Background

Guernsey has long been recognised as a leading jurisdiction for Trust structures, offering a stable, well-regulated environment ideal for wealth management and succession planning. At Dixcart Guernsey, we have extensive experience in establishing and administering Trust structures tailored to meet the diverse needs of our clients since 1975.

This article provides an overview of the key elements of Guernsey Trust structures, highlighting their benefits and explaining why they remain a popular choice for individuals and families seeking to protect and manage their wealth.

What is a Trust?

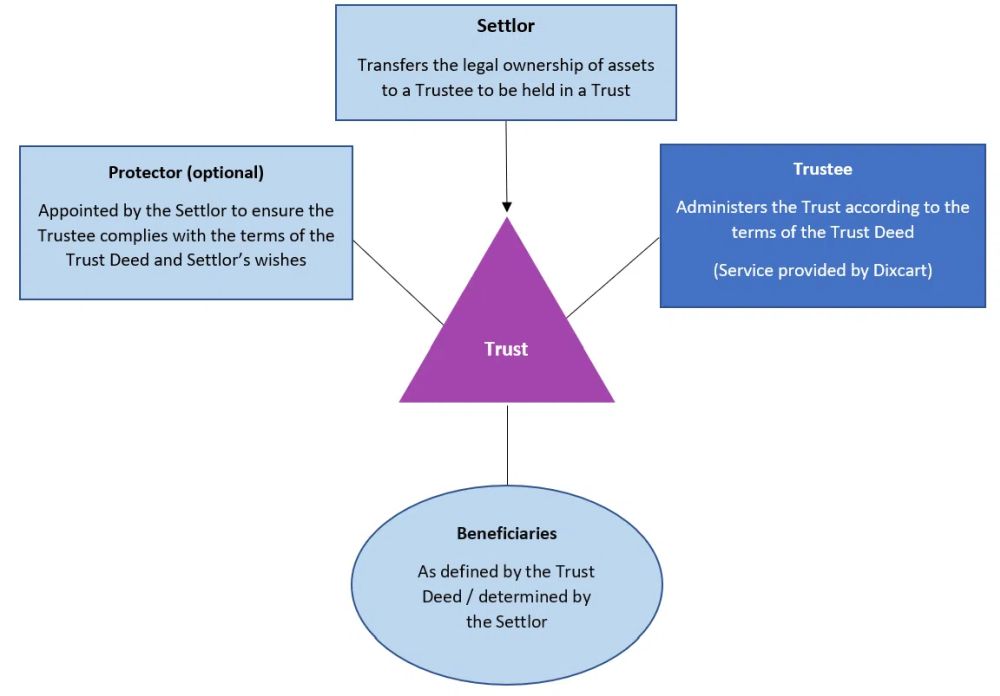

A Trust is a legal arrangement where one party, known as the settlor, transfers assets to another party, the trustee, to hold and manage for the benefit of third parties, the beneficiaries. The trustee is legally obligated to manage the Trust assets in accordance with the terms of the Trust deed and the applicable laws, ensuring that the beneficiaries' interests are safeguarded.

An example of a typical Trust structure would be the following:

Why Set Up a Trust in Guernsey?

- Strong Reputation and Local Resources – Guernsey is home to a number ofregulated professional fiduciaries who, together with a plethora of professional accounting and legal firms, lend themselves to the smooth running of a Guernsey trust. In addition, the jurisdiction is well respected, has an excellent reputation globally, and is well recognised by third party counterparts such as Banks and Lenders.

- Tax Efficiency: Guernsey Trusts can be structured in a tax-efficient manner, depending on the tax residency of the settlor and beneficiaries. While Guernsey does not impose capital gains, inheritance, or wealth taxes, it is essential to seek professional advice to ensure compliance with all relevant tax obligations in other jurisdictions.

- Confidentiality: Guernsey Trusts benefit from a high level of confidentiality. There is no public register of Trusts, and details regarding the settlor, beneficiaries, and Trust assets remain private.

- Asset Protection: Trusts in Guernsey can be used to protect assets from potential future claims by creditors or to shield family wealth from potential disputes. The robust legal framework in Guernsey supports the use of Trusts for asset protection, provided that the Trust was not established with the intent to defraud creditors.

