- within Law Department Performance, Antitrust/Competition Law, Litigation and Mediation & Arbitration topic(s)

- in Ireland

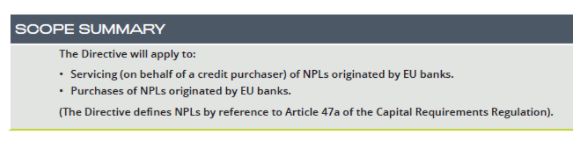

Political agreement has finally been reached on the scope of the proposed Directive on credit servicers and credit purchasers. Following lengthy negotiations, its scope has been narrowed to the servicing (on behalf of a credit purchaser) of NPLs originated by EU banks, and the purchase of NPLs originated by EU banks. In-scope servicers will require authorisation, but in-scope purchasers will not. The Irish credit servicing framework will require some amendments as a result.

Agreement Reached

The European Commission proposed the Directive as part of its strategy to reduce current stocks of non-performing loans (NPLs) on EU banks' balance sheets, and prevent future NPL build-ups. It was keen to facilitate the disposal, by EU banks, of NPL portfolios in "efficient, competitive and transparent secondary markets", and to introduce a harmonised EU-wide framework for NPL purchasers and NPL servicers whereby NPL servicers must be authorised on a harmonised basis across the EU, and able to passport that authorisation. The current, divergent, approaches by EU Member States to the treatment of NPL purchasers and services has hindered competition in the secondary market and made that market inefficient. Specialist credit servicing firms cannot, for the time being, scale-up their activities on a cross-border basis within the EU.

The provisionally-agreed text of the Directive was published last week.

Scope

When the Directive was first proposed by the European Commission in March 2018, its scope included the servicing and purchase of performing loans and NPLs originated by EU banks and their subsidiaries, and also included a proposal for an accelerated extrajudicial collateral enforcement procedure (AECE).

The AECE-related provisions were later split out into a separate legislative proposal due to concerns about how long it might take to reach consensus on how a harmonised AECE would work.

When EU trilogue negotiations began earlier this year, it was clear that the Commission, the European Parliament and the EU Council had different positions on scope. The EU Council proposed that the parts of the Directive relating to credit purchasers apply only to sales of NPLs. The Parliament proposed that the Directive's scope be limited to NPLs only. Following extensive negotiations, agreement has now been reached and the scope is narrower than the Commission's original proposal.

Key Points

Timing

The Directive is expected to be published in the Official Journal in Q3 or Q4 2021, and Member States will be required to transpose it into domestic law within 24 months.

It will apply irrespective of the type of borrower, but certain requirements regarding the appointment of credit servicers will only apply where the borrowers are consumers or SMEs.

Credit Servicing Activities

The Directive defines "credit servicing activities" in respect of NPLs as:

- collection/recovery of payments from borrowers

- renegotiating terms and conditions with borrowers

- dealing with complaints

- telling borrowers about changes to interest rates, charges or payments due

If, while being serviced, an NPL is re-classified as performing, the credit servicer will be allowed to continue to service it based on the terms of its authorisation.

Authorisation - Credit Servicers

Legal entities that carry out "credit servicing activities" in respect of in-scope NPLs originated by EU banks will require authorisation in their home Member State. They will be able to passport that authorisation across the EU.

Ireland will be able to deem entities that are already authorised as credit servicing firms to be authorised credit servicers for the purposes of this Directive. However, in respect of NPL servicing, the list of activities that trigger authorisation in Ireland as a credit servicing firm will need to be pared back to remove activities (such as holding legal title, determining strategy, or maintaining control over key decisions) that go beyond the Directive's requirements.

No Authorisation - Credit Purchasers

Purchasing an in-scope NPL will not trigger an authorisation requirement. The EU has been very strong in its position that credit purchasers buy existing NPLs at their own risk (rather than creating 'new' credit) and do not cause prudential concerns. Their contribution to systemic risk is seen as 'negligible'. Member States cannot go beyond this and impose an authorisation requirement on in-scope credit purchasers of NPLs.

As expected, this will require a change to the Irish credit servicing framework. At the moment, holding legal title to a credit agreement can trigger a requirement for authorisation as a credit servicing firm. Once the Directive is transposed into Irish law, those who purchase NPLs originated by EU banks will no longer need authorisation to do so.

Out-of-Scope Loan Sales

- Sales of performing loans.

- Sales of NPLs originated by non-bank lenders.

- Sales of NPLs by EU banks that take place prior to the transposition deadline.

- Sales of NPLs by EU banks to other EU banks.

Out-of-Scope Servicing

- Servicing of performing loans.

- Servicing of NPLs originated by non-bank lenders.

- Servicing of NPLs by EU banks, alternative investment fund managers authorised or registered under the Alternative Investment Fund Managers Directive, UCITS management companies, or creditors that are subject to supervision under the Consumer Credit Directive (CCD) or Mortgage Credit Directive (MCD) frameworks.

