- within Finance and Banking topic(s)

- with readers working within the Law Firm industries

- within Finance and Banking topic(s)

- with readers working within the Law Firm industries

- within Finance and Banking, Media, Telecoms, IT, Entertainment and Employment and HR topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

In today's globalized economy, outward remittances by Indian residents play a vital role in facilitating financial support for family members abroad, covering education and medical expenses and fulfilling personal and professional needs. These transactions, while beneficial in nature, are regulated under the Foreign Exchange Management Act, 1999 and regulations thereunder (FEMA) to ensure transparency, accountability and the prevention of misuse.

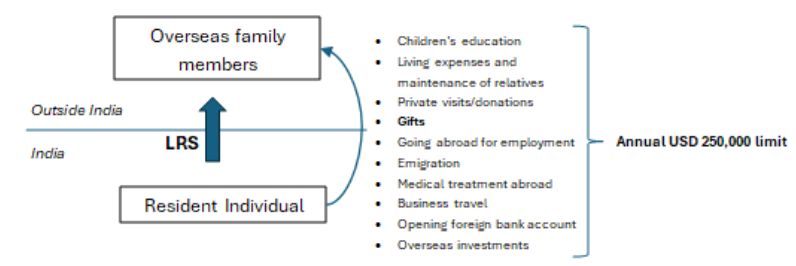

Resident individuals, including high net-worth individuals (HNIs) commonly remit funds abroad for legitimate purposes such as family maintenance, medical treatment, overseas education, business travel, etc. A significant number of these remittances are facilitated through the Liberalised Remittance Scheme (LRS), which allows residents to remit up to USD 250,000 per financial year for permissible transactions including gifts, education expenses, and maintenance of close relatives.

Recently, the Reserve Bank of India (RBI), India's central bank, has raised concerns over the potential misuse of the "gift" route for overseas investment as a part of outward remittances, which may be structured to circumvent FEMA. This has led to heightened regulatory scrutiny to prevent such violations.

As a result, the regulatory environment has become more stringent, especially for HNIs, with enhanced documentation requirements and greater scrutiny of the end-use of remitted funds.

While genuine financial support such as funding for children's education or living expenses abroad remains permissible, resident individuals will need to now exercise greater diligence and ensure full compliance with FEMA and LRS guidelines to avoid regulatory penalties or adverse action.

Misuse of the "Gift" Route under LRS: Regulatory clampdown on Overseas Investments

Permissibility of Overseas Investments: Resident individuals are permitted to make overseas investments under the Overseas Investment Rules, 2022, ('OI Rules') either as Overseas Direct Investment (ODI)1 or Overseas Portfolio Investment (OPI)2. Typically, ODI involves significant control, whereas OPI does not.

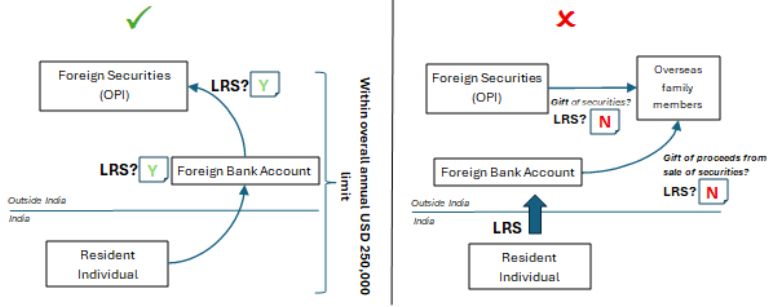

Misuse of the 'Gift Route' identified: It has come to the RBI's attention that certain HNIs have been misusing the "gift" category under LRS by investing in foreign securities under OPI and subsequently remitting the investment proceeds/principal amounts thereof abroad, through the foreign currency account opened outside India, for LRS purposes in the form of gifts or expense support to non-resident family members. These transactions, although ostensibly compliant with permissible LRS end-use purposes such as living expenses or family maintenance, are increasingly being viewed as attempts to circumvent the intent and spirit of OI Rules.

