PREFACE

This Guide to Partnerships in Bermuda is concerned exclusively with exempted partnerships and overseas partnerships and does not concern local partnerships i.e. partnerships established by Bermudians for the purpose of carrying on business and trading within Bermuda. The intention is to provide an outline of Bermuda's legal and regulatory environment in relation to exempted partnerships (both limited and general) and overseas partnerships, and the formation and/or registration procedures for such entities. The Guide is, therefore, designed as a starting-point for a more detailed and comprehensive discussion of the issues.

Persons interested in the establishment of or the operation of exempted or overseas partnerships in Bermuda should consult legal, tax and other professional advisers in their respective jurisdictions.

This Guide has been prepared according to Bermuda law and practice as of March 2013 and has been produced for the benefit of our clients and professional colleagues. It is divided into four parts:

1. Introduction

General and limited partnerships are distinguished and the more significant elements of the applicable law are briefly discussed.

2. Procedures for Formation

Details of the steps for the formation of partnerships are considered with the general and limited partnerships being treated separately.

3. Management and Administration

Considerations relative to the conduct of a partnership's business are outlined, including accounting and audit, record keeping and filing requirements.

4. Exchange Control, Taxation and Fees

Details of the tax treatment of partnerships are discussed.

Whilst we have made every effort to ensure the accuracy of the statements made herein, we accept no liability for any errors. In all cases expert legal advice from a qualified practitioner of Bermuda law should be obtained.

DEFINITIONS

"Appointed Newspaper" means the Gazette, or newspaper appointed by the Registrar under section 2(2) of the Exempted Partnerships Act 1992;

"Appointed Stock Exchange" means any stock exchange appointed as one by the Minister;

"Authority" means the Bermuda Monetary Authority;

(*)"Competent Regulatory Authority" means any authority appointed by the Minister by notice in the Gazette to approve the offering of shares or debentures to the public by companies;

"Dollar(s)" means Bermuda dollars, the value of which is on par with the US dollar;

"Exempted Partnerships Act" means the Exempted Partnerships Act 1992;

"Exempted Undertaking" means an exempted company, or a permit company or an exempted partnership as defined under applicable Bermuda law;

"IFA" means that Investment Funds Act 2006;

"Limited Partnership Act" means the Limited Partnership Act 1883;

"Minister" means the Minister of Finance;

"OECD" means the Organisation for Economic Development;

"Overseas Partnership Act" means the Overseas Partnership Act 1995;

"Partnership Act" means the Partnership Act 1902;

"Registrar" means the Registrar of Companies;

"Stamp Duties Act" means the Stamp Duties (International Businesses Relief) Act 1990;

"Supreme Court" means the Supreme Court of Bermuda; and

"Tax Protection Act" means the Exempted Undertakings Tax Protection Act 1966.

1. INTRODUCTION

a. Definition and Classification

Under Bermuda law, a partnership is the relationship between persons carrying on a business in common with a view to profit. Two types of partnerships may be created: general partnerships and limited partnerships.

Exempted partnerships are registered to carry on business outside of Bermuda from a place of business in Bermuda and must have at least one non-Bermudian partner. Overseas partnerships are partnerships formed or registered in another jurisdiction and are registered to trade or carry on business in Bermuda. While an overseas partnership is not a Bermuda partnership in the same sense as an exempted partnership, it must maintain a registered office in Bermuda and will enjoy similar treatment under Bermuda law. An overseas partnership can be a general partnership or a limited partnership.

b. Governing Statutes

A partnership carries on business subject to the provisions of its partnership agreement and to the applicable partnership statutes of Bermuda. The governing statutes include:

i. the Partnership Act (similar to the English Partnership Act 1890);

ii. the Limited Partnership Act;

iii. the Exempted Partnerships Act; and

iv. the Overseas Partnerships Act.

c. Legal Identity

Bermuda partnership law largely follows English partnership law. Both general and limited partnerships may operate as unincorporated entities constituted by the contractual relationship between the partners or they may elect to have 'legal personality' upon formation. A partnership that makes such an election is a legal person separate from its partners. Once made, the election of legal personality is irrevocable. Whether a partnership has elected to have separate legal personality or not, a partnership may carry on business in its own name and may sue and be sued in the partnership name.

d. Liability of Partners

In the case of a general partnership, the liability of the partners for a partnership's debts and obligations is not limited. Each of its partners is jointly and severally liable for all partnership debts and obligations.

