Tax Administration (FTA): The FTA is responsible for tax matters. It may be involved in relation to tax issues and stamp duty.

1.4 What is the general approach of these bodies to the regulation of IPOs in your jurisdiction?

The regulatory approach of these bodies is generally principles based and issuer friendly:

- emphasising:

-

- transparency;

- investor protection; and

- efficient markets; and

- seeking to maintain flexibility and international competitiveness.

In particular, Switzerland's self-regulated exchanges and DLT-trading facilities are unique in Europe: while most other countries rely on government authorities to supervise their exchanges, in Switzerland, the regulatory bodies of the exchanges or DLT trading facilities fulfil this function. Self-regulation means that the market participants themselves establish the rules for exchange trading. The regulator, FINMA, must approve these rules. However, the exchange or DLT trading facility remains responsible for ensuring that issuers and trading participants comply with its rules.

2. Market snapshot

2.1 How mature is the IPO market in your jurisdiction?

Switzerland has a very mature IPO market, with a broad range of experienced institutional and professional IPO investors. For example, on 23 June 2025, Amrize Ltd made its trading debut on the SIX Swiss Exchange (SIX) after its successful spinoff from Holcim as an independent, publicly traded North American market leader in building solutions. The resulting market capitalisation of Amrize was around CHF 26 billion. Further, in 2025, an important milestone was the IPO of healthcare company BioVersys on SIX (market cap: CHF 207.9 million). In 2024, the highlight was the IPO of healthcare company Galderma Group AG on SIX (market cap: CHF 15.2 billion). Furthermore, telecoms company Sunrise Communications AG conducted its IPO on SIX (market cap: CHF 2.9 billion). The number of new IPOs in Switzerland per year is influenced by global market conditions and can thus be cyclical.

2.2 What are the main securities markets/stock exchanges in your jurisdiction and what are the key features of each?

The following are the main traditional exchanges in Switzerland and their key features:

- SIX Swiss Exchange (www.six-group.com/en/products-services/the-swiss-stock-exchange.html): SIX is the main exchange in Switzerland and a gateway to the Swiss and international capital markets. SIX is the third-largest exchange in Europe, with a free float market capitalisation of CHF 1.8 trillion (per mid-2024). Around 250 companies of all sizes and sectors – including small and mid-caps, family businesses and international giants – are listed on SIX.

- BX Swiss (www.bxswiss.com): BX is the second-largest exchange in Switzerland and has historically had a focus on:

-

- mid and small-cap IPOs; and

- agility and innovation.

The following are the main digital exchanges and distributed ledger technology (DLT) trading facilities in Switzerland and their key features:

- SIX Digital Exchange (SDX) (www.sdx.com): SDX is the world's first fully regulated stock exchange and central securities depository (CSD) based on blockchain technology. It focuses on digital securities and DLT-based infrastructure.

- BX Digital (www.bxdigital.ch): BX Digital is a DLT trading facility and regulated financial market infrastructure in Switzerland, with a trading and settlement system for digital assets on public blockchain.

- Rulematch: Rulematch is a digital assets trading venue for the spot trading of cryptocurrencies and other digital assets. SDX and Rulematch have announced a partnership to offer financial institutions an integrated solution to trade, settle and manage crypto assets (www.rulematch.com).

2.3 What are the key advantages and disadvantages of conducting an IPO in your jurisdiction?

Advantages: The key advantages of conducting an IPO in Switzerland are as follows:

- Reputation: Switzerland's stable political and economic environment enhances:

-

- investor confidence; and

- the reputation and credibility of companies.

- Efficient regulatory framework: Switzerland's model of self-regulation of the exchanges allows for a faster, more flexible listing process.

- Lower costs: A listing on a foreign exchange and the resulting exposure to multiple jurisdictions are generally expensive and legally challenging issues. In Switzerland, however, the costs of an IPO are generally lower than in other jurisdictions (especially compared to the United States).

- Lower underwriting fees: The underwriting fees, which typically are the biggest cost item in an IPO, amount to approximately 2–5% of the gross IPO proceeds in Switzerland, but total around 3.5–7% in the United States.

- Lower risks: Between 2010 and 2019, one out of six IPOs in the United States was subject to legal disputes and faced a high risk of class action litigation. This risk arises as soon as a company presents documents to prospective investors prior to an IPO. In Switzerland, plaintiffs must meet higher requirements for a liability claim to succeed. Moreover, class actions are not permitted under Swiss law.

- Higher visibility: Whereas in other markets, such as the United States, there may be over 1,000 IPOs each year, in Switzerland there are historically only a limited number of IPOs per year, making it much easier for a company to compete for capital and benefit from the high visibility resulting from the IPO.

- Access to investors: Switzerland offers access to a well-capitalised set of Swiss investors, but also to many international investors seeking to invest in one of the world's most stable and trustworthy currencies – the Swiss franc. Moreover, many foreign investors are invested in Switzerland.

Disadvantages: The key disadvantages of completing an IPO in Switzerland are as follows:

- Market size: Compared to larger markets such as the United States or China, the Swiss market is smaller, potentially limiting liquidity.

- Regulatory compliance: While efficient, the regulatory requirements are stringent, necessitating thorough preparation. Breaches of exchange regulations may lead to sanctions by the exchange.

2.4 What types of companies typically choose to conduct IPOs in your jurisdiction? Are any specific sectors particularly well represented in this regard?

