- within Criminal Law topic(s)

Introduction

On 1 June 2023, the three European Supervisory Authorities (the "ESAs") published their respective progress reports (ESMA, EBA and EIOPA) in response to a request for their input from the European Commission (the "Commission") on Greenwashing in the financial sector. The ESAs subsequently issued a call for evidence in November 2022 from stakeholders to gather information to enable them to understand the key features, drivers and risks associated with greenwashing and to collect examples of potential greenwashing practices.

Background

ESMA had noted that while existing references in the EU regulatory framework which mention greenwashing (such as in recital 16 of the SFDR Delegated Regulation1) form the starting point for its assessment, several existing references do not explicitly define greenwashing in a broad sense as encompassing all environmental, social and governance aspects.

ESMA's supervisory briefing on sustainability risks and disclosures in May 2022 had set the scene for regulatory action to take place on greenwashing in the asset management sector listing a number of non-exhaustive examples where administrative measures including enforcement may be appropriate, such as where legally required Sustainable Finance Disclosure Regulation ("SFDR") disclosures have not been made, where SFDR disclosures are severely misleading or where sustainability risks have not been integrated throughout the organisation as required. ESMA flagged its reservations that while SFDR was designed to enhance transparency around sustainability, in practice the disclosures are often being used as product classification, raising particular concerns for investors investing in products disclosing under Article 8 SFDR. Status as "Article 8" or "Article 9" funds were being used in marketing material by fund managers as quality labels for sustainability. On 31 May 2022, ESMA Chair, Verena Ross, gave a speech at the Irish Funds conference where she noted that ESMA would be working with national competent authorities ("NCAs") to reduce what one might call "over-disclosure" by investment funds under Article 8, to avoid misleading disclosures to investors about the greenness of a product.

Notably, ESMA's Securities and Markets Stakeholder Group (the "SMSG") had in March 2023 published its report with additional advice concerning greenwashing which had proposed a holistic definition of "greenwashing"2 linked to the concept of gaining an unfair competitive advantage but deferring to applicable legislation for each market participant on whether intent is relevant or not.

Common Understanding of Greenwashing

In these reports, the ESAs have put forward their common high-level understanding of greenwashing:

"a practice where sustainability-related statements, declarations, actions, or communications do not clearly and fairly reflect the underlying sustainability profile of an entity, a financial product, or financial services. This practice may be misleading to consumers, investors, or other market participants".

Some of the core characteristics central to this understanding of greenwashing are as follows:

- communications can be misleading due to the omission of information, or may be due to the actual provision of information, that is false, deceives or is likely to deceive;

- may not only result in a direct claim but also in misleading actions e.g. where clients with sustainability preferences are identified in the target market of non-sustainability products;

- communications can be misleading due to the omission of information, or may be due to the actual provision of information, that is false, deceives or is likely to deceive;

- may not only result in a direct claim but also in misleading actions e.g. where clients with sustainability preferences are identified in the target market of non-sustainability products;

- can arise intentionally or unintentionally (e.g. through negligence, or the lack of robustness and appropriateness of due diligence efforts);

- may occur at:

- an entity level,

- a financial product level, or

- a financial service level including advice (e.g., regulating to the integration of sustainability-related preferences to the provision of financial advice);

- may occur at any point where sustainability-related statements, declarations, actions or communications are made, including at different stages of the business cycle of financial products or services or of the sustainable finance value chain;

- may relate to entities and products that are either within or outside the remit of the EU regulatory framework;

- can be triggered by the entity to which the sustainability communications relate, by the entity responsible for the product, by the entity providing advice or information on the product, or by third parties (e.g., ESG rating and data providers, or third-party verifiers); and

- may or may not result in immediate damage to individual investors (in particular through mis-selling) or the gain of an unfair competitive advantage.

Regardless of whether adverse outcomes result, if not kept in check, greenwashing may undermine trust in sustainable finance markets and policies.

In ESMA's progress report (the "Report"), it assesses which areas of the sustainable investment value chain ("SIVC") are more exposed to the risk of greenwashing. The Report's findings show that misleading claims may relate to all key aspects of the sustainability profile of a product or an entity – from governance aspects to sustainability strategy, targets and metrics or claims about impact. The Report also provides sector-specific assessments for key sectors under ESMA's remit i.e. issuers, investment managers, benchmark administrators and investment service providers.

