Summary

The Federal Inland Revenue Service ("FIRS" or "the Service") recently issued a Public Notice reminding the general public of the obligations to remit Stamp Duties to the Service under the Stamp Duties Act (SDA) as amended by the Finance Act, 2019. We have summarised the clarifications below.

Details

The Public Notice reiterates the provisions of Section 4(1) of the SDA as amended by the Finance Act, 2019 which provides that the FIRS is the only competent authority to impose, charge and collect Stamp Duties on dutiable instruments, where such instruments are executed between a company and an individual, group or body of individuals.

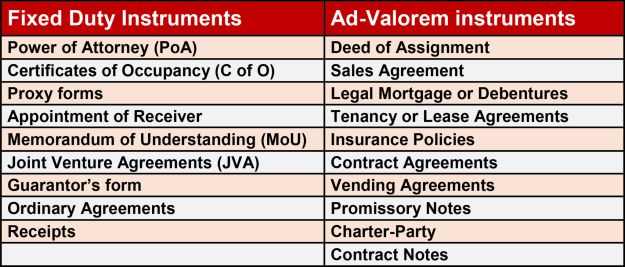

The Public Notice further lists the instruments which are subject to Stamp Duties as provided below:

In addition, the Public Notice reiterates the following:

- Any electronic receipt or electronic transfer of money

deposited in any bank or with any banker from

N10,000 and above will attract a one-off duty ofN50; - Duties on receipts (written, printed or in electronic form) for

transactions between corporate bodies or between a corporate body

and an individual, group or body of individuals, which value

amounts to

N10,000 and above will be denoted by payment ofN50 per receipt to the Service; and - Stamp Duty transactions can be carried out online via www.stampduty.gov.ng.

Implication

The Public Notice reiterates the powers of the FIRS to collect Stamp Duties on dutiable instruments, where such instruments are executed between a company and an individual, group or body of individuals in line with Section 4(1) of the Stamp Duties Act as amended by the Finance Act.

However, it is worth noting that the Nigerian Postal Service (NIPOST), in a recent Public Notice stated that the rights to print, mint, produce, retail and provide postage adhesive stamp resides with the NIPOST. In that Notice, NIPOST informed the public that it had taken steps to ensure that the appropriate authorities addressed "the legal contradiction" which NIPOST claims exists in an earlier FIRS' Circular that attempted to clarify the provisions of the Finance Act on the appropriate agency for the collection of Stamp Duties. Read our tax alert on the FIRS Circular here.

Although the legal basis for NIPOST's Public Notice is unclear, it is necessary for the FIRS and NIPOST, being both government agencies to reach a consensus on the implementation of the Stamp Duties Act on applicable documents so that taxpayers are adequately guided.

We will monitor any further administrative guidelines and directives in this regard and highlight any subsequent developments.

Originally published June 20, 2020

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.