MFSA launches AIFMD applications process

The MFSA launched the new Investment Services Rulebooks on 27 June 2013. The Authority has been accepting applications for licences in terms of the Alternative Investment Fund Managers Directive [Directive 2011/61/EU hereinafter referred to as the 'AIFMD'] and the related Commission Delegated Regulation [Commission Delegated Regulation (EU) No 231/2013, herein-after referred to as the 'Level II Regulation']

New Applications

As from 22 July 2013:

1. new licences for investment management services provided to Collective Investment Schemes which are not UCITS, will be issued pursuant to the provisions of the Investment Services Act and in compliance with the revised Investment Services Rules for Investment Services Providers, in particular with the new Part BIII regulating Alternative Investment Fund Managers (AIFMs);

2. new licences for Collective Investment Schemes targeting professional investors will be issued in compliance with new Investment Services Rules for Alternative Investment Funds (AIFs);

3. new licences for professional investor funds (PIFs) may continue to be issued under the updated Investment Services Rules for Professional Investor Funds in the following cases:

i. applicants who opt to apply to be licensed as a 'de minimis' self-managed AIF;

ii. applicants who opt to apply for a PIF licence provided the PIF is man-aged by a de minimis AIFM;

iii. applicants who opt to apply for a PIF licence provided the PIF is man-aged by a AIFM in full compliance with the AIFMD;

iv. applicants who opt to apply for a PIF licence provided the PIF is managed by a non-EU AIFM in terms of the relevant conditions of the AIFMD under which other EU-Member States may allow them to market to professional investors in their territory;

4. new licences for non-UCITS retail schemes will be issued under updated Investment Services Rules for Non-UCITS Retail Collective Investment Schemes;

5. Private Collective Investment Schemes will continue to be issued with a recognition certificate as these fall outside of scope of the AIFMD.

Revision of Existing Licences

Managers and self-managed schemes that are already licensed under the current Investment Services Rules have a one year transitional period with effect from 22 July 2013 in order to satisfy the requirements of the AIFMD and convert to an AIFM or Self-Managed AIF Licence as applicable. This process may be carried out by submitting a duly filled in Self-Assessment Form for Fund Managers (or Self-Assessment Form for Self-Managed Collective Investment Schemes Applying for an AIFM Licence, as the case may be).

Applications for conversion to AIFM compliant Licence by 22

July 2013

The Authority has advised by means of Circular dated 10 May 2013 that existing licence holders wishing to convert to an AIFM Licence as soon as the AIFMD comes into force on 22 July 2013 should have already notified the Authority and submitted the relevant Self-Assessment Form, duly completed, by not later than Monday, 10 June 2013. The same cut-off date applies to Self-Managed Collective Investment Schemes requiring an AIFM Licence by the same date. MFSA has started processing these applications and following due consideration applicants who are deemed by the Authority to be AIFMD compliant will be issued with a revised AIFM licence which will be operative from 22 July 2013. The MFSA will use its best endeavours to process any questionnaires submitted after this deadline so that the revised licence may be issued at the earliest possible date following the coming into force of the Directive.

Transitional period for existing Licence Holders

AIFMD Managers and self-managed funds licensed under the outgoing framework may opt to avail themselves of the transitional period. In order to be in line with the European Commission's interpretation that all managers should fully comply with the Directive by 22 July 2014, these Licence Holders should ensure that their Self-Assessment Form is submitted to the MFSA by 31 March 2014 at the latest. These Licence Holders are also advised to use the transitional period to adapt to the new AIFMD framework and should note that during this period the MFSA will require compliance on a 'best efforts' basis. In any case all Licence Holders shall ensure that they are fully compliant with the AIFMD by 22 July 2014.

Umbrella Collective Investment Schemes (including PIFs) that are self-managed or are managed by third party managers that have opted for the transitional period may continue to establish new sub-funds under the current Rules until 22 July 2014.

Revision of current licence to a 'De Minimis' AIFM

licence

Managers and self-managed funds who choose to be classified as a 'de minimis' AIFM/AIFs should also submit the relevant Self-Assessment Form by not later than 31 March 2014.

'De Minimis' Professional Investor Fund

option

Self-managed PIFs that fall under the AIFMD's 'de minimis' thresholds may continue operating under an updated PIF frame-work provided they submit a Self-Assessment Form for Self-Managed Schemes applying as De Minimis Licence Holders by 31 March 2014. A revised self-managed PIF licence shall be approved if the MFSA is satisfied that the PIF in question falls below the thresholds specified in the updated Investment Services Rules for Professional Investor Funds and is in a position to comply with the provisions of the said Rules by the same date.

Non-UCITS Retail Collective Investment Schemes

An AIFMD-compliant version of the Investment Services Rules for Non-UCITS Retail Collective Investment Schemes will come into effect on 22 July 2013. The AIFM must ensure that all existing non-UCITS retail schemes under management are fully com-pliant with these Rules once the AIFM is in possession of its revised licence.

A "de minimis" option for self-managed non-UCITS retail schemes is also available in the Rules.

