The Russian and CIS Overseas Commercial Buyer Report 2015 is the fifth major study to be published by Tranio. It is the conclusion of two major surveys, the first involving 561 real estate agencies from 37 countries. The second covered foreign commercial property investments and involved 153 Russian-speaking investors (recent and potential).

Foreign property purchases by Russian and CIS buyers (hereinafter «Russian») were halved following the successive Russian ruble devaluations in 2014–2015. However, the percentage of commercial property investments, as opposed to personal dwellings, increased.

The object of this research was to define the most popular destinations for Russian buyers and identify new trends in terms of capital invested, credit and issues pertaining transactions following the depreciation of the ruble.

Top locations

The top ten destinations according to search results by Yandex (Russia's largest search engine) for commercial property in 2015 were all in Europe, with the exception of the United States and Turkey. Germany emerged as a clear winner in terms of potential demand, attracting 22.1% of all foreign commercial property searches last year.

User requests for foreign commercial property in 2015

| Country | Search

engine requests, % |

|

| 01 | Germany | 22.1 |

| 02 | Spain | 06.5 |

| 03 | United States | 06.0 |

| 04 | Czech Republic | 04.9 |

| 05 | Italy | 04.8 |

| 06 | United Kingdom | 04.7 |

| 07 | France | 04.6 |

| 08 | Turkey | 04.3 |

| 09 | Latvia | 04.0 |

| 10 | Montenegro | 03.5 |

Source: Yandex

Tranio survey results confirm the popularity, though not necessarily the rankings, of these countries. The top twenty destinations as reported by participants in the survey, are mostly in Europe with the exception of Turkey and the USA (mentioned above) as well as Thailand and the UAE. In terms of commercial property investments per price category (organised by affordability), Russian investors spend the same or less than average on real estate all but six countries.

Russian/CIS spending vs. local budgets in top 20 destinations

| Price category | Country |

Average property price to world average ratio* |

Commercial property | |

| Average

acquisition budget, EUR thousands |

Russian

spending vs. local average, % |

|||

| Low | Bulgaria | 0.53 | 0,250 | +00 |

| Hungary | 0.65 | 0,308 | +00 | |

| Turkey | 0.66 | 0,400 | +10 | |

| Medium | Greece | 0.89 | 0,400 | −10 |

| Montenegro | 0.94 | 0,325 | −20 | |

| Portugal | 0.96 | 0,535 | +10 | |

| Latvia | 0.96 | 0,584 | +10 | |

| Cyprus | 1.09 | 0,500 | −10 | |

| Croatia | 1.10 | 0,600 | +10 | |

| Czech Republic | 1.19 | 0,571 | −10 | |

| Thailand | 1.28 | 0,626 | +00 | |

| Spain | 1.47 | 1,000 | +40 | |

| High | Germany | 2.18 | 1,000 | −10 |

| USA | 2.22 | 0,894 | −10 | |

| Italy | 2.30 | 1,000 | −20 | |

| UAE | 2.33 | 0,671 | −70 | |

| Austria | 2.40 | 1,100 | −10 | |

| Very high | UK | 2.92 | 1,500 | +10 |

| France | 3.15 | 1,400 | −20 | |

| Switzerland | 6.40 | 3,000 | −20 | |

Source: Tranio Buyer Survey, *World average = 1, calculated with Numbeo data for 2014–2015

The average sum invested for buy-to-let residential property in Europe is €200,000 and €1.2M for commercial property. However, this varies considerably across countries and property types.

For example, Russian investors spent 70% less than average in the UAE but 40% more in Spain. This is largely due to the availability of bank loans: the UAE rarely grants loans to foreigners (even residents) while lenient lending laws and low interest rates have stimulated investments in Spain.

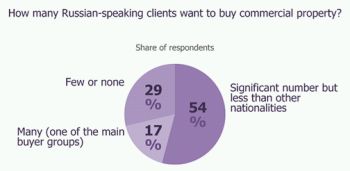

When asked if there were many Russian clients for commercial property, over half (54%) of real estate agents responded: Their presence is significant but less visible than investors of other nationalities.

Real estate agents and developers highlighted a major increase in demand for commercial property in locations that were previously popular for holiday homes (i.e., France, Spain, Italy). Countries that are traditionally popular with investors (i.e., the UK, Germany) have maintained Russian interest.

