- within Transport, Environment and Insolvency/Bankruptcy/Re-Structuring topic(s)

On 26 July 2021, the European Commission published a Q&A clarifying the application and implementation of the Sustainable Finance Disclosures Regulation (SFDR). The Q&A was issued in response to the January 2021 'SFDR priority issues' letter from the European Supervisory Authorities' (ESA) which set out a range of questions on the following aspects of the regime:

- application to non-EU and registered (sub-threshold) AIFMs;

- principal adverse impact (PAI) reporting requirements for parent entities of large groups;

- scope of Article 8 (light-green product) transparency rules and specifically the meaning of 'promotion' in that context;

- Article 9 (dark-green product) transparency rules; and

- application of transparency rules to portfolios and dedicated funds.

While publication of the Q&A has largely been welcomed, including by EFAMA (the European Fund and Asset Management Association), some of the Commission's answers have raised additional operational and compliance issues for entities and products in scope of SFDR. As a result, in its letter to the Commission on 20 August 2021 highlighting various SFDR implementation concerns, EFAMA have requested further clarification of several of the answers and an opportunity to discuss these at an industry workshop with the Commission. The following summarises the clarifications provided in the Q&A and highlights potential consequent impacts and action items for those in scope of SFDR. Relevant further points of clarification as requested by EFAMA are also highlighted.

1. Non-EU and Registered (Sub-Threshold) AIFMs

SFDR applies to AIFMs without distinction as to authorisation status or location of the AIFM.

The Q&A clarifies that SFDR applies to registered AIFMs (being sub-threshold AIFMs not authorised under AIFMD) as well as non-EU AIFMs carrying out activities in the EU under a national private placement regime (or NPPR, being non-EU AIFMs' means of accessing EU markets pending activation of the AIFMD third-country passport). While registered AIFMs are specifically referred to as in scope of both entity- and product-level SFDR transparency rules, the Q&A states that non-EU AIFMs are required to "ensure compliance with [SFDR], including the [product-level] provisions". Reference to "including" has led EFAMA to query with the Commission the implication that non-EU AIFMs marketing in the EU are subject not only to product-level SFDR transparency rules for EU-marketed products (which, according to EFAMA, was the prevailing market view), but to all entity- and product-level SFDR transparency rules. A requirement under SFDR for non-EU AIFMs to publish both entity- and product-level disclosures, including in respect of non-EU marketed products, raises questions as to the extra-territorial reach of SFDR. Notably, the Commission has previously commented on the extra-territorial reach of the EU Sustainable Finance Action Plan (of which SFDR is a key legislative measure). In its 2020 Q&A on the application of the Taxonomy, the Commission states that the "disclosure obligations [under the Taxonomy] apply to anyone offering financial products in the EU, regardless of where the manufacturer of such products is based" and that "[t]his approach is not different to other corporate or financial product disclosure obligations already in place in the EU" while noting that "[t]he international influence of the EU Taxonomy will exist despite there being no intention to bind third countries on their own sustainability or sustainable finance activities."

As entity- and product-level SFDR transparency rules (other than for periodic report and Taxonomy-related disclosures) have been in effect since 10 March 2021, advice should be sought in early course by registered and non-EU AIFMs not already in compliance with their obligations under these rules.

2. Principal adverse impact reporting for parent entities of large groups

Under SFDR, in-scope entities with ≤ 500 employees have the option to explain non-compliance with the requirement to assess and report on the principal adverse sustainability impacts (PAI) of investment decisions. Since 30 June 2021, in-scope entities with > 500 employees and in-scope parent entities of groups with > 500 employees are mandated to comply with the SFDR PAI reporting rules i.e. these entities no longer have the option to explain non-compliance and must assess and report on investments' PAIs.

The Q&A clarifies that the calculation of the 500-employee threshold by an in-scope parent entity must count employees both of the parent entity and each subsidiary entity, regardless of whether the subsidiaries are established inside or outside the EU. EU parent entities currently explaining non-compliance with PAI reporting rules based on a headcount of EU group entities only must therefore, to the extent there are non-EU subsidiaries within the group, revisit their calculation to include employees of all (EU and non-EU) group entities. Any entity which, following this recalculation, exceeds the employee threshold should seek to comply as a matter of priority given the June 2021 deadline for compliance.