Passporting

Passporting of AIFM services

i) Management Passport: EU AIFMs may passport their services and manage EU AIFs either directly or by establishing a branch pursuant to the provisions of the Directive as transposed in the Investment Services Act (Alternative Investment Fund Manager) (Passport) Regulations, 2013; additionally, these AIFMs may also be authorised to manage UCITS in accordance with Directive 2009/65/EC;

ii) Marketing Passport: EU AIFMs may also market the units or shares of an EU AIF pursuant to the provisions of the Directive as transposed in the Investment Services Act (Marketing of Alternative Investment Funds) Regulations, 2013;

iii) Portfolio Investment Services: according to article 6(4) of the AIFMD, AIFMs may also be authorised to provide discretionary portfolio services on a client-by-client services regulated in accordance with certain provisions of Directive 2004/39/EC (MiFID). These services will be included in the MFSA's passport notification to the host EEA Member States. Firms should be aware however that in line with an opinion expressed by the Commission, certain Member States may refuse pass-porting of these MiFID services

Transitional cross-border and third-country services

arrangements applicable until July 2015

i) Authorised EU AIFMs may continue to manage/market without a passport non-EU AIFs on a private placement basis in the EU until 22 July 2015 subject to the full Directive provisions but with a depository lite, and may have the opportunity to obtain a full EU passport in 2015 pending ESMA's deliberations;

ii) Non-EU AIFMs may continue to manage/market without a passport non-EU AIFs/ EU AIFs on a private placement basis in the EU without requiring full AIFMD compliance and without a depository until 2015. Thereafter an EU passport may be granted subject to full Directive applicability.

Delegation of Management Functions

Under the AIFMD, managers that intend to delegate any functions to third parties shall notify the competent authority accordingly and must be able to justify the entire delegation structure on objective reasons. Notwithstanding this, the AIFM shall at all times retain the power to perform senior management functions in particular in relation to the implementation of investment policy and investment strategies. It shall also have the expertise and resources to supervise the delegated tasks effectively and manage the risks associated with the delegation.

Subject to the foregoing the MFSA may allow certain portfolio and risk management tasks to be delegated in line with the Directive (including partial delegation of both activities) and shall determine the extent of delegation that may be allowed following a review of the proposed delegation structure.

Any delegation of management duties to a Sub-Manager would have to be notified to the MFSA and would have to be in accordance with a number of conditions, as contained in Section 4 of Part BIII of the Investment Services Rules for Investment Services Providers. The liability of the AIFM will in no case be affected by delegation of any its functions to third parties.

Remuneration Policy

In line with Article 13 of the AIFMD, the MFSA's approach is that remuneration policies and practices shall apply at the level of the AIFM - specifically to "those categories of staff, including senior management, risk takers, control functions, and any employees receiving total remuneration that takes them into the same remuneration bracket as senior management and risk takers, whose professional activities have a material impact on the risk profiles of the AIFMs or of the AIFs they manage."

The approach adopted by the MFSA does not require that entities to which portfolio management or risk management activities may have been delegated be subject to similar remuneration requirements as the AIFM.

Depositary Arrangements

The MFSA has negotiated a derogation at EU level which has been incorporated in the Directive and which will allow Malta-based AIFs and AIFMs to make use of the services of an AIFMD-compliant depositary based in another EU or EEA Member State until 22 July 2017. Thereafter a Maltese AIFM or self - managed AIF must employ the services of a depository located in Malta.

Delegation of Functions and contractual discharge of

liability

In terms of Part BIV of the Investment Services Rules for Investment Services Providers the delegation by a Depositary/ Custodian to a prime broker of any of its custody tasks in accordance with SLCs 4.15 to 4.18 of these Rules is allowed if the relevant conditions are met. These include the condition that the Licence Holder should be able to demonstrate that there is an objective reason for delegation.

Subject to other conditions stipulated in SLCs 4.23 and 4.24, the Licence Holder would only be able to discharge itself of liability in the case of an appropriate delegation of the said custody tasks if, among other conditions, this is done by means of written contracts as specified in paragraphs [b] and [c] of SLC 4.24.

The justification for contractual discharge should be based on clear and objective reasons which may include those in article 102 of the Level II Regulation.

Subject to these essential requisites being satisfied, the MFSA accepts that the arrangements themselves may take different forms that cater for the different scenarios that may exist, provided the chosen model is within the scope of Article 21 of the AIFMD and the Level II Regulation.

The MFSA will be providing guidance to the industry on Depository/ PB models for fund structures which it may consider in this context.

Depositary "lite"

In terms of Article 21(3)(c) of the AIFMD, funds which have no redemption rights exercisable during the five year period from the date of initial investment and which generally do not invest in assets that must be held in custody may appoint as Custodian an entity which carries out a depositary (safe-keeping and oversight) function as approved by the MFSA.

A depository "lite" regime will also apply to EU AIFMs managing non-EU AIFs marketed in the EU (at least until July 2015).

