Overall default rate was 4.2%, a return to Q1 levels

New York, NY – October 16, 2020- Proskauer, a leading international law firm, today announced the results of Proskauer Private Credit Default Index for the third quarter.

The default rate for the third quarter was 4.2%, a decline from 8.1% recorded in the second quarter and on par with the first quarter default rate of 5.9%

The quarterly index tracks the default rates of senior secured and unitranche loans.

"The return of the index to the levels that we saw in the spring really speaks to the resilience we are seeing in the market. After a few slow months, the market has come roaring back, and we expect will continue through the fourth quarter," said Stephen A. Boyko, co-chair of Proskauer's Corporate Department and Private Credit Group. "As liquidity has improved and businesses have started to reopen, lenders have provided borrowers with the flexibility they need to execute on their business plans."

For Q3 2020, the Proskauer Private Credit Default Index reported the following:

- Overall default rate was 4.2% down from 8.1% in Q2

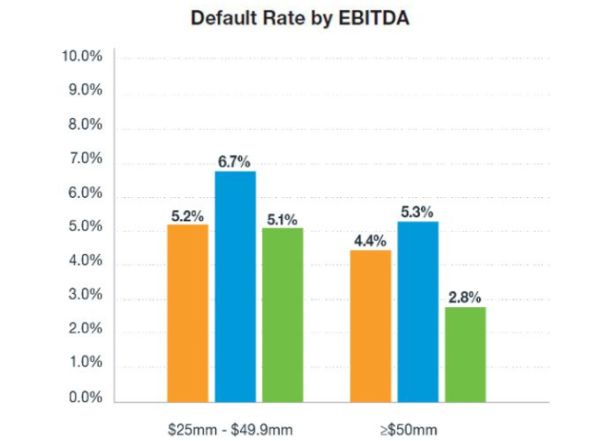

- Companies with more than $50 million of EBITDA at the time of origination had a 2.8% default rate, down from 5.3% in Q2.

- Companies with $25-49.9 million of EBITDA had a 5.1% default rate compared to 6.7% in Q2.

The Index also includes several proprietary features for clients

including an analysis of defaulted loans by: industry, including

consumer/retail; food/beverage; healthcare; manufacturing and

software/technology by EBITDA band (0-$25mm,$25-49.9mm, and $50mm+)

by default type (payment, bankruptcy, financial covenant, other

material default, etc.) and by comparison to the publicly reported

default rates for leveraged loans as reported by the rating

agencies.

The Proskauer Private Credit Default Index includes 642 active loans in the United States for Q3, representing $121.5 billion in original principal amount. The number of deals in our database for Q3 increased from 546 in Q2 due to the net addition of 92 deals that meet the criteria for inclusion in our index. During the same period we saw the removal of 32 deals as a result of loan payoffs, restructurings, and deals no longer in default. The Index includes companies across all major industry groups with EBITDA (earnings) from $0 to more than $1 billion. While there are varying conventions of what is considered a default for purposes of calculating a default rate, the Index includes loans that have a payment, financial covenant or bankruptcy default, loans that are otherwise in default if the default is expected to continue for more than 30 days (excludes immaterial defaults) and loans that were amended in anticipation of a default.

The Private Credit Group continues to create tools that offer unique insights to their clients, including an annual survey that features predictions from top lending institutions, which compliments the findings of Proskauer's proprietary Private Credit Insights annual report.

As a market-leading advisor to the private credit industry, Proskauer has assembled a cross-disciplinary finance and restructuring team exclusively dedicated to private credit investors. This team includes over 75 restructuring and transactional lawyers focused on representing credit funds, business development companies, and other direct lending funds in the restructuring of "clubbed" and syndicated credits and preferred equity investments.

Over the past five years, Proskauer has worked on more than 800 deals for more than 75 private credit clients across the United States and Europe with an aggregate transaction value exceeding $150 billion.

We operate a free-to-view policy, asking only that you register in order to read all of our content. Please login or register to view the rest of this article.