A broad range of large and small companies in numerous industry sectors pursue or consider IPOs in Switzerland. The following sectors are particularly well represented:

- biotech and pharma;

- telecommunications;

- technology;

- financial services;

- industrial manufacturing; and

- real estate.

Furthermore, investment companies, real estate companies and collective investment schemes or other financial products are regularly listed in Switzerland. Moreover, since 2022, about 17 Chinese companies have listed global depository receipts on SIX under the China Stock Connect programme.

3. IPO process

3.1 How much preparation is required for an IPO in your jurisdiction, what does it preparation involve and how far in advance of an IPO should it start?

An IPO is one of the most important transactions of a company and a once-in-a-lifetime opportunity for its founders, investors and other stakeholders. However, the process is challenging. Getting a company ready for an IPO can take several years. When IPOs are considered by companies that are well prepared (often, but not always), the timeline for the IPO process should be in the range of four to six months, as described in question 3.6. The earlier the company starts the preparations, the better the chances of following a certain timeline.

3.2 What key rules and requirements must be met to conduct an IPO in your jurisdiction? What restrictions apply in this regard? Do any exemptions apply?

The key rules and requirements that must be met to conduct a listing and/or admission to trading in the context of an IPO in Switzerland are set out in the Listing Rules ("LR") of SIX Swiss Exchange (SIX) or BX, respectively, SIX Digital Exchange or the Admission Rules ("AR") of BX Digital. These rules contain general provisions and govern the listing and admission to trading of securities. As a general principle, the applicant for the IPO must provide evidence that the requirements of these rules in relation to the issuer and the securities are met.

Furthermore, the Regulatory Board may authorise exemptions from certain provisions of these rules, provided that:

- this is not against the interests of the investors or the stock exchange; and

- the applicant can provide evidence that the purpose of the provisions in question can be served satisfactorily by other means.

Requirements and conditions may be attached to the authorisation of an exemption.

Requirements for the issuer:

- The issuer must have been established as a company for:

-

- at least three years on SIX; or

- at least one year on BX.

- Exemptions for young companies are set out in the Directive on Track Records.

- The issuer must have produced annual financial statements that comply with the financial reporting standard applicable to the issuer for:

-

- the three full financial years preceding the listing application on SIX; and

- one full financial year preceding the listing application on BX.

- On the first day of trading, the issuer's reported equity capital must be:

-

- at least CHF 25 million, in accordance with the applicable financial reporting standard on SIX; and

- CHF 2 million on BX.

- the issuer is the parent company of a group, this requirement refers to the group's consolidated reported equity capital.

- In addition, the issuer must fulfil the requirements set out in Articles 7 and following of the Federal Act on the Licensing and Oversight of Auditors when appointing its auditors.

The Regulatory Board may determine further requirements for issuers if justified by:

- the nature of the business; or

- the securities that are to be listed.

Requirements for the securities: Among the numerous requirements for the securities, the following are notable:

- The securities must have a sufficient free float at the time of listing.

- The issuer must ensure that services pertaining to dividends and all other corporate actions, including the receipt and handling of exercise notices, are provided in Switzerland. The issuer may assign these activities to a bank or a securities firm which has the necessary professional and technical capabilities available in Switzerland.

- The listing must comprise all of the issued securities in the same category.

Obligations with respect to the listing: The listing application must contain:

- a short description of the securities;

- a request regarding the planned first trading day;

- the required enclosures to the application; and

- an 'official notice'.

On SIX, the listing application must be submitted by a recognised representative in writing.

Listing procedure: The Regulatory Board will:

- review the listing application on the basis of the documents that have been submitted; and

- approve the listing application if it fulfils the requirements laid down in the Listing Rules.

Approval may be subject to further requirements and/or conditions.

Special provisions for certain financial instruments: Special provisions and listing requirements apply for:

- investment companies;

- real estate companies;

- special purpose acquisition companies (SPACs);

- global depository receipts; and

- the Sparks segment of SIX.

3.3 What kinds of penalties might an issuer incur in case of breach of the IPO rules and requirements?

Regulatory sanctions may be imposed by the competent body of the exchange if the issuer:

- breaches the Listing Rules, the additional rules or their implementing provisions (specifically for breaches of duties to cooperate and to provide or disclose information); or

- does not ensure compliance with these rules and regulations.

One or more of the following sanctions may be imposed alternatively or cumulatively on issuers:

- a reprimand;

- a fine of up to:

-

- CHF 1 million in cases of negligence; or

- CHF 10 million in cases of wrongful intent;

- suspension of trading;

- delisting or reallocation to a different regulatory standard;

- exclusion from further listings; and/or

- withdrawal of recognition.

The responsibility for instigating and conducting sanction proceedings is governed by the SIX Rules of Procedure.

Pursuant to Article 90(1) of the Financial Services Act, in case of violations of the prospectus regulations, a fine of up to CHF 500,000 may be imposed on any person who:

- wilfully provides false information;

- withholds material facts in the prospectus; or

- fails to publish the prospectus by the beginning of the public offer at the latest.

3.4 What are the most common IPO structures? What are the advantages and disadvantages of each? What other factors should companies consider when deciding on an IPO structure?

IPOs can be structured in different manners. Primary offerings (ie, the offering and issuance of newly created equity securities by way of a capital increase) can be distinguished from secondary offerings (ie, the offering of existing equity securities) and combinations thereof. Other structuring approaches include fixed-price offerings and auction proceedings.

