Although Hong Kong's employment laws are relatively straight forward and consistent with international norms, there are a number of unique provisions which companies employing workers in Hong Kong should be aware of.

In Hong Kong, a worker may be employed to perform work for a business either as an:

- employee under a contract of employment, or

- independent contractor under a consultancy agreement or a contract for services.

Where a worker is hired as an independent contractor, the employer is only bound by contractual terms of the consultancy agreement or contract for services. Parties are, by and large, free to agree terms of the working relationship and, generally speaking, parties will only be bound by the terms expressly agreed.

On the other hand, where a worker is hired as an employee, the worker is entitled to further and additional basic protections and rights under legislation and common law. The primary legislation governing the employment of employees in Hong Kong is the Employment Ordinance (Cap. 57) (EO). Employers and employees cannot contract out of the EO (any attempt is void). Breach of the EO can have serious consequences, and depending on the type of breach, may result in civil liability and/or criminal prosecution for employers and/or directors and officers of the employer.

This article will focus on some key aspects of Hong Kong's employment laws which are binding on employers and may differ from international practices.

Statutory employment protections and rights

1. Wages

Whilst employers and employees may agree on the amount of wages and intervals of payments, employers should be aware that:

- wages must be paid on time: aside from any civil liabilities, an employer who fails to pay wages on time commits a criminal offence and is liable to a maximum fine of HK$350,000 and imprisonment for three years

- employers are generally not allowed to make deductions from the wages of an employee: there are very limited situations in which an employer is lawfully permitted to make a deduction from an employee's wage (for example, deductions for unauthorized absence from work or contributions to the Mandatory Provident Fund). Unless expressly permitted by the EO, any other deduction is unlawful and may trigger civil and/or criminal liabilities. Upon conviction, an employer who makes illegal deduction from wages is liable to a fine of $100,000 and to imprisonment for one year

- employee must not be paid less than minimum wage: the current statutory minimum wage rate is set at HK$37.50 per hour worked. Employers should ensure wages paid exceed this amount.

2. Annual leave

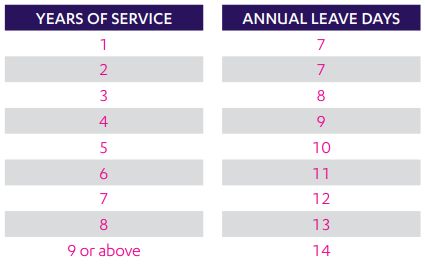

Depending on the length of service, employees are entitled to paid annual leave ranging from zero days (if the employee has not been continuously employed for at least one year) to 14 days (if the employee has accrued at least nine years' service or more) as set out in the table below:

In the case of most professional industries in Hong Kong, employers generally offer employees a more enhanced contractual annual leave entitlement with 20-30 days annual leave per year being most common.

Irrespective of length of service, employees are entitled to statutory public holidays. An employee that has been employed under a continuous contract for at least three months before a statutory public holiday is entitled to holiday pay for that statutory public holiday.

Annual leave pay is calculated with reference to the daily rate of wages earned by the employee and should be paid to the employee by the day on which the employee is next paid their wages after the period of annual leave taken.

If an employer fails to grant annual leave or to pay annual leave pay, the employer will be guilty of a criminal offence and will be liable upon conviction to a fine of HK$50,000.

3. Sickness

Employees are entitled to be paid statutory sick leave if sick leave is taken for four consecutive days or more, at a rate of four-fifths of the employee's daily average wage.

Statutory sick leave entitlement accrues as follows: two paid sickness days for each completed month of employment during the first year of employment and four paid sickness days for each month thereafter (up to a maximum of 120 paid sickness days).

In the case of most professional industries in Hong Kong, employers generally offer employees a more enhanced contractual sick leave entitlement. Most commonly, employers will pay full daily wages for any period of sickness.

Where an employer fails to pay sick leave pay by the end of the wage period, the employer will be guilty of a criminal offence and will be liable upon conviction to a fine of HK$50,000.

It should also be noted an employer is prohibited from terminating an employee's employment on his paid sickness day, except in cases of summary dismissal due to the employee's serious misconduct. An employer who contravenes this provision is liable to prosecution and, upon conviction, to a fine of HK$100,000.