Rising demand for commercial property

| Country |

Participants reporting Russian interest in commercial property, % |

|

| 2013 | 2015 | |

| Spain | 37 | 65 |

| Italy | 32 | 75 |

| France | 00 | 50 |

| United Kingdom | 67 | 80 |

| Germany | 89 | 82 |

Source: Tranio Buyer Survey 2015

Investor motivations

The majority of respondents (74%) said they closed less deals with Russian-speaking buyers after the ruble devaluations of 2014–2015, but they also reported growing interest in income-generating property. In 2014, over half of all respondents (56%) noted the scarcity or absence of Russian-speaking commercial property investors. In 2015, 73% of respondents reported there were "many" Russian buyers, up from 44% in 2014.

Most Russian-speaking investors are successful entrepreneurs, owning and operating businesses in Russia and/or CIS countries. Due to the volatile financial situation in the region, they are looking for income-generating property with moderate yields and stable returns in a dependable currency.

Investor goals when

investing abroad:

|

These investors typically choose buy-to-let residential or commercial property. Relatively few (less than 10%) are interested in development or redevelopment projects according to the majority of survey respondents (65%).

The exceptions are Thailand, Montenegro and the Czech Republic where most local respondents (89%, 75% and 63% respectively) confirmed that over 10% of Russian investors were involved in development or redevelopment projects.

According to George Kachmazov, managing partner at Tranio, when Russian investors buy overseas property, they look for rental income. As a general rule, they don't have the time or knowledge to look after value-added projects in Europe. However, this situation is improving thanks to growing exposure to foreign markets.

|

George Kachmazov, managing partner at Tranio |

Russian nationals frequently buy commercial property where they already own residential property. This is because they know the features of these locations well and are familiar with the local market. Usually they spend time in their homes abroad and find it more convenient to manage commercial property located nearby. |

Popular property types

The most popular investment vehicles are apartments and houses according to 63% of respondents. Demand is particularly high in Bulgaria, Hungary and Portugal (95%, 89% and 86% of respondents respectively). In contrast, residential buy-to-let is not popular in leading destinations like Germany, Italy and the UK (37%, 36% and 27% respectively).

Hotels are the second most popular option (34% of respondents overall), especially in Austria (78% of local respondents). Russian-speaking investors were more likely to manage the hotels themselves rather than taking on a management companies according to the majority of respondents who named hotels as the most popular investment.

Nevertheless, there are substantial disparities between countries. In Bulgaria and the UK, 100% of the survey participants said that investors used management companies compared to 71% in Germany and Austria. In Turkey and Italy, respondents said that 100% of investors managed the hotel personally.

Commercial apartment buildings came in third (16% of respondents) with strong interest in the Czech Republic, United States and Germany (57%, 43% and 42% respectively).

Less common investments for Russian-speaking buyers

| Property type | Countries (respondents, %) |

| Street retail | United Kingdom (60), France (36), Austria (33), Latvia (33) |

| Cafes and restaurants | Spain (29), Portugal (29), United Kingdom (27) |

| Supermarkets | Germany (32), Spain (16), United Kingdom (7) |

| Offices | United Kingdom (33) |

| Student accommodation | Austria (22), Greece (17) |

| Retirement homes | Bulgaria (16) |

Source: Tranio survey 2015

Other investment property types were less popular overall but benefited from high demand in some countries like street retail premises in the UK.

Transaction times and credit

The whole buying process (from searching for property to signing the sales contract) takes four to six months on average. However, buying with loan delayed the transaction by one month on average (33 days).

Getting a loan prolongs the transaction time

| Country | Transaction registration time, months | Time

difference, days |

|

| without mortgage | with mortgage | ||

| Spain | 4.5 | 5.2 | 21 |

| France | 6.1 | 6.9 | 24 |

| UK | 6.7 | 7.7 | 30 |

| USA | 4.5 | 5.5 | 30 |

| Italy | 4.3 | 5.4 | 33 |

| Germany | 4.4 | 5.6 | 36 |

| Austria | 6.0 | 7.6 | 48 |

| Average | 5.2 | 6.3 | 33 |

Germany and Austria stand out in terms of extended delays (36 and 48 days on average respectively), which can also be explained by longer registration procedures for commercial property. In Spain, on the other hand, taking out a loan only extends the buying process by 21 days. Over half of Spanish survey respondents remarked that more Russian-speakers used bank loans to finance their property purchase.

