- with readers working within the Securities & Investment industries

- within Compliance topic(s)

Summary

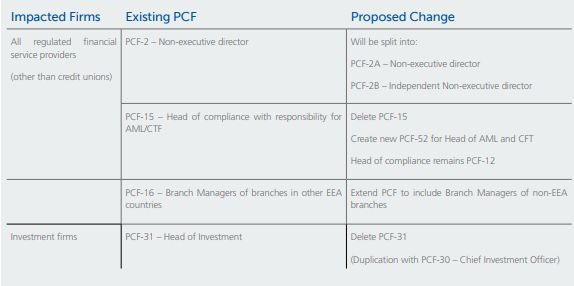

On 22 September 2021, the Central Bank of Ireland (the "Central Bank") published a Notice of Intention regarding proposed amendments to certain Pre-Approval Control Functions ("PCFs") under its Fitness and Probity regime. Amendments would be introduced by way of amending regulations.

The Central Bank has provided details of the requirements for in-situ PCFs impacted by these changes which are set out below.

1. Splitting the PCF-2 role to distinguish between Non-Executive Directors ("NEDs") and Independent Non-Executive Directors ("INEDs")

This amendment will designate NEDs as PCF-2A and INEDs as PCF-2B.

This amendment will impact all Irish regulated financial services providers ("RFSPs") with one or more INEDs appointed to their boards.

Next Steps

In-situ NEDs will be re-designated as PCF-2A by the Central Bank. RFSPs will be required to notify the Central Bank which individuals should be designated as PCF-2B, and that they have confirmed that they have undertaken the relevant due diligence to assess independence.

2. Removal of the PCF-15 role and establishment of a dedicated PCF-52 Head of Anti-Money Laundering and Counter Terrorist Financing Role

This amendment will dispense with the current PCF-15 Head of Compliance with responsibility for Anti-Money Laundering and Counter Terrorist Financing Legislation role and will replace it with a dedicated PCF-52 Head of Anti-Money Laundering and Counter Terrorist Financing role. The existing PCF-12 Head of Compliance role will be retained and this will be the default role for the Head of the Compliance Function.

This amendment will impact all RFSPs with an individual performing a PCF-15 role and others with an individual who is Head of Anti-Money Laundering and Counter Terrorist Financing, but who is not Head of Compliance.

Next Steps

All in-situ individuals performing a PCF-15 role will have this designation end-dated. RFSPs will be required to notify the Central Bank of the appropriate PCF designation(s) of the individual i.e. either or both PCF-12 and PCF-52. No action is required in respect of in-situ individuals performing a PCF-12 role.

In all other cases, RFSPs should review their functions and determine whether any individual would meet the PCF-52 Head of Anti-Money Laundering and Counter Terrorist Financing role. Where it is determined by RFSPs that this role does exist, they will be required to review their fitness and probity assessment of the relevant individual and submit confirmation of such an assessment to the Central Bank. It does not appear from the Notice of Intention that an Individual Questionnaire will be required for such individuals.

3. Expanding the PCF-16 role beyond managers of European Economic Area ("EEA") branches to branches outside of Ireland

This amendment will expand this PCF-16 role from its current scope of managers of branches of Irish RFSPs in the EEA to encompass managers of branches of Irish RFSPs based anywhere outside of Ireland.

This amendment will impact all RFSPs with branches outside of the EEA.

The Notice of intention states: "The Central Bank notes that these individuals are also currently subject to the fit and proper requirements of the host regulator responsible for the supervision of the relevant branches. While, as a PCF, it will not be permissible for a branch manager of a branch in a non-EEA country to be appointed without the Central Bank's approval, the Central Bank does not envisage that this amendment would have any other impact on the role of the Central Bank with regard to the supervision of such branches."

Next Steps

The Notice of Intention states that no action arising from this change will be required in respect of in-situ EEA branch managers.

RFSPs with branches outside of the EEA will be required to review their fitness and probity assessment of the relevant in-situ non-EEA branch managers and submit confirmation of such an assessment to the Central Bank. It does not appear from the Notice of Intention that an Individual Questionnaire will be required for such individuals.

4. Removal of PCF-31 Head of Investment Role

This amendment will dispense with the PCF-31 Head of Investment Role, as the Central Bank notes that there is an element of duplication between it and the PCF-30 Chief Investment Officer role.

This amendment will impact investment firms which have an individual performing a PCF-31 Head of Investment role.

Next Steps

No action is required by impacted investment firms. All individuals who are performing PCF-31 roles will automatically be re-designated as PCF-30.

The Notice of Intention states that the process for in-situ persons will commence after the amended regulations come into effect and a period of 6 weeks will be provided to submit the in-situ confirmation. The full application process will apply to any new appointment to the amended PCFs after the amended regulations come into effect.

The Central Bank invites comments from stakeholders on this proposal which should be submitted to governanceconsultations@centralbank.ie no later than 20 October 2021.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]