- within Wealth Management topic(s)

- in European Union

Margaret Snowdon OBE, Chair of the UK Pensions Scams Industry Group (PISG), is a campaigner who has worked for many years to prevent pension scams, protect the interests of those affected by them, and for positive reform in the industry.

She recently visited Guernsey, where she addressed the Guernsey Association of Pension Providers (GAPP) to talk about her work and Guernsey's involvement with PSIG.

In this blog for WE ARE GUERNSEY, Margaret discusses the definition of a scam, how to spot the tell-tale signs and how Guernsey is also playing its part in protecting pension holders from scammers.

PSIG was set up in 2014 as a voluntary body to combat pension scams through the publication of good practice in due diligence for trustees, providers and administrators. Its Pension Scams Industry Forum (PSIF) was established to share intelligence on scam threats and trends with industry and regulators.

It is important to understand the difference between fraud and a scam. There are several types of fraud, including internal, service, cyber and identity fraud. But the main difference is that fraud targets the pension scheme or provider, whereas a scam targets the individual member via an offer that involves deception, misrepresentation or omission in order to encourage a transfer from an authorised pension scheme into one that is unauthorised, or even a bogus or clone one.

Figures show that £60bn-worth of transfer values were requested from Defined Benefit schemes in 2018. We believe as much as 5% of that value was likely to be scams. Scams affect around 10,000 people a year at an average of £85,000 per victim – it's robbing people of their life savings. Fifty percent of people don't recognise a scam, so it is vital to educate.

There are some tell-tale signs, or flags, to help potential victims recognise a scam, which are set out in PSIG's Code and which have been carried into recent UK government regulations. 'Amber flag' indicators include the fees being high or unclear in the receiver scheme; the investments being high risk, unorthodox; incomplete or incorrect responses to member requests for information; there being overseas investments in the receiving scheme; and no employment link for the supposed Occupational Pension Schemes (OPS) or residency link for supposed Qualified Recognised Overseas Pension Schemes (QROPs).

In these cases, guidance from MoneyHelper is required before a statutory transfer can be made. MoneyHelper is a specific impartial pensions guidance service, offered for free by the UK Money and Pensions Service.

The more severe warning signs, we refer to as 'red flags'. These include advice coming from an unauthorised independent financial adviser; the person making contact failing or refusing to provide requested information, pressure being applied to the member, or the initial contact being unsolicited altogether. In such cases, there is no statutory right to transfer, so the request may be refused and reported to the relevant authorities.

GAPP has been involved with PISG since its inception and is also involved with PISF, mainly for its expertise on overseas transfers. Information sharing is one of the critical ways you can defend against scams. Guernsey knows how to spot a potential scam and where trends are going as much as anyone else. To share that information is invaluable. PISG's push to change UK transfer rights and give trustees greater say in stopping scams was strengthened by Guernsey's different approach.

It was suggested during my presentation in Guernsey that we should explore the idea of a database of trusted schemes – a universal clean, green list – with a quality mark issued by the regulator so individual investors can check before becoming involved. PSIG has already put its mind towards this but it is actually quite hard to do. It would change and evolve so much, so keeping on top of it would require quite a huge effort. There is also a risk that comes with trying to focus on a list of 'bad guys' – you have to be careful because data protection regulations mean that even scammers can ask what data you hold, so it needs to be factually accurate to avoid being sued. The industry does need to get together on this because there will be a solution.

The UK and Guernsey have a number of common areas and ideas to explore further and I look forward to it. It is very encouraging to see the interest in Guernsey in protecting pension members from harm.

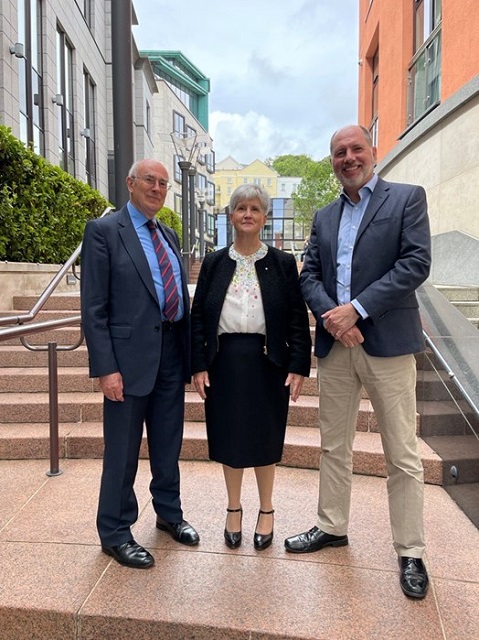

Left to right: GAPP President Stephen Ainsworth, PSIG Chair Margaret Snowdon, GAPP Vice President Roger Berry.

For more information about Guernsey's finance industry please visit www.weareguernsey.com.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]