A limited partnership consists of one or more general partners (which may be bodies corporate or general or limited partnerships, whether formed under the laws of Bermuda or another jurisdiction) and one or more limited partners.

In broad terms, the liability of a limited partner is limited to the value of the money and/or the value of any property that the limited partner undertakes to contribute to the partnership. However, the liability of a general partner of a limited partnership is unlimited.

There is no limit on the number of limited or general partners of a limited or general partnership.

e. Name of Partnership

The business of a partnership may be conducted under a name chosen by the partners. The proposed partnership name may be reserved in advance by application to the Registrar. The reservation of a name is renewable every three months and confers exclusive rights to its use. The Registrar has discretion to refuse a name if it is undesirable, already in use by another partnership or is too similar to an existing entity's name.

The name of a limited partnership must end in the words "Limited Partnership" or the abbreviation "L.P." (either designation may be used interchangeably.)

In the case of an overseas partnership, the name under which the entity has been formed must be advertised in an Appointed Newspaper (along with other particulars of the partnership) at least three months prior to the application for a permit. The overseas partnership may, on the grant of such a permit, be registered in Bermuda under its original name, unless the Registrar objects to that name on the grounds stated above. It is also possible for an overseas partnership to reserve a name with the Registrar.

f. Permitted Scope of Activities

Exempted partnerships and overseas partnerships are permitted to engage in a wide range of activities, excluding carrying on business in Bermuda in certain circumstances (See "Doing Business in Bermuda" below).

g. No Minimum Capital

Bermuda partnerships are not subject to a minimum capitalization requirement. The permit granted for an overseas partnership may, however, specify any conditions or restrictions that the Minister deems appropriate, including a mechanism for imposing a minimum capital requirement.

2. FORMATION

a. Governing Statutes

The registration procedures for an exempted partnership (whether general or limited) are governed by the Exempted Partnerships Act. The Limited Partnership Act places additional requirements on any exempted partnership which is also a limited partnership. The partnership agreement of any exempted partnership must be governed by Bermuda law.

The application requirements for an overseas partnership are goverened by the Overseas Partnership Act. The governing law of the partnership agreement of an overseas partnership remains the law indicated in the partnership agreement and does, therefore, need to be governed by Bermuda law.

An overseas partnership that is a fund, does not require a permit if it engages a fund administrator or registrar in Bermuda to carry out any of the following services or activities for the fund in Bermuda: corporate secretarial, accounting, administrative or registrar and transfer agent services.

Additionally, an overseas fund partnership does not require a permit to engage in marketing or dealing with the holders of its partnership interests or any of the following activities: offering of partnership interests, acceptance of subscriptions, redemptions, distribution of partnership information, making known that it may be contacted in Bermuda, or otherwise dealing with the holders of its partnership interests.

b. General Partnerships

Persons seeking to register a general exempted partnership must apply to the Authority for consent to register the partnership and the general partner(s) by making application to the Authority to include information about the general partner(s) and a certificate of particulars containing:

i. the proposed name;

ii. the names of all partners (in the case of a limited partnership, only the names of the general partner(s);

iii. the registered office address in Bermuda;

iv. the name of the resident representative in Bermuda and its address; and

v. a declaration specifying that the partnership has elected to have legal personality (if applicable).

In addition, the Authority will require information regarding the proposed general partner(s). (See "Compliance" below.)

All information supplied to the Authority in the course of the application is confidential (subject to certain statutory exemptions related to Bermuda's anti-money laundering/anti-terrorist financing regime). Applications are usually processed in one to two working days, and are made to the Authority online through the Authority's electronic filing system.

Within six months of receiving the Authority's consent, the partners must deliver the certificate of exempted partnership and the Authority's consent to the Registrar. The Registrar will register the partnership and issue a certificate of registration, specifying the date of registration and attaching a copy of the certificate of exempted partnership to it. The certificate of registration is part of the public file maintained by the Registrar, which is open for public inspection. The partnership agreement does not form part of the public file and is not required to be registered with any regulators in Bermuda.

c. Limited Partnerships

An exempted limited partnership requires a certificate of particulars of an exempted partnership and a certificate of particulars of a limited partnership. The certificate of particulars of a limited partnership should be signed by the persons proposing to form and register the limited partnership. Any election of separate legal personality that has been made will only be noted in the certificate of exempted partnership.

