- within Employment and HR and Family and Matrimonial topic(s)

- with Senior Company Executives and HR

The Client

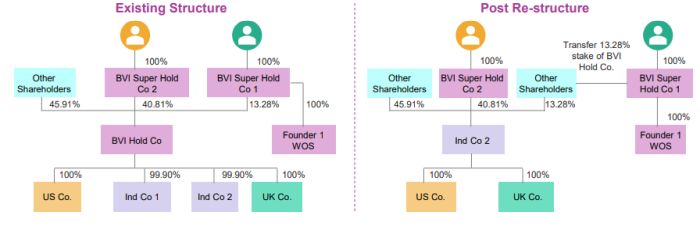

The Holding Company (BVI Hold Co.) of the Client was Headquartered in British Virgin Islands. The Client is a leading international auction house conducting live and online auctions. BVI Hold Co. owned intellectual property concerning the business. The BVI Hold Co. was having 4 wholly owned subsidiaries across the globe, out of which 2 were in India (Ind Co. 1 and Ind Co. 2) and others were in United States of America and United Kingdom respectively (US Co. and UK Co.). The Ind Co. 1 was incorporated in India in 2000 and was in the business of providing back-office support to other group companies whereas the Ind Co. 2 was incorporated in 1999 and was engaged in the business to act as auctioneer, commissioner agent, consultant, advisors of artwork, jewellery, other artefacts and real estate and to act as authenticator and valuer of artwork. It was proposed to merge BVI Hold Co and Ind Co.1 with Ind Co. 2.

Case Highlights

- Due diligence on compliances status and Pre-merger advisory to conceptualize the restructuring plan

- Valuation of shares of all entities to derive share exchange ratio

- Transactional documentation for share transfer in overseas jurisdiction and merger involving multiple jurisdictions

- Liaised with regulatory authorities in India and overseas jurisdiction

- Advice on significant stamp duty issue in overseas jurisdiction due to merger nitty-gritties

- Obtained order from tribunal as well as competent authority in overseas jurisdiction sanctioning the scheme of merger

- Post-merger integration plan and managing entire project

Context

The companies are part of the same group. BVI Hold Co. owned intellectual property concerning the business and value was created therein. There were investors in BVI Hold Co. The subsidiary companies were operation companies. The management desired to integrate and consolidate the companies into a single entity

Nexdigm was approached to advise, and project manage the entire business reorganization process end-to-end as desired by the Group in the given timeframe.

Our Approach

The Nexdigm approach to this project was based on project management's four pillars: Time, Cost, Quality, and Risk. The assignment's primary requirement was to assess the existing situation and build a roadmap for business reorganization. A dedicated project team was assigned, which led the project, which involved complex regulatory involvement.

Project Management Support

Nexdigm provided support across several phases of the project, from initiation to merger of companies (and even post-merger integration). The team managed the project in the following areas:

Initial advisory

Nexdigm advised on the structure that involved transfer of shares in overseas jurisdiction followed by consolidation of entities by way of merger. The advice involved tax and regulatory advisory in light of the Indian jurisdiction and multiple overseas jurisdictions.

Conceptualization of Merger Option

The initial advisory on structure conceptualized transfer of shares in overseas jurisdiction followed by reverse flip of BVI Hold Co into Ind Co 2 as also merger of Ind Co 1 into Sub Co 2.

The conceptualization of the merger option was finalized after extensively evaluating the available options from tax and regulatory perspectives. This involved review of conditions of tax neutral amalgamation, stamp duty implications, other regulatory impacts in India as well as in overseas jurisdiction. The share transfer in the overseas jurisdiction was handled considering the tax and regulatory aspect of the overseas jurisdiction.

Initiation of Merger Process

The merger process broadly involved determining share exchange ratio, drafting of the scheme of amalgamation, approval of shareholders, application to the Tribunal, procuring dispensation of creditors meeting, filing of a petition for confirmation of the scheme, procuring reports from regulatory authorities such as the Registrar of Companies, Regional Director, Official Liquidator, Ministry of Corporate Affairs, availing exemption notification under Competition Act, 2002, FEM (Cross-Border Merger) Regulations, 2018, obtaining final approval to the merger from the Tribunal, consolidation of authorized capital post-merger and adjudication of stamp duty payable on merger order.

The merger also involved project managing merger process in overseas jurisdiction. Wherein extensive coordination with local lawyers for drafting of transaction documents, merger documents, filing of scheme with the overseas registry and procuring their approval were handled in time bound manner.

Nexdigm extensively worked with the Company's existing consultant to ensure that they were also aligned to project sensitivity and timelines.

Considering it was cross border merger, lot of questions of law and facts emerged which were dealt with effectively throughout the process.

Critical Issues

The project faced certain issues that involved advice on compliances required from overseas jurisdiction and the requisite actions to be taken for the same. Furthermore, one of the critical issues was to maintain desired shareholding pattern of Holding Co even after the merger. Nexdigm also successfully procured dispensation to holding creditors meetings by assistance in procuring necessary consent from the creditors well in advance.

Nexdigm represented the Company before regulatory authorities to obtain their clean reports and satisfied all their observations on the proposal, including a rationale for the merger, protection of creditors' interest, and stated that the scheme is in compliance with applicable laws.

The combination of authorized capital also posed certain issues which were resolved and capital was combined.

Time-bound Merger Process

The entire project was time-bound as due to the timeline set up by the Group to complete this restructuring.

Impact

Nexdigm's overall project management approach helped achieve the management's objective of completing the project within the desired timeline despite the complications that occurred due to meeting the requirement of overseas jurisdiction. The Nexdigm project team ensured that the merger was consummated within the timeline set by the Management by resolving every critical issue appropriately and in accordance with the law, delivering to the management's expectations.

Our Project Management service helped the client to complete the transaction from various perspectives successfully. The project supported the Group to integrate and consolidate the Companies in a single entity which will deliver pooling of resources, management and administrative efficiencies, rationalize number of entities, reduce complexity and optimize the compliance and reporting requirements coupled with to achieve a lean corporate entity structure and manage business efficiently with minimum reporting entities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]