High-Risk Areas for Investment Managers

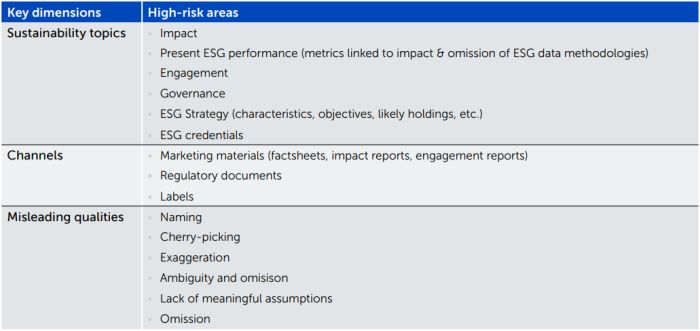

In the Report ESMA describes the sustainability claims that appear particularly exposed to greenwashing risks in relation to investment managers are those concerning:

- a fund's or the manager's engagement with investee companies;

- ESG strategy;

- policies and credentials;

- ESG governance as well as claims on sustainability impact; and

- fund names, particularly important for retail investors' decisions.

The highest areas of greenwashing risk apply equally to claims about funds and to entity-level claims about the ESG profile of the asset manager.

Accordingly, based on ESMA findings (summarised in the table below), specific high-risk areas identified for investment managers include, but are not limited, to impact claims, statements about engagement with investee companies, about a fund or asset manager's ESG strategy (characteristics, objectives, likely holdings etc.) and ESG credentials (such as ESG labels, ESG ratings or ESG certifications), present ESG performance, fund names, and claims about governance around ESG.

While regulatory documents appear less exposed to greenwashing risks than marketing materials, labels and voluntary reporting, they should also not be underestimated or overlooked.

Possible remediation actions

The Report identifies for the Commission preliminary actions it could take to remediate the risk of investment management greenwashing. These include:

- clarifications regarding the concept of contribution to a sustainable objective,

- standardised disclosures in particular for engagement; and

- addressing the misuse of the SFDR as a labelling regime.

On minimum contribution to a sustainable objective:

ESMA sees merit in additional clarification on best practices for defining the minimum contribution to a sustainable objective under SFDR, as well as regarding selecting adequate sustainability indicators to measure it.

On labelling:

To address the misuse of SFDR classifications as labels, the EU

could consider a new labelling legislation or changes to the

current EU regulatory framework to create distinct investment

product labels or categories

based on minimum standards.

On fund names:

With regard to fund naming, ESMA perceives great merit in aligning fund and benchmark names as much as possible in order to avoid investor confusion. One way could be to require asset managers offering passive funds and ETFs tracking a given benchmark to seek consistency in the naming convention of the funds with that of the tracked benchmarks.

On engagement activities/stewardship:

Changes to the SFDR regime could see the introduction of clearer disclosures about financial market participants' ("FMPs") firm-wide and fund-specific engagement, proxy voting and general stewardship activities. These disclosures could further complement the information from existing entity-level disclosures arising under the Shareholders Rights Directive II, voluntary reporting on stewardship (engagement, stewardship outcomes and proxy voting) such as the number of meetings held with engaged companies, milestones and intermediate targets that need to be achieved in order to keep going with the engagement, and conditions or triggers which lead to termination of the engagement process. An EU-level stewardship code - if one were put in place - could apply not just to asset managers and institutional investors, but that (in principle) could be partially applicable to other entities across the SIVC such as benchmark administrators and investment service providers.

On benchmarks:

SFDR disclosures on benchmarks could include a link to the cited benchmark's "benchmark statement". This could be even further facilitated by the introduction of an ESG benchmark label which could build off the findings of the recent study contracted by the Commission on the feasibility of such a label.

To address the issue of perceived greenwashing due to a lack of transparency on likely portfolio holdings for funds and benchmarks, changes to SFDR and the Benchmark Regulation could also be used to provide more transparency on expectable or likely benchmark and fund portfolio holdings and overall exposures (e.g., maximum x% exposure to fossil fuels), which would ideally be aligned with similar disclosures for funds disclosing under Article 8 or 9 SFDR.

