- with readers working within the Banking & Credit industries

- within Environment, Transport and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Insurance industries

Key Dates & Deadlines: Q1 / Q2 2025

The following are key dates and deadlines in Q1 / Q2 2025 along with possible impacts and action items arising for fund managers.

| Date | Source | Summary | Action/Impact |

| 26 February 2025 |

EU Sustainable Finance omnibus simplification package The European Commission is expected to publish proposals around simplification of the disclosure requirements across EU Taxonomy, CSRD and CSDDD |

Please see article on the topic in the January 2025 update for further details. | |

| 28 February 2025 |

Central Bank of Ireland questionnaire on costs Response date for management companies who received the CBI questionnaire on costs |

Please see article on the topic in this update for further details. | |

| Q1 2025 |

AIF Rulebook consultation The CBI expects to publish an AIF Rulebook consultation which would include AIFMD II transposition |

||

| Q1 2025 |

Central Bank of Ireland – Money Market and Investment Fund Return Update In Q1 2025 the CBI plans to organise a follow up workshop with industry and management companies on the additional reporting requirements |

Please see article on the topic in this update for further details. | |

| 12 March 2025 |

Loan originating AIFs Deadline for responding to ESMA consultation for open-ended loanoriginating AIFs |

Please see article on the topic in the January 2025 Update for further details | |

| Q2 2025 |

ESMA CSA on sustainability disclosures ESMA expected to issue its report on the outcome of the CSA |

||

| End Q2 2025 |

Central Bank of Ireland ETF review Date by which fund management companies are required to incorporate any necessary changes to frameworks and practices in accordance with the requirements of the CBI letter on review of the ETF ecosystem |

Please see article on the topic in the December 2024 Update for further details | |

| 2 April 2025 |

UK SDR naming and marketing rules End of temporary flexibility period for FCA 'naming and marketing' and disclosure rules |

Please see article on this topic in the November 2024 Update for further details. | |

| 21 May 2025 |

ESMA Guidelines on funds' names using ESG and sustainability related terms Funds in existence before 21 November 2024 must comply with the guidelines from this date. |

Please see article on topic in the September 2024 Update for further details | |

| December 2025 |

ECB Regulation on investment fund statistics including money market funds The first reporting under the European Central Bank Regulation on statistics on investment funds, including money market funds, will be with a reference date of December 2025 |

Please see article on the topic in this update for further details. |

DORA update – Financial services with an ICT component

From 17 January 2025, financial entities subject to the Digital Operational Resilience Act (DORA) (Regulation (EU) 2022/2554) are obliged to submit reports on major information and communication technology (ICT)- related incidents to the CBI, where the required criteria and thresholds have been met. In-scope financial entities may also submit reports on significant cyber threats. Information to support financial entities in the submission of these reports via the CBI Portal is provided on this CBI webpage.

What types of services should be considered ICT services?

On 22 January 2025, the European Commission responded to the question of the types of services which should be considered 'ICT services' based on the Article 3(21) definition of DORA. The response is of particular interest to financial entities receiving financial services with an ICT component from regulated financial entities.

The definition of 'ICT services' intentionally maintains a broad scope. DORA specifies that, with the aim of maintaining a high level of digital operational resilience, the definition of ICT services should be understood in a broad manner to the extent that such services encompass digital and data services provided through ICT systems on an ongoing basis. Therefore, financial entities are responsible for undertaking an assessment on this basis to determine whether the services they rely on are ICT services, as defined under DORA.

Receiving services with an ICT component from regulated financial entities

Financial services may entail an ICT component. Where financial entities provide ICT services to other financial entities in connection to their financial services, the receiving financial entities should assess whether i) the services constitute an ICT service under DORA, and ii) whether the providing financial entities together with the financial services they provide are regulated under Union law or any national legislation of a Member State or of a third country.

If both tests are positive, then the related ICT service should be considered to be predominantly a financial service and should not be treated as an ICT service within the meaning of DORA.

If the service is provided by a regulated financial entity providing regulated financial services but is unrelated or is independent from such regulated financial services, the service should be considered as an ICT service under DORA.

Central Bank of Ireland questionnaire on costs

The Central Bank of Ireland (CBI) issued a one-off questionnaire on costs to a sample of management companies on Friday, 29 November 2024 with a submission date of 28 February 2025. This is linked to the current ESMA data collection exercise on costs in UCITS and AIFs which you can read about in the December 2024 update.

Updated Q&A template

An updated questionnaire template was issued on 4 February 2025 by the CBI to the selected management companies. In the update, ESMA provided answers to questions on the template which had been submitted by management companies and distributors via the CBI. The answers covered items related to the technical requirements of the template questionnaire, NAV of share class and definition of distributor.

