- within Employment and HR and Family and Matrimonial topic(s)

- with Senior Company Executives and HR

Notifications Updates

Notification No. 18/2025-Central Tax

The Central Board of Indirect Taxes and Customs (CBIC) has issued a notification related to Seeks to notify the Central Goods and Services Tax (Fourth Amendment) Rules 2025 on 31 October 2025.

Seeks to notify the Central Goods and Services Tax (Fourth Amendment) Rules 2025

You may refer to Update No. 2 i.e. Simplified GST Registration Scheme of the GST Portal Update Section for this update.

Circulars Updates

The Circular no. 254/11/2025 issued by CBIC on 27 October 2025 Regarding Assigning proper officer under Section 74A, Section 75(2) and Section 122 of the Central Goods and Services Tax Act, 2017.

Assigning proper officer under section 74A, Section 75(2) and Section 122 of the Central Goods and Services Tax Act, 2017

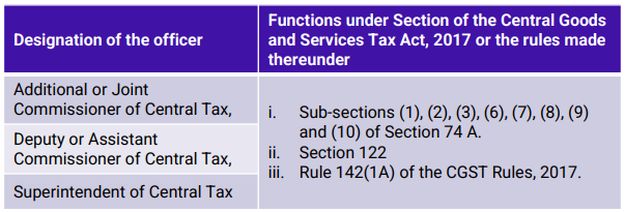

Circular No. 254/11/2025-GST assigns "proper officer" powers and specifies monetary limits for initiating action under Sections 74A, 75(2), and 122 of the CGST Act (and corresponding IGST provisions). It also prescribes the officer ranks authorized to issue pre-SCN communications under rule 142(1A).

Purpose and Scope

- The circular highlights that proper officers had not yet been designated for exercising powers under Section 74A, Section 75(2), Section 122 of the CGST Act, and rule 142(1A) of the CGST Rules.

- The circular highlights that proper officers had not yet been designated for exercising powers under Section 74A, Section 75(2), Section 122 of the CGST Act, and rule 142(1A) of the CGST Rules.

Assignment of proper officers

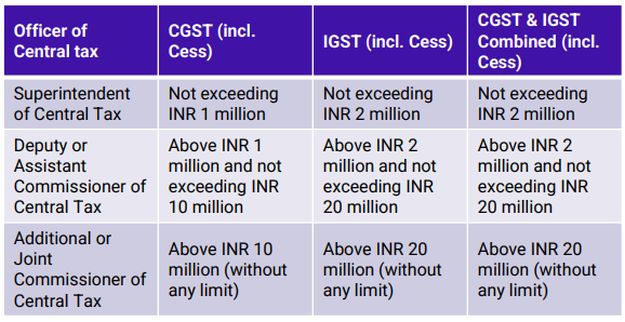

Monetary limits for Section 74A (Tax Demand)

Clarification

- Proper officer decided based on the highest total tax demand across all periods.

- If the new statement exceeds the officer's limit, a higher-ranked officer must issue it; earlier SCNs/statements must be shifted via corrigendum.

- Officer determination is based only on tax amount, not penalties.

- For Audit Commissionerate SCNs, the jurisdictional Commissionerate ensures the statement is answerable to the original adjudicating authority.

- When an SCN under Sections 73(1), 74(1) or 74A(1) covers both Central Tax and IGST (including cess), the proper officer is decided based on the combined tax amount as per Column (4) of Table.

- If an appellate forum holds that an SCN under Section 74(1) is not sustainable (fraud/suppression not proved), the same adjudicating officer must redetermine tax as if the notice were under Section 73(1).

- In Section 75(2), If an appellate forum holds that an SCN under Section 74(1) is not sustainable (fraud/suppression not proved), the same adjudicating officer must redetermine tax as if the notice were under Section 73(1).

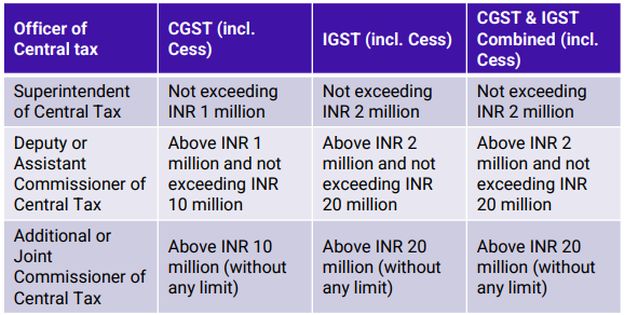

- In Section 122 jurisdiction allocation, Under Section 2(91) and Section 5 of the CGST Act read with Section 20 of IGST Act, officers listed in Column (1) of TableIII are assigned as proper officers for issuing SCNs and orders under Section 122, within the monetary limits specified in Columns (2) to (4).

Monetary limits for Section 122 (Penalties)

Clarification

- For SCNs issued under Section 122 involving penalties for both Central Tax and IGST, the proper officer shall be determined based on the combined penalty amount (Column 4 of Table), irrespective of whether the individual penalty amounts for Central Tax or IGST exceed the limits in Columns 2 or 3.

GST Portal Updates

Gross and Net GST revenue collections for the month of October 2025

The GSTN team has released Gross and Net GST revenue collections for the month of October 2025. Detailed report may be viewed here.

Advisory for Simplified GST Registration Scheme

The Government has introduced a Simplified GST Registration Scheme under Rule 14A of CGST Rules, 2017 to ease compliance for small taxpayers.

Eligibility

- Taxpayer whose total monthly output tax liability (including all GST components and cess) does not exceed INR 250,000 can opt for registration under this rule.

- Only one registration per State/UT is allowed under the same PAN.

Key features on GST Portal

- Applicants must choose "Yes" for registration under Rule 14A in FORM GST REG01.

- Aadhaar authentication is compulsory for the primary authorised signatory and at least one promoter/partner.

- Registration is approved within 3 working days, subject to Aadhaar verification.

Withdrawal Conditions

- Applicants must choose "Yes" for registration under

Rule 14A in FORM GST REG01.

- if withdrawing before 1 April 2026

- & 1 tax period, if withdrawing on or after 1 April 2026.

- No pending amendment, cancellation, or Section 29 proceedings should exist for such registration.

Advisory for Furnishing of Bank Account Details as per Rule 10A

- Taxpayers must update their bank account details on the GST portal within 30 days of registration or before filing GSTR-1/IFF, whichever comes first.

- Since Rule 10A changes will be implemented soon, those who haven't added their bank details should do so immediately to avoid suspension of GST registration and business disruptions.

- Bank account details can be added through a non-core amendment by navigating to:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]