- within Tax topic(s)

- with Finance and Tax Executives

- in United States

- with readers working within the Property industries

If you are building or investing in a Nigerian tech company and thinking about an eventual exit, the Nigeria Tax Act 2025 (NTA 2025) has materially changed how much of that exit value you actually keep. Tax planning that begins only when a buyer appears is often too late. Under the new rules, the way shares are held, how value is assessed, and how a deal is structured now play a role in determining net returns.

In our previous edition of the Tax & IP Series we examined how the Act introduced new frameworks for intellectual property and digital assets. This edition of TechBrief by TALP focuses specifically on tech exits. It explains how the revised Capital Gains Tax (CGT) regime affects founder payouts and investor returns, outlines how gains are now calculated, and highlights practical strategies and exemptions that can help preserve exit value.

A Different CGT Landscape

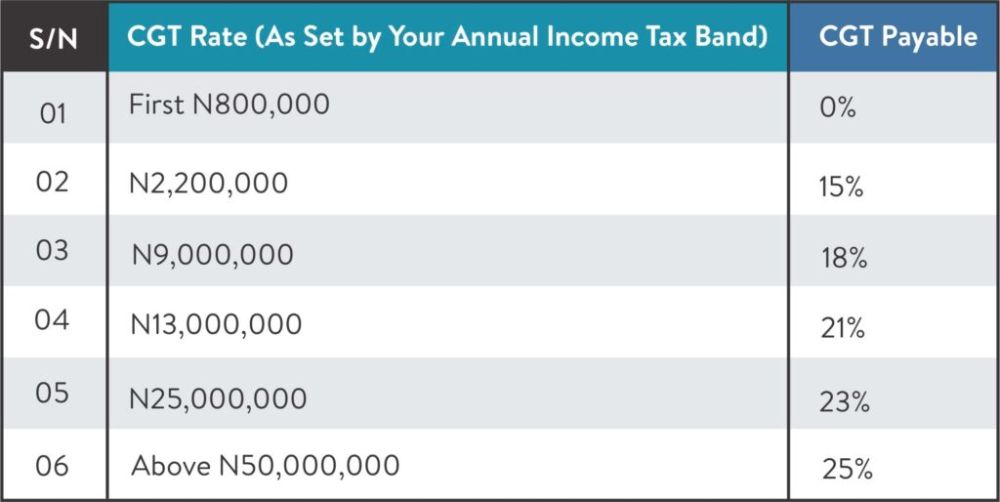

Under the new tax regime, the CGT rate for companies has increased from 10% to 30%, significantly raising the cost of exit for corporate investors. Individuals are treated differently. Capital gains earned by individuals now follow the same progressive structure used for personal income tax. The rates rise with income and cap at 25%. In practical terms, many founders and early investors may face a lower tax burden by holding shares personally rather than through holding companies or SPVs.

The following is a breakdown of the new Individual Tax Bands:

This distinction is especially important for founders who set up corporate structures early for convenience, fundraising, or governance reasons, without considering how those structures affect exit taxation.

Filing Obligations

CGT is self-assessed. For corporate entities, returns must be filed within six months after the financial year end, or within six months of cessation if the company stops operating in Nigeria. For individuals, CGT must be filed no later than 31st March of the following year.

Capital Gains Tax is Charged on Profit, Not the Headline Price

A common misconception is that Capital Gains Tax applies to the full sale price of an asset. It does not. CGT is charged only on the profit made from the sale, known as the chargeable gain. The chargeable gain is calculated by subtracting the cost of acquiring and developing the asset from the amount it is sold for. In simple terms, CGT applies to your margin, not your total proceeds.

For example, if a founder acquires or develops intellectual property for ₦10 million and later sells it for ₦20 million, the taxable gain is ₦10 million. Only that ₦10 million profit is subject to tax.