The certificate of particulars of a limited partnership must contain:

i. the partnership name;

ii. the names and respective places of residence or registered address of the general partner(s); and

iii. the address of the registered office (which may not be a post office box) in Bermuda.

The Authority's review of the application will focus on the general partner(s). It will be necessary to submit certain information regarding the jurisdiction of formation, good standing, business, registered office and in some circumstances, depending on the proposed business of the partnership, details of their financial standing and experience relative to the proposed partnership business. The beneficial ownership details of anyone (directly or indirectly) owning 10% or more of a general partner, which is not publicly traded on a recognised exchange, will need to be submitted. (See "Compliance" below.)

Depending on, inter alia, the type of fund, where it is intended to invite subscriptions for interests in a limited partnership pursuant to an offering document, a copy of the proposed offering document should be supplied. (See "Investment Funds Act" below.)

Once approval is received from the Authority, the limited partnership may be registered by the Registrar. The Registrar will register the certificates of particulars and issue a single certificate of registration indicating the date of registration. The limited partnership is formed as a matter of Bermuda law when the consent of the Authority is received and the two certificates of particulars are registered with the Registrar.

d. Overseas Partnerships

An overseas partnership may apply to the Minister for a permit to engage in or carry on business in Bermuda. (See comments above regarding a partnership fund that is exempt from requiring a permit.) Within the three months prior to the making of an application for a permit, the partnership must publish, in an Appointed Newspaper, a newspaper advertisement announcing the intention to apply for a permit and specifying:

i. the name of the partnership;

ii. the names of all the general partners;

iii. law governing the partnership; and

iv. the general nature of the business to be transacted by the partnership.

The application is submitted to the Minister (through the Registrar) in order to obtain his consent to grant a permit. The documentation provided with the application is similar to that required from the general partners of an exempted partnership. In addition, the application must include a certificate of particulars pursuant to the Overseas Partnership Act made out by or on behalf of the persons seeking to obtain the permit. The certificate of overseas partnership must contain the following particulars:

i. the name of the partnership;

ii. the names and respective addresses of all general partners;

iii. the name and address of the resident representative;

iv. the registered office address in Bermuda; and

v. the law governing the partnership.

In considering whether to grant a permit for an overseas partnership, the Minister is required to have regard to:

i. the economic situation of Bermuda and the protection of persons already engaged in or carrying on any trade or business in Bermuda;

ii. the nature and previous conduct of the partnership; and

iii. any advantages or disadvantages (to Bermuda or persons in Bermuda) which may result from the partnership being granted a permit.

A permit may be issued subject to such conditions or restrictions (if any) that the Minister sees fit to impose. However, the general partner(s) may apply for variation of any condition or restriction to which the permit is subject.

The certificate of particulars of an overseas partnership and the signed permit are then delivered to the Registrar for registration. The Registrar will register the signed permit and issue a certificate of registration specifying the date of registration of the permit. A copy of the certificate of particulars and the permit are attached to the certificate of registration. The permit is effective on the date of registration.

A register of overseas partnerships is maintained at the office of the Registrar and is open to inspection by the public on payment of a fee.

e. Compliance

All applications for the registration of exempted or overseas partnerships require the disclosure of certain details regarding the ultimate beneficial owners of the proposed general partner(s). The type of information to be disclosed depends on the nature of the general partner(s), and is governed by both Appleby (Bermuda) Limited, or Appleby Services (Bermuda) Limited's obligations under existing anti-money laundering/anti-terrorist financing regulations and policy as provided by the regulator.

Where an individual intends to act as the general partner(s) of a limited partnership, Appleby (Bermuda) Limited requires that he or she must complete and submit a personal declaration form.

Where a company intends to act as the general partner of a limited partnership, a list of the company's shareholders including their names, addresses and the number of shares they own, must be submitted with the application. In addition, each shareholder who owns 10% or more of the company must complete a personal declaration from.

Where a listed public company intends to act as the general partner of a limited partnership, details of the exchange on which the company is listed, its ticker symbol and a copy of its most recent annual report to its shareholders must be submitted.

Where a limited partnership intends to act as the general partner of a limited partnership, information on that partnership's general partner must be disclosed. Disclosure must include the entire chain of ownership until the identity of the individual(s) who own(s) that corporate structure is revealed.

