Vide two notifications dated 7th March 2024, the Ministry of Corporate Affairs has (i) enhanced the wholesale price index of the monetary thresholds provided under Section 5 of the Competition Act ("Act") ("Jurisdictional Thresholds") by 150% and (ii) increased the monetary thresholds provided under the existing small target or De-minimis Exemption ("De-minimis Thresholds"). Set out below is a brief snapshot of these revised thresholds.

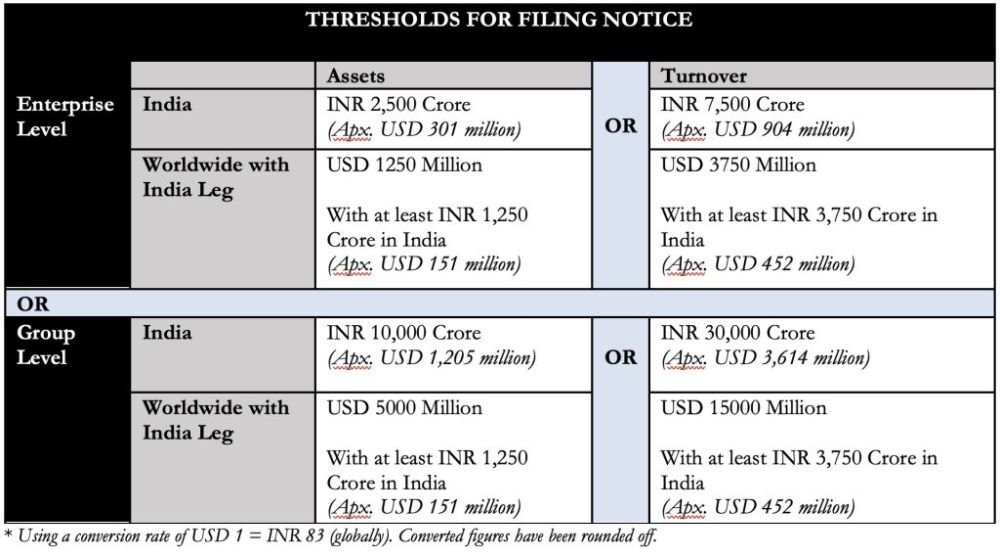

Jurisdictional Thresholds

As per the Indian merger regime, Jurisdictional Thresholds have been provided at both, an enterprise level and a group level. If any of the Jurisdictional Thresholds (mentioned below) are met, a requirement to notify the envisaged transaction to the Competition Commission of India ("CCI") for its approval will get triggered.

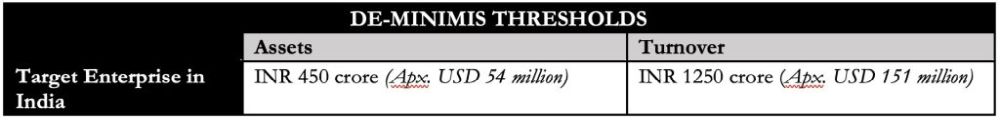

De-minimis Exemption

Transactions where the target enterprise either has assets or a turnover that is less than the De-minimis Thresholds (mentioned in the table below) are presently exempted from obtaining the CCI's approval, for a period of two years (i.e. until 6th March 2026), even if the Jurisdictional Thresholds are met.

Acquisitions of a Portion or Division of an Enterprise

As per these notifications, it may be noted that in situations where only a 'portion of an enterprise or division or business is being acquired', the value of the assets and turnover attributable to the relevant portion, division or business will be considered whilst calculating the Jurisdictional Thresholds and the De-minimis Thresholds, as the case may be.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]