- within Litigation, Mediation & Arbitration, Family and Matrimonial and Environment topic(s)

- with Inhouse Counsel

- with readers working within the Technology, Utilities and Law Firm industries

Introduction

The Union Budget 2023 – 24 was expected to provide the guard rails for the Indian Economy amidst a global slowdown, and to avoid recessionary effects on the country. The Hon'ble Finance Minister's speech to some extent delivers on this aspect. With a slew of measures being proposed to push the growth story by increasing capital expenditure spending, the Budget this year focusses on 7 key areas viz., Inclusive Development, last mile delivery, Infrastructure, Investments, Green Growth, Youth Power and the Financial Sector.

While the capex initiatives are going to influence job creation also, a major development on the direct tax front that can potentially impact foreign investment into India, is on extending the 'angel tax' provisions to non-resident investments as well. While there have been no other bigbang changes on the corporate tax front in terms of rates, some key positives include extension of the tax holiday for start-ups, and the time for start-ups to claim benefits and carry forward of losses in case of change in majority shareholding. Another major development is on the personal taxation front, wherein the government has tried to bring in several changes, to possibly wean taxpayers away from the old tax regime.

On the indirect tax front, the Budget focusses on making domestic manufacturing attractive and making India export friendly. Along with the overall infrastructure spending push, rate changes in customs will have an impact on certain sectors. With not many changes in GST, as expected, one can only look to the GST Council to solve the misses in this years Budget, on this front!

Hope you find the third edition of our annual Budget Analysis an interesting and informative read!

TAX DIRECT TAX

TAX RATES

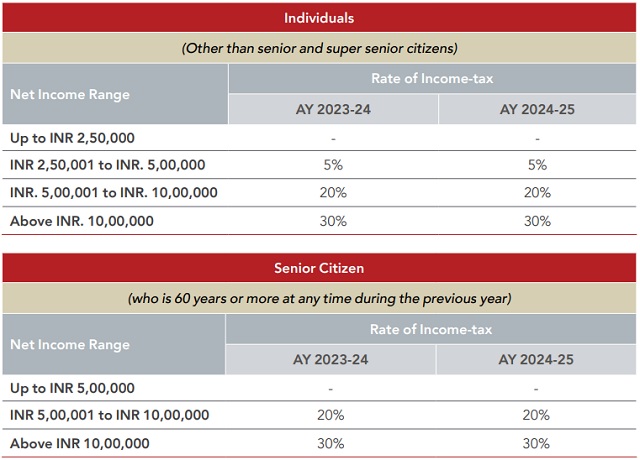

The income-tax rates under Section 115BAC i.e., alternate tax regime has undergone a change. All the other income tax rates have remained same. Hence, the tax rates for AY 2024-25 are the same as applicable in AY 2023-24 except the tax rates under alternate tax regime. Further, to make the alternate tax regime more attractive, the maximum surcharge rate of 37% has been reduced to 25%, standard deduction of INR 50,000 has also been introduced and limit for rebate has been increased from INR 5 lakhs to INR 7 lakhs. The comparative tax tables are provided below for easy reference.

Individual Opting for Normal Tax Regime*

* Rebate under section 87A is available to resident individuals whose total income during the previous year does not exceed INR 5,00,000 under the normal tax regime. Rebate is available to the extent of INR 12,500 only and no rebate will be available if total income exceeds INR 5,00,000.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]