Appleby (Bermuda) Limited's "Know Your Client" procedures require the completion of certain compliance forms which are retained in confidence for client verification purposes.

3. MANAGEMENT, BUSINESS AND ADMINISTRATION

a. Management of Partnership

The management of a partnership's business and affairs is arranged by and is subject to the provisions of the partnership agreement.

In the case of an exempted limited partnership, only the general partners may manage the business of the partnership. If a limited partner participates in management, he may become liable as a general partner for the debts and obligations of the partnership. The Limited Partnership Act does however list a number of activities which do not constitute management, including, but not limited to:

i. advising a general partner on the business of the partnership; and

ii. taking any action or making any decisions in respect of any investment made by a limited partnership.

The limited partners of an overseas partnership are subject to any restrictions on participation in management pursuant to that partnership's governing law. The Limited Partnership Act and the Overseas Partnership Act do not regulate the degree to which limited partners of an overseas partnership may participate in the management or affairs of a partnership overseas.

b. Doing Business in Bermuda

Exempted partnerships and overseas partnerships are Exempted Undertakings and as such are subject to restrictions on the business activities that they may conduct in Bermuda. These restrictions preclude such partnerships from engaging in retail trade and from owning land in Bermuda (except by way of a tenancy agreement or lease of businesses premises for a term not exceeding fifty years).

These restrictions do not preclude exempted and overseas partnerships from effecting or concluding contracts in Bermuda or holding meetings in Bermuda. Exempted and overseas partnerships are not prevented from for example:

i. exercising all other powers necessary for carrying on their business with persons outside Bermuda;

ii. doing business in Bermuda with other "Exempted Undertakings" in furtherance of their business conducted outside Bermuda; and

iii. transacting banking business in Bermuda or (if the partnership agreement expressly provides) acting as manager or agent for, or consultant or adviser to, the business of another Exempted Undertaking.

All overseas partnerships must include the partnership name, governing law, and registered office address on letters sent from their place of business in Bermuda.

c. Alteration of Partnership Agreement: Supplementary Certificates

An exempted partnership must obtain prior consent from the Authority to make changes to its general partner(s).

An overseas partnership must obtain prior consent from the Minister to make changes to its general partner(s).

No prior consent is required for an exempted partnership or an overseas partnership to change the partnership name (subject to any objection by the Registrar), registered office, resident representative or, in the case of an exempted partnership, the resident representative's address, but a supplementary certificate must be signed by the general partner(s) and submitted to the Registrar. Any changes, including to a general partner, will become effective on the date of registration.

If there is any change to the particulars specified in a limited partnership certificate, the general partner(s) must file a supplementary certificate with the Registrar. Any changes will become effective on the date of registration.

d. Resident Representative

The resident representative must be a resident of Bermuda and may be a partner or an unrelated party engaged contractually for this purpose. The resident representative may file any documents and make any application that can be made by the partnership that appoints it. The resident representative has a right to notice of all partnership meetings and is entitled to attend, be heard at and receive copies of the minutes of such meetings.

Where an exempted partnership fails to comply with the requirements of the Exempted Partnerships Act, the resident representative has a reporting responsibility to the Minister and is subject to criminal sanctions for any defaults.

Where an overseas partnership fails to comply with the Overseas Partnership Act, the resident representative has a similar reporting responsibility. The resident representative must make a report to the Minister in regards to:

i. breaches of any conditions or restrictions contained in a partnership's permit;

ii. failing to keep the required records of its acts and financial affairs;

iii. failing to pay any fee or file any certificate which it required under the Overseas Partnership Act; or

iv. the failure to obtain consent from or notify the Minister where required.

e. Registered Office

Every exempted partnership and overseas partnership must designate a registered office in Bermuda. This office cannot be a post office box. Service of proceedings may be affected on an exempted or overseas partnership, by depositing notice of such proceedings at the registered office. Partnerships may establish a separate office as their registered office or, as is generally the case, rely upon the person or company contracted as the resident representative to provide the registered office.

