- in United States

- with readers working within the Technology industries

- within Litigation, Mediation & Arbitration, Family and Matrimonial and Environment topic(s)

- with Inhouse Counsel

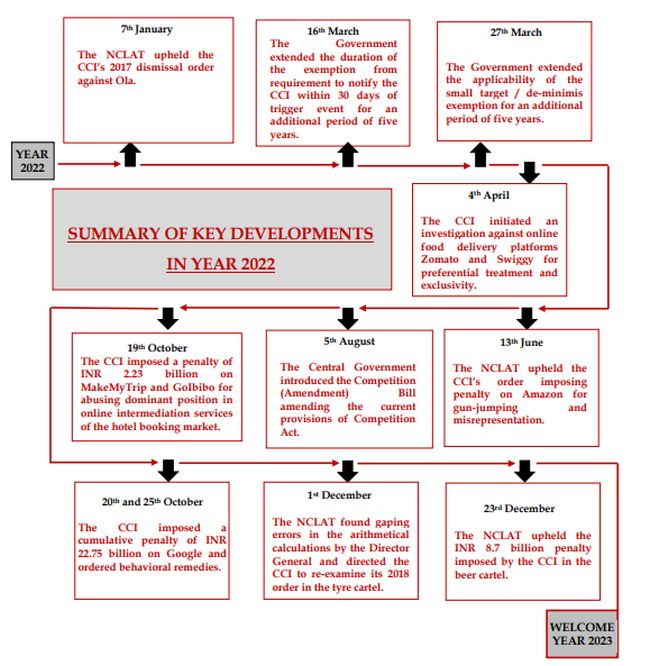

The year 2022 was a landmark year for competition law in India as the Competition Commission of India passed key orders which will be pivotal to the development of competition law jurisprudence. A diagrammatic overview of the key developments in the competition law sphere in India is given below:

| 1. | INTRODUCTION |

| 1.1 | The year 2022 has been the year of rebuilding the post pandemic economy, and during this recovery phase, competition law authorities around the globe were very active in taking cognizance of antitrust violations, particularly in the digital markets. Taking a cue from its global counterparts, the Competition Commission of India ("CCI") has also been largely focusing its enforcement policies in the digital markets space and has initiated various investigations as well as imposed penalties on major players in the technology sector. Further, the CCI has shown flexibility by adopting a lenient approach towards the erring micro, small, and medium enterprises ("MSMEs"), who are still reeling from the economic aftermath of the pandemic. |

| 1.2 | This overview is divided into six parts, part I focuses on the noteworthy enforcement cases, part II includes an overview of merger control cases, part III highlights the various regulatory developments, part IV covers the competition advocacy initiatives, part V focuses on institutional developments, and part VI provides the conclusion. |

| 2. | PART I – NOTEWORTHY ENFORCEMENT CASES |

| 2.1 | Penalties imposed on big-tech companies in abuse of dominance cases: In the year 2022, the CCI passed four penalty orders in relation to abuse of dominance. Out of these four orders, two orders were passed against Google, imposing hefty penalties and the third order penalised MakeMyTrip, GoIbibo, and OYO (defined below).1 |

| A. |

A Major setback for Google: In October, by way of two separate orders, the CCI imposed a penalty of INR 13.36 billion (i.e., approx. USD 163 million) ("Android Case") 2 and INR 9.36 billion (i.e., approx. USD 114 million) ("Billing Case") 3 on Google LLC and Google India Private Limited ("Google"), for abuse of dominant position in the market related to licensable operating systems for smart mobile devices and other related markets. Further, the CCI directed Google to not enforce the anti-competitive clauses of multiple agreements entered with various stakeholders, in India, with immediate effect. Additionally, it also granted Google a period of three months to implement necessary changes and modify its agreements in compliance with the provisions of the Competition Act, 2002 ("Act"). In January 2023, the National Company Law Appellate Tribunal ("NCLAT") refused to grant interim relief to Google in the Android Case.4 The Supreme Court ("SC") also reaffirmed the decision of the NCLAT and refused to grant an interim stay.5 Further, the SC has directed the NCLAT to decide Google's appeal by March 31, 2023. |

| B. |

MakeMyTrip, GoIbibo, and Oyo penalized for abuse of dominance and refusal to deal: In October, the CCI imposed a penalty of INR 2.23 billion (i.e., approx. USD 27 million) on MakeMyTrip-Goibibo ("MMT-Go") for: (i) imposing price and room parity obligations; (ii) imposing exclusivity conditions; and (iii) discriminating against hotels / chain hotels. The CCI also imposed a penalty of INR 1.69 billion (i.e., approx. USD 20 million) on Oravel Stays Private Limited ("OYO") as well as MMT-Go for refusing to deal with various hotels / chain hotels.6 Additionally, the CCI also directed MMT-Go to suitably modify its agreements with hotel chains and provide transparent disclosures on its platform In December, the NCLAT admitted the appeal filed by MMT-Go subject to the deposit of 10% penalty amount but refused to grant an interim relief to MMT-Go.7 The NCLAT order was challenged by way of a writ petition in the Delhi High Court ("DHC"), wherein the DHC directed that subject to the deposit of 10% of the total penalty amount, as directed by the NCLAT, no recovery shall be effected in respect of the remaining 90% of the penalty amount.8 The NCLAT refused to grant an interim stay in regard to the behavioral remedies directed by the CCI. The matter is currently pending adjudication before the NCLAT. |

