- within Corporate/Commercial Law topic(s)

- in European Union

- within Law Department Performance, Strategy and Tax topic(s)

- in European Union

TAX

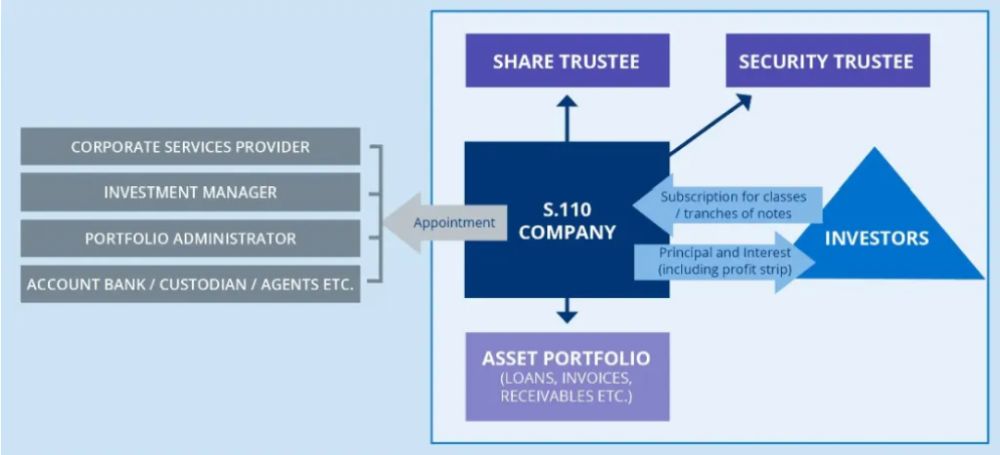

A Section 110 company can take a deduction for interest on profit participating notes ("PPNs") provided it satisfies 4 rules:

Section 110 Rules – a deduction should be available where:

- PPN is held by a resident of an EU/Treaty country and that noteholder is subject to tax; or

- PPN is listed and noteholder is not a "specified person". A "specified person" includes a person (i) controlling the p 110 company, including by holding 20%+ PPNs and having "significant influence"; or (ii) providing 75% of the assets of the p 110 company. A person will be regarded as having "significant influence" if it has the ability to participate in the financial and operating decisions of the p 110 company (eg. where the PPN holder is the manager or an entity related to the manager or appoints directors to the board, etc).

Anti-hybrid rules – if the PPN holder treats the PPN as equity or the return on it as a distribution, a deduction will only be available where the PPN holder is not an "associated enterprise" of the p 110 company (eg, it does not consolidate the p 110 company for financial accounting purposes and does not have board representation)

Interest limitation rules – A deduction should be available provided the income received by the p 110 company is interest or "interest equivalent" or the p 110 company is a "single company group" (ie. not consolidated with any party for financial accounting and has no debt issued to associated enterprises)

Irish land assets – additional requirements apply where the p 110 company holds assets deriving their value from Irish land.

Withholding tax – wide of range of exemptions available

Pillar 2

This should not be a material issue provided the p 110 company is not consolidated with any person and is not expected to have annual turnover in excess of €750m annual turnover.

USES

- Credit/Loan Origination

- NPL Acquisitions

- Music/Film/Pharma Royalty Receivables

- Aviation

- Private Equity

- Intra-Group Funding

NOTES

- p 110 companies are not regulated by CBI

- Can only hold financial assets, commodities and plant and machinery (for leasing)

- All transactions must be at arm's length

This article contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate.