Aurtus Consulting LLP’s articles from Aurtus Consulting LLP are most popular:

- in European Union

- in European Union

Aurtus Consulting LLP are most popular:

- within Government, Public Sector, Energy and Natural Resources and Employment and HR topic(s)

TRANSACTION

BRIEF FACTS

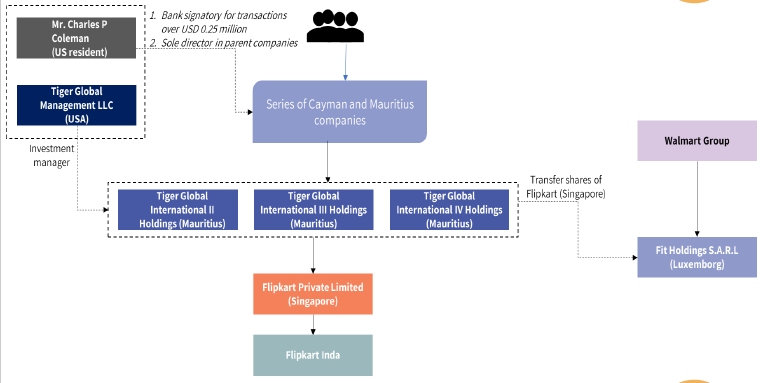

- Tiger Global International II Holdings, Tiger Global International III Holdings, and Tiger Global International IV Holdings, (collectively known as 'Tiger Global or the Taxpayer') were incorporated in Mauritius with the primary objective of undertaking investment activities. These entities were regulated by the Financial Services Commission in Mauritius and held Category I Global Business License.

- Tiger Global acquired shares of Flipkart Private Limited ('Flipkart Singapore'), a company incorporated in Singapore , between October 2011 to April 2015 i.e. before April 1, 2017, the date relevant for the applicability of grandfathering provision under the India – Mauritius Double Taxation Avoidance Agreement ('DTAA').

- Subsequently, Tiger Global transferred shares of Flipkart Singapore to Fit Holdings S.A.R.L (Luxembourg) in 2018, as part of Walmart Inc.'s broader acquisition of Flipkart.

- Tiger Global approached the Indian Tax Authorities seeking 'NIL' withholding certificate u/s 197 of the Act contending that the capital gains arising from the transfer of the shares of Flipkart Singapore were exempted under the DTAA since the shares were acquired prior to April 1, 2017, and were grandfathered under Article 13(3A) of the DTAA.

- Tax authorities denied DTAA benefits, stating Tiger Global was not independent in decision-making and control over the decision making relating to purchase and sale of shares did not lie with Tiger Global.

- Tiger Global filed applications seeking advance ruling on whether capital gains from sale of Flipkart Singapore shares would be taxable in India. The AAR rejected the application on the grounds that the transaction was prima facie designed for tax avoidance.

- Pursuant to the order of AAR, Tiger Global filed a writ petition before the High Court and the High Court quashed AAR's order and held that Tiger Global is entitled to benefits under the DTAA and their income is not chargeable to tax in India.

- Aggrieved by the order of High Court, Revenue filed appeal before the Hon'ble Supreme Court of India.

AAR'S CONTENTION

- Control and Management outside Mauritius: The real control over transactions exceeding USD 0.25 million was exercised by Mr. Charles P. Coleman (resident of USA), who was also the beneficial owner. Accordingly, the control and management were situated outside Mauritius, in the USA.

- See-through entities for DTAA benefits: Tiger Global made no investment other than shares of Flipkart Singapore, and the real intention for obtaining TRC was to avail the benefit of DTAA. Tiger Global was only a "see-through entity" to avail the benefits of the DTAA.

- Article 13(4) of DTAA: The capital gains arose from sale of shares of Flipkart Singapore, not an Indian company, and therefore did not qualify for exemption under Article 13(4) of the India - Mauritius Treaty.

- No commercial substance: Tiger Global were mere conduit companies, lacking commercial substance, and were disentitled to claim DTAA benefits.

- Accordingly, the AAR concluded that the transaction was prima facie designed for tax avoidance and accordingly rejected the application of Tiger Global.

HIGH COURT'S OBSERVATIONS

- Control and Economic substance: Tiger Global Management, LLC, USA functioned merely as an investment-manager and had no equity participation. Tiger Global could not be dismissed as entities lacking economic substance.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.