The Q&A further clarifies that a parent entity of a group which exceeds the 500-employee threshold, in complying with its PAI disclosure obligations, need only disclose in respect of itself and not the group as a whole.While the Q&A acknowledges that subsidiary or group entities may themselves exceed the 500-employee threshold and therefore be in scope of mandatory PAI reporting rules, the parent entity should report PAI details adapted to its specific situation, as the criterion of a group is solely relevant for the headcount that triggers the reporting obligation.

3. Scope of Article 8 (light green product) transparency rules

Article 8 SFDR requires products which "promote environmental or social characteristics" to make prescribed website, pre-contractual and periodic report disclosures. Despite the passing of the first key SFDR compliance deadline on 10 March this year, uncertainties as to the scope of Article 8 transparency rules have persisted.

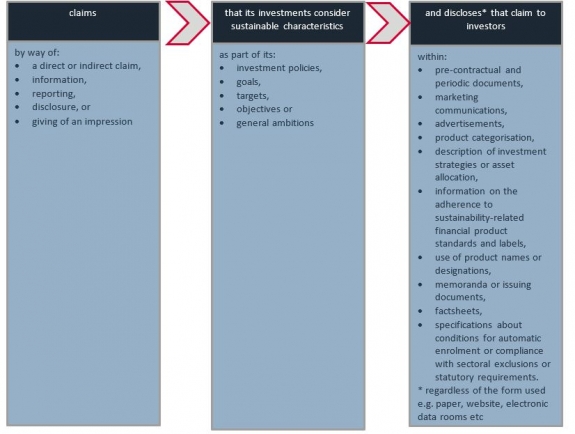

The Q&A provides several clarifications on the scope of Article 8 transparency rules, key amongst which is the interpretation of the term "promote" in the context of Article 8. According to the Commission, a product is considered to be "promoting" a sustainable characteristic if it:

The following clarifications of the scope of Article 8 transparency rules are either specifically clarified in the Q&A or may be inferred from the interpretation of the term "promote":

- product names: use of words like "sustainable", "sustainability", or "ESG" in the name of a product is likely to bring a product in scope of Article 8 transparency rules given "promotion" includes disclosing "an impression" that investments have "a general ambition" to consider sustainable characteristics through the "use of product names";The following clarifications of the scope of Article 8 transparency rules are either specifically clarified in the Q&A or may be inferred from the interpretation of the term "promote":

- advertising: the absence of active advertising of an environmental, social or sustainability-related characteristic may not be sufficient to take a product out of scope of Article 8 transparency rules as "promote" is a broad concept that goes beyond active advertising;

- legal requirements: if a product complies with an environmental, social or sustainability-related requirement or restriction laid down by law (including international conventions, or voluntary codes) and such compliance is "promoted", the fund is subject to Article 8 transparency rules;

- sustainability risks: integration per se of sustainability risks is not sufficient for Article 8 transparency rules to apply. Therefore, compliance with SFDR sustainability risk disclosure rules is unlikely to bring a product in scope of Article 8 transparency rules;

- sustainable characteristics: in-scope products are free to choose how they pursue any "promoted" environmental or social characteristic as SFDR is neutral in terms of the design of financial products which are in scope of Article 8 transparency rules. Specifically, products in scope of Article 8 transparency rules are not subject, under SFDR, to minimum investment thresholds or eligible investment targets or required to adopt specific styles, tools, strategies or methodologies in the implementation of a sustainable characteristic. The only relevant criteria when determining the scope of Article 8 transparency rules is whether the product "promotes" a sustainable characteristic;