f. Register of Limited Partners

Limited partnerships are required to establish and maintain a current register of their limited partners at their registered office. This register must contain the limited partners' names, addresses and the dates they commence and (if applicable) cease to be limited partners. The register is open to inspection by any limited partner without charge. A limited partnership that trades on an Appointed Stock Exchange or on a market which is supervised by a Competent Regulatory Authority, may keep one or more branch registers of limited partners outside Bermuda. Overseas partnerships that are limited partnerships are not required to maintain a register of limited partners unless it is specified by the permit issued to the partnership.

g. Accounts and Audit

An exempted partnership must maintain proper records and accounts of its business at its registered office in Bermuda or at such other place as the partners think fit. If the records are maintained outside of Bermuda, sufficient records of accounts must be kept at its registered office in Bermuda to enable an assessment of the partnership's financial position at the end of each quarter. The records of accounts must be open to inspection by the partners (including limited partners) and the resident representative at all times. Such records are not, however, open to the public and are not filed with any governmental agency or regulator.

In response to certain OECD initiatives, the Exempted Partnerships Act and the Overseas Partnership Act have recently been amended to require exempted partnerships to keep accounting records for a period of five years from which they were prepared.

Exempted partnerships are also required to maintain audited financial statements prepared in accordance with generally accepted accounting principles, unless all the parties agree in writing to waive their preparation.

Overseas partnerships must also maintain business and financial records which illustrate the business initiatives that it is carrying on in Bermuda which include proper records of account. Such partnership records may be maintained overseas provided that sufficient records are kept at its registered office in Bermuda to enable all the partners to ascertain the partnership's financial position at the end of each quarter. Such records are not open to the public and there is no requirement to file them with any Bermuda governmental agency or agency. Overseas partnerships are not required to produce audited accounts though this may be a specific condition of their permit As with exempted partnership, accounting records must be maintained in Bermuda for a period of 5 years from the date on which they were prepared.

h. Government Supervision

The Authority does not exercise a supervisory role with regard to the business of exempted or overseas partnerships unless they engage in the provision of regulated services. Accordingly, such partnerships are free to conduct their affairs in accordance with their partnership agreement and the applicable provisions of Bermuda law.

The Exempted Partnerships Act confers the Minister with the power to appoint an inspector to investigate the affairs of an exempted partnership and to report on their findings. If the Minister considers that a breach of the Exempted Partnerships Act has been knowingly and willfully committed, the Minister can direct the Registrar to petition the Supreme Court for sanctions including the dissolution of the partnership. However, provisions exist to safeguard the privacy of an exempted partnership in the event of an investigation.

The Overseas Partnership Act confers similar powers on the Minister to appoint an inspector to investigate the affairs of an overseas partnership. If the Minister considers that an overseas partnership, a partner, the resident representative or any officer, agent or employee of the overseas partnership has knowingly and willfully contravened the Overseas Partnership Act, the Minister may revoke the partnership's permit. If the Minister considers that any of the foregoing persons are carrying on the partnership's affairs in a manner which is detrimental to the partnership's creditors, the Minister may require the partnership to take corrective measures in relation to its affairs. However, provisions exist to safeguard the privacy of an overseas partnership in the event of an investigation.

Annually, an exempted partnership, limited or general, must submit a declaration to the Registrar stating the nature of the business transacted by the partnership, and pay an annual fee to the Bermuda Government. Overseas partnerships are also liable to an annual fee to the Bermuda government.

i. Investment Funds Act

The IFA requires Bermuda exempted partnerships that operate as open-ended investment funds to be authorised by the Authority (or have been exempted by the Authority) unless they are excluded from such authorization or exemption as private funds. It is an offence for these types of partnerships to operate without authorisation.

To be characterized as an investment fund, a limited partnership must possess one or both of the following characteristics;

i. contributions of its participants and the profits or income out of which payments are to be made to them must be pooled; and

ii. the fund property must be managed as a whole by, or on behalf of the general partner(s).

Additionally, the participants must not have day to day control over the assets. The fund's constitution and prospectus must allow for the redemption of units and the calculation of their price.

A partnership investment fund will qualify as a private fund if the number of limited partnership participants does not exceed twenty persons and it does not promote itself by communicating invitations or inducements to invest to the public. The general partner(s) of a private fund must notify the Authority in writing if the fund qualifies for exclusion.

Please see the Appleby Brief on the IFA (available from the firm's website www.applebyglobal.com) for greater details as to the authorization requirement for partnership investment funds.

j. Winding Up: Cancellation of Registration and Surrender of Permit

Where the business and affairs of an exempted partnership are to be wound up, the partners or the persons duly authorized by the exempted partnership are required to file a certificate of cancellation with the Registrar within thirty days of the commencement of the winding up of the affairs of the partnership.