ESMA Market Report on Costs and Performance of EU Retail Investment Products 2024

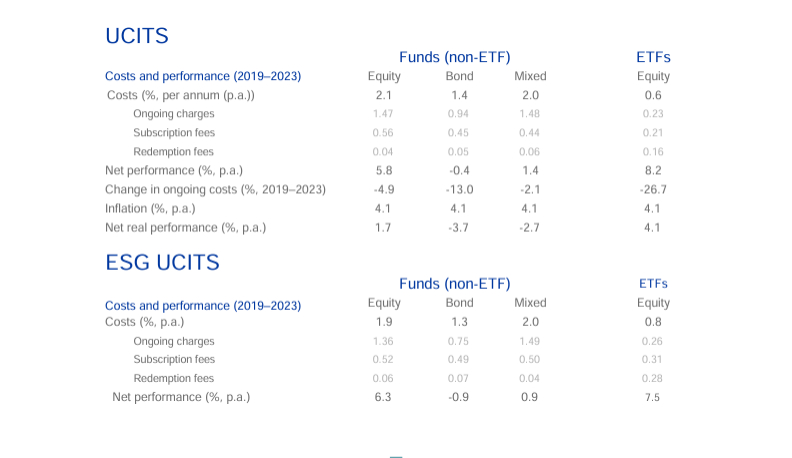

The 2024 ESMA report on costs and performance of EU retail investment products provides an overview of key developments up to the end of 2023. Below are notable takeaways from the analysis in the report covering UCITS and retail AIFs.

Headline takeaways

UCITS

- 2023 saw an overall decline in ongoing costs at low and varying pace

- Bond UCITS ongoing costs reduced more than equity UCITS.

- At the one-year investment horizon, between 2019 and 2023 the ongoing costs of equity funds declined by 5%, while the ongoing costs of bond funds reduced by 13%

- Investors paid around EUR 2,000 in costs for an investment of EUR 10,000, obtaining a net value of EUR 15,100 after ten years.

- Ongoing costs of mixed funds and passive equity funds were relatively stable over time

- Despite the decline in costs, active equity funds continued to underperform (after fees) passive nonexchange-traded equity funds and exchange-traded equity funds

- Domestic UCITS have, on average, lower ongoing costs than cross-border funds

- At the aggregated EU level, equity funds tend to have lower reported transaction costs than mixed and bond funds

- While costs only moderately change over time, gross performance is highly volatile. In 2023, improved returns for UCITS were observed by ESMA

- The highest returns were observed for equity funds

- Investing long-term significantly reduces the risks related to swift and large changes in the valuation of financial products. It also reduces the impact of one-off costs

- Investment strategy can be important - equity funds focusing on large caps tend to have lower ongoing costs compared to other equity strategies

- Across asset classes, riskier funds are associated with higher total costs

- Larger funds tend to have lower ongoing costs

- Inflation plays a significant role on top of fund costs. For a ten-year EUR 10,000 investment, an investor loses more than EUR 3,000 due to inflation. For a ten-year EUR 10,000 investment, this leads to a net real value of around EUR 12,000

- Costs across EU member state fund domiciles continue to vary widely

- When management companies are held by a large parent company, the managed share classes are associated with lower ongoing costs on average

- Ongoing costs of ESG funds are lower than, or similar to, the ongoing costs of non-ESG equivalents

- Overall ESG funds outperformed their non-ESG equivalents

Retail AIFs

- AIFs less demanded by retail investors

- Annualised returns of AIFs offered to retail investors significantly improved in 2023 compared with 2022

- Assets invested in retail AIFs were concentrated in the type of AIFs classified as 'Others' (42%), FoFs (22%) and RE funds (21%)

- A hypothetical five-year investment of EUR 10,000 between 2019 and 2023, based on a stylised portfolio composed of other AIFs (40%), FoFs and RE funds (30% each), would yield around EUR 12,600 in net terms

- A full analysis of costs is still impaired by lack of data. On average, RE funds are the most expensive category of AIFs

UCITS essential statistics

Retail AIFs essential statistics

Coverage and Data availability

The ESMA report covers UCITS assets worth around EUR 10.2tn, of which retail investors were estimated to hold around EUR 6.4tn in 2023. Retail investors were estimated to hold almost 65% of the total outstanding EU UCITS assets. More than 90% of retail investment centres on equity, bond and mixed assets.

AIFs reached almost EUR 7.7tn in assets in 2023, with just under EUR 900bn of which was estimated to be held by retail investors.

There is significantly more data available for UCITS than AIFs and as a result, the report contains more analysis of UCITS costs and performance. For UCITS, entry and exit costs are still subject to limitations, while no data are available on distribution costs. The forthcoming AIFMD and UCITS Directive updates should bring new information on fund costs which will be analysed in future ESMA reports.

Irish Funds Guidance paper on UCITS Regulation 72

The CBI may authorise a UCITS to invest up to 100% of its assets in different transferable securities and money market instruments issued or guaranteed by any EU Member State, its local authorities, a third country or public international bodies of which one or more EU Member States are members. This is provided for under UCITS Regulation 72.

