- within Finance and Banking topic(s)

- in Ireland

- with readers working within the Securities & Investment industries

- within Finance and Banking, Corporate/Commercial Law, Litigation and Mediation & Arbitration topic(s)

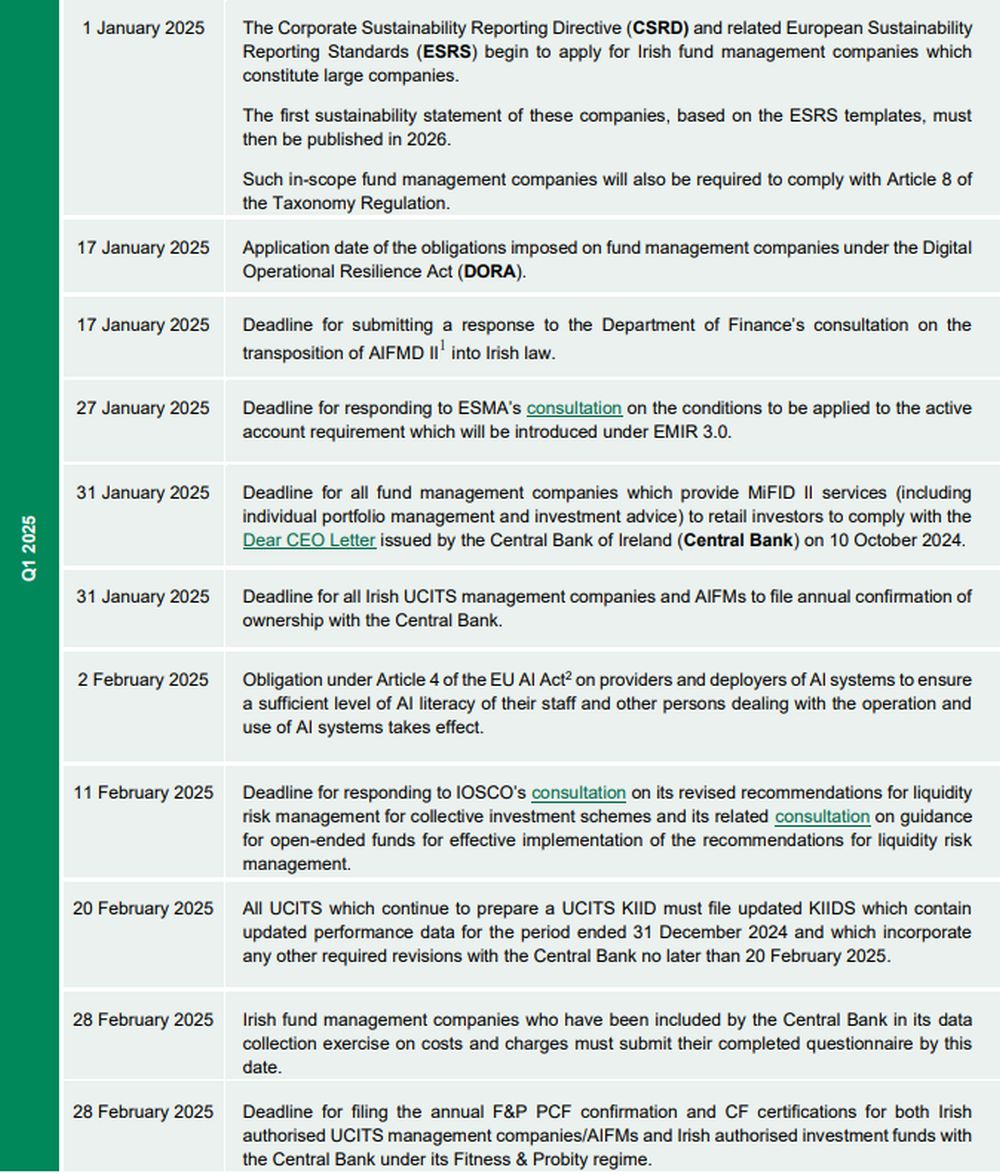

1 APPROACHING DEADLINES

2 UCITS & AIFMD

2.1 ESMA publishes new Q&A on UCITS and AIFMD

On 3 October 2024, ESMA published a revised Q&A on performance fees charged to UCITS (ESMA UCITS Q&A). On the same date, it published a revised Q&A on performance fees charged to AIFs marketed to retail investors (ESMA AIFMD Q&A).

Both Q&A are revised editions of Q&As originally published by ESMA in July 2021 with the sole change being to the question asked by ESMA. The revised question in each case now clarifies that the date of creation of a new UCITS/AIF share class for the purposes of the Q&A is the date on which the share class is launched or seeded.

