- within Technology topic(s)

- within Technology topic(s)

- with Finance and Tax Executives

- with readers working within the Property industries

Introduction

Nigeria's Fintech revolution is unstoppable, but so are the regulators. With over 430 companies now transforming how money moves, from digital banking and mobile payments to blockchain, lending, and wealth management, the sector has become one of Africa's most vibrant innovation hubs. But rapid growth attracts not just capital and customers, but also scrutiny.

In previous editions of Tech Brief by TALP, we explored the key requirements for various Fintech licences and provided a concise playbook for playing within the boundaries of your licence. This edition breaks down the key regulators shaping Nigeria's Fintech landscape, what each one does, and why understanding their mandates is not just about staying out of trouble; it is about building a business that scales sustainably.

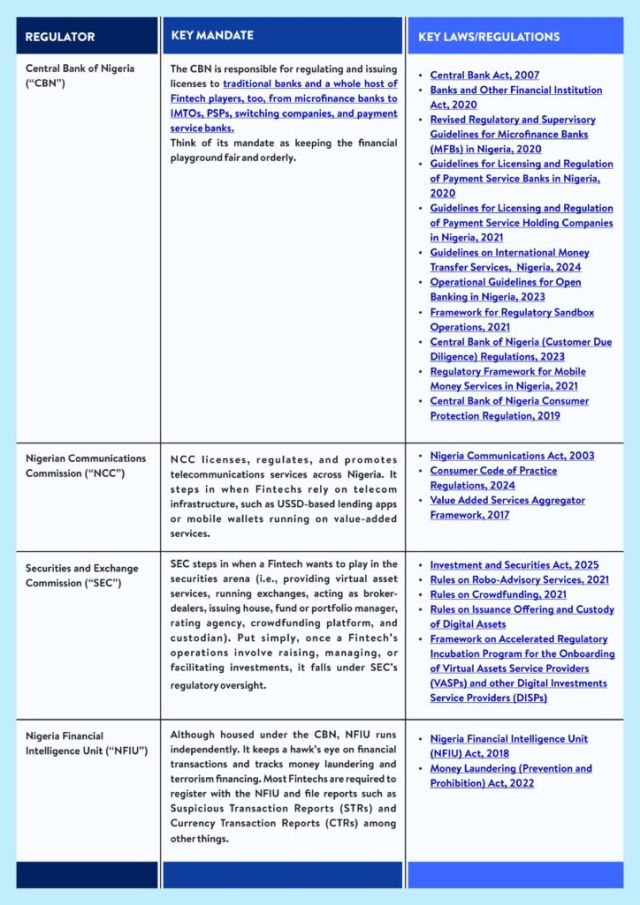

Regulatory Mapping

Every Fintech journey begins with two foundational steps:

- Corporate Affairs Commission (CAC): Securing your company's "birth certificate." This is where your Fintech gets formally incorporated.

- Federal Inland Revenue Service (FIRS): Once incorporated, you will need to register for tax purposes and stay compliant with ongoing reporting obligations.

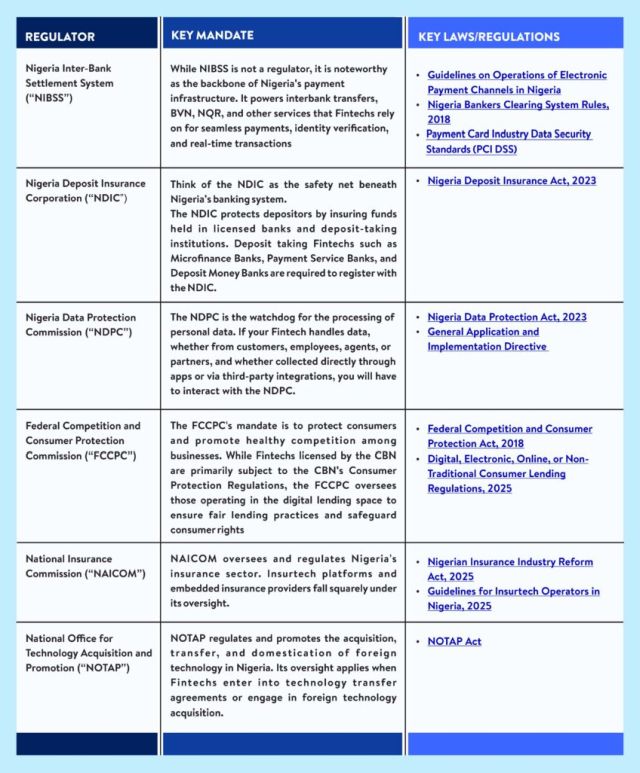

Once those basics are covered, the real work begins. A host of sector-specific regulators come into play, often before you even launch operations. Below are key regulators, their mandates, and the laws and regulations you need to look out for:

*Kindly note that the laws/regulations mentioned above are not exhaustive. Additionally, the regulations are subject to review and update by the regulator from time to time.

In practice, most Fintechs fall under multiple regulators simultaneously. For instance:

- A digital lender providing other financial services might require CBN licensing, FCCPC oversight, NDPC compliance, and NFIU reporting.

- A crypto platform could fall under SEC, CBN, and NDPC simultaneously.

Pro tip: Map out your regulatory touchpoints before product launch. Engage regulators proactively, they are increasingly open to dialogue, especially with early-stage companies acting in good faith.

Conclusion

Nigeria's Fintech regulatory landscape may be complex, with multiple bodies overseeing different areas of operations. However, getting familiar with key regulators and understanding the scope of their mandates can make the navigation of compliance a lot less daunting.

To view original Tope Adebayo article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.