- within Government and Public Sector topic(s)

- in United States

- within Government, Public Sector, Corporate/Commercial Law and Environment topic(s)

Business Structures in Nigeria for Foreign Investors: Understanding Liabilities & Entry Options

Entering a new market is exciting but also legally complex. For foreign investors, choosing the right business structure in Nigeria is essential to ensure smooth operations and avoid regulatory challenges. This guide explains the best options, liability considerations, and repatriation rules.

Selecting the appropriate business structure in Nigeria for foreign investors is essential for compliance and long-term operational success.

1. Overview of Business Structure in Nigeria for Foreign Investors

Nigeria's corporate framework, governed by the Companies and Allied Matters Act (CAMA) 2020, provides several incorporation options tailored for different scales and goals of foreign investment. Each structure carries its own rules on ownership, liability, and operational flexibility.

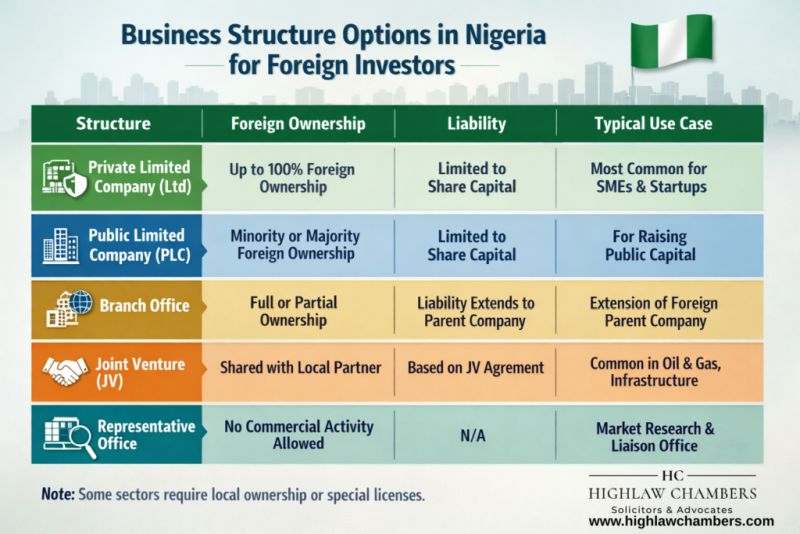

| Structure | Foreign Ownership | Liability | Typical Use Case |

|---|---|---|---|

| Private Limited Company (Ltd) | Up to 100% foreign ownership (except restricted sectors) | Liability limited to share capital | Most common entry vehicle for foreign investors |

| Public Limited Company (PLC) | Foreigners may own shares or even 100% ownership | Liability limited to share capital | Used when raising public capital; not typical for initial entry |

| Branch or Subsidiary Office | Full or partial ownership | Liability extends to parent company | For long-term operations by foreign parent companies/Used by established corporations entering Nigeria |

| Joint Venture (JV) | Shared ownership (sector-dependent) | Based on JV agreement | Common in regulated sectors like oil, gas, infrastructure |

| Representative Office | Allowed but no commercial activity | N/A | Market research and liaison activities |

Note: Regulated sectors, such as broadcasting, aviation, and oil & gas services may require local equity participation or special permits. See NIPC investment guidelines for sector-specific rules.

2. Liability and Repatriation of Profits

Foreign investors often choose a Private Limited Company (Ltd) because liability is limited to the value of share capital, protecting the parent company from on-ground operational risks.

Nigeria also provides legal protections for capital movement. Under Section 24 of the NIPC Act, foreign investors registered with the Nigerian Investment Promotion Commission may freely repatriate:

- Dividends

- Profits

- Capital

Repatriation must comply with Central Bank of Nigeria (CBN) foreign-exchange regulations and requires a Certificate of Capital Importation (CCI). See CBN FX regulations here: https://www.cbn.gov.ng

Case Example:

A UK-based renewable energy company initially considered launching

operations in Nigeria as a branch. After legal evaluation, it

incorporated a Private Limited Company (Ltd) to limit liability,

access investment incentives, and simplify profit repatriation

under CBN rules.

3. The Strategic Advantage of Getting It Right

Your chosen structure affects tax exposure, governance, investor protections, ownership control, and long-term operational strategy. Getting this right at the outset avoids costly restructuring and ensures compliance with Nigerian regulators, including CAC, NIPC, and CBN.

HighLaw Chambers supports foreign investors with incorporation, regulatory approvals, and ongoing compliance, ensuring a secure and well-structured entry into Nigeria's growing economy.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.