Both Q&A then confirm that performance fees must be crystallised after at least 12 months from the date of launch or seeding of the relevant share class.

A copy of the ESMA UCITS Q&A is available here.

A copy of the ESMA AIFMD Q&A is available here.

| Key Action Points | In-scope fund management companies should review existing performance fee calculation methodologies for all Irish UCITS funds and any Irish RIAIF funds to ensure that the crystallisation methodology aligns with ESMA's expectations outlined in the ESMA UCITS Q&A and ESMA AIFMD Q&A. |

2.2 ESMA publishes consultation on open-ended loan-originating AIFs

Under AIFMD II which introduces a new pan-EU loan origination framework which will be available from April 2026, a loanoriginating AIF4 must be established as a closed-ended fund unless the AIFM can satisfy its home regulator that its liquidity management approach is aligned with the investment strategy and redemption policy of the relevant fund.

On 12 December 2024, ESMA published a consultation setting out draft regulatory technical standards specifying the conditions that it proposes must be satisfied by an open-ended loan-originating AIF (Consultation). These conditions have been divided into four categories, namely (i) the establishment of an appropriate redemption policy, (ii) maintaining an appropriate amount of liquid assets, (iii) the type and frequency of liquidity stress testing to be carried out and (iv) the monitoring of the liquidity management system.

Responses to the Consultation must be submitted to ESMA by 12 March 2025.

A copy of the Consultation is available here.

A detailed overview of the Consultation is available in the Dillon Eustace briefing on the topic which is available here.

| Key Action Points | Interested fund management companies should respond to the consultation by 12 March 2025 via the ESMA portal. |

2.3 Department of Finance publishes consultation on implementation of AIFMD II

On 22 November 2024, the Irish Department of Finance published a public consultation on the exercise of national discretions in AIFMD II (Consultation).

It has sought feedback on the exercise of a number of different national discretions, including:

- whether the list of ancillary activities and services that may be provided by an external AIFM or UCITS management company should be extended to include the administration of benchmarks and the same functions and activities already provided by an AIFM or UCITS management company in relation to funds that it manages may be performed for the benefit of third parties, in the case of AIFMs, the provision of credit servicing activities and in the case of UCITS management companies, the receipt and transmission of orders; and

- whether AIFs that originate loans should be prohibited from granting loans to consumers in Ireland.

Responses to the Consultation can be made via the Department of Finance's consultation portal which is available here on or before 17 January 2025.

A copy of the Consultation is available here.

| Key Action Points | Interested fund management companies should respond to the consultation by 17 January 2025. |

2.4 ESMA announces collection of data on costs charged to investors in UCITS and AIFs

On 14 November 2024, ESMA launched a data collection exercise with the EU national competent authorities (NCAs) to assess the costs linked to investments in UCITS and AIFs and to better understand pricing practices currently employed by those managing and distributing such funds.

This exercise involves the collection of data from fund manufacturers on the different costs charged for the management of investment funds as well as collecting data from distributors (such as investment firms, independent financial advisors, neobrokers) on fees paid directly by investors to distributors.

Those Irish fund management companies selected to participate in the exercise must complete a detailed questionnaire on costs charged to investors by 28 February 2025.

A report based on data received by ESMA via the NCAs will be submitted to the European Parliament (Parliament), the Council of the EU (Council) and the European Commission in October 2025 and will also input into an enhanced 2025 ESMA market report on costs and performance of EU retail investment products.

A copy of the ESMA press release is available here.

| Key Action Points | Those Irish fund management companies selected for participation in the data collection exercise should implement an appropriate action plan to gather all required data to allow them to complete the questionnaire by 28 February 2025. |

2.5 ESMA and EIOPA publish letter relating to the EU Retail Investment Strategy

In April 2024, the Parliament adopted its negotiating position on the European Commission's proposal on the EU Retail Investment Strategy (RIS) while in June 2024, the Council adopted its finalised position on the proposal, paving the way for trialogue negotiations to begin in 2025.

On 13 November 2024 ESMA and EIOPA published a letter which they sent to the European Commission relating to the RIS (Letter). In that Letter they:

- recommended that the introduction of any investment/saving product for retail investors (as recommended by the Council in its conclusions on the capital markets union (amongst other topics)) be built into the current RIS proposal to avoid multiple revisions of the retail investment framework in a short period of time;

- advised that they did not agree with the proposals put forward by the Council and the Parliament on the RIS in which value for money benchmarks created by ESMA and EIOPA would be used only as a supervisory tool for national competent authorities instead of mandating fund management companies to use such benchmarks in their pricing processes to satisfy themselves that the fund will deliver value for money to investors (as had been put forward by the European Commission in its proposal)

- supported the Parliament's proposal to introduce an online comparison tool for PRIIPS to allow investors access to "an unbiased source of information on all relevant product features".

