CHAIRMAN'S STATEMENT

The Malta Financial Services Authority (MFSA) is pleased to present its report on its activities and operations in 2012. It was a year of further consolidation in Malta's standing as a successful, stable, skilled and reliable financial services economy. New direct intermediation jobs were created and a number of sub-sectors saw very marked growth. The great majority of businesses involved in finance continued to thrive and none of any significance in terms of jobs, activity or turnover ceased to exist. The overwhelming majority of businesses operated to the very high standards expected in Malta. Those that fell short were handled with full impartiality and fair penalties imposed as appropriate to each case.

The troubles of the global economy saw the number of new companies registered with The Registry of Companies down on 2011, which was a record year. However, 2,869 new companies were registered in 2012; a figure exceeded only three times in the past twelve years.

I have little doubt that Malta's political, economic and regulatory stability has taken on greater importance to the continuing growth of the finance industry than prior to the financial crises of 2008. Evidence for the blue chip nature of Malta's offering can be found in the European Central Bank announcement of January 2013 that showed that in 2012 Malta recorded the largest increase in monetary financial institutions [MFIs] of any EU nation; up 3%. This growth was against an overall decline of 6% in the number of MFIs in the EU.

The World Economic Forum's [WEF] global competitive index once again confirmed Malta's position as a premier division finance economy. It rated Malta's banking sector as the 12th “soundest” in the world and put the country at No 15 for financial market development. The EU awarded Malta first place for the implementing of Internal Market Directives into law. Such recognition from the WEF and the EU serve the very important purpose of providing independent and authoritative third party endorsement of Malta's standing in global finance and confirm to foreign investors, political and media observers Malta's wholly progressive compliance in legal and regulatory affairs and its nimbleness and attractiveness in a highly competitive and demanding marketplace.

Throughout 2012, the MFSA continued to play a core role in disseminating information to consumers, media and the industry, support industry education and training programmes, conduct seminars and meetings on legal, technical and regulatory developments, contribute to the framing of national and EU-wide technical policy development and exchange views and experiences with other national and international regulatory and supervisory bodies. To give just one example of these activities, the MFSA invited the European Insurance and Occupational Pensions Authority to take part in a joint seminar in Malta, which was open to supervisors from other EU jurisdictions and directors of insurance companies licensed by the MFSA. The pensions sector is still young in Malta and this type of seminar provides invaluable guidance to Maltese providers building businesses.

As was to be expected once the new EU-wide regulatory structure came into being in 2011, the full effect of the new regime was felt by the MFSA in 2012, with substantial amounts of time and human resource being deployed.

The new MFSA organisational structure, introduced at the start of 2012, has improved our ability to manage the additional load implications of the pan-EU supervisory regime. However, the main objective of the reorganisation was to underpin the Authority's ability to better identify risk across disciplines and across licensed sectors and entities. First year progress has been good and has provided a higher quality of service to the public and fee payers. The changes have significantly strengthened the Authority's senior executive team.

On the non-EU stage an important development was the signing of a Memoranda of Understanding with the Qatar Financial Centre Regulatory Authority [QFCRA]. Qatar has emerged in the past fifteen years as a global investor in blue chip assets and an ever more important regional political power in the Middle East and North Africa. The country also has one of the world's most advanced economic development strategies. It aims to keep Qatar an affluent and even more highly advanced economy in a post fossil fuel world. We look forward to a long relationship with the QFCRA.

The Authority is fully engaged with the Government of Malta, other public institutions and international organisations and regulatory bodies in continuing to improve mechanisms to help safeguard financial sector stability in the country. That work includes strengthening consumer protection measures.

The MFSA has been an international leader in the field of consumer financial education. As a result, Malta can match some of the world's largest economies in the quality and depth of activities that give the consumer the tools to make better informed decisions about financial products. Now, and in line with the commitment we have given to the International Monetary Fund, [IMF] we are developing a “blueprint” for further consumer protection actions. Consumer protection differs from consumer advice in that protection seeks to give the consumer a system that puts greater onus on the seller of financial products to be clear and accurate and enhances the consumer's ability to seek redress in the event of dispute. In line with the IMF's recommendations, it is likely that the MFSA will emerge with a more robust set of legal powers in consumer protection.

