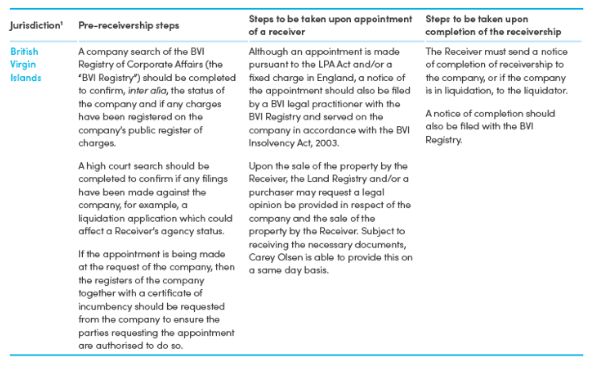

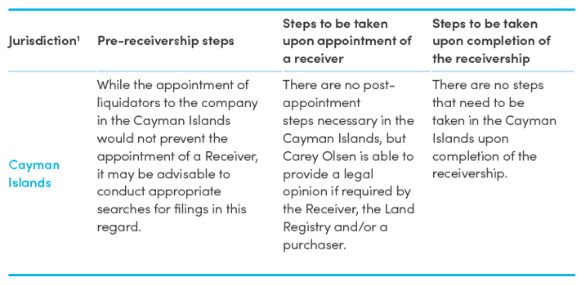

This Carey Olsen bitesize guide is designed to provide a

snapshot of the steps that should be taken in the British Virgin

Islands and Cayman in connection with the appointment of a fixed

charge receiver or Law of Property Act 1925 (the "LPA

1925") receiver (each a "Receiver") to a property in

England which is owned by an offshore company.

This note assumes that the Receiver is not an administrative receiver appointed pursuant to a floating charging over all or substantially all of a company's assets. This should be confirmed before any appointment is made, to avoid additional and potentially more onerous provisions applying under applicable offshore law.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.