- Servicing by individuals - a credit servicer under the Directive must be a "legal person".

Member States can regulate/continue to regulate other forms of credit servicing, such as the servicing of loans originated by non-bank lenders, but those credit servicers will not benefit from the EU passport under the Directive. The EU position that the purchase of credit should not, of itself, trigger an authorisation requirement will need to be considered as part of any Member State decisions on authorisation frameworks.

Additional Detail

Authorising Credit Servicers

The Directive will introduce a harmonised authorisation framework that will allow credit servicers of NPL portfolios, acting on behalf of purchasers of NPLs, to scale-up their activities in different EU Member States for the first time by using a passport.

Those credit servicers will be subject to uniform and harmonised conditions for authorisation, and to harmonised conduct of business rules, across the EU. Each national competent authority (NCA) will need to maintain a register of authorised credit servicers; the Central Bank of Ireland (expected to be appointed as the Irish NCA) already maintains a register of authorised credit servicing firms, but may have to modify this in light of guidelines that the European Banking Authority (EBA) is expected to publish to ensure uniformity between the registers maintained in different EU Member States.

The Directive contains a short list of authorisation requirements, together with requirements relating to the holding of borrower funds, and we expect that these will be supplemented by both the EBA and individual NCAs.

Appointing Credit Servicers

EU-based credit purchasers will need to appoint an authorised credit servicer (or an EU bank or a creditor that is subject to CCD/MCD-related supervision) where they acquire consumer NPLs.

Third country-based credit purchasers will need to appoint an EU-based representative and, where they acquire consumer or SME NPLs, they must appoint an authorised credit servicer (or an EU bank or a creditor that is subject to CCD/MCD-related supervision). Where the appointed EU-based representative falls into one of these categories, it can act as credit servicer.

Pre-Sale Information from EU Banks

EU banks must give prospective credit purchasers sufficient information to enable them to diligence the relevant NPLs. The EBA must develop technical standards on the format in which this information is to be provided within 9 months of the publication of the Directive in the Official Journal. The information required from EU banks must be proportionate to the nature and size of the NPL portfolio that is being disposed of.

The format(s) that will be developed by the EBA will need to be populated in full in respect of any in-scope NPLs originated post 1 July 2018. For all other in-scope NPLs, the relevant EU bank will need to complete those format(s) with the information available to it.

Two key points should be noted:

- bank-to-bank NPL sales will also be subject to the EBA data templates

- where securitisation-related templates also need to be completed, double reporting is to be avoided

Post-Sale Information from Purchasers

The credit purchaser or credit servicer must provide certain post-sale information to a borrower before the first debt collection, and whenever the borrower requests it. In addition to information on the purchaser and servicer, that information must include a breakdown of what is owed (rather than simply an overall figure). However, information on the price paid for the NPL does not need to be provided.

Reporting by EU Banks and credit purchasers

EU banks, and credit purchasers who on-sell NPLs, must supply data to their respective home Member State NCAs bi-annually (or quarterly if requested) on NPL disposals, which must include purchaser details and aggregated borrower data. Additional data must be included if the NPLs include consumer loans.

The original proposal that a credit purchaser be required to inform its home Member State NCA on proposed enforcement action was removed from the provisional final text of the Directive.

Borrower Protections

The Directive contains obligations on in-scope credit servicers and credit purchasers to act in good faith, fairly and professionally in their dealings with borrowers, to provide them with clear and accurate information, and to communicate appropriately with them.

The overriding requirement of the Directive is that no borrower should be worse-off following the sale of its NPL, and that borrower protections should travel with the loan. This reflects the current position in Ireland. It is open to Member States to apply stricter pro-borrower protections.

CCD and MCD

The Directive will also amend the CCD and MCD to include additional requirements regarding forbearance measures. Given the existing Irish borrower-protection framework, most notably the Code of Conduct on Mortgage Arrears, the Consumer Protection Code and the Land and Conveyancing Law Reform Act 2009, these should not necessitate a substantive change in approach in Ireland. These amendments will be covered separately in a briefing on proposed reforms to the CCD and MCD that we will be publishing in the coming days.

What Happens Next?

The Directive is expected to be published in the Official Journal later this year, so the transposition deadline is likely to be Q3 or Q4 2023. Considering the activity in the EU market, the harmonised approach to the treatment of NPL credit purchasers and NPL credit servicers will bring welcome consistency. From an Irish perspective, it is particularly welcome that in-scope credit purchasers will not need to be regulated as this requirement has been particularly onerous. However, some key issues will need to be worked through, including the categorisation of NPLs, and how sales of combined portfolios by EU banks (comprising NPLs and performing loans) are to be dealt with. As mentioned, the Directive will apply to post-transposition NPL sales only, so credit servicers and credit purchasers are likely to be dealing with a mixed regime for some time to come. We will publish further updates as developments occur.

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.

[View Source]