- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Business & Consumer Services, Technology and Media & Information industries

Welcome to the 2025/26 edition of the Emerging Europe report.

The CEE region delivered a standout year for M&A in 2025. Overcoming global uncertainty with remarkable strength, dealmaking accelerated across almost every market. This was driven by renewed investor confidence, steadier financial conditions, and a marked resurgence in strategic consolidation. Transaction volumes and values both reached historic highs as megadeals returned across multiple sectors — from banking and retail to manufacturing and mining.

Results at a glance

Deal activity reached record heights

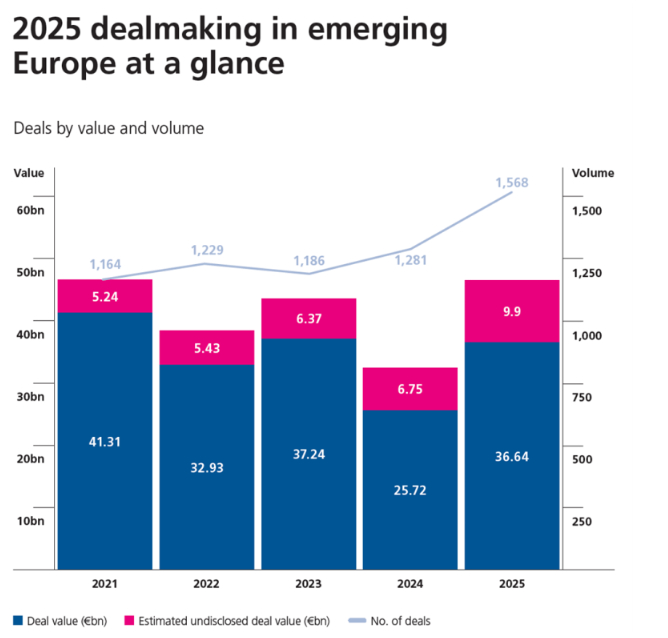

Dealmaking in 2025 surpassed all expectations, with transaction volumes climbing to 1,568 deals, a 22.4% increase compared with 2024 and the highest annual total ever recorded. Aggregate values also rebounded strongly, rising by 42.5% to EUR 36.64bn, driven by the return of large‑cap and megadeal activity across several key sectors. This renewed momentum reflects both the region's inherent resilience and the growing confidence of buyers willing to deploy significant capital across CEE.

Largest sectors

By aggregate deal value, the strongest‑performing sectors in 2025 were Finance & Insurance, Manufacturing, and Real Estate & Construction, which together accounted for a significant share of the year's high‑value activity. Finance & Insurance led the region with EUR 8.76bn in recorded value, supported by several landmark banking transactions. Manufacturing followed with EUR 7.06bn, reflecting renewed strategic investment and capacity expansion across the region. Real Estate & Construction reached EUR 5.65bn, fuelled by sustained investor appetite. Collectively, these sectors illustrate where consolidation, modernisation and long‑term structural demand are shaping investor priorities across CEE.

Cross-border deal activity

Cross‑border M&A accelerated notably in 2025, rising to 953 transactions, an increase of 22.8% compared with the previous year. Total cross‑border deal value also recovered strongly, reaching EUR 32.2bn. The US, UK, and Germany were the most active foreign investors by volume, while Austria, the US and the Netherlands led by deal value. Domestic activity followed a similarly positive trajectory: domestic transactions increased from 505 to 615 deals, with domestic deal value almost doubling to EUR 4.5bn, underscoring the breadth and depth of regional investment momentum across Emerging Europe.

Download the full Emerging Europe M&A Report 2025/2026

Private equity

Private equity remained a major force across the region in 2025, with involvement rising to 330 transactions: a 18.7% increase compared to the previous year. Aggregate PE deal value also grew strongly, reaching EUR 17.24bn, up 24.2% year‑on‑year. Several landmark transactions underscored the depth of investor appetite, including GTCR's EUR 4.1bn acquisition of Zentiva and the CVC-backed Mehiläinen acquisition of Regina Maria & MediGroup for EUR 1.3bn. Together, these developments highlight private equity's continued focus on high‑quality healthcare, consumer and industrial assets across CEE.

M&A activity time trend

Across CEE, the M&A market demonstrated clear momentum throughout the year. Transaction volumes climbed from 1,281 in 2024 to 1,568 in 2025, a continuation of the region's long‑term upward trajectory. Deal values also rebounded sharply, rising from EUR 25.7bn to EUR 36.64bn, driven by the renewed presence of EUR 1bn+ transactions. Where 2024 saw a heavier weighting toward small and mid‑market deals, 2025 marked a return to high‑value strategic consolidation, enhancing both deal size and overall market confidence.

Deals by value and volume

Dealmaking in CEE remains attractive for international investors and the 2025 data indicates dynamic volumes and higher aggregate values, supported by large-cap transactions across key sectors. With financing stabilising and confidence increasing, 2026 should bring continued consolidation, more cross border acquisitions and selective PE deployment across the region.

Horea Popescu

Managing Partner

Sector trends

Sector performance in 2025 highlighted strong momentum across several key industries. Finance & Insurance, Manufacturing, and Real Estate & Construction delivered some of the most significant gains of the year, with deal values rising to EUR 8.76bn, EUR 7.06bn, and EUR 5.65bn respectively, supported by major high‑value domestic and cross‑border transactions. Driven by sustained investment in digital infrastructure and operator consolidation across CEE, Telecoms & IT also continued to expand, reaching 285 deals and EUR 5.24bn in total value. Pharma & Healthcare, underpinned by sustained demand and investor appetite, reached 124 deals.

Activity remained robust in Real Estate & Construction, where transaction volumes increased to 249 deals, reflecting continued appetite for core and infrastructure‑linked assets throughout the region. Food & Beverage similarly recorded stronger activity, with deals rising to 84, supported by consumer‑driven growth and strategic consolidation among local and regional players. Energy & Utilities also remained an active segment of the market, with 107 transactions recorded and strong interest in renewable generation and energy‑storage solutions (BESS) as the region continues to advance its long‑term energy transition. Together, these shifts demonstrate the breadth of investment across CEE and the increasing focus on scalable, future‑oriented sectors.

Investor confidence is clearly rebuilding in CEE, and that is translating into fuller pipelines and faster deal timetables. We are seeing broad based interest across jurisdictions and sectors and the momentum is tangible.

Radivoje Petrikić

Partner

Country M&A deal volumes

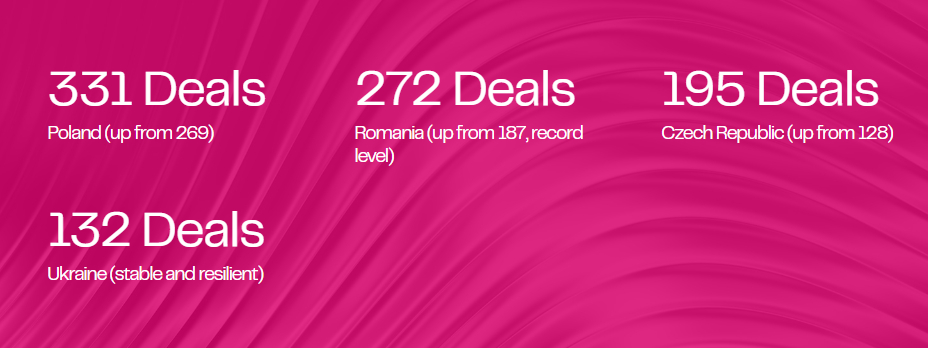

The most active M&A markets in the region by deal volume:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.