- within Insolvency/Bankruptcy/Re-Structuring, Finance and Banking, Litigation and Mediation & Arbitration topic(s)

- in Nigeria

- with readers working within the Law Firm industries

Introduction

The Infrastructure Concession Regulatory Commission ("ICRC"), in August 2025 issued the PPP Regulatory Notice (the 'Notice'), pursuant to the powers conferred on it under Section 34 of the Infrastructure Concession Regulatory Commission Act (the "ICRC Act"). The Notice introduced significant changes to the approval thresholds for PPP projects in Nigeria. In September 2025, the ICRC also released a new set of guidelines to regulate the development and implementation of Public-Private Partnerships (PPPs) in Nigeria ("the Guidelines").

This review focuses on the Notice and the Guidelines, examining the implication for investors, project developers and public institutions while highlighting the opportunities that were presented by the revised framework.

Highlights Of The Notice

The Notice introduces significant changes to the approval process for PPP projects undertaken by any Federal Ministry, Department or Agency ("MDA") involved in the financing, construction, operation, or maintenance of infrastructure in Nigeria under the PPP model. These changes apply exclusively to Federal level PPP projects within the ICRC's statutory mandate and cover both future projects and those currently undergoing approval.1

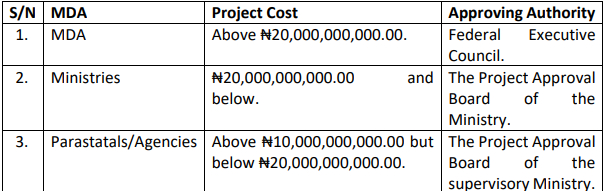

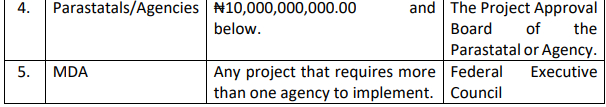

Under the ICRC Act, all PPP projects to be undertaken by any Federal MDA were subject to the approval of the Federal Executive Council ("FEC"). However, the Notice now delegates this authority to Project Approval Boards ("PABs") 2 established within the respective MDAs, subject to defined financial thresholds. The FEC, however, will remain the sole approving authority for PPP projects that (i) exceed the approved financial threshold or (ii) projects whose initiation and implementation necessitate the participation of multiple agencies and/or subnational governments, where applicable.

The approved financial thresholds are as follows:

By the Notice, key operational requirements to the application of the new approval thresholds are also introduced. Key among them is that all projects must be fully funded by the private sector, with no recourse to government financial support3 . Accordingly, project proponents can no longer rely on, or request government guarantees, comfort letters, or direct public funding, but must ensure that financing is mobilized independently from private sources4 . In addition, all PPP Agreements are now to be executed solely by the Project Owners (MDAs), as Grantors, to ensure sustainable service delivery, since PPPs are time-bound and require a hand-back of the project at the end of the concession period5 .

Notwithstanding the new approval thresholds and the changes, the ICRC remains responsible for:

- leading project negotiations and conducting due diligence on all prospective PPP partners;

- issuing the mandatory ICRC Certificate of Compliance for all PPP projects undertaken; as prerequisite for approval by either the FEC or the PABs of the respective MDAs;

- maintaining custody of executed PPP agreements;

- approving any proposed amendments to project terms and conditions; and

- preparing and submitting periodic reports to the President on the performance and status of PPP projects nationwide6 .

ICRC Guidelines 2025

The Guidelines introduce a revised financial approval threshold for PPP projects and establish a framework for constituting Project Approval Boards within Ministries, Departments, and Agencies (MDAs)7 . They also provide directions on the preparation of key project documents such as, the Outline Business Case, Full Business Case, and financial model, and set out procedures for procurement routes, PPP agreement, among others. The Guideline comprises of 12 sub-guides and notices namely: Full Business Guide; Direct Negotiation; PPP Unit Governance Structure and Functions; PPP Project Financial Model Guide; Outline Business Case Guide; Unsolicited PPP Procurement Guide; Swiss Challenge Guide; Solicited PPP Procurement Guide; PPP

Regulatory Notice; Project Approval Board Governance Structure and Functions; Modified Swiss Challenge Gude; and Financial Model Template.