The CBI must be satisfied that investors in the UCITS have protection equivalent to that of investors in UCITS complying with the 5 /10 / 40 rule. The UCITS must also observe the principle of risk spreading, including holding securities from at least 6 different issues but securities from any one issue shall not account for more than 30% of its total assets.

Requirements for UCITS investing up to 100% of net assets

The UCITS must:

- observe the principle of risk spreading, including holding securities from at least 6 different issues but securities from any one issue shall not account for more than 30% of its total assets;

- specify in its constitution the names of the EU Member States, local authorities or public international bodies issuing or guaranteeing securities in which it intends to invest more than 35% of its assets

- include a prominent statement in its prospectus and any marketing communications drawing attention to the Bank's authorisation and indicating the States, local authorities and public international bodies in the securities of which it intends to invest or has invested more than 35% of its assets.

Guidance for depositaries and fund management companies

The Irish funds depositary working group has prepared a guidance paper for depositaries and fund management companies to support the application and interpretation of the requirements for UCITS funds in relation to this Regulation 72.

Topics covered in the guidance paper

The topics covered include:

- analysis whether "up to 100% of its assets" should be interpreted as a 100% per issuer or a 100% aggregate limit

- what value should be used for the different asset classes to be included in the calculation of the concentration of the 100% of NAV limit

- whether netting provisions can be applied when aggregating exposures to a single issuer

- how the minimum 6 issues requirement should be interpreted where a UCITS invests more than 35% of NAV in member state government, local authority etc issued securities but less than 100% of NAV

- how the 30% single issue limit requirement should be interpreted in the above situation.

Saudi Arabia added to UCITS and RIAIF list of issuers for up to 100% investment

The Central Bank has updated its application process to permit UCITS and retail investor alternative investment funds (RIAIFs) to invest up to 100% of net assets in different transferable securities and money market instruments issued or guaranteed by the government of Saudi Arabia, provided that the issues are of investment grade. In doing so the UCITS or RIAIF must comply in full with the provisions of UCITS Regulation 72 set out above in relation to CBI approval, risk spreading, authorisation in the fund constitutional document and prospectus and marketing material disclosure.

Considerations for existing funds

Existing funds wishing to avail of this investment opportunity should review the list of permitted issuers in the UCITS or RIAIF constitutional document or trust deed. If that is to be amended to include the government of Saudi Arabia in the list of permitted issuers, the necessary investor and other approval formalities will need to be observed to permit the change to the constitution or trust deed. The prospectus may also need to be amended and if it does, it will need to be approved by the CBI.

ESMA Publishes Final Report on Guidelines on Stress Test Scenarios under the MMF Regulation

On 7 January 2025, ESMA published their Final Report on Guidelines on Stress Test Scenarios under the MMF Regulation. These guidelines are updated at least every year taking into account the latest market developments.

The 2024 final report includes:

- Additional explanation on the way to report the results of the macro systemic shocks

- Updated guidelines and risk parameters, so that managers of MMFs have the information needed to fill in the reporting template referred to in Article 37 of the MMF Regulation

The report helpfully contains a section where the 2024 additions, parameter updates or amendments are clearly highlighted in red.

Next Steps

The updated guidelines will be translated into the official EU languages and published on the ESMA website. The guidelines will apply 2 months after the publication of the translation of the guidelines. After the start of the application of the updated guidelines, managers will have to report the results of the new parameters to NCAs with their quarterly reports, for the purpose of the reporting referred to in Article 37 of the MMF Regulation.

Central Bank of Ireland – Money Market and Investment Fund Return Update

The CBI Statistics Division is undertaking an update of investment fund and money market fund (MMIF) reporting. The first reporting of this new regulation will be with a reference date of December 2025 and will be called an MM2 Return.

These new reporting requirements are being driven by a new investment fund regulation concerning statistics on investment funds (ECB/2024/17) adopted and published by the European Central Bank on 27 June 2024.

The CBI held a workshop on 10 December 2024 on the new reporting requirements. The answers to questions received during and since the workshop are published on the CBI's website alongside the other OF3/MM2 documents. It is proposed to organise a follow-up workshop in H1 2025 and the CBI plans to carry out a wider industry engagement with management companies and funds in Q1 2025 regarding the additional reporting requirements.

ESMA Q&A update for AIFMD

ESMA has published updated questions and answers related to AIFMD in addition to questions and answers for CSDR, DORA, MiCA and EMIR.

New AIFMD questions

There were 2 new AIFMD related questions. The first was whether AIFMs are allowed to delegate portfolio or risk management to non-supervised undertakings established outside of the EU? The ESMA answer is no.

The second question is whether (a) AIFMs are permitted to hold client money and (b) if that will change following the AIFMD review. ESMA answered no to both questions.

FCA SDR update

The UK Financial Conduct Authority (FCA) continues to update its webpage in relation to the Sustainability Disclosure Regime (SDR). During December 2024, this was updated to include guidance on using one of the 4 SDR investment product labels and illustrative examples of pre-contractual disclosure for each.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.