The most common transaction structure in Switzerland is the traditional IPO with a bookbuilding proceeding. The characteristic feature of a traditional IPO is that a company is listed on the stock exchange for the first time in conjunction with a cash capital increase. An advantage of the bookbuilding process is that investor demand can be considered by setting a price range. Fixed-price offerings or auction proceedings are very rare in Switzerland.

As an alternative to a traditional IPO (with an appointed lead manager) or a direct listing (without the appointment of a lead manager) with capital increases, there is also the option of carrying out a simple listing without capital increase at the time of listing. This means that the costs of an IPO are not offset by an injection of equity capital and therefore no liquidity flows in the company. Further potential transaction structures to be considered may comprise:

- reverse IPOs;

- the purchase of a listed shell company or SPAC IPOs;

- carve-out (or spin-off) IPOs;

- dual-track IPOs; and

- dual listings.

3.5 What advisers are typically involved in the IPO process? What claims (if any) can be brought against advisers with regard to their role in the IPO process? Is there any way to mitigate such liability?

The typical advisers in an IPO process are:

- investment bankers;

- lawyers (issuer counsel and syndicate counsel);

- auditors;

- possibly independent IPO consultants; and

- public relations and communication agencies.

Potential claims may arise due to:

- a prospectus liability; or

- contractual claims under the advisory agreements concluded with the issuer.

A due diligence process related to the drafting of the IPO prospectus is typically conducted to mitigate the risk of claims by investors.

3.6 How does the IPO process typically unfold in your jurisdiction? What are the key milestones and how long does a typical IPO process take from start to finish?

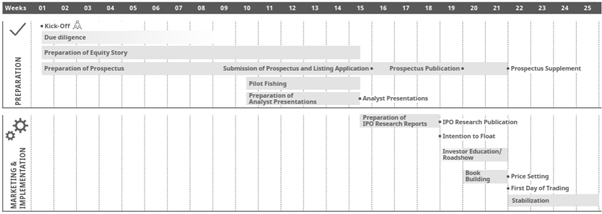

The typical IPO process can be divided in two phases:

- the preparation phase; and

- the marketing and implementation phase.

An overview of these phases with the key milestones is shown in the indicative timetable below (SIX IPO Guide, 7).

Against this background, the key milestones of the IPO-process are as follows.

Pre-IPO phase:

- Readiness check: An IPO requires preparation by the company. Important building blocks of the company's investment story include:

-

- the strategy;

- market positioning;

- accounting and controlling processes;

- company management; and

- good governance.

- It is important that companies:

-

- have the right legal structure and financial reporting in place; and

- in certain cases, perhaps even choose a restructuring to prepare for an IPO.

- Selection of advisers: To go public, a company needs to engage professional advisers, including:

-

- the lead manager (possibly of a bank syndicate);

- lawyers;

- auditors;

- consultants; and

- communication experts.

Preparation phase:

- Kick-off meeting: In the kick-off meeting, the management of the company and the chosen advisers discuss and define the responsibilities, timeline and structure for the public offer.

- Due diligence: The due diligence ensures that the material information about the company is appropriately identified and disclosed in the prospectus. It encompasses primarily business, financial, legal and tax due diligence. During the IPO preparation:

-

- the banks conduct business and management focused due diligence;

- the attorneys focus on legal, tax and corporate governance aspects of the due diligence process; and

- the auditors typically issue a comfort letter.

- Equity story: A compelling equity story is important and demonstrates the key information of the investment case of the company to:

-

- analysts;

- investment advisers;

- investors;

- journalists; and

- other recipients.

- Prospectus and listing application: The prospectus is a legal document and must be filed with the prospectus office of the exchange, together with a formal listing application.

Marketing phase:

- Pilot fishing: The company conducts initial meetings with key investors to:

-

- test investors' interest; and

- understand whether the equity story or transaction structure should be adjusted.

- Analyst presentations: The company present its equity story to the analysts of the banks, which draw up research publications.

- Admission decision: The Regulatory Board of the exchange issues an admission decision for the listing of shares on the exchange.

- Intention to float: The company announces its intention to conduct the IPO to the public, which dramatically increases the attention paid to the company.

- Investor education: The analysts present their research reports, prepared on the basis of the analyst presentation, to the sales teams of the syndicate banks as a sales tool, as well as to interested investors.

- Management roadshow: The management conducts a roadshow and provides investors with an introduction to the company in person.

Implementation phase:

- Book-building process: The book-building process is started in parallel to the roadshow, which means that investors can submit price offers to the syndicate banks.

- Placement price: In collaboration with the company, the syndicate banks determine the placement price based on the price offers submitted by the investors.

- Share allocation: The syndicate banks allocate the shares to the investors (order book). To ensure stability in the aftermarket, an option to allocate additional shares (over-allotment option, or 'greenshoe') in the amount of 10–15% of the planned issue volume is provided for.

3.7 What costs and fees are typically incurred in the IPO process?

The costs and fees incurred in connection with IPOs in Switzerland depend on the volume of the transaction and the specific offer. Generally, the following ballpark numbers can be stated, which may vary in specific transactions.

| Costs/fees | |

|---|---|

| Prospectus office | CHF 4,000–15,000 |

| Exchange (listing fees) | CHF 10,000–100,000 |

| Investment bank | 2–5% (of the gross proceeds of the sale of the shares) |

| Issuer's counsel | From CHF 150,000 for small transactions to over CHF 1 million for large transactions |

| Underwriter's counsel | Approximately half the fees of the issuer's counsel |

| Stamp duty | 1% of the issue price of the newly issued shares sold in the offering |

| Securities transfer taxes | Up to 0.15% or 0.3% of the offer price for the existing shares sold in the offering |

3.8 What other factors should companies consider when deciding on an IPO strategy?

An IPO can provide regular access to capital in amounts that companies often cannot find elsewhere. Even unicorn companies will at some point have to provide a return on investment to their investors. The IPO gives founders, venture capital, private equity and other pre-IPO investors an opportunity to realise a return on their investment.

