- within Real Estate and Construction, Food, Drugs, Healthcare, Life Sciences and Insolvency/Bankruptcy/Re-Structuring topic(s)

- with readers working within the Law Firm industries

Global trends towards a stakeholder-centric governance model have resulted in a structured movement towards responsible business conduct. Companies are expected to be driven not only by profitability but also the increasingly relevant non-financial parameters measured through impact on society and the environment, popularly referred to as the 'triple bottom line'.

ESG (environment, social and governance) related risks are being factored in by "socially-conscious" investors. Large institutional investors that had previously taken passive stances on ESG-related issues have become more assertive. Reports suggest that ESG-mandated assets could grow almost three times as fast as non-ESG-mandated assets to comprise half of all professionally managed investments in the United States by 2025.1 The business case for ESG-based performance includes better risk management which in turn creates long term value by providing access to capital, operational benefits and goodwill.

Business Responsibility Reporting in India

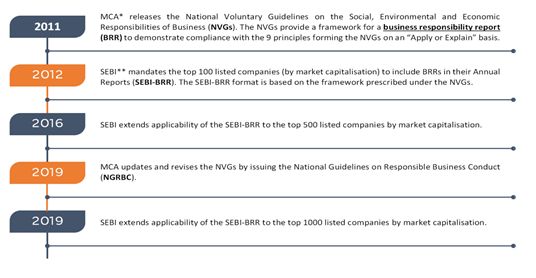

Market demand and regulatory developments have been the two key drivers for development of ESG-based performance metrics in India. Over the past decade, India has developed its very own business responsibility reporting framework enabling disclosures on key non-financial parameters in line with global commitments and legislative advancements.2 The timeline below sets out the implementation of this reporting framework:

*Ministry of Corporate Affairs

**Securities and Exchange Board of India

MCA Committee Recommendations for an enhanced BRR framework

Simultaneous to the adoption of the more refined NGRBC vis-à-vis NVGs, the MCA constituted a Committee on Business Responsibility Reporting (Committee) in 2018 to review the existing BRR framework and to formulate a tech-integrated, user-friendly, single and comprehensive reporting framework to measure non-financial parameters. Basis this review, the Committee published its report on 11 August 2020 (Report) with a recommendation that the revamped formats be formally adopted by regulators in a phased manner beginning 2021-22.

Key changes recommended by the Committee are as follows:

- Thrust on 'Sustainability': The Report recommends that the format should undergo a name change and be referred to as the 'Business Responsibility and Sustainability Report (BRSR). The revised name highlights the importance of integrating sustainability principles in traditional business practices and embracing it as a measure of good governance.

- BRSR Lite: In order to nudge unlisted companies, SMEs and new entrants towards voluntary disclosures, the Report provides a pared down Lite version of the regular BRSR format. While the Lite version continues to be mapped against the principles and the core elements prescribed in the NGRBC, it is a simpler and shorter format keeping in mind costs and burden of compliance for such companies.

- Guidance Notes to Aid Disclosures: Given the extensive stakeholder discussions preceding the Report, the Committee has been mindful of the challenges faced by companies in their SEBI-BRR disclosures. To promote quality disclosures, the Report provides detailed guidance notes on the BRSR and the BRSR Lite. This typically serves the purpose of an instruction kit as is provided for forms that are to be filed with the Registrar of Companies.

- E-filing and MCA21 Integration: Lack of digital integration has been a big drawback of the BRR framework. To rectify matters, the Report proposes that the BRSR formats be filed electronically and be integrated with filings made by companies on the MCA21 portal. The BRSRs would therefore, have pre-populated information based on filings already made, drop down menus, where applicable and overall, easier navigation options.

- Addressing Inadequate Disclosures: The Report states that an analysis of the disclosures made by companies in the SEBI-BRRs highlights the disparity in the quality of disclosures between companies. It seeks to remedy this to some extent by providing a mix of quantitative and qualitative data-based questions in the BRSRs. Where required, questions have been made more detailed or simplified/ pointed to enable clear and accurate disclosures. Questions around value chain, labour welfare and participation by women and the differently abled have received added emphasis in the BRSRs.

- Enhanced Coverage: The Report proposes that the BRSRs be extended to certain other companies and businesses (for example: unlisted companies, LLPs etc) which meet specified thresholds of turnover and/ or paid-up capital in a staggered manner.

Conclusion

The goal of the NGRBC and the BRSR framework is a lofty one that needs concerted government and industry participation for its success. In a business environment affected by COVID, ESG considerations would continue to be at the forefront with Boards likely to focus on long-term value creation. In this context, the MCA's recommendations on the BRSR framework is timely and will allow for standardisation of ESG-factors as well as bring greater quality and accuracy to such non-financial reporting.

While the BRSR Lite is a welcome step towards wider implementation, the preparedness of each company to adapt and align itself (sometimes, at quick notice) and ability to take on the added compliance will need to be kept in mind by SEBI and other regulators before formally adopting the recommendations in the Report.

The Report also states that a Business Responsibility-Sustainability Index is in the pipeline. If implemented well, this index could set the stage for greater ESG-based investments in India.

As first step towards implementation, SEBI has, on 18 August 2020, released a consultation paper seeking stakeholder comments on the adoption of the BRSR format proposed by the Committee. Also, with the MCA steering the process of formulating a National Action Plan on Business and Human Rights (NAP), it is evident that themes around being socially responsible coupled with an enhanced focus on corporate governance are here to stay. Demonstrating leadership in ESG may well become a differentiating factor for companies and Boards will have to stay ahead of the game and re-design strategy to push this agenda forward.

Footnotes

1. Deloitte Insights, "Advancing environmental, social, and governance investing" 20 February 2020 (click here)

2. For example, India's ratification of the Paris Agreement for Climate Change 2015, the United Nations 2030 Agenda for Sustainable Development (SDGs), CSR provisions under the Companies Act 2013, etc.

The content of this document do not necessarily reflect the views/position of Khaitan & Co but remain solely those of the author(s). For any further queries or follow up please contact Khaitan & Co at legalalerts@khaitanco.com