On non-binding ESG elements:

To address confusing and/or excessive references to non-binding elements of a product's ESG strategy which is particularly relevant for product-level fund and benchmark disclosures, FMPs could be encouraged to make the distinction between a product's binding and non-binding environmental, social or governance characteristics, sustainable objectives and indicator used to measure them when referencing these in any type of document. Moreover, they could be further discouraged from listing an excessive number of sustainable objectives or characteristics in regulatory disclosures unless they have a concrete commitment to them.

Overall preliminary remediation actions

To mitigate greenwashing risks, ESMA stresses that FMPs across the SIVC have to live up to their responsibility to make substantiated claims and communicate on sustainability in a balanced manner.

The Report concludes that comprehensibility of sustainability disclosures to retail investors needs to be improved, including by establishing a reliable and welldesigned labelling scheme for financial products. For the regulatory framework to gain in maturity, certain key concepts (what qualifies as a "sustainable investment", the 'do no significant harm' principle and a standard for measuring positive and negative impact on social factors) need to be clarified and sustainability impact or engagement better integrated.

Concluding remarks

The publication of the Report comes as the landscape of ESG funds across Europe continues to evolve amid persistent greenwashing concerns and regulatory uncertainty. Turning first to the UK, the Financial Conduct Authority's consultation on the introduction of its Sustainability Disclosure Requirements takes a more holistic approach to its proposed general 'anti greenwashing' rule which would require all regulated firms to ensure that the naming and marketing of financial products and services in the UK is clear, fair and not misleading, and consistent with the sustainability profile of the product or service i.e. proportionate and not exaggerated.

April also saw the release of clarifications from the European Commission on specific aspects of SFDR which may result in moves towards upwards reclassification of financial products that passively track a Paris-Aligned Benchmark or Climate Transition Benchmark to the "dark green" Article 9 classification. In addition, the actions outlined by ESMA in this Report come in the wake of recent proposals by the ESAs to revise the SFDR Level II measures with regard to principal adverse impacts and decarbonisation targets. Market participants will be closely monitoring the development of these proposals mindful of the apparent juxtaposition between the flexibility afforded by the Commission's responses around the definition of what is a "sustainable investment" against the ESAs call for more of a reliable and well-designed labelling scheme and further enhancements in the SFDR regulatory disclosures.

Mindful of the focus of the ESAs, NCAs and investors alike on greenwashing, downgrades of funds to the "light green" classification in accordance with Article 8 of SFDR have been seen across Europe in recent times. In Ireland ESG is one of the Central Bank's main regulatory priorities for 2023 and it is similarly increasing its scrutiny of how investment funds and their management companies are complying with their disclosure, reporting and governance obligations under SFDR and the Taxonomy Regulation (EU) 2020/852.

The Report lays the ground for future steps towards mitigating greenwashing risks throughout the SIVC in key sectors including investment management. Undoubtedly mitigating greenwashing risks is a key supervisory and investor-driven focus and the risks highlighted in the Report serve as a further important reminder that good governance policies and practices continue to be fundamental for fund clients and boards alike as they embed their approach to ESG matters and to mitigating the risk of greenwashing.

Next Steps

Together with the NCAs, the ESAs note they are "working to meet expectations from stakeholders to ensure consumer and investor protection, support market integrity and maintain a trusted environment for sustainable finance". A further sustainable finance package is expected from the Commission before the end of June to include a legislative proposal on ESG ratings, with a status report on the implementation of its Sustainable Finance strategy expected by the end of 2023.

ESMA will continue their evidence gathering work, alongside their strategic focus on ESG disclosures, and intend to publish a final greenwashing report to the Commission in May 2024. The set of final ESA reports on greenwashing will consider recommendations, including on possible changes to the EU regulatory framework while also providing a stocktake of the supervisory response to greenwashing by NCAs and of those convergence activities initiated by the ESAs.

Footnotes

1. Recital 16, Delegated Regulation EU 2022/1288 ("SFDR Level II") states "'greenwashing', that is, in particular, the practice of gaining an unfair competitive advantage by recommending a financial product as environmentally friendly or sustainable, when in fact that financial product does not meet basic environmental or other sustainability-related standards".

2. The SMSG defined the concept of greenwashing as "the practice of misleading investors, notably (but not limited to) in the context of gaining an unfair competitive advantage, by making an unsubstantiated ESG claim about a financial product or service"

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.