According to Regulation 22(4) of the Master Direction on Overseas Investment, 2024 "Resident individuals are not permitted to transfer any overseas investment by way of gift to a person resident outside India." This regulation places a clear restriction on the "gifting" of overseas investments held abroad to their non-resident family members.

Despite clear restrictions, some HNIs continue remitting funds as gifts to their non-resident family members, justifying their actions through a contested interpretation of the rules. Their argument hinges on the logic that "Since foreign exchange realised in an overseas bank account funded under LRS can be used for permitted expenses like foreign travel even if incurred from the overseas account then, by extension, giving a gift (also a permitted LRS transaction) should similarly be allowed from such overseas accounts."

However, this reasoning fails to distinguish between permissible usage of funds from domestic account remitted for specific temporary expenditures (e.g. travel or education) vs transfer of overseas investments made under OPI.

Mandate on repatriation of unused funds: As per Direction – 4.7 of Part I of 'Master Direction – Deposits and Accounts', a resident individual can open a foreign currency account with a bank outside India for the purpose of sending remittances under the LRS. Further, as per Direction A – 6 of 'Master Direction – LRS' ('MD-LRS'), (a) opening of a foreign currency account with a bank outside India, and (b) making investments in foreign securities under ODI/OPI, are both permissible capital account transactions for a resident individual under LRS. Direction A – 10 of MD-LRS provides that resident individual can also open, maintain and hold foreign currency accounts with a bank outside India for making remittances under LRS without prior approval of the RBI and such foreign currency accounts may be used for putting through all transactions connected with or arising from remittances eligible under LRS.

As per Direction A – 15 of MD-LRS, for making remittances (from a regular savings/current/EEFC/RFC account) under LRS, a resident individual is required to submit Form A2 with Authorized Dealer by selecting appropriate purpose code based on the nature of the remittance. For instance, the applicable purpose code is (a) S0023 – Opening of foreign currency account abroad with a bank, (b) S0001 – Indian Portfolio Investment Abroad – in equity shares and (c) S0002 – Indian Portfolio Investment Abroad – in debt instruments

Similarly, Direction A – 17 of MD-LRS provides that resident individual remitting funds outside India for any permissible purpose under LRS is allowed to retain/reinvest the income earned from such overseas investments. However, realised, unspent, or unused foreign exchange, unless reinvested, shall be repatriated within 180 days from the date of receipt/realisation.

Our Thoughts

Under LRS, remittances in the form of "gifts" are permissible up to USD 250,000 per financial year. However, where a resident individual exits from an investment in foreign securities using their foreign currency account abroad, the sale proceeds thereof unless reinvested shall be repatriated to India within 180 days of such exit, in accordance with the Direction 17 of MD – LRS. Only thereafter further onward remittance from India, including by way of gifts, shall be made under LRS.

In practice, however, certain HNIs have sought to bypass this requirement by directly transferring the proceeds from overseas investments to non-resident family members, such as children living abroad, without first repatriating the funds to India. This is often done to avoid breaching their LRS annual threshold, as repatriating the funds back to India and then re-remitting them as gifts would be counted toward their annual limit under LRS.

Such practices represent a clear contravention of FEMA guidelines, as they undermine the regulatory intent behind the mandatory repatriation requirement. To uphold regulatory integrity, remittances especially those tied to investment exits must strictly comply with FEMA and LRS guidelines. The RBI's heightened scrutiny underscores the need for transparency, ensuring that funds are not misused for tax evasion or undisclosed offshore investments.

Footnotes

1. ODI means (a) investment by way of acquisition of unlisted equity capital of a foreign entity; (b) Subscription as a part of Memorandum of Association; or (c) Investment in 10% or more of listed equity capital or investment with control where investment is less than 10% of listed equity capital.

2. OPI means investment, other than ODI, in foreign securities, but not in any unlisted debt instruments, or any security issued by a person resident in India who is not in an International Financial Services Centre (IFSC).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.