Other provisions in the ICRC Guidelines include the following:

1. Procedural Reforms: The guidelines reinforce the need for clear documentation and institutional processes. MDAs must prepare OBCs and FBCs, submit all agreements for ICRC verification, and adhere to standardised templates for procurement and concession contracts.8

2. The Outline Business Case (OBC) and Full Business Case (FBC)9 Templates: The ICRC included templates for OBC and FBC. OBC is the intermediate project development document that assesses the strategic need, technical feasibility, affordability, and value-for-money of a proposed project. It provides sufficient analysis for the approving authority to decide whether the project should proceed to detailed structuring and procurement. The FBC is the final, comprehensive project appraisal document prepared after procurement. It builds off the OBC, setting out the detailed technical, financial, legal, commercial, and risk structure of the project and demonstrates that the selected proposal is viable, bankable, and ready for implementation and contract execution.

3. PPP Project Financial Model Guide: The ICRC PPP Project Financial Model Guide 2025 sets out minimum requirements and standards for developing financial models for PPP projects in Nigeria. Notably, ICRC has pegged included its regulatory fees and has mandated that the financial model should contain the ICRC fees which fees may comprise a one-off charge of up to 5% of entry fee and a mandatory annual fee of 1% of the project's gross revenues10 .

4. Unsolicited PPP Procurement Guideline: This Guide outlines the process through which a Private Proponent can submit a Privately Initiated Infrastructure Proposal (PIIP) to an MDA11 . For Unsolicited PPPs, (Privately Initiated Infrastructure Proposals), the private proponent must pay a nonrefundable proposal fee to the ICRC based on the project cost as identified in the Guideline. 12

5. Solicited PPP Procurement Guideline: This guide applies where projects originate from government MDAs. It is a government-initiated process where an MDA identifies and priorities infrastructure projects suitable for private sector participation.

6. The PPP Unit Governance Structure and Functions: Under this notice, the PPP Units MDAs are to be established to provide the specialized expertise required to assess, structure, and manage PPP projects13 .

Implication Of The Notice And The Guidelines

Decentralisation Of Approval Powers

As previously stated, prior to the regime of this Notice, all PPP approvals were to be obtained from FEC14. This regime affected project delivery timelines, causing an unnecessary delay in the execution of the Project.

The introduction of PABs within MDAs marks a major shift from the centralised approval regime that previously required all PPP projects to be vetted by FEC. This decentralisation is intended to reduce bureaucratic delays, enhance institutional efficiency, and empower line Ministries to take ownership of their PPP pipelines. It could significantly shorten project development timelines and promote faster execution of viable projects below ₦20 billion. Also, the mandatory requirement for the procurement of the ICRC's FBC certificate of compliance before approval by the PAB is aimed at maintaining federal oversight and legal accountability and uniformity in standards of PPPs across MDAS. .

Post-Facto Regularisation Clause

The Notice now mandates MDAs to submit PPP projects already operational or executed outside ICRC oversight for "regularisation"15. While this provision effectively validates prior non-compliance and could be exploited to launder irregular or fraudulent contracts into legitimacy, its provision marks a legal shift from the tolerance of irregular PPPs to strict enforcement. Projects that were executed outside the ICRC's oversight now stand the risk of invalidation if not regularised through the MDAs.

Institutional Strengthening And Capacity Building

The Notice compels every MDA to establish a functional PAB and PPP Unit, for the administration of the provisions of the Notice16. This development enhances institutional capacity, promotes project ownership, and embeds PPP knowledge within the civil service. This could drive the professionalisation of PPP practice across the federal system and reduce overreliance on external transaction advisors.

To view the full article clickhere

Footnotes

1 Para 2.1.2 of the Notice. 2 This is discussed below.

3 Para 3.2 of the Notice

4 Ibid-Para 3.2

5 Para 3.5 of the Notice

6 Par 3.9 of the Notice

7 ICRC Guidelines 2025

8 The Full Business Case Guide 2025, the Outline Business Case Guide 2025, and Para 3.8 of the Notice.

9 Outline Business Case Guide 2025

10 Para 10 PPP Project Financial Model Guide 2025

11 Unsolicited PPP Procurement Guide 2025

12 Para 1(i) Unsolicited PPP Procuerment Guide 2025

13 Para 2.0 PPP Unit Governance Structure and Functions

14 Section 2(2) ICRC Act

15 Para 4.0 of the Notice

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.