This distinction is especially important in high-growth tech exits, where early development costs can be substantial but are often poorly documented. Without proper records, founders may end up paying tax on gains that could have been legitimately reduced.

How the calculation works under the new rules

To determine what you owe, the law applies a straightforward formula:

Chargeable Gain = Sale Proceeds – Acquisition Cost

Acquisition cost includes not only the original purchase price, but also allowable expenses incurred to create, protect, value, or sell the asset.

What has changed under the Nigeria Tax Act 2025

While the formula itself remains familiar, the meaning of its key components has tightened under the new regime.

- Sale proceeds and fair market value

Tax is now anchored on fair market value (FMV) rather than the price stated in a contract. The tax authority can disregard the agreed price and assess tax based on the asset's true market value where the transaction does not reflect economic reality. This applies in particular where:

- the transaction is between related parties or within a group,

- the consideration is unclear or non-cash, such as offshore shares, crypto, or barter arrangements, or

- the asset is transferred at a substantial discount.

In practice, this means assets can no longer be undervalued within a structure to reduce tax exposure. The law prioritizes substance over form.

2. Cost of acquisition and allowable expenses

Because CGT applies only to the gain, increasing your legitimate acquisition cost reduces the taxable amount. Acquisition cost goes beyond what you originally paid. It can include legal fees, valuation costs, professional advisers, and brokerage fees directly connected to creating or disposing of the asset. To benefit from these deductions, proper documentation is important. Invoices, contracts, and receipts must be retained to support every allowable expense.

Concerns on Retrospective Application

A key concern was whether the new CGT rules would apply to gains built up over many years. Although the Nigeria Tax Act is silent on a formal cost reset, the Presidential Fiscal Policy and Tax Reforms Committee has clarified how the rules will be implemented. For practical purposes, gains accrued up to 31 December 2025 will be grandfathered.

This means the cost base of existing assets will be treated as the higher of:

- the original acquisition cost, or

- the market value as at 31 December 2025.

Only gains arising after that date are expected to be taxed under the new regime. For example, if shares bought for ₦50 million are worth ₦80 million by 31 December 2025 and later sold for ₦90 million, CGT applies only to the ₦10 million increase after 2025. Gains earned before the new rules took effect are not brought into the tax net.

Exemptions & Reliefs That Save You Money

The Nigeria Tax Act 2025 also introduces several exemptions designed to support founders, investors, and early-stage businesses. If you qualify, these reliefs can significantly reduce, or even eliminate, your CGT exposure.

- Early-stage companies may benefit from a CGT exemption if they have low turnover and limited fixed assets and do not provide professional services. Low-income individuals are also exempt, which can benefit early employees and founders at the start of their careers.

- Small gains on share disposals can be exempt where both the sale proceeds and the resulting gains fall below specified thresholds, making minor exits or partial sell-downs tax-free.

- Angel investors, venture capital funds, and similar players are exempt from CGT on disposals of investments in labelled startups, provided the investment is held for at least 24 months. This exemption is aimed at encouraging long-term capital into the startup ecosystem.

- Additional reliefs apply to qualifying corporate reorganisations, where asset transfers within mergers or restructurings are treated as continuations rather than taxable disposals. There are also exemptions for gains on the sale of a principal private residence and reliefs that allow CGT to be deferred where proceeds are reinvested into shares of another Nigerian company within the same tax year.

Each of these reliefs comes with conditions, and careful planning is essential to take full advantage of them.

The Takeaway

The Nigeria Tax Act 2025 has fundamentally changed how tech exits are taxed.

Fair market value now carries more weight than contractual form, and structure and timing are more important than ever. Proper record-keeping is no longer optional.

Successful exits will depend not only on valuation and deal terms, but on early tax planning and effective use of the exemptions and reliefs built into the law. Founders, investors, and early employees who plan ahead, document acquisition and development costs, and structure transactions carefully are better positioned to protect their exit value and maximize returns.

To view original Tope Adebayo article, please click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]