Accordingly, the exit strategy of the existing shareholders of the company should be considered. For example, for family companies, succession planning may be a factor. An IPO also gives companies an opportunity to reward the talent who have helped to ensure the company's success.

Moreover, an IPO can:

- increase the profile of the company and the brand; and

- open up markets for new customers.

Staying private may limit the company's future growth.

In addition, an IPO demands a governance structure and level of professionalism that give the company credibility. However, it also invites:

- a new level of scrutiny from investors and regulators; and

- constant pressure to achieve short-term results.

Lastly, the macroeconomic and market conditions are crucial factors for the IPO decision, especially with respect to the timing of the IPO.

4. Prospectus rules and marketing

4.1 What kinds of securities are subject to prospectus requirements?

The term 'securities' encompasses:

- standardised certificated and uncertificated securities – in particular, uncertificated securities and ledger-based securities; and

- derivatives and intermediated securities which are suitable for mass trading.

These securities are typically financial instruments such as:

- equity securities;

- debt securities;

- collective investment schemes; or

- structured products.

4.2 When is a prospectus (or other type of offering document) required? What are the key exemptions from the prospectus requirements and what kinds of selling restrictions might apply?

Pursuant to Article 35(1) of the Financial Services Act (FinSA), anyone that makes a public offer for securities or seeks admission to trading on a trading venue must first publish a prospectus. As an exception, according to Article 36(1) of the FinSA, a prospectus does not need to be published if the (exempt) public offer:

- is addressed solely at investors classified as professional clients;

- is addressed at fewer than 500 investors;

- is addressed at investors acquiring securities to the value of at least CHF 100,000;

- has a minimum denomination per unit of CHF 100,000; or

- does not exceed a total value of CHF 8 million over a 12-month period.

Furthermore, there are specific exemptions:

- depending on the type of securities offered; and

- for admissions to trading.

The selling restrictions in the prospectus, respectively, private placement memorandum for exempt offers (private placements) typically contains a market standard selling restrictions language related to the applicable exemptions from the prospectus duty.

4.3 What key information, or categories of information, must be included in a prospectus? What other requirements and restrictions apply with regard to the content of the prospectus? Is there any form of reduced disclosure or simplified prospectus regime and, if so, which companies/offerings can take advantage of this?

Pursuant to Article 40(1) of the FinSA, the prospectus must contain all essential information for investors to make a decision on the issuer, the securities and the offer, including in relation to the following:

- the board of directors, management board, auditors and other governing bodies;

- the most recent semi-annual or annual accounts or, where these are not yet available, information on assets and liabilities;

- the business situation;

- the main prospects, risks and litigation;

- whether the securities are to be offered publicly or admitted to trading on a trading venue, and the associated rights, obligations and risks for investors; and

- the type of placement and the estimated net proceeds of the issue.

The content requirements for a FinSA prospectus are set out in Annexes 1–6 of the Financial Services Ordinance. These annexes contain checklists for the minimum content of the prospectuses for various financial instruments, such as:

- equity securities (Annex 1);

- debt securities (Annex 2);

- derivatives (Annex 3);

- real estate companies (Annex 4);

- investment companies (Annex 5); and

- collective investment schemes (Annex 6).

The information in the prospectus must be provided in one of the Swiss official languages or in English. Moreover, the prospectus must contain a clearly understandable summary of the essential information.

If the final issue price and the issue volume cannot be stated in the prospectus, the prospectus must indicate:

- the maximum issue price; and

- the criteria and conditions used to determine the issue volume.

The information on the final issue price and on the issue volume must be filed with and published by the prospectus office.

In Switzerland, there is currently no reduced disclosure or simplified prospectus regime which is comparable, for example, to a grow prospectus in other countries. However, Swiss-style prospectuses are generally shorter than EU prospectuses, especially for small-cap companies, which reduces the need for such special exemptions. Nevertheless, the introduction of a growth prospectus in the future would still be appreciated.

4.4 What is the process for preparation, approval, filing and publication of the prospectus? How long does each step take?

The prospectus is typically prepared by the issuer's legal counsel and its content is verified based on the due diligence conducted. The prospectus must be submitted to the prospectus office for approval prior to publication. The prospectus office will:

- check that the prospectus is complete, coherent and understandable; and

- decide whether to approve the prospectus within 10 calendar days of receiving the rectified prospectus (20 calendar days for new issuers).

The procedure followed by the prospectus office is based on the Administrative Procedure Act.

The prospectus office may approve a prospectus produced under foreign legislation if:

- it was produced in accordance with international standards established by international organisations of securities regulators; and

- the duty to inform, including with regard to providing financial information, is equivalent to the requirements set out in the FinSA; audited individual financial statements are not required.

Moreover, the prospectus office may provide that prospectuses approved in certain jurisdictions are considered approved in Switzerland too. It publishes a list of countries whose prospectus approval is recognised in Switzerland.

