BVI law imposes a number of on-going obligations on BVI regulated funds. The main continuing obligations for BVI private and professional funds are set out in basic detail below.

1. Authorised Representative, registered agent and registered office

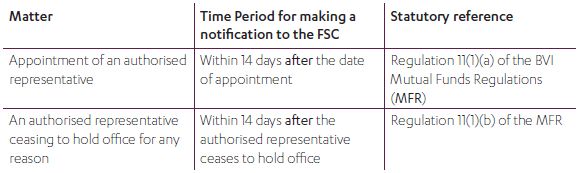

A BVI private or professional fund must at all time have a BVI registered agent and registered office. It must also have an authorised representative, who is certified to act as an authorised representative by the BVI Financial Services Commission (the FSC). It is also required to notify the FSC if it appoints an authorised representative or its authorised representative ceases to hold office for any reason, as follows:

2. Annual Fees

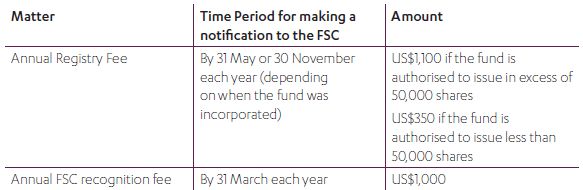

On an annual basis, a BVI private or professional fund must pay an annual corporate registry fee and an FSC recognition fee, as follows:

3. Fund documents

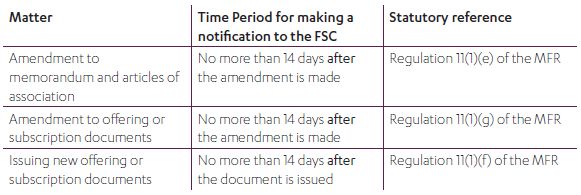

A BVI private or professional fund is required to notify the FSC if it makes amendments to its offering or constitutional documents or issues a new offering document, as follows:

4. Directors

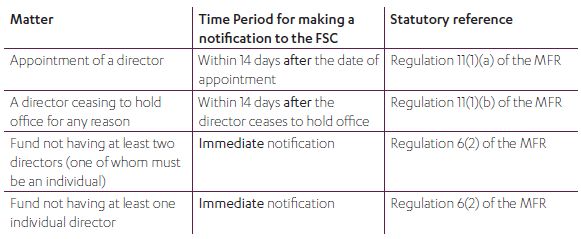

A BVI private or professional fund is required on an on-going basis to have at least two directors (one of whom must be an individual) at all times. There is no exemption available from this requirement.

5. Functionaries

A BVI private or professional fund is required on an on-going basis to have:

- a manager

- a custodian; and

- an administrator,

or have obtained an exemption from the requirement to have a manager or custodian. There is no exemption from the requirement to have an administrator.

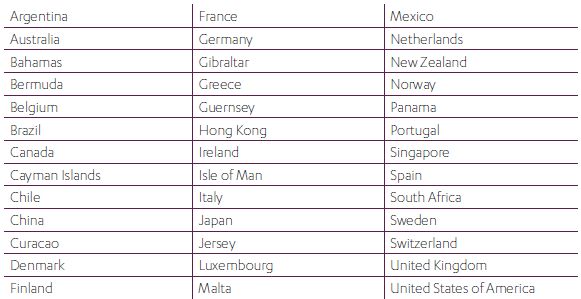

The functionary should be established and located in a "recognised jurisdiction" as defined in the Securities and Investment Business (Recognised Jurisdictions) Notice, 2010 (as amended) being:

The FSC has the discretion to accept a functionary which is not from a "recognised jurisdiction" if, on application, the fund is able to demonstrate to the FSC's satisfaction, that the functionary's jurisdiction of establishment and location has a system in place for the effective regulation of investment business, including funds.

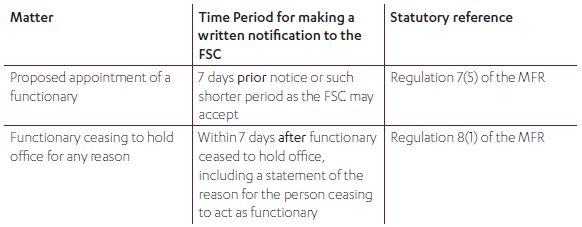

A BVI private of professional fund is required to notify the FSC if it appoints a functionary or appoints a functionary ceases to hold office for any reason, as follows:

For the purpose, functionary includes the manager, administrator, custodian and prime broker. In the case of a unit trust, it also includes the trustee.

A fund is also required to have a money laundering reporting officer (MLRO) but is exempt from the requirement to have a compliance officer. The MLRO does not need to be an employee but should be based in a "recognised jurisdiction".

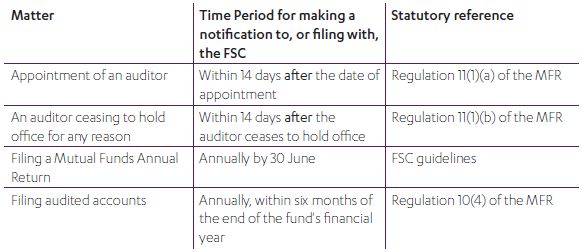

6. Auditor and financial statements

A BVI private or professional fund is required to have an auditor and file audited financial statements on an annual basis, or have obtained an exemption from the requirement to do so. It is also required to file a "Mutual Funds Annual Return" with the FSC on an annual basis.

7. Investors

A BVI private or professional fund may only accept an investor if that investor has provided prior to the investment:

- in the case of a professional fund, written confirmation that he is a "professional investor" as defined under SIBA; and

- the case of a professional or private fund, written acknowledgment that he has received, understood and accepted the BVI investment warning contained in the offering memorandum.

A "Professional Investor" under SIBA is any person (i) whose ordinary business involves, whether for his account or the accounts of others, the acquisition or disposal of property of the same kind as the property, or a substantial part of the property, of the Fund; or (ii) who has signed a declaration that he, whether individually or jointly with his spouse has a net worth in excess of U.S. $1 million in United States currency or its equivalent in any other currency (or any such other amount as may be specified from time to time in the BVI Mutual Funds Regulations, 2010 (as amended) and that he consents to being treated as a Professional Investor.

8. Place of business

A BVI private or professional fund is required to make a filing with the FSC if there are any changes to its place of business, as follows:

9. Record keeping

A BVI private or professional fund is required to maintain records that are sufficient:

- to show and explain its transactions;

- at any time, to enable its financial position to be determined with reasonable accuracy;

- to enable it to prepare such financial statements and make such returns as it is required to make under SIBA and the MFR; and

- if applicable, to enable its financial statements to be audited in accordance with SIBA.

Such records must be retained for a period of at least five years after completion of the relevant transaction.

10. Business of a foreign fund

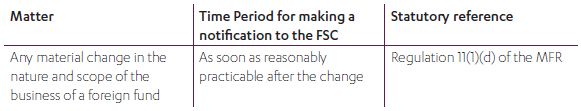

A foreign fund is required make a filing with the FSC if there are any material changes to the nature and scope of its business, as follows:

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.