- within Transport and Environment topic(s)

The European Parliament formally approved the proposed Regulation on Markets in Crypto-Assets (MiCA) and new legislation for tracing transfers of crypto-assets during its plenary session on 20 April 2023.

Once formally approved by the Council of the EU, MiCA will be published in the EU's Official Journal and will enter into force 20 days later. We expect that MiCA will begin to apply in early to mid-2024. Transitional arrangements may apply to firms providing certain crypto-asset services in the EU under national laws.

The compromise text of MiCA was published in October 2022 with some changes against the original text published in September 2020.

BACKGROUND

MiCA was initially published on 24 September 2020 by the European Commission as one aspect of its Digital Finance Strategy for Europe. For further information on the initial European Commission legislative proposals on MiCA, please see our client briefing dated October 2020 here.

The EU Digital Finance package is a suite of measures to further innovation and competition benefits of digital finance while mitigating the risks. In addition to MiCA, the package also includes a legislative proposal for a pilot regime on distributed ledger technology (DLT) market infrastructures, a Regulation on digital operational resilience (DORA), and a proposal to clarify or amend certain related EU financial services rules, which may also affect crypto-asset service providers.

The reasons for introducing MiCA cited by the European Commission include legal certainty; supporting innovation; introducing appropriate consumer and investor protection concerning crypto-assets; and ensuring financial stability. These reasons have been given further weight by recent instability in crypto-asset markets and sharp falls in the value of cryptocurrencies.

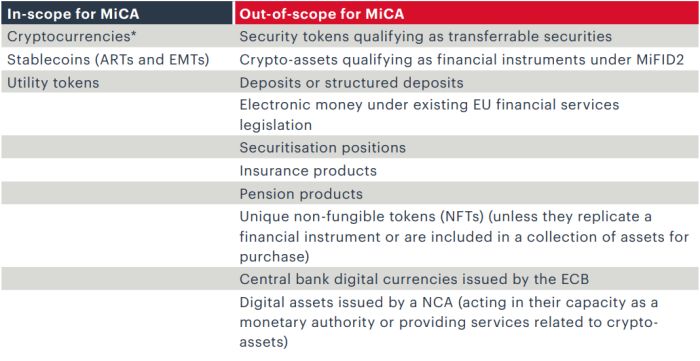

As it stands, some crypto-assets fall within the scope of existing EU financial services legislation, in particular, those that qualify as financial instruments (under the Second Markets in Financial Instruments Directive (MiFID2)) or electronic money under the second EU Electronic Money Directive (EMD2). However, other crypto-assets fall outside the scope of existing EU financial services legislation. Currently, there are no rules, other than AML rules, for services related to unregulated crypto-assets, including the operation of trading platforms for crypto-assets, the service of exchanging crypto-assets for funds or other crypto-assets, or the custody of crypto-assets.

To create a dedicated and harmonised pan-European regulatory framework, MiCA takes the form of a regulation. Consequently, there will be no national transposing measures. Depending on the circumstances, various EU regulatory bodies or national competent authorities (NCAs) can specify additional technical standards and requirements.

WHAT WILL MICA DO?

Once in force, MiCA will broadly provide for the regulation of (i) crypto-assets issuance activities and (ii) crypto-asset service providers (who will have similar regulatory obligations to investment firms). In line with existing financial services regulatory regimes, MiCA generally provides for the following:

- Authorisation requirements

- Transparency and disclosure requirements

- Operational, organisational, and governance requirements

- Protections for crypto-asset holders and clients of cryptoasset service providers (including consumer protection rules)

- Prohibition on market abuse

- The role of NCAs and European supervisory bodies.

MICA KEY TERMS & PROVISIONS

MiCA explicitly recognises the benefits of crypto-assets and states that:

- by streamlining capital-raising processes and enhancing competition, offers of crypto-assets can allow for an innovative and inclusive way of financing, including for small and medium-sized enterprises (SMEs); and

- when used as a means of payment, payment tokens can present opportunities for cheaper, faster and more efficient payments, particularly on a cross-border basis, by limiting the number of intermediaries.

A crypto-asset is defined under MICA as a "digital representation of a value or a right which may be transferred and stored electronically, using distributed ledger technology or similar technology." MiCA is intended to be technology neutral and is guided by the principles of same activities, same risks, same rules. MiCA is broadly drafted for future proofing in a rapidly evolving technological age and to capture all possible crypto-asset types not already within the scope of existing EU financial services regulatory regimes.

The European Supervisory and Markets Authority (ESMA) will be mandated to publish guidelines on criteria and conditions qualifying crypto-assets as financial instruments to delineate between crypto-assets covered under MiCA and financial instruments covered under MiFID2.

CRYPTO-ASSET SUB-CATEGORIES

MiCA creates three sub-categories of crypto-assets, subject to different requirements depending on the risks they entail. The classification is based on whether crypto-assets stabilise their value by reference to other assets. Each sub-category will attract a distinct and separate set of regulatory requirements under MiCA. The sub-categories are:

- Electronic Money Token (EMT) is a type of

crypto-asset that aims to stabilise its value by referencing only

one official currency. The function of EMT is like the function of

electronic money under EMD2. Rules under EMD2 on electronic money

issuance and electronic money institution regulatory capital

requirements on outstanding electronic money in issuance will apply

to EMTs. Like electronic money, crypto-assets are electronic

surrogates for coins and banknotes and are more likely to be used

for making payments.

EMT issuers must:

- Authorisation - be authorised as an EU credit institution or an electronic money institution (under EMD2);

- Requirements - issue electronic money tokens at par value and grant holders redemption rights at par value. EMT issuers may not grant interest on EMTs;

- White paper - produce a white paper, but this will not be subject to approval by their NCA. Issuers have obligations to publish white papers on their website and may also be subject to organisational, operational and conduct of business requirements.