4.5 What are the rules governing prospectus summaries/key information documents (KIDs) in your jurisdiction?

The prospectus must contain a clearly understandable summary of the essential information, which facilitates a comparison with similar securities. It must clearly state that:

- it is regarded as an introduction to the prospectus;

- investment decisions must be based not on the summary but on the information contained in the entire prospectus; and

- liability for the summary is limited to cases where the information contained therein is misleading, inaccurate or inconsistent when read together with the other parts of the prospectus.

Generally, where a (complex) financial instrument is offered to retail clients, the issuer must first produce a KID. However, as an exception to this general rule, any issuer that offers securities in the form of shares – including share-like securities allowing for participation rights, such as participation certificates, dividend rights certificates and non-derivative debt instruments – is not obliged to prepare a KID. Accordingly, no KID is required for the offer of shares in the context of an IPO of a stock company.

4.6 Who is responsible or liable for the content of a prospectus/KID in your jurisdiction? On what grounds can such claims be brought? Is there any way to mitigate such liability?

Pursuant to Article 69(1) of the FinSA, anyone that fails to exercise due care and thereby furnishes information that is inaccurate, misleading or in violation of statutory requirements in prospectuses, KIDs or similar communications is liable to the acquirer of a financial instrument for the resultant losses. This includes the producers of the prospectus – in particular, the natural and/or legal persons that take responsibility for the content of the prospectus. These persons must be stated in the prospectus.

Potential defendants of a prospectus liability claim can often mitigate such liability against claims of wilful or negligent conduct by means of a due diligence defence, provided that the due diligence was conducted in accordance with Swiss market practice, which typically involves:

- comprehensive due diligence and a due diligence report;

- management meetings;

- reviews of the business plan and the financial statements of the issuer;

- meetings with the company's accounting department and auditors;

- interviews;

- site visits;

- questionnaires;

- legal opinions from legal counsel;

- comfort letters from auditors;

- officers' certificates; and

- a bringdown due diligence.

5. Corporate governance/continuing obligations

5.1 What corporate governance requirements apply to new issuers? Do these vary depending on the market or exchange on which the IPO is conducted?

The Code of Obligations contains certain corporate governance requirements, such as:

- rules related to conflicts of interest; and

- a requirement for shareholders to approve the annual fixed and variable compensation of the board of directors and the management at the annual general meeting.

Further, certain categories of compensation are not permitted. However, these requirements apply:

- only to companies domiciled in Switzerland; and

- irrespective of the market or exchange on which the IPO is conducted.

Furthermore, the Directive on Information relating to Corporate Governance (DCG) of the SIX Swiss Exchange (SIX) obliges issuers to make certain key information relating to corporate governance available to investors in an appropriate form. For all information prescribed in the Annex of the DCG, the principle of 'comply or explain' applies. If the issuer refrains from disclosing certain information:

- a specific reference to this effect must be included in the corporate governance report, which is a separate section of the annual report; and

- substantial grounds must be given for each individual case in which information is not disclosed.

These requirements are SIX specific, but other exchanges or marketplaces may have similar requirements.

Moreover, the Code of Best Practice for Corporate Governance published by economiesuisse as the Swiss Business Federation for all sectors of the economy is an example of Swiss self-regulation. It influences the development of corporate governance in Switzerland – especially since it is aimed primarily at Swiss public limited companies. The code:

- sets out recommendations on how to structure sustainable corporate governance; and

- provides information that surpasses the legal requirements while ensuring that companies retain their organisational flexibility.

5.2 Is there a mandatory or voluntary corporate governance index? If so, what does it contain?

Yes – the Ethos Swiss Corporate Governance Index (ESCGI) focuses on the best governance within companies included in the Swiss Performance Index (SPI) and its larger version, ESCGI Large, both established by the Ethos Foundation. The aim of the Ethos Foundation is to help pension funds invest in a sustainable and responsible manner, considering environmental, social and governance (ESG) criteria.

Accordingly, the objectives of the ESCGI are to:

- reduce governance risks by:

-

- underweighting or excluding companies with poor governance practices;

- underweighting companies with severe controversies; and

- avoiding overweighting companies with serious controversies; and

- reduce carbon footprint by:

-

- underweighting companies with very high carbon emissions;

- avoiding overweighting companies with a weighting of over 10% in the SPI index; and

- overweighting all other companies.

The ESCGI Large is similar to the ESCGI but includes a wider selection of companies, allowing investors to reduce the weighting of companies with potential governance risks. Furthermore, several lesser-known ESG indices, scores (eg, the Swiss Climate Scores), ratings and rankings exist.

5.3 What reporting obligations apply to listed or quoted companies? Do these vary if the issuer is a foreign company or between trading venues/segments?

Ad hoc publicity: The company must inform the market of any price-sensitive facts which have arisen in its sphere of activity. 'Price-sensitive facts' are those whose disclosure can trigger a significant change in market prices. A price change is 'significant' if it is considerably greater than the usual price fluctuations. The issuer must provide notification as soon as it becomes aware of the main points of the price-sensitive fact. The disclosure of ad hoc announcements must ensure the equal treatment of all market participants.

Examples of price-sensitive facts that must be disclosed include:

- financial figures;

- changes in personnel in the board of directors or management;

- mergers;

- takeovers;

- spin-offs;

- restructurings;

- changes in capital;

- takeover bids;

- changes in business operations;

- information on trading results; or

- significant changes to the shareholder structure.

