- within Immigration and Family and Matrimonial topic(s)

1. INTRODUCTION

Over the past several years, the use of a Bermuda Private Trust Company in combination with a Purpose Trust has been increasingly attractive to many clients including clients from civil law countries, those wishing to establish a family office structure, or those who do not wish to use institutional trust companies.

2. WHAT IS A BERMUDA PRIVATE TRUST COMPANY?

It is a company with trustee powers which does not require licensing under Bermuda's trust legislation, namely the Trusts (Regulation of Trust Business) Act 2001 (the Act), provided that it fulfils the following criteria:

(a) it is not carrying on the business as a trustee, in essence, it cannot offer its services to the general public; and

(b) by the terms of its memorandum of association, it is empowered to act as trustee of only a limited number of identifiable trusts.

The Private Trust Company must also certify to the Bermuda Monetary Authority (BMA) in writing that it qualifies for the licensing exemption in observing the above restrictions, and provide some description of the trust or trusts which it administers.

There are no minimum share capital requirements for a Private Trust Company.

3. ADVANTAGES OF A PRIVATE TRUST COMPANY

As suggested above there are numerous advantages to using a Bermuda Private Trust Company, namely:

(a) Cost: unlike many other jurisdictions, a Bermuda Private Trust Company is not subject to an expensive licensing process. Accordingly, in some cases the fees related to the formation and on-going administration of the structure will be less than those charged by an institutional trustee. This is especially true for large trusts where an institutional trustee charges on an ad valorem basis.

(b) Familiarity: many settlors from civil law jurisdictions are unfamiliar with trust concepts. The combination of a trust and a Private Trust Company is similar in effect to a corporate or foundation structure.

(c) Efficiency: the absence of licensing makes it easier, quicker and less expensive to make changes to directors, officers or other structural elements. Many clients have complained about the costs and time involved in changing trustees. With a Private Trust Company typically all that is required is a change of directors or the termination of a trust administration agreement.

(d) Comfort: many clients are hesitant to transfer legal ownership of significant assets to an institutional trust company in an offshore jurisdiction. The client may be more comfortable having the assets owned and administered by a Private Trust Company that they have created, and perhaps control (depending upon the tax and other factors effecting the settlor and beneficiaries).

(e) Control: most trusts require that the trustee exercise their discretion in the administration of the assets, for example the investment or distribution of trust assets. The structure of a Private Trust Company enables family members or trusted advisers to be involved in the decision making process by becoming directors or consultants to the Private Trust Company.

(f) Privacy: many families are concerned about the disclosure of information regarding the family, their assets and their activities. Using a Private Trust Company makes it easier to control access to, and disclosure of, confidential information. This is especially true where the company's board consists of the family and their trusted advisers.

(g) Consolidation: many institutional trustees are unwilling to hold certain types of high risk assets and often have investment limitations and constraints. The Private Trust Company does not have similar constraints, and all of the assets can be administered by a single trustee.

(h) Integration: the Private Trust Company integrates easily with a Family Office, an operating company or even private philanthropic trust. It is possible to share a common name, board of directors and administrative facilities.

4. WHO WILL MAKE UP THE BOARD AND WHAT PRESENCE MUST THE COMPANY HAVE IN BERMUDA?

Bermuda law requires a company to have a minimum of one director. Corporate directors are permitted. The board may, but need not, include one or more Bermuda-resident directors and board meetings may be held anywhere. The board of directors provides an opportunity to create a "round table" forum in which family members can participate, perhaps together with trusted advisers. In this way, the client can be reasonably assured that there is a sufficient understanding of the family's background and dynamics and that their wishes regarding the administration of the underlying trusts will be respected. It is also possible to create various committees that will advise the Board, for example investment or audit committees.

5. WHO USES PRIVATE TRUST COMPANIES?

Private Trust Companies are commonly used by wealthy families as a replacement for institutional trust companies, or as part of their global planning. Typically a Private Trust Company is formed to act as the trustee of one or more private family trusts or connected trusts. These might be separate trusts for family members who each own shares of a single/common operating company, trusts holding non-income producing assets such as yachts, airplanes or real estate, or charitable trusts which fund the family's philanthropic activities.

The Private Trust Company can also be used to act as the trustee of commercial trusts. For example, a financial institution will form a wholly-owned Private Trust Company to act as trustee of "in-house" collective investment trusts, such as unit trusts or mutual funds. The Private Trust Company might also be used to own special purpose vehicles that are used in financing or other structures.

6. WHO MAY OWN THE COMPANY?

Care must be exercised in deciding who will own the shares of the Private Trust Company. Ownership can create tax and other problems. While the company may be owned by an individual or a company, it is generally thought to be undesirable that the ownership should have, or be perceived to have, any link with the settlor or any beneficiary of a trust administered by the Private Trust Company. For this reason the majority of Private Trust Companies are "orphaned" by having the shares owned by a Purpose Trust, or are created as companies limited by guarantee (i.e. a company without share capital).

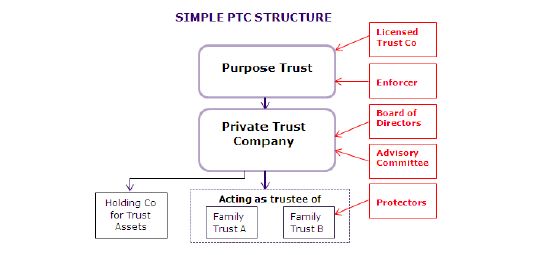

7. COMMON PURPOSE TRUST STRUCTURE

Unlike a traditional family trust, a Purpose Trust does not have beneficiaries during the term of the trust. The trust assets are only to be used for the purpose specified in the trust document. Where a Purpose Trust owns the shares of a Private Trust Company, it will be established for the exclusive purpose of incorporating the Private Trust Company, acquiring and holding its shares and generally dealing with those shares. Since there are no beneficiaries of the trust during the term of the trust, and no person has any ownership rights over the shares, this makes the Purpose Trust an ideal vehicle for ownership of the Private Trust Company where personal ownership may be problematic.

The typical Private Trust Company structure is as follows:

8. SIMPLIFIED PACKAGE

While it is possible to create highly complicated and unique Private Trust Company structures, it has been our experience that most clients prefer to create the "typical" structure as discussed above where the Private Trust Company is owned by a Purpose Trust administered by a licensed trust company in Bermuda. We have created a standardised package of documentation so that this typical structure can be created quickly, efficiently and at a reasonable cost. Naturally, costs will increase where modifications are made to the standard form documents.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.