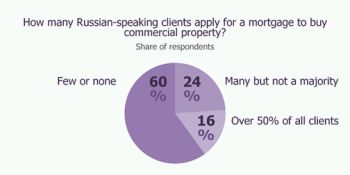

Russians are taking out more loans to buy commercial property: in 2013, only 10% of real estate agents noted that investors had taken out loans, compared to 27% in 2015. However, access to financing depends on the country. In France, the UK and Austria, investors rely on financing (as reported by 43%, 50% and 57% of respondents respectively). In more affordable countries (e.g., Thailand, Greece and Hungary) where Russian buyers struggle to obtain financing, few or no investors rely on credit for their purchase according to respondents.

When Russian-speaking investors take out loans, the loan-to-value ratio is usually 40/60 or 50/50 no matter the country.

The increasing use of credit for property investments can be explained by three factors. Russian-speaking investors have less capital, but they are also starting to understand that leveraging their investment can reduce the tax burden and increase yields. At the same time, low interest rates make lending a cheap option at the moment.

Origin of funds and investment plans

The profits available for investment were generated by businesses in the investors' home countries. Most of the funds originate in Russia according to 73% of respondents. However, in certain countries other answer variants stand out:

| Source of funds |

Overall response, % |

Most popular

destination of investment, % of respondents per country |

| Russia | 73 | Greece (100), Turkey (92), Montenegro (92), Bulgaria (91) |

| Offshore areas | 28 | United States (67), United Kingdom (57) |

| Europe | 24 | Austria (67) |

| Former Soviet

republics, except Russia |

13 | Czech Republic (43), Turkey (31), Bulgaria (24) |

More than half (52%) of investors said that they do not plan on selling their property. Instead, they will keep it in the family as inheritance for their children. Of those who plan on selling their property, 55% plan to keep it for 10 years, 35% for five years, and only 3% for just three years.

This is a noticeable change from 2013 when 40% of all investors planned to sell their buy-to-let residential property within 2–3 years. Previous investors were looking for speculative gains but in 2015 they are more interested in safeguarding their capital. This is why they now prioritise long-term investment reliability and low risks over high yields.

Issues and risks when dealing with Russian investors

The most frequent issues when dealing with Russian-speaking investors are above-average yield expectations and transaction delays.

Russian-speaking investors are known for their exaggerated yield expectations. According to survey respondents, they expect 5.7% annual yields on residential property on average and 6.9% for commercial property. However, their actual average earnings in terms of yields are 4.3% for residential real estate and 5.6% for commercial premises.

Nevertheless, Russian buyers have lowered their expectations: in 2013, buyers wanted 6–7% yields on average for residential and 8–9% for commercial.

Issues when working with Russian investors

| Issue |

Respondents, % |

Countries where

the issue is most prominent, % of respondents per country |

| Exaggerated yield expectations | 52 | United Kingdom (73), Germany (68), Austria (67) |

| Transaction delays | 36 | Czech Republic (75), United Kingdom (73) |

| Unwilling to follow the established transaction procedures | 25 | Thailand (56) |

| Issues with proof of funds | 23 | Spain (43) |

| Lack of property investment knowledge | 22 | United States (57) |

| Language barrier | 06 | Greece (27), Turkey (17) |

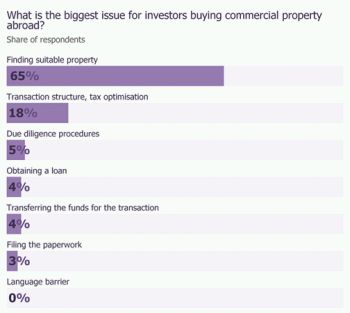

The biggest issue for investors is finding suitable property according to 64% of the survey participants. The second most popular answer is the "transaction structure and tax optimisation" (18%).

|

George Kachmazov, managing partner at Tranio |

The number of Russian-speaking buyers for overseas residential property will shrink by another 20–30% in 2016. We also expect to see 30–40% more Russian nationals trying to sell their foreign property as a weak ruble induces higher maintenance costs. Nevertheless, the amount of Russian-speaking investors for commercial property should grow by 20–30% in 2016. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.