4. Maternity and paternity

Employees that have been employed for a minimum period of 40 weeks are entitled to maternity and paternity benefits, including maternity/paternity leave and pay at a rate of four-fifths of the employee's daily average wage.

Employees who are entitled to maternity leave may take up to 14 weeks leave. A pregnant employee may decide to commence her maternity leave from two to four weeks before the expected date of confinement with the agreement of her employer.

Employees who are entitled to paternity leave may take up to five days leave. Whether the leave is taken in consecutive days or not, paternity leave can be taken in the period beginning four weeks before the expected date of delivery and ending 14 weeks after the actual birth of the child.

Where an employer fails to grant maternity/paternity leave or to pay maternity/paternity leave pay, the employer will be guilty of a criminal offence and will be liable upon conviction to a fine of HK$50,000.

5. Notice Periods

Regardless of any contractual agreement, during the probation period, an employee's employment may be terminated without notice during the first month of their employment. After the first month, the employee is entitled to notice as set out in their employment contract (which must be at least seven days).

Where an employment contract does not provide for a notice period and/or the employee is not required to undergo a period of probation, the employee is entitled to at least one month's notice of termination.

Depending on the seniority of the employee, in most professional industries, notice periods would typically be between one to six months. For other industries, the contractual notice periods are generally shorter with one week to one month being most common.

In Hong Kong, both employers and employees have a statutory right to terminate the employee's employment immediately by undertaking to make a payment in lieu of notice (PILON). No advance warning is necessary and neither the employer nor employee can object to a termination by PILON.

This unique statutory right has resulted in competitors of employers offering to buy out key employee's notices and, subject to any enforceable post termination restrictive covenants, having those employees work for them the very next day.

The amount of PILON payable is calculated by reference to the amount of wages the employee would have earned during the notice period.

6. Termination

It is relatively easy to dismiss an employee in Hong Kong who has not reached the qualifying period of employment of 24 months. The employer need not justify any reasons for termination and, subject to termination not being on discriminatory grounds or expressly prohibited by Hong Kong law, may simply give the employee the requisite notice or PILON.

After 24 months, an employer will need to justify its dismissal is for a "valid reason". There are five valid reasons permitted under the EO, including: redundancy or other genuine operational requirements of the employer; conduct/misconduct of the employee; the employee's incapability or absence of qualifications for performing their work; statutory requirements; or any other substantial reason which a court or the Labour Tribunal would deem sufficient. However, although an employee may bring a claim for unreasonable dismissal, this is rare on its own as in practice, such claims usually (unless special circumstances exist) only entitle the employee to claim the entitlements he/she should have received under the EO.

There is no qualifying period for discrimination claims. Dismissal may be deemed unlawful and discriminatory if an employee was dismissed on the grounds of one of the defined protected characteristics (namely, sex, marital status, pregnancy, disability or family status). There is no cap on the award which may consist of a compensatory element as well as damages for the loss of earning.

It should also be noted that termination is expressly prohibited by Hong Kong law in certain prescribed circumstances, including the following:

- pregnant employees: subject to the exceptions of summary dismissal and on the first 12 weeks of an employee's probationary period, it is an offence for an employer to dismiss a pregnant employee. If notice of termination has been served after the employee has served notice of pregnancy, the employer must withdraw the notice. Such protection will last from the date on which she is confirmed pregnant by a medical certificate to the date on which she is due to return to work upon the expiry of her maternity leave or if a pregnancy comes to an end by reason of miscarriage or abortion

- protection afforded to employees on statutory sick leave: an employer is prohibited from terminating an employee's employment contract, other than in circumstances justifying a summary dismissal, during any period of paid statutory sick leave

- protection afforded to employees giving evidence in health and safety related proceedings: an employer cannot terminate or threaten termination where an employee has given or agreed to give evidence in any proceedings, or information to a public officer in any inquiry, in any health and safety related proceedings.

- protection afforded to employees entitled to compensation for work related injury: an employer cannot terminate, without consent from the Commissioner for Labour, an employee who has suffered a work-related injury entitling him to compensation under the Employees' Compensation Ordinance (Cap. 282) (ECO). In addition, an employer cannot give notice of termination prior to the determination of a compensation claim under the ECO.