- sustainability factors: a product that discloses a strategy which aims to reduce the principal adverse impacts (PAIs) of its investments on sustainability factors is likely in scope of Article 8 transparency rules on the basis that this would meet the criteria for "promotion" of a sustainable characteristic. As SFDR requires product-level disclosure (by 30 December 2022) of any consideration of PAIs by those disclosing under entity-level PAI disclosure rules, the question arises as to whether compliance with such product-level PAI disclosure rules could automatically bring the product in scope of Article 8 transparency rules. While not specifically addressed in the Q&A, it appears that compliance with product-level PAI disclosure rules has the potential to bring a product in scope of Article 8 transparency rules unless such compliance does not simultaneously meet the threshold for "promotion" of a sustainable characteristic;

- binding elements: the Q&A reiterates the requirement set out in the draft SFDR Level 2 rules (as adopted by the ESA in February 2021) that products in scope of Article 8 transparency rules must only disclose on those elements of their environmental or social strategy which are binding during the whole holding period.

4. Article 9 (dark green product) transparency rules

A product with the objective of investing in sustainable investments is in scope of Article 9 transparency rules.

Sustainable Investments

The Q&A clarifies that, to be in scope of Article 9 transparency rules, a product's underlying assets must qualify as sustainable investments under SFDR (including Taxonomy-aligned sustainable investments) or, if held to comply with product-specific rules (e.g. for hedging or liquidity purposes), must meet minimum environmental or social safeguards. As indicated in the section above on Article 8 transparency rules, a product with a sustainable investment objective, the underlying assets of which do not qualify as sustainable investments under SFDR (including Taxonomy-aligned sustainable investments), is subject to Article 8 transparency rules.

Carbon Emission Reduction Objective

SFDR and the draft SFDR Level 2 rules require products in scope of Article 9 transparency rules and with the objective of reducing carbon emissions to disclose (i) how they align with the Paris Agreement objectives and (ii) that measurement of performance in meeting the product's objective is by reference to an EU Climate Benchmark (where available). An EU Climate Benchmark being a benchmark which qualifies under the EU Benchmarks Regulation (as amended) for use of the EU Climate Transition Benchmark or EU Paris-aligned Benchmark labels.

The Q&A clarifies that the objective of a reduction in carbon emissions "includes" the objective of a low carbon emission exposure in view of achieving the long-term global warming objectives of the Paris Agreement. In addition, where an EU Climate Benchmark exists, the Q&A states that a product must be "tracking" these and where one does not exist, disclosures must include a detailed explanation of how the product continually achieves the objective of reducing carbon emissions in view of achieving the Paris Agreement objectives. EFAMA has asked the Commission for further clarification of these answers, including whether SFDR requires products with carbon emission reduction objectives to align with the Paris Agreement objectives and if such alignment is sought, whether the product is required to replicate an EU Climate Benchmark, where available.

5. Application of transparency rules to portfolios and dedicated funds

Article 8 and 9 transparency rules apply to MiFID portfolios without distinction as to the form of mandate under which the portfolio is managed. As a result, compliance with the product-level transparency rules, in particular the requirement for website disclosures in respect of the portfolio, could conflict with a portfolio manager's client confidentiality obligations.

The Q&A clarifies that entities disclosing pursuant to SFDR must ensure compliance with EU and national data protection law, and where relevant, ensure confidentiality owed to clients. In that regard, where a portfolio manager makes use of standardised product solutions, the Commission acknowledges that transparency at the level of the solution may be a way for in-scope products to comply with Article 8 and/or 9 transparency rules.

Next steps

While a response to EFAMA's recent clarificatory request would certainly be welcome, the Commission's near-term focus is likely to be on avoiding any further delays to the application of SFDR Level 2 rules. As indicated above, the scheduled effective date of these rules was recently pushed back by six months from 1 January to 1 July 2022, following a delay by the ESA in adopting draft Level 2 rules for the SFDR Taxonomy-related disclosure requirements. However, once draft Level 2 rules have been finalised by the ESAs, the Commission has committed to "work intensively to ensure the earliest possible adoption of the [SFDR Level rules]" ahead of their application from 1 July 2022.

First published by Irish Funds in their Autumn Newsletter.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]