Work began on the “blueprint” in 2012. We aim to have completed consultations with all interested parties by the end of 2013 and have obtained trusted advice on best practise around Europe and on what will most suit Malta's needs. We will listen to all voices and take advice from all expert quarters. We have embarked on a necessarily complex road that has implications for future consumer and investor confidence, finance industry costs and Malta's competitiveness and reputation. We aim to complete the work as fast as the complexities allow and to have a preferred option ready for publication in 2014.

At the national economic safeguarding level, the MFSA worked throughout 2012 in tandem with The Central Bank of Malta to prepare for the announcement in early 2013 of the creation of a Joint Financial Stability Board. The central objective of the Board is to improve the ability of both organisations to better understand the factors that constitute systemic risk and thus take actions to reduce or eliminate risk where it is found.

2012 was an extremely difficult and uncertain year for the global economy. Growth was modest or absent in many parts of the world as governments slashed public spending to cut deficits and printed money to try and encourage private sector investment and consumer spending. Banks in many economies remained cautious about lending to business and numerous large companies, of the type that often drive global growth through their expansion and investment strategies, continued to build cash reserves or return money to shareholders. In more normal times such behaviour can be a sign of success, though the strongest motivation for recent practice appears to be insufficient confidence to take even the most modest risks. Confidence was further eroded by conflicts and political unrest in various parts of the world.

Amid much gloom there were a number of encouraging and welcome events. Malta itself was proportionately less damaged by the troubles of the global economy than many of its neighbours in and beyond the Eurozone. Perhaps most importantly, the huge increases in the number of young unemployed that has plagued countries across the EU and sapped the hope and ambition of millions of young people has been so far avoided in Malta. From the beginning of 2012, the US economy began to grow and the inevitable political and economic uncertainty that characterises every US presidential year ended with the emphatic re-election of President Obama. In Europe, the EU's political leaders pulled together to bring structure and direction to the crisis of the Euro that was threatening a further great shock to the global economic system, though the Eurozone's troubles are far from over.

While the global economy at the end of 2012 continued to be as fragile as it was at the end of 2011, further shocks to the world economic system cannot be ruled out. As the year closed, some small signs of limited recovery in Europe were apparent, though it will need two or three quarters of sustained growth, particularly in Germany, the UK and Japan and an uplift in US and Chinese output to be fully confident of global recovery.

The consequences for Malta of the global crash in 2008 can now be seen much more clearly than in the years immediately following the downturn. We have adapted well to the new EU regulatory structures and maintained our ability to attract foreign investment in financial services. The industry in Malta has become increasingly international in its markets and products. Our reputation for probity and stability remains in good repair. However, we do face some a number of serious challenges.

The Eurozone crisis combined with the global financial crisis and the subsequent political fissures that have opened up in the EU have created two political Europes and almost certainly two distinct economic blocks will exist inside the EU; those with policies driven by Euro membership and those with interests driven by the demands of their own national currencies. While the Internal Market should continue to function as before, the differing needs of each bloc may well see circumstances arise that begin to distort the level playing field that is the current Single Market.

The UK, which is still the world's biggest financial services economy, greatly fears that the Eurozone will act to boost its competiveness in finance at the expense of London. It too has also re-formulated its regulatory machinery and the focus will be very much on keeping the UK at the top of global finance. To complicate matters further, the USA's new regulatory policies and procedures pose their own behavioural challenges to firms in the global market. The BRIC nations are a growing voice in global financial regulation and southern Africa looks to be steadily emerging as a region of long-term financial importance. We are entering a much more complicated world.

Navigating Malta's way through the next five or more years will require a great deal of cooperation between the MFSA, the government, the Central Bank, the industry and all other parties that want to ensure that we can continue to benefit from an expanding finance sector. We also have to build on our reputation for dependability, skill and expertise in a stable environment. We need to demonstrate to the world that Malta adds value, that what its finance industry does here not only benefits Malta but also benefits the wider world by building capital and assets that help to fuel growth, jobs and recovery in many places.

Away from our shores, finance and its reputation have been badly bruised in recent years and the tax arrangements revealed about some very big multi-national businesses have damaged earnings and corporate reputation. Politicians are responding to public pressure with new legislation and tougher tax codes. The finance industry is perceived to be at the centre of this global reputational storm. The industry is important to Malta's economic future and its global standing. We have to reappraise our positioning and look to put more work into protecting and enhancing our reputation. We should also ensure that our many business, media and public sector friends around the world are kept well informed about Malta and its finance sector.