An employer who dismisses an employee in contravention of the law will be guilty of a criminal offence and liable upon conviction to a fine of HK$100,000.

Upon termination, the employer must pay to the employee any sums which are due to the employee, including any unpaid wages, payment in lieu of any untaken annual leave, PILON (if applicable), and long service payment or severance payment (if applicable). If the employer fails to make these termination payments when they become due, the employer will be guilty of a criminal offence and will be liable upon conviction to a fine of HK$350,000 and three years' imprisonment.

7. Statutory severance payment or long service payment

Subject to the length of service on termination, an employee may be eligible for statutory severance payment or long service payment as set out below:

- severance payment: an employee would be entitled to statutory severance payment if they have been employed for at least two years and they have been dismissed by reason of redundancy. In such circumstances, the employee should serve a written notice to their employer within three months of termination to claim for statutory severance payment, following which the employer must make the payment within two months. However, if the employer offers to renew the employment contract or re-engage the employee under a new contract at least seven days before the date on which the employment is terminated or the date on which the employment expires by reason of redundancy, and the employee unreasonably refuses this offer, the employee will not be eligible for statutory severance payment

- long service payment: an employee would be entitled to long service payment if they have been employed for at least five years and they were not dismissed by reason of redundancy or misconduct. In such circumstances, the employer must make long service payment within seven days of termination. However, if the employer offers to renew the employment contract or re-engage the employee under a new contract at least seven days before the date on which the employment expires without being renewed, and the employee unreasonably refuses this offer, the employee will not be eligible for long service payment. Furthermore, an employee that has received a statutory severance payment will not be entitled to long service payment.

Both severance and long service payment are calculated in the same way; that is, two-thirds of the employee's monthly wage or two-thirds of HK$22,500, whichever is less, for each year of service. The maximum payment which can be made is HK$390,000.

If the employer fails to make statutory severance payment, the employer will be liable upon conviction to a fine of HK$50,000. Similarly, if the employer fails to make long service payment, the employer will be liable upon conviction to a fine of HK$350,000 and three years' imprisonment.

Further considerations for employers

Employer should also be aware of other employment-related offences including:

- right to work: an employee without the right of abode will require an employment visa before working in Hong Kong. Visa applications are generally considered more favorably if the applicant possesses special skills, knowledge or experience of value to and not readily available in Hong Kong. The application must also be sponsored by an employer company registered as a business in Hong Kong. If an employee has no right to work in Hong Kong and is found to have done so, the employer will be liable upon conviction to a fine of HK$350,000 and three years' imprisonment

- notification: in accordance with the Inland Revenue Ordinance (Cap. 112), employers have certain reporting requirements including the requirement to notify the Inland Revenue Department of both the commencement and the cessation of employment of an employee for taxation purposes, within three months and one month respectively. If the employer fails to comply with these notification requirements, the employer will be liable upon conviction to a fine of HK$10,000

- insurance: employers must maintain a valid insurance policy in respect of work-related injuries, in accordance with the ECO. If an employer fails to hold a valid insurance policy, the employer will be guilty of a criminal offence and will be liable upon conviction to a fine of HK$100,000 and two years' imprisonment

- Mandatory Provident Fund (MPF): in accordance with the Mandatory Provident Fund Schemes Ordinance (Cap. 485), both the employer and employee must contribute 5% of the employee's income into a mandatory provident fund scheme, subject to minimum and maximum income levels. An employer is required to contribute to the relevant registered scheme from the employer's own funds and to deduct the employee's contribution from the employee's relevant income on a monthly basis. To be required to make the contribution, the current minimum relevant income of the employee must be at least HK$7,100 per month. If the employee earns less than this, only the employer is obliged to contribute. If an employer defaults on their MPF contributions, the employer will be guilty of a criminal offence and will be liable upon conviction to a fine of HK$450,000 and four years' imprisonment.

Takeaway

Employers are reminded to seek local employment law advice where they are unclear about their obligations. Unlike other jurisdictions, breaches of Hong Kong employment law can have serious consequences for both the business and the individuals running the business.

We have extensive experience in advising both local and overseas employers on their rights, entitlements and obligations. We are also able to advise on local market trends, norms and commercial resolutions to address issues that come up pre, post and during the employment relationship.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.