The certificate of cancellation shall specify:

i. the name and date of registration of the exempted partnership;

ii. that the exempted partnership is dissolved; and

iii. the effective date of the cancellation if the cancellation is not to be effective upon registration of the certificate by the Registrar. This has to be a date certain.

The certificate of cancellation must be signed by at least one partner or one person duly authorized to sign on behalf of the exempted partnership. After the dissolution of the exempted partnership the authority and obligations of each partner to bind the firm continue so far as may be necessary to wind up the affairs of the partnership. An exempted partnership will terminate (and be cancelled) upon the completion of its winding up which shall effectively be the date of cancellation.

An overseas partnership may, at any time, voluntarily surrender its permit to the Minister. With the surrender of its permit, an overseas partnership will no longer be regulated by the Overseas Partnership Act or have any right to maintain a place of business in Bermuda.

In the event that the overseas partnership is dissolved, the procedures that apply to its dissolution are determined by its governing law. The partnership's resident representative is under a duty to notify the Minister promptly upon learning of the dissolution if the partnership has been dissolved without surrender of its permit.

4. EXCHANGE CONTROL, TAXATION AND FEES

a. Exchange Control

Exempted partnerships and overseas partnerships will be designated as non-resident by the Authority for exchange control purposes. Such partnerships will be free to designate their capital and deal in any currency with the exception of Bermuda dollars.

b. Taxation

In Bermuda, there are no taxes on profits, income or dividends, nor is there any capital gains tax, estate duty or death duty for Exempted Undertakings. Profits can be accumulated and it is not obligatory to pay dividends. As Exempted Undertakings, exempted partnerships and overseas partnerships are entitled to apply for an assurance pursuant to the Tax Protection Act. In the event that legislation introducing taxes on profits, income, or computed on any capital asset is enacted, the assurance provides that such taxes shall not be applicable to the partnership or any of its operations until 31 March 2035. The assurance does not provide an exemption from tax payable in relation to land leased by the partnership.

c. Stamp Duties

Instruments executed by or in relation to an exempted or overseas partnership are exempt from stamp duties by virtue of the Stamp Duties Act. Thus, stamp duties are not payable on:

i. instruments that effect the transfer or assignment of an interest in an exempted partnership or an overseas partnership;

ii. the sale or mortgage of partnership assets; and

iii. partnership capital.

5. CONCLUSION

Bermuda partnership legislation features streamlined formation procedures and simplified administrative requirements well suited to partnerships conducting a wide range of businesses. The option for Bermuda partnerships to assume legal personality facilitates holding and dealing with partnership property and continuity where partnerships undergo changes in their partners. The legislation establishes Bermuda as a jurisdiction of choice for a comprehensive range of partnership vehicles and permits great flexibility for the structuring of commercial transactions around them.

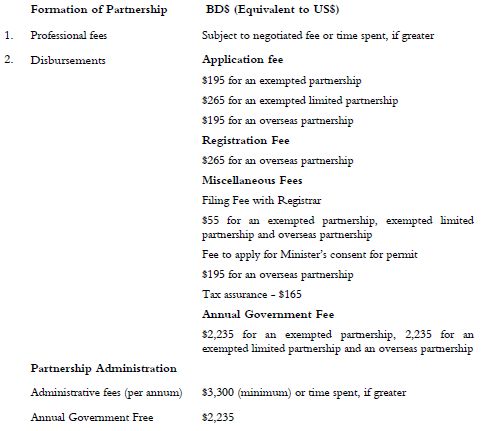

6. FEE SCHEDULE

Partnership administration is provided by Appleby Services (Bermuda) Ltd., a company affiliated with Appleby (Bermuda) Limited. The partnership administration fee includes the provision of the registered office and a resident representative.

The minimum partnership administration fee is billed annually in advance each year. From time to time additional fees may be billed in respect of time charges in excess of the annual partnership administration fee to the extent that services exceed the level predicted for this fee.

Appleby Services (Bermuda) Ltd. reserves the right (upon negotiation with the client) to engage the professional services of Appleby (Bermuda) Ltd. as may be warranted in connection with the due performance of its administrative duties.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.