A copy of the Letter is available here.

3 CENTRAL BANK OF IRELAND5

3.1 Central Bank publishes Dear CEO letter on marketing materials used for retail investors

On 10 October 2024, the Central Bank issued a Dear CEO letter on MiFID II marketing communication requirements to all Irish authorised MIFID investment firms, credit institutions and fund management companies providing MiFID II services to retail clients (Dear CEO Letter).

In the Dear CEO Letter, the Central Bank set down its key findings and expectations in respect of the common supervisory action it recently conducted on marketing and advertising requirements, as well as good practices observed by it during its review.

The Dear CEO Letter requires in-scope fund management companies (i.e. those which provide MiFID II services to retail clients) to:

- review their marketing and advertising practices against the relevant ESMA report and the findings, expectations and good practices set out in Schedule 1 to the letter;

- identify any necessary actions to be taken to address gaps; and

- have that action plan discussed and approved by the board of directors of the relevant management company by 31 January 2025. and have an action plan by 31 January 2025

A copy of the Dear CEO Letter is available here.

A copy of the related ESMA report is available here.

| Key Action Points | Fund management companies which provide MiFID II services to retail clients should review their marketing and advertising practices against the ESMA report on CSA on marketing communications and the findings set out in Schedule 1 to the Dear CEO Letter and document an action plan of required steps to address any identified shortcomings and have such action plan approved by 31 January 2025. |

3.2 Central Bank establishes new Fitness and Probity Unit

In July 2024, the Central Bank published a report outlining the findings of an independent review of its fitness sand probity regime which is intended to operate as a gatekeeping process to ensure that those who work in key positions within Irish regulated firms are fit and proper to do so. As explored in more detail in our briefing on the topic, the recommendations made focus on the clarity of supervision expectations, internal governance and the fairness, efficiency and transparency of the process.

In July 2024, the Central Bank published a report outlining the findings of an independent review of its fitness sand probity regime which is intended to operate as a gatekeeping process to ensure that those who work in key positions within Irish regulated firms are fit and proper to do so. As explored in more detail in our briefing on the topic, the recommendations made focus on the clarity of supervision expectations, internal governance and the fairness, efficiency and transparency of the process.

On 19 December 2024, the Central Bank announced that it has established a new dedicated fitness and probity unit which will be in place from the start of 2025 and which will bring together fitness and probity activities that until now have been dispersed across the Central Bank.

The Central Bank's press release announcing the establishment of the dedicated unit is available here.

4 SUSTAINABLE FINANCE

4.1 ESMA publishes Q&A on its fund naming guidelines

On 21 August 2024, ESMA published its finalised guidelines on funds' names using ESG or sustainability-related terms (Guidelines).

Any funds established on or after 21 November 2024 must comply with the Guidelines immediately while funds established prior to that date must comply with these rules by 21 May 2025.

On 13 December 2024, ESMA published three Q&A providing further guidance on specific aspects of the Guidelines (Q&A).

The three Q&A are intended to ensure a smooth application of the Guidelines through common understanding of key concepts and address the following:

- the application of the PAB exclusion criteria/CTB exclusion criteria6 to funds falling within the scope of the Guidelines which hold green bonds and other "use-of-proceeds" instruments

- ESMA's interpretation of what is meant by "meaningful investment" in sustainable investments for any fund which uses a sustainability-related term in its name

- how the term "controversial weapons" should be understood by fund management companies when applying the PAB/CTB exclusion criteria to funds which fall within the scope of the Guidelines.

A copy of the Q&A is available here.

A copy of the Guidelines is available here.

To view the full article, click here.

Footnotes

1. Directive (EU) 2024/927

2. Regulation (EU) 2024/1689

3. Directive 2007/16/EC

4. Defined as an AIF whose investment strategy is mainly to originate loans or whose originated loans have a notional value that represents at least 50% of its NAV)

5. For Central Bank of Ireland developments relating to exchange traded funds, please refer to the section entitled "Exchange-Traded Funds" below.

6. Under the Guidelines, in-scope funds must comply with the exclusion criteria applicable to either EU Paris-aligned benchmarks (PAB exclusion criteria) or EU climate transition benchmarks (CTB exclusion criteria) which are set down in Article 12 of Commission Delegated Regulation (EU) 2020/1818.

Originally published 17 January 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.