Duty to publish annual reports and recognised reporting standards: The issuer must publish an annual report. This comprises:

- the audited annual financial statements, in accordance with the applicable financial reporting standards; and

- the corresponding audit report.

Furthermore, issuers of listed equity securities must generally publish semi-annual financial statements.

On SIX, the recognised reporting standards are governed by the Directive on Financial Reporting. Depending on the regulatory standard, issuers of equity securities on SIX must apply one of the following recognised accounting standards.

| Accounting standards | |

|---|---|

| International reporting standards |

|

| Swiss reporting standards |

|

| Standards for investment companies |

|

| Standards for real estate companies |

|

| Standards on Sparks |

|

| Standards for SPACs |

|

| Standard for depository receipts |

|

| Standard for collective investment schemes | Collective investment schemes are subject to the rules laid down in the special legal provisions applicable to them |

On BX Swiss, the following accounting standards are currently recognised.

| Accounting standards | Restrictions |

|---|---|

| Swiss GAAP FER | Only companies based in Switzerland |

| IFRS | - |

| US GAAP | - |

| Banking Act standards |

|

| EU IFRS | Only for companies not based in Switzerland |

| Commercial Code, Germany | Debt securities only |

Regular reporting obligations: The Directive on Regular Reporting Obligations governs:

- the content and form of regular reporting obligations in connection with maintaining listing; and

- the details of how these obligations are to be fulfilled.

The issuer must report the reportable fact. It may decide at its own discretion whether to:

- fulfil its reporting obligations itself; or

- instruct a third party to do so.

5.4 What other continuing obligations apply to listed or quoted companies?

Disclosure of management transactions: An issuer whose equity securities have their primary listing on SIX, BX, SIX Digital Exchange or admission to trading on BX Digital must ensure that the members of its board of directors and its executive committee report transactions in the issuer's equity securities, or in related financial instruments, to the issuer no later than the second trading day after the reportable transaction has been concluded.

Publication of the corporate calendar: Upon listing and at the beginning of each financial year, the issuer must:

- produce a corporate calendar covering at least the current financial year; and

- keep it up to date.

The corporate calendar must provide information on the dates that are of major importance to investors, such as:

- the annual general meeting; and

- the publication dates of the annual and interim financial statements and the corresponding reports.

Notification of changes in the rights attached to equity securities: The company must:

- provide notification of changes in the rights attached to the listed securities in good time prior to the entry into force of those changes to ensure that investors have the ability to exercise their rights;

- notify the exchange of such changes; and

- draw the attention of investors to any planned changes in the rights attached to securities, so that investors may exercise their rights.

5.5 Is there a market abuse/insider dealing regime in your jurisdiction? What is its purpose and what are its key features?

Yes. The Financial Market Infrastructure Act (FinMIA) contains regulatory as well as penal law provisions on insider trading and market manipulation which aim to ensure fair and transparent markets and investor protection. In a nutshell, any person who has insider information and who knows or should know that it is insider information, or who has a recommendation that they know or should know is based on insider information, will behave inadmissibly if they:

- exploit it to:

-

- acquire or dispose of securities admitted to trading on a trading venue or distributed ledger technology (DLT) trading facility which has its registered office in Switzerland; or

- use derivatives of such securities;

- disclose it to another; or

- exploit it to recommend to another to:

-

- acquire or dispose of securities admitted to trading on a trading venue or DLT trading facility which has its registered office in Switzerland; or

- use derivatives of such securities (Article 142(1) of FinMIA).

The related criminal provision on exploitation of insider information provides for a custodial sentence or a monetary penalty (Article 154 of FinMIA).

With respect to market manipulation, any person behaves inadmissibly if they:

- publicly disseminate information which they know or should know gives false or misleading signals regarding the supply, demand or price of securities admitted to trading on a trading venue or DLT trading facility which has its registered office in Switzerland; or

- carry out transactions or acquisition or disposal orders which they know or should know give false or misleading signals regarding the supply, demand or price of securities admitted to trading on a trading venue or DLT trading facility which has its registered office in Switzerland.

The related criminal provision on price manipulation provides for a custodial sentence or a monetary penalty (Article 155 of FinMIA).

5.6 What are the consequences of breach of any of the above obligations?

The possible consequences of breaches of obligations may include:

- sanctions;

- disciplinary measures;

- suspension of trading; or

- delisting or termination of admission.

The following sanctions may be imposed:

- reprimand;

- a fine of up to:

-

- CHF 1 million in cases of negligence; or

- CHF 10 million in cases of wrongful intent;

- suspension of trading;

- delisting or reallocation to a different regulatory standard;

- exclusion from further listings; or

- withdrawal of recognition.

5.7 Do mandatory auditing rules apply and is there a special review/enforcement process?

Yes. Mandatory auditing rules apply to companies that are:

- listed on a Swiss exchange; or

- admitted to trading on a DLT trading facility.

Issuers must have their financial statements audited by an admitted state-supervised audit firm in accordance with Articles 7 and 8 of the Act on the Licensing and Oversight of Auditors. In addition, there may be a special review and enforcement process by the exchange or DLT trading facility.

6. Inbound IPOs

6.1 What key considerations and concerns should foreign issuers bear in mind when conducting an IPO in your jurisdiction?