- Safeguarding – issuers do not have to have a reserve fund; instead, under EMD2, they have safeguarding obligations regarding funds received in exchange for EMTs.

- Significant EMTs - will also have increased

capital requirements and be subject to oversight by the European

Banking Authority (EBA).

- Asset Referenced Token (ART) is a type of

crypto-asset aiming to maintain a stable value by referencing one

or more assets, including one or several official currencies. More

stringent regulatory requirements are applied to ARTs under MiCA as

these are expected to be the most widely used category of

crypto-asset.

Issuers of ARTs must:

- Authorisation - be authorised under MiCA or as a credit institution and established in the EU;

- Governance - put in place well-defined, transparent and consistent lines of responsibility to deal with risk;

- Recovery - maintain a recovery plan and hold reserve assets under particular conditions;

- White paper - produce a white paper subject to approval by their NCA. Issuers must publish white papers on their website and may be subject to certain organisational, operational, conduct of business and reporting requirements.

- Significant ARTs - will have more onerous requirements, such as increased capital requirements and oversight by the EBA.

- Exemptions - may apply depending on whether

the issuer is already regulated (e.g. authorised as an EU credit

institution) or the type of offer (e.g. to qualified

investors).

- Other crypto-assets are crypto-assets other than ARTs or EMTs covering a wide variety of crypto-assets, including Utility Tokens (UT). A UT is defined as a type of crypto-asset intended to provide digital access to a good or service available on Distributed Ledge Technology (DLT). MiCA imposes less onerous regulatory requirements in respect of other crypto-assets. For example, MiCA may allow for regulatory derogations where the crypto-asset is offered for free or only to a limited group of qualified investors (e.g. for the benefit of start-ups or smaller fintech players).

*In situations where the crypto-asset has no offeror and is not traded in a trading platform which is considered to be operated by a service provider, the provisions of Title II do not apply.

CRYPTO-ASSET SERVICE PROVIDER

Crypto-asset service providers (CASPs) provide crypto-asset services to third parties on a professional basis. Under MiCA, CASPs must be authorised by a NCA in an EU member state unless they fulfil specific requirements and are:

- a credit institution authorised under the EU Capital Requirements Directive (e.g. an EU bank) providing crypto-asset services;

- an investment firm authorised under MiFID2 providing crypto-asset services matching the investment services and activities it is authorised to provide in the EU;

- an electronic money institution authorised under EMD2 providing on behalf of third parties custody and administration of crypto-asset services or transfer services for crypto-assets concerning the electronic money tokens it issues;

- an undertaking for the collective investment in transferable securities (UCITS) management company authorised under the EU UCITS Directive providing portfolio management services on crypto-assets, and (if it holds certain permissions for giving investment advice) offering advice on crypto-assets; or

- an alternative investment fund manager authorised under the EU Alternative Investment Fund Managers Directive (AIFMD) providing portfolio management services on crypto-assets and (where necessary permissions are held) advising on crypto-assets and the reception and transmission of orders for crypto-assets on behalf of third parties.

Legal persons with an EU registered office authorised as a CASP in one EU member state may passport those services to other EU member states. MiCA does not provide for a separate third-country regime. Regulatory requirements vary depending on whether CASPs provide custody and administration of crypto-assets, trading platforms or otherwise. MiCA gives certain enforcement powers to NCAs including, suspension of services or advertisements and public notice of compliance failure.

Significant CASPs – are CASPs that have over 15 million active users in the EU on average in one year.

Obligations as a CASP include:

- Governance – governance and risk management arrangements (including systems and controls requirements) must be observed. Know your customer policies must be in place.

- Disclosure – including on conflicts of interest and blockchain consensus mechanism.

- Prudential safeguarding – by own funds, regulatory capital or insurance.

- Third parties – where applicable, custody and administration, operation of a trading platform, order execution and provision of advice.

RECENT MICA DEVELOPMENTS

Algorithmic stablecoins - were initially outside the scope of MICA. However, the definition of ARTs in the compromise text may capture certain algorithmic stablecoins.

NFTs – clarity is provided in the recitals to the compromise text of MICA on what does or does not constitute an NFT. NFTs are unique and are not traded or exchanged at equivalency, unlike cryptocurrencies.

Transaction cap – There is a proposed transaction cap on ARTs and EMTs in the compromise text where an ART or EMT is used widely as a means of exchange within a single currency area. In such cases, transactions in that token will be limited to one million transactions in number and EUR 200,000,000 in value. The transaction cap would apply to all ARTs and to EMT tokens denominated in a non-EU currency.

Market abuse – The scope of territorial application has been widened in the compromise text.

Environment – There are new sustainability and disclosure requirements for issuers and CASPs, added to the compromise text. Consensus mechanisms should deploy more environmentally friendly solutions and ensure that issuers and CASPs adequately identify and disclose any climate and environment related adverse impacts. In co-operation with the EBA, ESMA may develop draft regulatory technical standards to specify further requirements, including content, methodologies, and presentation of information on climate and other environment-related impacts. There are also certain factors that ESMA may consider when developing such standards.

Public register – It is proposed that the EBA create a public record of businesses and services involved in crypto-assets that may have a high risk of money-laundering, terrorist financing and other criminal activities, including a non-exhaustive list of non-compliant providers. To counter money laundering threats, ESMA will set up a public register for non-compliant CASPs that provide services without authorisation, in the European Union.

Traceability - Crypto-asset transfers must include information on the source of the asset and its beneficiary, which is to be made available to NCAs. The rules would not apply to person-to-person transfers conducted without a provider or among providers acting on their own behalf.

NEXT STEPS

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.