Co-operation with Non-EU Jurisdictions

The MFSA has signed co-operation arrangements with 34 non-EU securities regulators, with responsibility for the supervision of alternative investment funds (AIFs), including jurisdictions such as the USA, Canada, Brazil, India, Switzerland, Australia, Hong Kong and Singapore. ESMA negotiated the agreements on behalf of all 27 EU Member State securities regulators.

These arrangements are a key element in ensuring compliance with the AIFMD and are a pre-condition to allowing non-EU AIFMs access to EU markets or to perform fund management activities on behalf of EU managers. The arrangements also cover co-operation in the cross-border supervision of depositaries and AIFMs' delegates.

The arrangements will apply from 22 July 2013 and will facilitate the exchange of information, cross-border on-site visits and mutual assistance in the enforcement of the respective supervisory laws.

MFSA Website Information

Further information on the updated Investment Services Rules, relevant legislation, application forms, information guides, Q&A and other information related to the transposition of the AIFMD, is available on http://bit.ly/11ZVNtR

Industry Updates

Capital Requirements Directive and Capital Requirements

Regulation ('CRD IV package')

The prudential regulation and supervision of credit institutions and investment firms is regulated in terms of the Capital Requirements Directive. The Directive is in the process of be amended. In this regard, the detailed prudential requirements have been incorporated in a proposed EU Regulation, while the conditions for prudential supervision are being retained in the form of a Directive.

The Council has approved the compromise text of the CRD IV package. This has also been approved by the European Parliament. The latest version of the CRD IV package is available through the following: web-links:

- Proposed Capital Requirements Directive: http://register.consilium.europa.eu/pdf/en/13/st07/st07746.en13.pdf

- Proposed Capital Requirements Regulation: http://register.consilium.europa.eu/pdf/en/13/st07/st07747.en13.pdf

The final text of the CRD IV package will come into force once it is published in the EU Official Journal. If the final text is published in the Journal before the 30 June 2013, the implementation deadline will be set for the 1 January 2014. If the publication occurs between the 1 July and the 31 December 2013, the implementation deadline will be set for the 1 July 2014. It is likely that the CRD IV package will be published before the 1 July and that a tight deadline for implementation will be applicable.

The MFSA is carrying out a detailed analysis of the provisions of the CRD IV to determine the legislative changes that have to be undertaken in order to implement this package.

Proposed - Markets in Financial Instruments Directive II

('MIFID II') and Markets in Financial Instruments

Regulation ('MiFIR')

MIFIR sets the requirements applicable to trading platforms, including the rules on disclosure of trade transparency data to the public and transaction data to competent authorities. MiFID II amends specific requirements regarding the provision of investment services, including the scope of exemptions from the current Directive and the organisational and conduct of business requirements applicable to investment firms.

MiFID II and MiFIR have been the subject of intensive negotiations aiming at an agreement on the Council's general approach, which would allow the Presidency to start negotiations with the European Parliament with a view to reaching a compromise. The latest Presidency Compromise text was published by the Council on the 10 June 2013. The documents are available through the following web-links:

- MiFID II: http://register.consilium.europa.eu/pdf/en/13/st09/st09711-re02.en13.pdf

- MiFIR: http://register.consilium.europa.eu/pdf/en/13/st09/st09710-re02.en13.pdf

ESMA Guidelines on Remuneration Policies and

Practices

On the 11th June 2013, the European Securities and Markets Authority (ESMA) published Guidelines on remuneration policies and practices. The purpose of the guidelines is to ensure the consistent implementation of the MiFID requirements on conflicts of interest and conduct of business. The guidelines focus on the field of remuneration.

The guidelines strengthen investor protection as they seek to create the right incentives for persons involved in the provision of investment services to retail and professional clients. In Malta the guidelines will apply to investment services licence holders.

The MFSA will be taking the necessary action to implement the guidelines. In the meantime, the industry is encouraged to consider the conditions set in the guidelines.

A copy of the guidelines is available on the ESMA website.

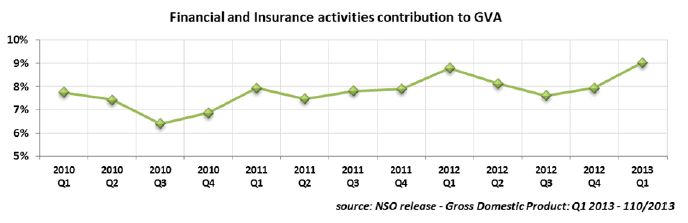

Financial and Insurance activities contribution to Gross Value

Added

13% growth in 2013-Q1 registered

Gross Value Added (GVA) from financial and insurance activities in Malta amounted to €132 million during the first quarter of 2013. This reflects a growth of 13 per cent when compared to the previous quarter. Financial and insurance activities in Malta contributed 9 per cent to total GVA during the period under review, up from 8 per cent registered during the previous quarter.

The 2013 Malta International Financial Crime Forum

On the 5th and 6th June 2013, the ICC Financial Investigation Bureau (FIB), co-sponsored by the Malta Financial Services Authority (MFSA) and the Malta Financial Intelligence Analysis Unit (FIAU), held the 2013 Malta International Financial Crime Forum at the Hilton Hotel, St. Julians, Malta.

The first speaker, