- within Insolvency/Bankruptcy/Re-Structuring topic(s)

- in United States

With entry into force of the Act on the Stabilization and Restructuring Framework for Enterprises (StaRUG) on January 1, 2021, an independent preventive restructuring framework was established to complement existing insolvency law. Its primary objective is the early prevention of existential corporate crises through systematic risk management and structured early crisis detection.

Section 1 StaRUG imposes a binding obligation on the management of limited liability entities (e.g., GmbH, AG, KGaA, eG, SE, and SCE) to implement a system for early crisis identification. This system is intended to facilitate the timely recognition and assessment of developments that may threaten the company's continued viability. It thereby functions as a critical interface between risk management, legal compliance, strategic corporate governance, and forward-looking restructuring preparedness. Importantly, the obligation to establish such an early risk detection system is not limited to periods of crisis or imminent insolvency. Rather, it applies as a continuous duty for all limited liability companies – regardless of their current financial position.

The objective of StaRUG is to equip companies with a legal framework that enables the early identification of financial crises and the timely implementation of countermeasures. It is designed to facilitate the initiation of an orderly restructuring process through structured measures, before insolvency becomes unavoidable. This approach aims to stabilize companies, safeguard creditor interests, and mitigate adverse consequences.

The legislation requires not only the early detection of existential risks but also the establishment of structured risk management systems to enable effective crisis response. Section 1 StaRUG, in particular, underscores the importance of continuous risk monitoring and the implementation of appropriate countermeasures to secure the company's ongoing viability.

In the context of increasing economic uncertainty, heightened expectations for corporate resilience, and evolving regulatory requirements, this article takes a closer look at Section 1 StaRUG, focusing on the core obligations for management and practical strategies for implementation.

Objectives and Requirements of Section 1 StaRUG

Section 1 StaRUG refines and codifies existing risk management obligations – such as those set out in Section 91 (2) and (3) of the German Stock Corporation Act (AktG) – across all corporate legal forms. It promotes a holistic and proactive approach to early risk detection. These obligations were initially introduced by the Control and Transparency in Business Act (KonTraG) and were most recently further developed by the Financial Market Integrity Strengthening Act (FISG). Under StaRUG, these requirements are given a significantly higher degree of formalization and structural integration.

Companies are not only required to identify risks in a timely manner but must also implement appropriate countermeasures as soon as concrete threats to the business become apparent. These measures may include capital increases, the development of restructuring plans, or operational adjustments, the effectiveness of which must be reviewed in accordance with Section 14 StaRUG.

Another central element of Section 1 StaRUG is the integration of corporate planning into the risk assessment process. Companies are expected to analyze not only past developments but also to incorporate future scenarios into their risk analysis. While the law does not mandate specific methodologies, the use of scenario-based simulations (e.g., Monte Carlo Analysis) is considered best practice in corporate planning.

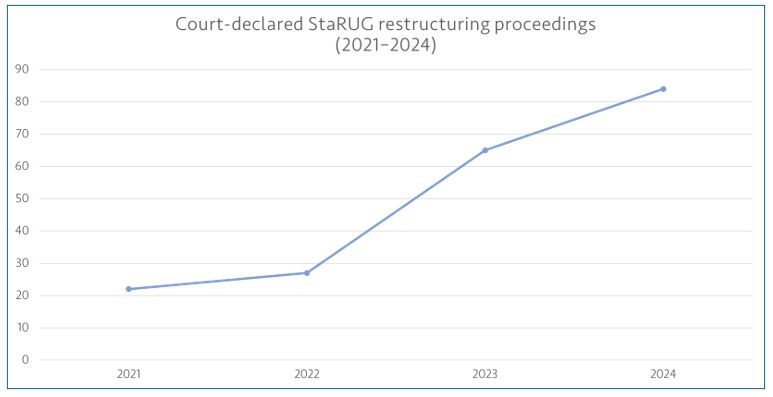

INDat Report: Restructuring Cases Remain Limited – but Increasing Dynamics

There is currently no public registry (e.g., from the Federal Statistical Office) of StaRUG proceedings. Nonetheless, statistical data has been compiled through direct surveys of the 24 restructuring courts across Germany. In 2021, a survey was conducted by the specialist publisher INDat, which focuses on restructuring, reorganization, and insolvency matters. In 2022, this task was assumed and further expanded in coordination with INDat by the Center for Insolvency Law and Restructuring Practice (ZEFIS), an academic institute at the University of Trier.

