Ernst & Young are most popular:

- within Corporate/Commercial Law topic(s)

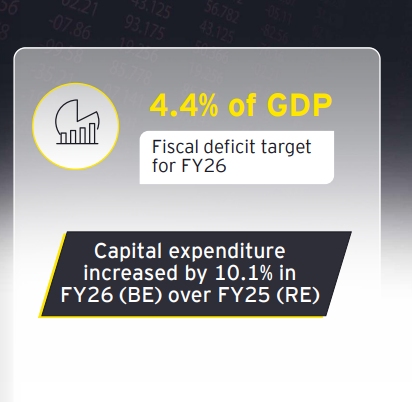

Macro fiscal

- Growth: The Economic Survey 2024-25 projected a real GDP growth for FY26 between 6.3% to 6.8%.

- Revenue highlights: FY26 (BE) over FY25 (RE)

- Gross Tax Revenue (GTR) growth budgeted at 10.8%.

- Net tax receipts (net to centre) budgeted to grow at 11%.

- Gross direct tax growth budgeted at 12.7%.

- Gross indirect tax growth budgeted at 8.3%.

- Expenditure priorities

- The Government of India's capital expenditure has been kept at INR11.2 lakh crore for FY26 (BE) or 3.1% of GDP for infrastructure investment.

- Allocation of INR1.5 lakh crore for long -term interest-free loans for states.

- Revenue expenditure growth is budgeted at 6.7% in FY26 (BE).

- Continuing focus on fiscal consolidation

- Fiscal deficit for FY25 (RE) improved to 4.8% of the GDP as against 4.9% budgeted earlier.

- Fiscal deficit for FY26 (BE) budgeted at 4.4% of the GDP.

- The Budget seeks a healthy balance between fiscal consolidation and boosting consumption.

Policy

- Agricultural District Programme: Enhancing agricultural productivity and access to credit. A six -year mission will focus on achieving self -reliance in pulses will also be launched.

- Support for MSMEs: Enhancing investment and turnover limits by 2.5 times, improving credit guarantee cover.

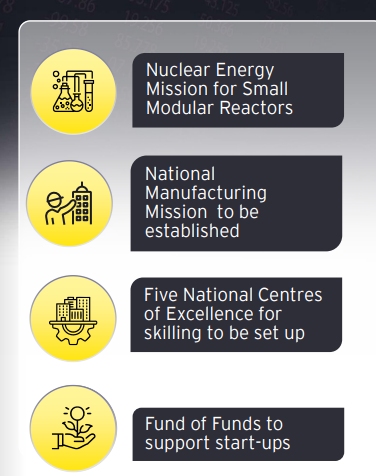

- Continuing focus on skilling: A Centre of Excellence in AI for education will be set up with a total outlay of INR500 crore.

- Focus on urban sectors : Urban Challenge Fund of INR1 lakh crore to be set up to implement the proposals for 'Cities as Growth Hubs.'

- Start -up, innovation and entrepreneurship: INR20,000 crore allocated for private -sector driven research.

- Domestic Manufacturing Mission: The National Manufacturing Mission will be established to incentivize large -scale electronics manufacturing and promote sustainable toy production.

- Sustained energy transition efforts: Nuclear Energy Mission for R&D of Small Modular Reactors (SMRs) with an outlay of INR20,000 crore to be set up. Support for clean tech manufacturing also to be provided.

- Ease of doing business: Committee for Regulatory Reforms to be set up for reviewing all non -financial sector regulations, certifications, licenses, and permissions.

- Export Promotion Mission: Easy access to export credit and cross -border factoring support to MSMEs to tackle non -tariff measures in overseas markets.

- Regulatory reforms: High -level committee to be set up for a review of all non -financial sector regulations.

To view the full article please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.