The requirements of foreign issuers when conducting an IPO on the SIX Swiss Exchange (SIX) are set out in the Directive on the Listing of Foreign Companies. Foreign issuers can list equity securities on SIX via primary or secondary listings. On SIX, if a company is not yet listed on another exchange recognised by the Regulatory Board when it submits its listing application, its only option is a primary listing. If a company is already listed on an exchange recognised by the Regulatory Board, it may choose between a primary listing and a secondary listing. The same applies if a company is to be listed simultaneously on its primary exchange and on SIX – that is, with the same first trading day on both exchanges (dual listing). Other exchanges or marketplaces may have different requirements.

6.2 Are there different requirements for a foreign issuer seeking an IPO or secondary or dual listing in your jurisdiction?

Primary listings: For primary listings on SIX, the issuer must provide proof that it has not been refused listing in its home country under legislation on investor protection. This proof may take the form of:

- a legal opinion from an independent law firm; or

- a relevant extract from the rejection decision issued by the competent authority in the home country in connection with the registration process in question.

It must be clear that the company was not refused listing because it failed to comply with investor protection regulations.

Foreign issuers of equity securities which have their primary listing on the SIX must basically comply with the same requirements for maintaining listing as issuers which have their registered office in Switzerland.

Secondary listings: For secondary listings on SIX, the requirements that apply to the issuer are regarded as having been fulfilled if its equity securities are listed in its home country or in a third country on an exchange recognised by the Regulatory Board. The free float is considered adequate if:

- the capitalisation of the shares circulating in Switzerland is at least CHF 10 million; or

- the applicant can otherwise demonstrate that there is a genuine market for the equity securities.

Issuers of secondary-listed equity securities must participate in the annual data collection survey conducted by SIX Exchange Regulation (SER). The obligation of issuers of secondary-listed equity securities to publish price-sensitive facts (ad hoc publicity) is governed by the system of law applicable to the primary exchange. Where such obligation exists, the relevant media release must be made available to Swiss market participants at the same time. To this end, when it is published for the first time, it must be submitted to at least two electronic information systems which are widely used by professional market participants (and the press release must be transmitted simultaneously to SER). Issuers of secondary-listed equity securities must further comply with the regular reporting obligations.

7. Tax

7.1 What key considerations and concerns should issuers bear in mind from a tax perspective when conducting an IPO in your jurisdiction?

Switzerland levies stamp duty of 1% on the issuance price of shares – that is, on the nominal value plus the share premium. The stamp duty is due by the issuer. Exemptions are available for group reorganisations, such as so-called 'quasi-mergers' (share-for-share exchanges).

Share purchase transactions are subject to securities transfer tax if a Swiss securities dealer (as defined by the Stamp Duty Act) acts as a party or intermediary. A securities transfer tax of 0.15% is due on the transaction price (0.3% on shares issued by a non-Swiss entity). The issue of shares is exempt from Swiss securities transfer tax (primary market). Also, exemptions are available for group reorganisations.

A withholding tax of 35% is due on dividend payments. The return of share premium qualifying as capital contribution reserves for tax purposes is not subject to withholding tax, provided that the restrictions set out in Article 5(1)ter of the Withholding Tax Act are considered when determining the distributable amount. The withholding tax can be fully reclaimed by Swiss tax resident shareholders. A full or partial refund or a reduction at source may be available for non-Swiss tax resident shareholders, depending on the applicable double taxation treaty.

If Swiss tax resident individual shareholders are contributing shares in exchange for shares, attention should be paid to ensuring that no taxable increase in the nominal value and capital contribution reserves will arise, as this would be subject to withholding tax and income taxes.

8. Environmental, social and governance (ESG)

8.1 What key considerations and concerns should issuers bear in mind from an ESG perspective when conducting an IPO in your jurisdiction?

Sustainable investing allows shareholders to support companies that:

- actively address ESG issues; and

- contribute to positive social and environmental outcomes.

Conversely, shareholders may divest from companies that fail to meet their ESG standards. Shareholder engagement, active ownership and stewardship also play an important role. In particular, shareholders can:

- actively participate in general meetings;

- exercise their voting rights;

- elect board members; and

- engage in discussions related to a company's ESG practices.

Moreover, large companies that meet the criteria set out in Articles 964a and following of the Code of Obligations must publish a report on non-financial matters. In particular, the report must describe:

- the due diligence that the company must apply; and

- the way in which it must manage risks relating to non-financial matters (Article 964b(2) of the code).

If the company does not apply a concept regarding one or more of these matters, it must include in the report a clear and substantiated explanation of the reasons for not doing so (comply or explain). The Ordinance on Climate Reporting provides further clarifications in this respect.

Furthermore, companies with their seat, head office or principal place of business in Switzerland must comply with due diligence obligations in the supply chain and report thereon if they:

- place in free circulation or process in Switzerland minerals containing:

-

- tin, tantalum, tungsten or gold; or

- metals from conflict-affected and high-risk areas; and/or

- offer products or services in relation to which there is a reasonable suspicion that they have been manufactured or provided using child labour (Articles 964j and following of the code).

Violations of these reporting obligations are also subject to criminal law sanctions.

In addition, provisions on transparency in raw material companies exist. According to Articles 964d and following of the code, companies that are subject to an ordinary audit and are, either themselves or through an affiliate company, involved in the extraction of minerals, oil or natural gas, or in the harvesting of timber in primary forests, must prepare a yearly report on the payments they have made to state bodies. Wilful violations of these obligations are subject to criminal prosecution (Article 325bis of the Criminal Code (SCC)).