- Succession Planning: Trusts can be an effective tool for succession planning, allowing settlors to manage the distribution of their assets according to their wishes. Trusts can be structured to provide for successive generations, ensuring that family wealth is preserved and passed down in a controlled manner.

- Flexibility and Control: Guernsey Trusts offer significant flexibility in terms of how they are structured and managed. Settlors can dictate specific terms within the Trust deed, and with the use of discretionary Trusts or private Trust companies, they can exert a degree of influence over the management of the Trust.

- Legal Certainty and Stability: Guernsey's Trust law is well-established, providing legal certainty and stability to settlors, trustees, and beneficiaries. The jurisdiction's legal system is based on English common law, which is recognised for its clarity and predictability.

Types of Trusts in Guernsey

Guernsey offers a variety of Trust structures to cater for different client needs, including:

- Discretionary Trusts: In a discretionary Trust, the trustee has the authority to determine how the Trust income and capital are distributed among the beneficiaries within the terms of the Trust Deed. This type of Trust offers flexibility in responding to changing circumstances and can be an effective tool for asset protection.

- Fixed Interest Trusts: Here, the beneficiaries have a fixed entitlement to the Trust's income or capital, as specified in the Trust deed. These Trusts are typically used when the settlor wants to ensure that specific beneficiaries receive predetermined amounts.

- Accumulation and Maintenance Trusts: Commonly used for the benefit of minors, these Trusts allow income to be accumulated until the beneficiaries reach a certain age, at which point they become entitled to receive the income or capital.

- Purpose Trusts: Unlike traditional Trusts that benefit specific individuals, purpose Trusts are established to achieve a particular purpose, which must be specific, reasonable, and capable of being enforced. These are often used in commercial transactions or to hold shares in a Private Trust Company.

- Private Trust Companies (PTCs): PTCs are corporate trustees established to act as trustee for a specific family Trust or group of Trusts. They offer a higher level of control to the settlor or their family and can be particularly advantageous for families with complex or significant assets.

Setting Up a Guernsey Trust

The process of establishing a Trust in Guernsey involves several key steps:

- Consultation and Planning: The first step is to work with a qualified Trust and corporate service provider, such as Dixcart Guernsey, to understand your specific needs and objectives. This ensures that the Trust structure is tailored to your personal or family circumstances. These are not a "one size fits all" type of structure and all aspects must be carefully considered.

- Drafting the Trust Deed: Once the objectives are clear, a Trust deed is drafted. This legal document outlines the terms of the Trust, including the roles and responsibilities of the trustee, the rights of the beneficiaries, and the powers of the settlor (if any). It is crucial that the deed is carefully drafted to reflect the settlor's intentions and to comply with Guernsey law.

- Appointing the Trustee: The trustee can be a professional corporate trustee, such as Dixcart Guernsey's corporate Trustee, or a private individual. It is essential that the trustee is capable of managing the Trust assets and fulfilling their fiduciary duties.

- Transferring Assets to the Trust: After the Trust is established, the settlor transfers assets into the Trust. These assets could include cash, investments, property, fine art, yachts or shares in a company. The trustee then assumes legal ownership of these assets, managing them on behalf of the beneficiaries.

- Ongoing Administration: Trusts require ongoing administration, including record-keeping, reporting, accounting, distributions to beneficiaries and ensuring compliance with any legal or tax obligations. At Dixcart Guernsey, we provide comprehensive Trust administration services to ensure that the Trust operates smoothly and in accordance with all applicable laws.

Why Choose Dixcart Guernsey?

Dixcart are proud to be family owned since its formation in 1972, with the fourth generation of the family having joined the Group in 2023. With decades of experience in the Trust sector, Dixcart Guernsey offers expert advice and tailored solutions for the establishment and management of Trust structures. Our team is dedicated to ensuring that each Trust is administered in the best interests of the beneficiaries, while also meeting the wishes of the settlor. We pride ourselves on providing a personal and bespoke service, maintaining the highest standards of professionalism, confidentiality and friendliness.

Guernsey Trust structures provide a versatile and robust framework for managing and protecting wealth. Whether you are looking to secure your family's financial future, protect your assets, or plan for succession, Dixcart Guernsey is here to guide you through every step of the process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.