- within Cannabis & Hemp, Strategy and Privacy topic(s)

Under Foreign Exchange (Compounding Proceedings) Rules, 2000 (Erstwhile Rules), a person who contravenes any provision under the Foreign Exchange Management Act (FEMA), 1999, except for contravention of dealing in or transferring any foreign exchange or foreign security to any unauthorized person, can seek redressal for the same by making a compounding application to the Foreign Exchange Department of the Reserve Bank of India or the Directorate of Enforcement, as applicable.

To enhance the regulatory framework governing foreign investments, the Ministry of Finance on 12 September 2024, introduced the Foreign Exchange (Compounding Proceedings) Rules, 2024 (New Rules) under the authority of Section 46, in conjunction with Section 15 of the Act, to replace the Erstwhile Rules.

In a press release, the Ministry of Finance highlighted that the primary objective of the amendment is to expedite and simplify the process of compounding. The revisions aim to streamline the rules, remove ambiguities, and ensure a more transparent and efficient procedure for all stakeholders.

A. Key Changes Via The New Rules

1. Enhanced pecuniary limit:

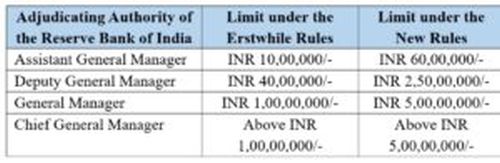

One of the significant amendments is the increase in the threshold of pecuniary jurisdiction of the compounding through the officer of the RBI. Accordingly, the updated thresholds are as follows:

Accordingly, while the pecuniary thresholds for compounding through the RBI officer have been raised, there appears to be no change in the monetary limits for compounding through the ED officer.

2. Circumstances where contraventions cannot be compounded:

Under the Erstwhile Rules, compounding was not allowed for: (a) any offence determined by the ED involving money-laundering, terror financing or affecting the sovereignty and integrity of the nation; (b) cases where the amount involved was unquantifiable.

The New Rules have added new categories for which compounding would not be allowed. These are the cases where:

a. Assets are held outside India in violation of the law.

b. The adjudicating officer has passed a penalty order.

c. Further investigation by the ED is necessary to determine the extent of the contravention.

3. Payment of application fee and penalty:

a. Compounding application fee: The fee for filing a compounding application has been increased from INR 5,000 to INR 10,000.

b. Mode of payment: The New Rules allow payments through online modes like National Electronic Fund Transfer (NEFT) and Real Time Gross Settlement (RTGS), which is a significant step towards digitization of the compounding process as compared to the erstwhile regime were only payments through demand draft was allowed. This step will benefit the applicants as they would be better placed to comply with the compounding order and pay the quantified amount within the stipulated period of 15 days (from the date of compounding order) as the non – payment results into the compounding order being deemed ineffective as if no application was made.

4. Discontinuation of Inquiries and Expanded Powers of the Compounding Authority:

While under the Erstwhile Rules, it was understood that no further inquiry would be made upon passing of the compounding order with respect to contraventions to which such compounding order pertains, the New Rules have classified this by specifically providing that if contraventions have been compounded before the completion of the adjudication process under Section 16 of the Act, then any ongoing inquiries by the adjudicating authority shall be discontinued.

The compounding authority previously had the power to request any information, records, or documents related to the contravention. Under the New Rules, the authority is now also empowered to instruct the applicant to take any necessary action regarding the transactions involved in the contravention pursuant to any compounding order.

B. Conclusion

The New Rules shall be applicable for all compounding applications which are filed after the date on which the New Rules come into effect. Accordingly, any applications that are currently pending will continue to be processed under the Erstwhile Rules.

Both the new and old rules state that compounding through RBI officers is not allowed if a 'similar contravention' has occurred within three years of the previous violation. While the New Rules bring more clarity and transparency to the FEMA compounding process, the term 'similar contravention' has not been defined leading to interpretational issues.

It is worth mentioning that the Late Submission Fee (LSF) was introduced in 2019 for Foreign Investment, External Commercial Borrowings, and Overseas Investment filings. If the LSF were to be applied to other filings, including less severe contraventions under these compounding rules as well, then it would help in disposing huge backlog of pending compounding applications by having only serious contraventions to be taken for compounding under the New Rules.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.