Malta's finance industry has built a solid mass of skills, knowledge and products. We have a proven regulatory system and a trusted legal system. These are all essential pillars of our national success, but above all is the political consensus between the political parties. In a very uncertain world this is the element that businesses and investors most value.

I want to thank the Governors for all that they did during 2012 to serve the MFSA and the nation. I take great pleasure in continuing to work with them. They all have real independence of thought, sharp intellectual capabilities and a real desire to do the right thing in all circumstances.

The staff at the MFSA performed diligently and professionally throughout the year and stayed resourceful and focussed at all times. I am as always grateful for their enthusiasm, knowledge, dedication and expertise.

J V Bannister

THE AUTHORITY

Board of Governors

Chairman

Prof. Joe V. Bannister, B.Sc, M.Sc, D.Phil (Oxon)

Members

Mr. Albert A. Attard

Prof. Josef Bonnici, B.A.(Hons.), M.A., Ph.D.

Dr. Louise Ellul Cachia Caruana, LL.D, M.A (Fin. Serv.)

Dr. Anton Felice LL.D

Dr. Cynthia Scerri Debono, LL.D

Mr. Frank Xerri de Caro, ACIB

Secretary

Dr. David Fabri LL.D

The Board of Governors is also the Listing Authority for the purpose of the Financial Markets Act.

Supervisory Council

Chairman

Dr. Andre Camilleri LL.D, Dip. Econ. & Ind. Law

Director General

Members

Dr. Marisa Attard LL.D, ACII

Director – Insurance and Pensions Supervision Unit

Mr. Mike Duignan

Director – Securities and Markets Supervision Unit

Mr. Karol Gabarretta B.A (Hons.) Econ., M.A (Fin. Serv.)

Director – Banking Supervision Unit

Ms. Marianne Scicluna B.A (Hons.) Bnkg. & Finance, M.Sc (Fin. Reg. & Compliance Mngt.)

Director – Authorisation Unit

Dr. Michael Xuereb LL.D, M.A (Fin. Serv.)

Director – Regulatory Development Unit

Secretary

Dr. Sarah Pulis B.A. Legal & Humanistic Studies, Dip. Not. Pub., LLM (EU Law) (Leicester), LL.D

Board of Management and Resources

Chairman

Mr. Joseph Demanuele FCCA, FIA, CPA

Chief Operations Officer

Members

Mr. Robert Aquilina DPA, MBA

Head – Communications Unit

Mr. Godfrey Farrugia (up to October 2012)

Deputy Director – Information and Communication Technologies Unit

Ms. Anne Marie Tabone B.A Hons, Accty. FIA, CPA (from November 2012)

Director – Finance & Risk Management Unit

Mr. Paul Vella B.A (Hons.) Bs. Mgt.

Director – Human Resources Development Unit (up to September 2012)

Mr. George Spiteri Dip. Social Studies (Industrial Relations), MSc. in Training and HR Mgt. (University of Leicester)

Head – Human Resources Development Unit (from September 2012)

Mr. Charles Zammit DBA, FCMI, FAIA.

Director – Administration Unit

Secretary

Mr. Colin Mcelhatton B.Sc (Hons), IS & Management (London)

Organisation

The Malta Financial Services Authority (MFSA) was established by law in 2002. The Authority is the single regulator for the financial services sector which includes credit and financial institutions, securities and investment services companies, recognised investment exchanges, insurance companies, insurance intermediaries, pension schemes and trustees. The MFSA also incorporates the Registry of Companies and is responsible for the admissibility to listing on recognised investment exchanges.

