- within Corporate/Commercial Law topic(s)

- in India

- with readers working within the Oil & Gas and Law Firm industries

- within International Law, Law Department Performance, Litigation and Mediation & Arbitration topic(s)

- with Inhouse Counsel

It's been over a decade since the concept of corporate social responsibility ("CSR") was introduced under the Companies Act, 2013 ("Act"). CSR has catalysed thousands of projects across education, health, sanitation, skilling, and the environment. While a positive initiative for a country like India with its diverse demographic needs and its developmental needs, CSR has not achieved its full potential as most companies still approach it as a legal formality rather than a genuine opportunity to create a meaningful impact. The prevailing operating model typically focuses on short-gestation, input-heavy, and activity-focused projects: new classrooms built, health camps hosted, saplings planted, trainings delivered.

Who has to comply with CSR?

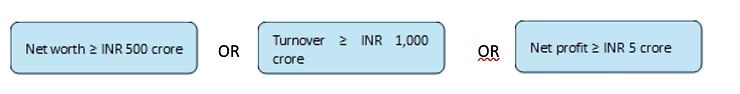

Under the Act, Indian companies that meet the following financial thresholds in a financial year are, in the following financial year, required to constitute a CSR committee and formulate a CSR Policy:

In addition, companies that have breached any of the above thresholds are also required to spend at least 2% of their average net profits made in the preceding three financial years (or where a company has not completed three financial years since its incorporation, made during immediately preceding financial years) on CSR activities. For an activity to be counted towards a company's CSR obligations under the Act, the activities need to fall within the areas listed in Schedule VII to the Act (which include education, healthcare, environmental sustainability, poverty alleviation and protection of national heritage).

The effectiveness of CSR funding has been limited due to its allocation primarily towards short-term initiatives, rather than programs designed to create systemic change. Although CSR remains a mandatory compliance obligation, companies should view their investments as a means to engage in strategic, long-term projects that drive sustainable impact rather than a mere compliance obligation to be fulfilled and then crossed off the list of mandatory activities for a company.

Today's stakeholders (communities, investors, and regulators) are asking a different question: not how much was spent as CSR, but what changed and for whom! The next frontier for India's CSR is clear—move from expenditure compliance to outcome-centric impact creation.

What is outcome-based funding?

Outcome-Based Funding ("OBF") is an advanced financing model that ties payments to the achievement of measurable results. A fundamental element of this model is the agreement on specific, measurable outcomes upfront, which can then be independently verified. The concept of outcome-based funding has its origins in the development of results-based financing ("RBF"), with the World Bank playing a key role in pioneering RBF mechanisms. Using this base model, along with OBF models used by other countries, India has started using OBF models as a finance tool to ensure higher accountability.

Outcome-Based Funding is not a one-size-fits-all solution but rather a collection of flexible mechanisms that can be tailored to various contexts and challenges. OBF offers adaptable, multi-year funding that enables local stakeholders to lead development initiatives tailored to their unique contexts and priorities. By concentrating on the outcomes achieved rather than the processes used, flexibility is provided to make necessary adjustments and course corrections along the way.

What are some of the important features to ensure a successful OBF Model?

- Clear identification of the proposed CSR activity (including ensuring that the proposed activity would be eligible as CSR under the Act) and ensuring the proposed activity meets the company's CSR objectives laid down in its CSR Policy;

- Clear pre-defined outcomes with baseline data and with information/data requirements that allow a company to accurately report the CSR activity;

- A clearly defined framework for the CSR activity/project including clarity on what would be the desired outcomes (or impact) for each stage of the proposed CSR activity, the results of which can be verified independently;

- Sensible risk-sharing by linking disbursements to clearly identifiable milestones/outcomes;

- Data systems that can be audited and which are compliant with the extant privacy guidelines;

- Operational flexibility for activities/projects within agreed parameters by implementing agencies.

From Compliance to Credible Impact

Rather than treating CSR as a peripheral cost, it should be positioned as an outcome-based investment with tangible results. Long-horizon initiatives can still qualify if they're broken into phases, each with clear deliverables that fall within CSR timelines, allowing impact to be demonstrated at every stage.

To meet rising regulatory and stakeholder expectations, CSR should be structured as an outcome-based portfolio rather than a compliance exercise. Establishing clear objectives, verification frameworks, and adaptive delivery mechanisms enables organizations to demonstrate measurable results and withstand external scrutiny. Engaging experienced advisors can assist in designing outcome-based CSR portfolios that meet statutory requirements, withstand scrutiny, and deliver measurable change.

India's CSR regime catalyzed a decade of giving. The next decade must be about results. Outcome-Based Funding offers a pragmatic, scalable pathway to demonstrate that CSR resources are not simply deployed, but are demonstrably improving lives and ecosystems in ways that endure. For companies, it means transforming CSR into a strategic lever that reinforces brand, mitigates risk, and builds social capital.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]