| 2.2 | Investigations ordered by the CCI into exclusivity agreements of online platforms: |

| C. | Food delivery platforms: In April, the CCI ordered an investigation against online food delivery platforms Zomato Limited ("Zomato") and Bundl Technologies Private Limited ("Swiggy")9 for: (i) giving preferential treatment to their own cloud kitchen brands and restaurant partners; (ii) imposing exclusivity on certain partners; and (iii) imposing price parity obligations, in violation of the provisions of the Act. |

| D. | Online intermediation platform for movie tickets: In June, the CCI ordered an investigation against Big Tree Entertainment Private Limited ("BookMyShow")10 for: (i) entering into exclusive agreement / arrangement(s) with certain cinema theatres in the city of Hyderabad, Telangana; and (ii) charging a high convenience fee from the cine-goers for the online booking of movie tickets. Further, the CCI also observed that in its agreements with single screen cinemas, BookMyShow has reserved the right of data collection, ownership, and storage without the cinemas having the right, title, interest to such data and such a practice of exclusive ownership of and access to data by a dominant intermediary merit an investigation. |

| 2.3 | Appeals / writs involving big-tech companies for abuse of dominance: |

| E. | NCLAT upheld CCI's order dismissing the case against Ola: In January, the NCLAT11 upheld the CCI's 2017 dismissal order and held that ANI Technologies Private Limited ("Ola") had not abused its dominant position in the radio-taxi services market in Bengaluru. With respect to dominance, the NCLAT noted that in the relevant market, Ola is facing stiff competition from companies such as Meru, Fast Track, and Uber. Additionally, the NCLAT noted that Ola did not involve itself in predatory pricing nor did it enter into any anti-competitive agreements with its drivers. The NCLAT further held that the presence of Uber around the same time has forced Ola to change its market strategy, including its pricing to deal with competition. |

| F. |

NCLAT upheld CCI order dismissing the case against WhatsApp: In August, the NCLAT upheld the CCI's 2017 dismissal order whereunder the CCI held that WhatsApp LLC ("WhatsApp") was not abusing its market dominance in India through its new privacy policy as it provided the users the option to 'opt-out' from it.12 The NCLAT primarily (while reiterating the decision of CCI) held that the appellant was unsuccessful in establishing abuse of the dominant position by WhatsApp. Further, with regards to the allegation of predatory pricing, the NCLAT held that there are no significant costs preventing the users to switch from one consumer communication app to another as almost all consumer communication apps are offered free of cost and are available normally by simple user interfaces. However, in the year 2021, WhatsApp introduced its updated privacy policy wherein the option of 'opt-out' was not provided to the users. Based on this, the CCI had initiated a suo moto case and ordered an investigation against WhatsApp ("2021 Investigation Order"). In August, the DHC dismissed the writ petition filed by WhatsApp and Facebook against the CCI's 2021 Investigation Order. Further, in October, the SC also dismissed a petition for special leave to appeal filed by Meta, 13 challenging the order of the DHC. 14 The SC held that the CCI cannot be restrained from proceeding further with the investigation since the CCI has jurisdiction to take cognizance of any alleged violation of the Act. |

To view the full article click here

Footnotes

1. The fourth order of the CCI imposing penalty related to abuse of dominance is Case No. 03 of 2021, Confederation of Professional Baseball Softball Clubs v. Amateur Baseball Federation of India, order dated June 03, 2022.

2. Case No. 39 of 2018, In Re Umar Javed and Ors. v. Google LLC and Anr. order dated October 20, 2022.

3. Case No. 07 of 2020, In Re XYZ v. Alphabet and Ors., order dated October 25, 2022.

4. Competition Appeal (AT) – 1 / 2023, Google LLC & Anr. v. Competition Commission of India & Ors., order dated January 04, 2023.

5. Civil Appeal No. 229 of 2023, Google LLC & Anr. v. Competition Commission of India & Ors., order dated January 19, 2023.

6 Case No. 14 of 2019, Federation of Hotel & Restaurant Associations of India (FHRAI) and Anr. v. MakeMyTrip India Pvt. Ltd. (MMT) and Ors. with Rubtub Solutions Pvt. Ltd. v. MakeMyTrip India Pvt. Ltd and Ors., order dated June 16, 2022.

7. Competition Appeal (AT) – 57 / 2022, MakeMyTrip Private Limited & Ors. v. Competition Commission of India & Ors., order dated December 06, 2022.

8. W.P.(C)-16963 / 2022, MakeMyTrip India Private Limited MMT & Anr. v. Competition Commission of India & Ors., order dated December 14, 2022.

9. Case No. 16 of 2021, National Restaurants Association of India v. Zomato and Swiggy, order dated April 4, 2022.

10. Case No. 46 of 2021, Vijay Gopal v. Big Tree Entertainment Private Limited (BookMyShow) and Ors., order dated June 16, 2022.

11. Competition Appeal (AT) No. 19 of 2017, Meru Travel Solutions Private Limited v. Competition Commission of India and Anr., order dated January 07, 2022.

12. Competition Appeal (AT) No.

13. of 2017, Vinod Kumar Gupta v. Competition Commission of India and WhatsApp LLC, order dated August 02, 2022. 13 Meta is the parent company of Facebook and WhatsApp.

14. SLP(C) No.-017121 / 2022, Meta Platforms Inc v. Competition Commission of India and Anr., order dated October 14, 2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.