Available statistics indicate that practical application of the StaRUG preventive restructuring framework has so far been limited. Nevertheless, a marked year-over-year increase in the number of proceedings is observable. It is important to emphasize that these figures reflect only those cases in which companies have actively made use of the StaRUG framework and formally initiated proceedings before the competent restructuring courts:

- 2021: A total of 22 restructuring initiatives were reported.

- 2022: 27 initiatives were reported, of which seven resulted in court-confirmed restructuring plans.

- 2023: The number of proceedings doubled compared to the previous year, reaching 65 cases.

- 2024: According to IfM Bonn, 84 proceedings were reported in total.

These figures illustrate that companies have so far made only limited use of the preventive restructuring framework. This reluctance is likely closely related to shortcomings in companies' risk management systems, as required under Section 1 StaRUG. Many companies still lack structured early warning mechanisms that would enable them to identify existential threats at an early stage and to initiate suitable countermeasures. The increase in proceedings in 2024 may be interpreted as a sign of growing awareness of the importance of preventive restructuring instruments.

Current Status: Are Companies Prepared?

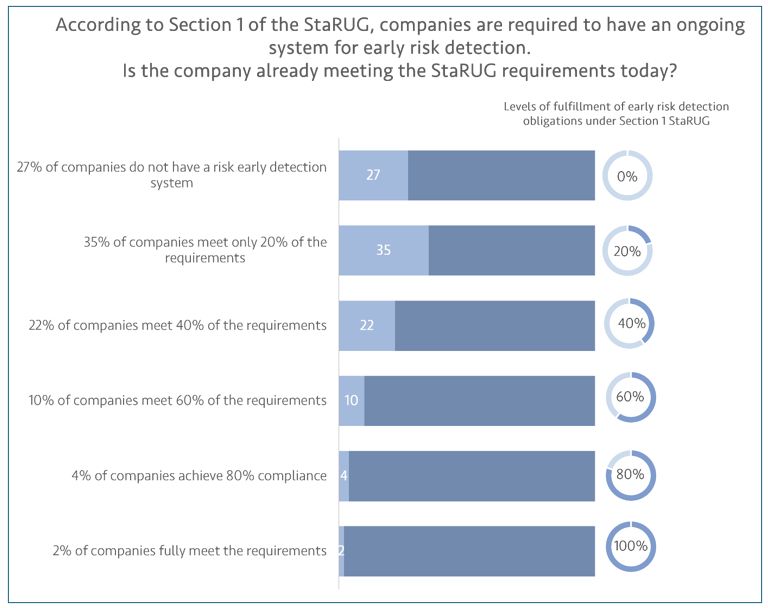

A survey conducted by the industry network "RiskNET" reveals that a significant proportion of companies—particularly those potentially falling within the scope of StaRUG—are struggling to comply with the requirements set forth in Section 1 StaRUG. For many organizations, establishing an effective early risk detection system remains a considerable challenge. Based on responses from 406 companies, the survey underscores persistent implementation difficulties and highlights the substantial need for practical solutions.

The survey results indicate that many companies remain in the initial phases of implementing structured early warning systems. However, both the level of obligation and the urgency of implementation increase significantly once indications of impending insolvency arise or when the StaRUG framework is actively applied. According to the survey, a substantial number of companies continue to encounter difficulties in establishing effective early detection mechanisms. The most frequently cited challenges include limited methodological expertise, constrained resources, and inadequate integration of risk management into overall corporate governance structures. For companies exposed to potential financial distress, this highlights the pressing need to establish a robust and structured risk management system.

It is important to distinguish that the data reported by INDat pertains exclusively to companies that have formally utilized the StaRUG framework and filed proceedings with the competent restructuring courts. By contrast, the RiskNET survey encompasses a broader corporate sample, irrespective of whether StaRUG procedures have been initiated. As such, it offers a representative view of the general state of implementation regarding early risk detection systems in line with Section 1 StaRUG. Notably, the survey found that over one-quarter (27%) of respondents had not established a functioning early warning system. While companies not currently subject to StaRUG proceedings are not required to use the restructuring framework itself, the obligation for early crisis detection under Section 1 remains fully applicable—and is critical for timely intervention and long-term corporate resilience.

