- within Employment and HR topic(s)

- in India

- within Employment and HR topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in India

- with readers working within the Accounting & Consultancy, Insurance and Technology industries

On July 1, 2025, the Government of India approved the Employment Linked Incentive (ELI) for rollout from August 1, 2025, a scheme designed to support employment generation, enhance employability, and strengthen social security across all sectors, with a particular emphasis on the manufacturing sector. The Scheme to be implemented in mission mode from August 2025 to July2027, with disbursements processed through Employees' Provident Fund Organisation (EPFO),contains two Parts with the aim to support formal job creation and social security across various sectors.

- Part A: Incentives for first-time employees

- Part B: Incentives for employers hiring additional staff

Part A: Incentive to First Time Employees:

Under Part A, first-time employees earning salary up to INR 100,000 per month and contributing to the Employees' Provident Fund (EPF) for the first time, will receive an incentive equivalent to one month's EPF wages, capped at a maximum of INR 15,000.

Eligibility for Part A

- Incentives for First-Time Employees

Applicability: Employees who are first-time registrants with EPFO (never previously a member under EPF Act, 1952) and have salaries up to INR 100,000 per month are eligible.

Incentive: One month's EPF wage (up to INR 15,000) to be paid in two installments:

- First installment after 6 months of continuous service.

- Second installment after 12 months and completion of a financial literacy program (detail spending from EPFO/Ministry of Labour and Employment).

Savings Component: A portion of the incentive will be kept in a savings instrument or deposit account for a fixed period, withdrawable later to encourage saving habits.

Action Steps:

- Companies need to identify and register first-time employees hired between August 1, 2025,and July 31, 2027, with EPFO.

- Companies need to ensure these employees complete the financial literacy program when details are provided by EPFO.

- Companies need to facilitate Direct Benefit Transfer (DBT) via the Aadhaar Bridge Payment System (ABPS) by ensuring employees' Aadhaar details are linked and updated.

- To ensure long-term financial security, the second instalment of the incentive will be deposited into a savings instrument for a fixed period and can be withdrawn by the employee at a later date.

- Relevance to Companies: For new hires, Companies need to verify their EPFO registration status. Employees with salaries up to INR 100,000 (clarification awaited on whether this is CTC, basic salary, or gross salary less HRA/overtime/bonus/commission) are eligible.

Part B: Incentive for Employers Hiring Additional Employees

Part B is tailored to support employers looking to expand their workforce and covers generation of additional employment in all sectors, with a special focus on the manufacturing sector.

Under Part B, employers hiring additional employees with salaries up to INR 100,000 per month shall receive incentive up to INR 3,000 per month from the Government for two years for each employees, with extended incentives for the third and fourth years in the manufacturing sector.

To qualify for the incentive under Part B, the additional employees must maintain their employment for a minimum of six months. Establishments, which are registered with EPFO, will be required to hire at least two additional employees (for employers with less than 50 employees)or five additional employees (for employers with 50 or more employees), with a minimum retention period of six months.

Eligibility for Part B

Part B: Incentives for Employers

Applicability: Employers hiring additional employees beyond the baseline headcount of July 31,2025, are eligible for incentives. For establishments with 50 or more employees , companies need to hire at least 5 additional employees with sustained employment for at least 6 months. For establishments with less than 50 employees, Companies need to hire at least 2 additional employees with sustained employment for 6 months.

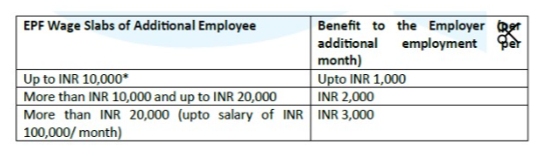

Incentive Structure:

The incentive structure will be as under:

* Employees with EPF wages up to INR 10,000 will get a proportional incentive.

- Incentives are provided for two years, with payments directly credited to PAN-linked accounts.

- Extended benefits for the third and fourth years apply only to the manufacturing sector.

Mandatory Actions for All Employees

Requirement: Regardless of ELI eligibility, all active employees must complete the following:

- 100% activation of Universal Account Number (UAN).

- 100% updating of Know Your Customer (KYC) details (Bank Account, Aadhaar, PAN) on the EPFO portal.

- 100% filing of e-Nomination on the EPFO portal.

Payment Mechanism and Verification

Employees: Under Part A, incentives for first-time employees will be disbursed via DBT through ABPS, requiring Aadhaar-linked accounts.

Employers: Under Part B, Incentives will be credited to PAN-linked accounts after verification of data and compliance status on the EPFO portal.

Risk of Refund with Interest and Damages

Requirement: If the Ministry of Labour and Employment determines post-disbursement that either the employee or the Company was ineligible, the incentive received must be refunded with12% p.a. interest and 1% per month damages.

Action Steps:

- Companies need to ensure accurate reporting of employee data and compliance with EPFO requirements to avoid eligibility disputes.

- Companies need to maintain detailed records of hiring, EPF contributions, and compliance to support verification processes.

Awaiting Clarifications

The following aspects of the Parts A and B are pending clarification from EPFO/Ministry of Labour and Employment:

- Details of the mandatory financial literacy program required for the second installment of employee incentives lacks specifics, such as the curriculum, delivery mode (online or offline),and who will administer it.

- The exact definition of "salaries up to INR 100,000" (whether CTC, basic salary, or gross salary less HRA/overtime/bonus/commission) requires clarity.

- While a portion of the incentive is to be held in a savings instrument or deposit account for a fixed period, the specific type of savings instrument (e.g., fixed deposit, provident fund, or other),its tenure and withdrawal conditions remain unclear.

- Specific processes and requirements for the payment mechanism, including potential EPFO inspections awaits clarity.

- The exact scope of the manufacturing sector (e.g., specific industries or sub-sectors eligible for extended four-year incentives) requires further clarity.

- The criteria and process for verifying "first-time" employee status, including how EPFO will ensure compliance and prevent fraudulent claims, need further elaboration to avoid misuse.

- The criteria for what constitutes "additional employment" (e.g., whether it includes rehiring former employees or only new hires) in Part B and how EPFO will monitor sustained employment levels to ensure employers maintain increased workforce levels await clarity.

- How Part B interacts with other employment schemes (e.g., Aatmanirbhar Bharat Rojgar Yojana) or whether benefits can be combined remains unclear.

Payroll Provider Coordination:

Companies need to work closely with its payroll provider to ensure timely EPF contributions, accurate employee data, and compliance with EPFO requirements. It is required to monitor updates on the financial literacy program and payment mechanism clarifications.

Anhad Law's Perspective:

The ELI scheme, introduced in the 2024-25 Union Budget, is part of the Prime Minister's five schemes to facilitate employment, skilling and other opportunities and to help 4.1 crore young people with a total budget of INR 200,000 crore. It aims to tackle unemployment by encouraging job creation, formalizing workers, and improving skills. Though well-intentioned, its success, however, will depend on effective implementation, coordinated engagement among relevant stakeholders, and the rectification of structural deficiencies to promote lasting economic growth and empower youth.

Originally published on 31 July 2025 on Lexology

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]