- within Finance and Banking topic(s)

- with Finance and Tax Executives

The use of Guernsey umbrella structures for both regulated and unregulated investment structures has seen a notable rise over the past 18 months.

Where these structures have typically been used for larger, master fund/ fund-of-funds type structures, they are frequently being used across asset classes and for emerging managers.

The reasons for the marked increases, include investor preferences, asset accessibility and distribution strategies, as well as administration and cost efficiencies. Guernsey benefits from clear statutory and regulatory guidance around establishing and operating umbrella structures, including cellular companies.

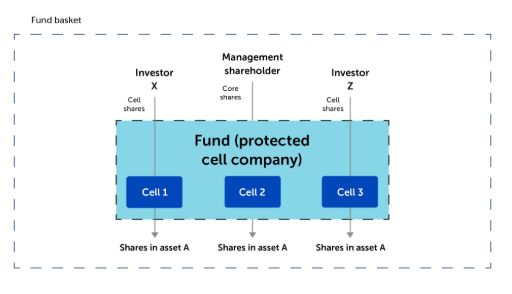

We cover the key features of protected cell companies (PCCs), a popular option for umbrella funds in our guide here.

Manager-led platforms to address investor preferences

It is becoming more important than ever for managers and promoters to be led by investor preferences, and to take a solutions-based approach to designing bespoke and adaptable structures to meet these. The way that managers and promoters are fundraising is changing. We explore this further in our fundraising trends article here.

While managers are increasingly under pressure to offer new and innovative product solutions, investors want to see these solutions housed within structures with which they are familiar. It is imperative that from the outset these structures are advantageous for investors from both tax and regulatory perspectives.

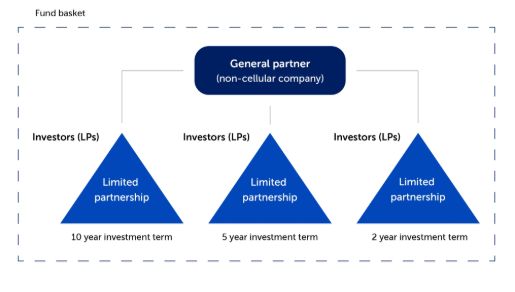

What investors are looking for in terms of liquidity or returns expectations may vary significantly, and therefore umbrella structures allow for that deviation and variation of terms between investor vehicles in sub-portfolios, cells or parallel funds.

Multi-strategy fund platforms

Umbrella structures can offer fund managers and advisers the ability to run multiple strategies under one structure, which may offer significant management and cost efficiencies. Generally, these type of structures would see an allocation of strategy on a cell by cell basis, whether these vary by risk, volatility, industry or jurisdictionally. This type of structure not only allows investors access to a wider spread of strategy and asset classes, but it also offers an element of cost-sharing across administration, legal and regulatory costs. The Guernsey Financial Services Commission offer heavily reduced fees for additional entities or cells within an umbrella structure which is authorised or registered, as applicable.

Family offices

Family offices are adapting through generations, and private wealth structures are increasingly looking to Guernsey segregated structures for generational wealth management and preservation, thematic investing (requiring and exposure of more volatile spread of risk), and even to consider philanthropic arms.

We discuss how family offices are exploring structuring options, including platform structures, for investment purposes here.

Incubator or proof-of-concept funds

We are seeing more and more enquiries in the venture capital space or from start-up managers looking to establish within an unregulated segregated platform to test performance, build track record and establish fundraising prior to establishing a regulated fund.

Co-investment or segregated mandates

Umbrella structuring can also be advantageous for unregulated vehicles, where multiple investors into a single asset are looking for exposure while requiring preservation of confidentiality and minimisation of risk of dilution by other investors. Cellular structures can allow for dedicated cells to be created on a per investor basis, where each investor has their own cell through which to invest yet benefiting from sharing costs across the structure. This can be across a diversified portfolio or single asset mandate.

Why Guernsey?

Guernsey domiciled umbrella platforms offer a unique combination of legal certainty, regulatory efficiency, and structural flexibility. For fund managers seeking scalable platform solutions with a future-proofing focus or customised investor offerings, the Guernsey platform model provides a tried and tested route for growth and innovation in a competitive global market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.