- in United States

- within Litigation, Mediation & Arbitration, Family and Matrimonial and Environment topic(s)

- with Inhouse Counsel

- with readers working within the Technology, Utilities and Law Firm industries

1. INTRODUCTION

The 49th Goods and Services Tax ("GST") council meeting under the chairpersonship of the Union Minister for Finance and Corporate Affairs, Smt. Nirmala Sitharaman was held in New Delhi, on February 18, 2023.

The GST council has made several recommendations including on GST compensation, GST appellate tribunals, Group of Ministers ("GoM") report on capacity-based taxation, and special composition scheme in certain sectors. Further, recommendations were also made on GST rates on certain goods and services, in addition to announcing various additional measures for facilitation of trade. We have provided a summary of these recommendations along with our comments below:

2. GST APPELLATE TRIBUNAL

The GST council adopted the report of the GoM with certain modifications. The final draft amendments to the GST laws shall be circulated to Members, i.e, the state finance ministers for their comments. While it may still take up to a few months for the GST appellate tribunals to become functional, this announcement comes as a welcome move for assessees as many cases and issues that are stuck because of the lack of an appellate forum will soon be able to see the light of day.

3. GST COMPENSATION

Government of India has decided to clear the entire pending balance GST compensation of INR 16,982 crores incurred for the period of June, 2022. As there were no amounts in the GST compensation fund, government of India has released this amount from its own funds and will recoup the same from future compensation cess collection.

4 CAPACITY BASED TAXATION

While the GoM had recommended capacity-based levy in its report, the same was not accepted by the GST council. However, with a view to plug the leakages and improve revenue collection from commodities like pan masala, gutkha and chewing tobacco, the GST council has approved the following recommendations:

- Compliance and tracking measures to be taken to plug leakages and/or tax evasions;

- Exports of such commodities to be allowed only against letter of undertaking with consequential refund of accumulated Input Tax Credit ("ITC");

- Compensation cess levied on such commodities to be changed from ad valorem to specific tax-based levy to boost the first stage collection of revenue.

5 AMNESTY SCHEME

Extension of time limit for filing an application for revocation of cancellation of registration and one time amnesty for some cases are mentioned below:

- The time limit for filing an application for revocation of cancellation of registration is increased from 30 (thirty) days to 90 (ninety) days. It is further recommended where the registered person fails to apply for such revocation within 90 (ninety) days, the said time period may be extended by the commissioner or an officer authorized by him in this behalf for a further period not exceeding 180 (one hundred and eighty) days. It is in this regard that the GST council has also recommended that amnesty may be provided for past cases, where registration has been cancelled on account of non-filing of returns but application for revocation of cancellation of registration could not be filed within the time specified in section 30 of the Central Goods and Services Tax Act, 2017 ("CGST Act"). Accordingly, such persons can file an application for revocation of cancellation of registration by a specified date, subject to certain conditions.

- The GST council has recommended to amend section 62 of the CGST Act to increase the time period for filing of return, for enabling deemed withdrawal of a 'best judgment assessment order' 1 , from the present 30 (thirty) days to 60 (sixty) days, extendable by another 60 (sixty) days, subject to certain conditions. The amnesty scheme has also provided for conditional deemed withdrawal of assessment orders in past cases where the concerned return could not be filed within 30 (thirty) days of the assessment order but has been filed along with due interest and late fees up to a specified date, irrespective of whether appeal has been filed or not against the assessment order, or whether the said appeal has been decided or not.

- Amnesty in respect of pending returns in Form GSTR-4 (annual form for composition dealers2 ), Form GSTR-9 (annual return for normal taxpayers) and Form GSTR-10 (final return) has been extended by way of conditional waiver or reduction of late fee.

6 MEASURES FOR TRADE FACILITATION

Rationalisation of late fees for annual return:

- For aggregate turnover more than INR 5 (five) crores and upto INR 20 (Twenty) crores: INR 100 (one hundred) per day, subject to a maximum of 0.04% of turnover in the State or Union Territory.

- For aggregate turnover of up to INR 5 (five) crores: INR 50 (fifty) per day, subject to a maximum of 0.04% of turnover in the State or Union Territory.

Rationalization of provision of place of supply of services of transportation of goods: Pursuant to the proposed deletion of section 13(9) of Integrated Goods and Services Tax Act, 2017, the revised framework contemplates that the place of supply of services of transportation of goods, in cases where location of supplier of services or location of recipient of services is outside India, shall be the location of the recipient of services.

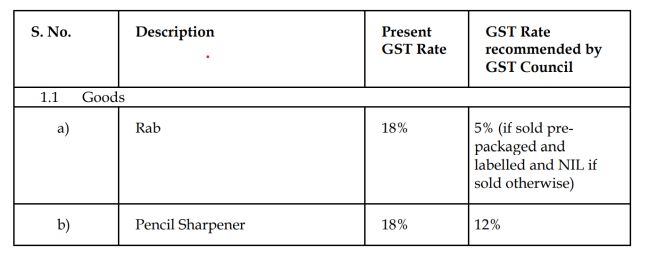

7 RECOMMENDATIONS RELATING TO RATE CHANGES

Amendment to entry at serial no. 41A of notification no. 1/2017- Compensation Cess (Rate) dated June 28, 2017, such that exemption benefit covers both coal rejects supplied to and by a coal washery, arising out of coal on which compensation cess has been paid and no ITC thereof has been availed by any person.

Extend the exemption available to educational institutions, central and State educational boards for conduct of entrance examinations, to any authority, board or a body set up by the government of India or State government including National Testing Agency for conduct of entrance examination for admission to educational institutions.

Exemption of reverse charge mechanism extended to the Courts and tribunals, in respect of taxable services supplied by them such as renting of premises to telecommunication companies for installation of towers, renting of chamber to lawyers etc. Earlier this was available to government of India, State governments, parliament, and State legislatures.

8 INDUSLAW VIEW

Without a GST appellate tribunal in existence, cases have been piling up as high courts were unable to dispose them off successfully because of the back log of cases since the pre-GST era. The much awaited constitution of the GST appellate tribunals will now ease the mounting pressure on the high courts as well as pave the way for faster disposal of pending matters.

Further, while the amnesty scheme is limited to certain issues, it is indeed a welcome move, and the industry will look forward for more such schemes from an ease of doing business and trade facilitation perspective. With two meetings conducted in a span of three months, it appears that the intention of the GST council is to bring in more clarity and resolve as many issues as possible, most importantly those which continue to be industry wide concerns.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.