Duties of Managing Directors: Prevention and Responsibility

The responsibilities of managing directors under Section 1 StaRUG become particularly significant in situations involving imminent insolvency or when the preventive restructuring framework is formally initiated. In such cases, the scope and intensity of their obligations increase substantially.

Executives are required to establish and maintain an effective system for early crisis detection and risk management, one that aligns not only with statutory requirements but also with the specific operational realities of the company. StaRUG imposes comprehensive duties on corporate leadership – duties that extend well beyond the scope of previous regulatory standards:

- Ongoing Risk Monitoring and Evaluation

Managing directors are required to ensure that all developments with the potential to endanger the company's going-concern status are continuously and systematically monitored. This obligation includes the regular review and updating of risk assessments and corporate planning. Specific risks – such as impending illiquidity, breaches of financial covenants, or adverse credit rating impacts – must be evaluated not only in isolation but also in terms of their interdependent and cumulative effects.

- Risk-Oriented Crisis Management: Planning and Implementation of Measures

Once a defined risk threshold is exceeded, management is obliged to initiate appropriate crisis response measures. This includes assessing the severity of the threat to the company's continued existence – specifically, the likelihood of insolvency – and determining the point at which a situation qualifies as an acute crisis requiring intervention. In addition, contingency plans should be in place to ensure a prompt response to both emerging and realized risks.

These actions are not only operationally critical but also carry legal significance: under Section 93 of the German Stock Corporation Act (AktG), the "Business Judgment Rule" requires that management decisions be based on adequate information. This encompasses the use of documented methodologies such as materiality assessments or sustainability analyses for the purpose of risk prioritization. Upon identifying a critical risk level, a formal restructuring plan must be developed, and an informed, well-founded decision must be taken regarding its implementation.

- Reporting Obligation and Supervisory Board Oversight

Management is obligated to inform the supervisory board not only on regular basis but also immediately when relevant risks arise or countermeasures are implemented. The supervisory board assumes an active role in assessing the company's crisis response, particularly with regard to defining decision-making criteria and ensuring compliance with governance standards.

This expands the board's supervisory (oversight) function under Section 111 of the German Stock Corporation Act (AktG) elevating it to a more operational level within the context of StaRUG, especially in restructuring scenarios. Fulfilling these obligations requires not only organizational adjustments but also a high degree of technical and strategic expertise. For mid-sized companies, this presents the challenge of scaling their internal systems to satisfy StaRUG requirements – should they opt to utilize the framework – while maintaining operational agility and efficiency.

Supporting Measures and the Path to Risk-Management-Oriented Implementation

To comply with the requirements of StaRUG, companies must develop robust crisis and risk management systems that are specifically aligned with their individual risk profiles, industry characteristics, and organizational structures. The use of modern technologies and advanced simulation techniques (e.g., scenario analyses, stress tests) is essential. These tools enable a systematic evaluation of current risks and modeling of their potential impacts under various scenarios.

In addition, specialized service providers offer a broad spectrum of support to assist in both the implementation and refinement of such systems. This includes the development of industry-specific risk models, and the provision of tailored advisory services designed to address the distinct needs and challenges of each organization.

Conclusion: Preventive Risk Management as the Key to Crisis Response

Section 1 StaRUG requires limited liability companies to continuously monitor and detect potential threats to their going concern status – regardless of whether a crisis has already developed. These requirements become particularly critical when insolvency risks arise, and targeted crisis response measures are mandatory. The preventive restructuring framework provides a structured legal instrument to proactively mitigate insolvency risks and preserve business continuity.

The relevance of Section 1 StaRUG extends beyond periods of acute crisis. Rather, the obligation to systematically monitor risks should be regarded as an ongoing management responsibility. Early risk detection not only strengthens legal certainty but also serves as a critical lever for enhancing corporate resilience and long-term stability. This focus is further reflected in the draft of the forthcoming IDW Standard on Early Crisis Detection (IDW ES 16), which has yet to be formally adopted. The very development of such a standard underscore the increasing importance of Section 1 StaRUG as a key reference point for responsible corporate governance and strategic risk management.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.