Further transparency and disclosure norms include:

- an equal pay analysis reporting obligation for public sector employers and listed companies with 100 or more employees (Articles 13a and following of the Gender Equality Act); and

- a gender-quota reporting obligation for listed companies (Article 734f of the Code of Obligations).

9. Disputes

9.1 In what forums are disputes relating to IPOs typically heard and what kinds of issues do they typically involve? How common are disputes in relation to IPOs in your jurisdiction?

Prospectus liability disputes are typically heard in civil or commercial courts. They typically involve investors who:

- lost their investment fully or partially; and

- claim for the restitution of damages based on false or missing information in the prospectus or similar documents.

Legal disputes in relation to IPOs are very rare in Switzerland.

9.2 Can class actions be brought by IPO investors in the event of a dispute?

Swiss law does not provide for class actions related to IPOs.

9.3 What remedies are typically available in disputes relating to IPOs?

Prospectus liability claims related to prospectuses or similar communications such as press releases and marketing materials may be filed against any person who fails to exercise due care and thereby furnishes information that is inaccurate, misleading or in violation of statutory requirements in prospectuses, key information documents or similar communications for the resulting losses of the acquirer of a financial instrument (Article 69 of the Financial Services Act). In addition, plaintiffs may consider general remedies under Swiss civil law.

Furthermore, a person responsible for false or misleading information may also be subject to criminal law provisions under the Criminal Code. In particular, any person who conducts fraud with a view to securing an unlawful gain for themselves or another and wilfully induces an erroneous belief in another person by false pretences or concealment of the truth, or who wilfully reinforces an erroneous belief and thus causes that person to act to the prejudice of their or another's financial interests, will be liable to:

- a custodial sentence not exceeding five years; or

- a monetary penalty (Article 146 of the Criminal Code).

If the offender acts for commercial gain, a custodial sentence of between six months and 10 years will be imposed.

Moreover, in case of forgery of documents, any person who, with a view to causing financial loss or damage to the rights of another or in order to obtain an unlawful advantage for themselves or another, produces a false document, falsifies a genuine document, uses the genuine signature or mark of another to produce a false document, falsely certifies or causes to be falsely certified a fact of legal significance or makes use of a false or falsified document in order to deceive will be liable to a custodial sentence not exceeding five years or a monetary penalty (Article 251 of the Criminal Code).

10. Trends and predictions

10.1 How would you describe the current IPO landscape and prevailing trends in your jurisdiction? Are any new developments anticipated in the next 12 months, including any proposed legislative reforms? If so, what is the rationale for these and what do they aim to achieve?

Initially, 2025 saw heightened investor optimism and a promising increase in IPO activity. However, this momentum proved to be volatile. A variety of factors – such as trade tensions, tariffs, monetary policy shifts and geopolitical conflicts and uncertainty – have weighed on global markets and impacted Swiss IPO activity. However, various Swiss IPO transactions are in the pipeline and are still expected to move forward. A further trend for listed companies is AI solutions, which may also become more important for investor relations.

From a regulatory perspective, a reform of the Financial Market Infrastructure Act (FinMIA) has been proposed. FinMIA governs the organisation and operation of financial market infrastructure, such as:

- stock exchanges and other trading facilities;

- payment systems; and

- central counterparties.

It also sets out the rules of conduct for financial market participants in securities and derivatives trading, including rules to prevent market abuse (insider trading and market manipulation). The proposed adjustments take account of technological developments and relevant further developments in international standards and foreign legal systems. They should strengthen the stability of the financial system and the competitiveness of the Swiss financial centre. Further, a continued alignment with EU and global ESG regulations (and a related reform of the Code of Obligations) is expected.

11. Tips and traps

11.1 What are your top tips for the smooth conclusion of IPOs in your jurisdiction and what potential sticking points would you highlight?

Before the IPO preparation starts, a readiness check and, if needed, a related clean-up should be conducted. Unlisted companies regularly underestimate the differences in governance and compliance when compared to listed companies. Engaging advisers early may bring to light legal, tax or financial structuring issues sufficiently early to be fixed in time to avoid a subsequent delay to the listing date. In particular, thorough IPO preparation increases the importance of:

- governance;

- risk management;

- compliance; and

- general market conduct.

Recognised accounting standards should generally be implemented at least three full business years prior to the IPO. Moreover, the company webpage should:

- be created or enhanced in a professional manner; and

- adhere to:

-

- the market standards of listed companies; and

- the requirements of ad hoc publicity.

The company should also have strong leadership and sufficient staff resources to process the IPO transaction. The IPO transaction requires:

- the full attention of the company and its management; and

- a dedicated project team with sufficient full-time employees to focus primarily on the transaction for a longer period of time.

Further, the preparation of the data room is time consuming and the due diligence cannot be processed efficiently if the data room is not prepared in advance (or kept up to date) in accordance with the information request list provided by the issuer counsel. A delay in the preparation of the data room will delay completion of the prospectus.

Moreover, investor communications and the answers to questions from the media:

- should be prepared in advance; and

- should not be released without the sign-off of the transaction team and issuer's counsel.

Incorrect or otherwise inappropriate communications (including social media posts) or information provided to banks, analysts, investors or exchanges should be avoided at all costs due to potential:

- civil law liabilities;

- regulatory sanctions; and

- penal law consequences.

In addition, it is critical to avoid information leaks. Furthermore, all marketing documents for financial instruments must contain a disclaimer.

Lastly, insider trading rules (insider lists) and the rules on market manipulation must be followed in accordance with market practice.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.