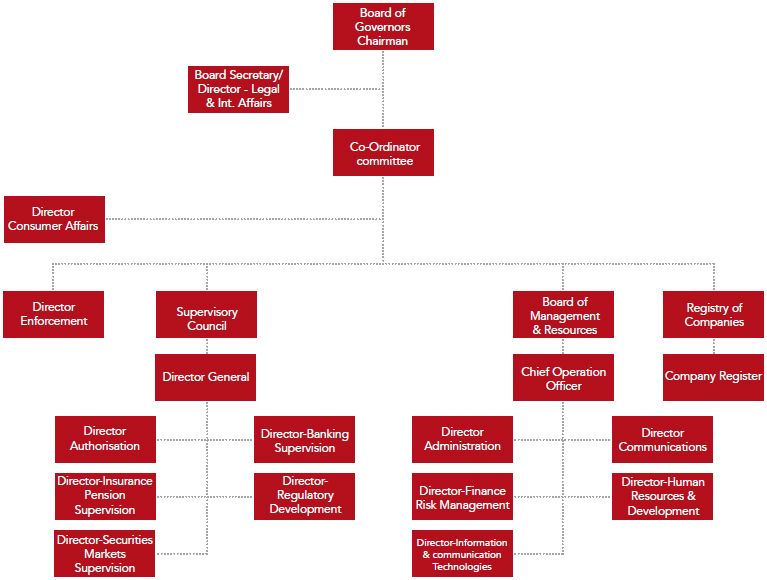

The MFSA is an autonomous body constituted by the Malta Financial Services Authority Act (Cap. 330), and reports annually to Parliament. The main organs (Chart 1) are the Board of Governors, which is appointed by the Prime Minister, the Supervisory Council and the Board of Management and Resources. The three organs are co-ordinated through a Co-ordination Committee.

Chart 1: MFSA Organisation Chart

The Legal and International Affairs Office is one of the statutory organs of the Authority and some of its primary functions are set out in the Act. These include the provision of legal advice and assistance to all the organs of the Authority. In addition to serving as secretary to the Board of Governors and the Co-ordination Committee and providing assistance to the various Units within the Authority, the Unit is also responsible for co-ordinating all legal international affairs.

Chart 2: Composition of the Co-ordination Committee

Chart 3: The Supervisory Council

Banking Supervision Unit:

responsible for the supervision of credit and financial institutions.

Insurance and Pensions Supervision Unit:

responsible for the supervision of insurance companies, insurance intermediaries, insurance management companies and pension schemes.

Securities and Markets Supervision Unit:

responsible for the supervision of investment services companies, collective investment schemes, fund management and related fund services operations, admissibility to listing on recognised investment exchanges, trustees and oversight of financial markets.

Regulatory Development Unit:

responsible for the implementation of cross-sectoral policies and regulatory developments.

Authorisation Unit:

responsible for licensing of all financial services entities.

Chart 4: Composition of the Board of Management & Resources

Administration Unit:

The Unit has now been separated from the Finance & Administration Unit so that more focus and attention will be given to the administrative function of the Authority. This Unit has responsibility for the day-to-day administrative functions including upkeep and maintenance of the premises, transport and logistics, security within the premises and other related matters.

Communications Unit:

The Unit's remit encompasses the functions for both information and public relations together with the provision of logistical support for events. It is also responsible for the preparation of corporate publications and for the development and maintenance of the Authority's internet and intranet site.

Finance & Risk Management Unit:

The unit oversees and manages the finances of the Authority and is a support unit for all the regulatory and operational units. It prepares financial budgets and produces monthly management information. It sets, monitors and improves the operation of the MFSA's financial control framework ensuring compliance with policies and controls. The team is responsible for the collection of fees, payments to suppliers, computation of payroll together with timely submission of financial statistics and information required by the Ministry of Finance, Board of Governors as well as other Government bodies. Co-ordinates with the Statutory Auditors, the annual audit of the Authority's Financial Statements drawn up in compliance with International Financial Reporting Standards. As part of the recent restructuring of this Unit, the functions also include the responsibility for the development of a risk management framework for the operational functions of the organisation.

Human Resources and Development Unit:

The Unit is responsible for employee welfare and personnel development through training and other initiatives. The Unit is also responsible for identifying training needs in the financial services sector and for developing, creating and implementing training programmes in conjunction with the relevant professional training bodies and academic institutions.

Information and Communication Technologies Unit:

The Unit provides operational support to the other units and is responsible for managing the Authority's resources efficiently and supporting the overall business strategy. This is achieved with the provision of reliable ICT services; systems and technology, enabling the MFSA to maximise the value of its information and knowledge whereby working with a mixture of in-house and outsourced technology suppliers. Recently, the unit has also been assigned with a new remit to provide information security analysis to the Regulatory Units.

