- in United States

- within Tax, Corporate/Commercial Law and Energy and Natural Resources topic(s)

- with readers working within the Law Firm industries

Amidst the brouhaha surrounding the removal and a sort of re-introduction of the indexation benefit on the sale of capital goods, the Finance (No.2) Bill, 2024 ('the Finance Bill') was introduced in Lok Sabha on August 6, 2024, for consideration and passed on August 7, 2024. Among the various proposed legislative amendments related to Customs and Central Excise, a significant one pertains to Section 3(12) of the Customs Tariff Act, 1975 ('the Customs Tariff Act'). The amendment was introduced subtly at a later stage by way of amendment to the Finance Bill.

Understanding the current Customs framework on levy of interest and penalties:

Before delving into the amendment, it is essential to understand the framework of the Customs laws with respect to the levy of interest and penalties on Additional duties (under the erstwhile laws)/ IGST. The Customs Act, 1962 ('the Customs Act') governs the levy and collection of Basic Customs Duty (BCD), including provisions related to interest, penalties, assessment, refunds, etc. However, the levy of other Customs Duties like Countervailing Duty (CVD), Special Additional Duty (SAD), Integrated Goods and Services Tax (IGST), and GST Compensation Cess is governed by the Customs Tariff Act. The Customs Tariff Act primarily addresses the levy of respective duties, whereas provisions related to interest, penalties, assessment, and refunds are not explicitly detailed in the Customs Tariff Act. Instead, Section 3(12) of the Customs Tariff Act refers to the provisions of the Customs Act. In the context of the proposed amendment, it may be relevant to refer to the current provision:

"The provisions of the Customs Act, 1962 (52 of 1962) and the rules and regulations made thereunder, including those relating to drawbacks, refunds and exemption from duties shall, so far as may be, apply to the duty or tax or cess, as the case may be, chargeable under this section as they apply in relation to the duties leviable under that Act."

Legal Controversy: Historical and Current Perspective

A legal controversy that arose in the case of Mahindra & Mahindra before the Bombay HC [TS-446-HC-2022(BOM)- CUST] was whether in the absence of specific references to interest and penalties in the existing provision such levies be considered illegal.

In this case, it was held that Section 3(12) of the Customs Tariff Act does not contain any machinery provision for levy of interest and penalty on CVD, SAD, or any surcharge. Accordingly, in the absence of a specific machinery provision the High Court affirmed that interest or penalty cannot be levied on any short payment of such duties. The High Court concluded this by relying on the Supreme Court ruling in the case of India Carbon Ltd.& Ors. vs State of Assam, wherein it was held that the interest can be levied and charged on delayed payment of tax only if the statute that levies and charges the tax makes a substantive provision in this behalf.

It is a settled position in law that in the absence of the machinery provisions, a levy could not be imposed. Numerous judicial precedents in the past have confirmed this view1 that in the absence of machinery provisions in the Act, the levy would be beyond the legislative competence of the Parliament.

It is also worth noting that another writ petition on the same issue for the past period is pending before the Calcutta High Court in the case of Texmaco Rail and Engineering Limited vs Commissioner of Customs [TS-574-CESTAT-2021- EXC], wherein, an interim stay has been granted. Furthermore, recently the CESTAT Ahmedabad in the case of Chiripal Poly Films Ltd vs Commissioner of Customs-customs Ahmedabad [TS-310-CESTAT-2024-CUST] has held that interest on IGST, redemption fine and penalty is not payable in the absence of specific provisions under the Tariff Act.

Amendment proposed vide the Finance Bill:

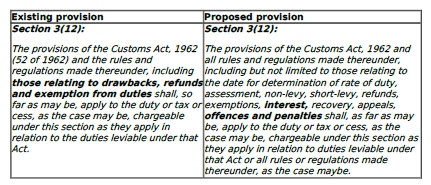

The following table provides a comparison of the existing provision vs the proposed provision of Section 3(12) of the Customs Tariff Act:

It is evident that the proposed amendment rectifies the legislative gap whereby, the chargeability to interest and penalty has been specifically incorporated.

The proposed amendment to Section 3(12) of the Customs Tariff Act is clearly aimed at curing the legislative defect in the current provisions. However, as is evident, the amendment is prospective and not retrospective, thereby indicating that interest and penalties collected in the past concerning duties levied under Section 3 of the Customs Tariff Act were without the authority of law. Consequently, taxpayers could apply for refunds of such interest and penalties paid under the existing provisions.

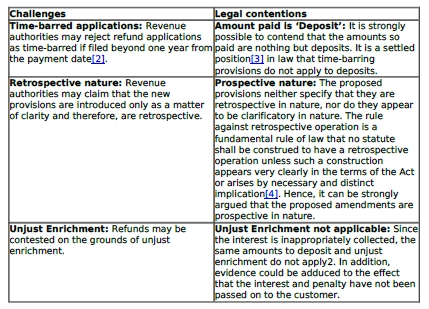

Challenges in claiming refund and legal contentions

Conclusion

The Hon'ble Supreme Court5 dismissed the Special Leave Petition filed by the Department without going into the merits of the case. Hence, one would expect another round of litigation right up to the Supreme Court before such refunds could be granted. Needless to mention the taxpayers will also have to cross the bridge of time-barring and unjust enrichment before they can witness a positive outcome.

Footnotes

1. Suresh Kumar Bansal vs Union of India & Ors [TS-231-HC-2016(DEL)-ST] and Commissioner of C.Ex. & Cus. Kerala vs Larsen & Toubro Ltd [TS-437-SC-2015-ST]

2. Section 27(1)(a) of the Customs Act

3. Suvidhe Ltd. v. Union of India — 1996 (82) E.L.T. 177 (Bom.). SLP against this dismissed by Supreme Court [U.O.I. v. Suvidhe Ltd. - 1997 (94) E.L.T. A159 (S.C)]

4. Commissioner of Income Tax (Central)-I, New Delhi v. Vatika Township Private Limited, [Civil Appeal No.8750 of 2014 in Supreme Court]

5. UOI & Ors. Vs Mahindra and Mahindra Ltd. [TS-434-SC-2023-CUST]

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.