The Enforcement Unit

The Enforcement Unit is responsible for reviewing the actions and where necessary conducting investigations of licence holders who have or are suspected of having committed serious compliance failures, serious misconduct, market abuse, breach of listing rules or any other serious breaches of the law.

Registry of Companies

The MFSA also houses the Registry of Companies. All registered information and documentation including company accounts and annual returns are publicly available. The Registrar of Companies is appointed in terms of the Companies Act and is entrusted with ensuring compliance with the provisions of the Act.

Listing Committee

The Listing Committee is appointed by the Board of Governors in terms of Article 14 of the Financial Markets Act (Cap. 345). In accordance with the Listing Rules, the Listing Committee is responsible for scrutinising applications prior to admission to listing and ensuring compliance with Listing Rules. The Listing Committee is chaired by Mr David Pullicino and has as members Mr Albert Attard, Mr Saviour Briffa, Dr Andre Camilleri and Mr Paul Spiteri.

Consumer Affairs

The Consumer Complaints Unit investigates complaints from private consumers arising out of any financial services transaction. The Consumer Complaints Manager is directly responsible to the Board but, where appropriate, cases may be referred to the Supervisory Council. The Unit is also responsible for consumer awareness and education.

The Education Consultative Council (ECC)

The terms of reference of the ECC include co-ordination and information sharing on matters related to training and career development for current and prospective employees within the financial services sector including all employees of the Authority. The ECC provides input to the Authority on matters related to training and career development within the sector and co-ordinates initiatives aimed towards filling of skills gaps that may be identified within the sector from time to time.

The ECC is chaired by Professor Charles J. Farrugia. It includes representation from the Human Resources Development Unit of the Authority, which also provides secretarial support, the Malta College of Arts Science and Technology (MCAST), the Guidance and Counselling Unit within the Department of Education, the Malta International Training Centre (MITC), the Institute of Financial Services Practitioners (IFSP), the Institute of Legal Studies (ILS), the Institute of Financial Services – Malta (IFS), and the Malta Institute of Accountants.

Corporate Social Responsibility

The Authority also continued providing financial support to the Fondazzjoni Patrimonju Malti. The Children's Foundation established by the Authority in 2008 continued providing support to underprivileged children. The Board of the Foundation is composed of Mrs Sonia Camilleri as Chairperson, Mr Marcel Pisani, Ms Josephine Baldacchino, Mr George Spiteri, and Mr Robert Aquilina. Ms Nathalie Farrugia acts as Secretary to the Board.

Market Overview

Global economic recovery continued to prove elusive and was characterised by multi-speed recoveries with advanced economies suffering from setbacks as emerging economies experiencing modest economic upturns. A similar scenario persisted within European Union impeding progress towards economic stability within the bloc.

European Central Bank (ECB) policies sought to decouple sovereign and banking risk and restore market confidence within the Euro Area. The ECB continued calling for deficit reduction plans to be stepped up and unveiled a new bond-buying plan known as Outright Monetary Transactions aimed at easing the Eurozone's debt crisis. This announcement together with the ECB's pledge to do “whatever it takes” to preserve the Euro eased default concerns in peripheral Euro economies leading to a reduction in liquidity pressures within the European financial system.

Against this background Malta continued to maintain a high degree of financial stability and avoided many of the difficulties experienced by some other Euro countries. The Maltese economy did though face significant challenges during the year with some sectors lagging behind in terms of growth. Initially the Maltese economy suffered from weakened economic activity for two consecutive quarters with Malta officially entering into recession in first quarter of 2012. The economy started recovering in the following quarters, registering positive economic growth and outpacing that of other Euro Area member states by the end of the year.

Notwithstanding these disturbances in the Eurozone, Malta's financial services sector remained buoyant, contributing significantly towards the overall recovery. New licences were issued in all areas with electronic money and payment services, investment services and pension fund activity registering above average rates of growth. Growth was also registered in non-life insurance business and trustee services.

In the World Economic Forum's Global Competitive Index 2012-2013 Malta retained 15th position, out of 144 countries, in terms of financial market development, also ranking 12th in terms of bank soundness.

To view the full Annual Report, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.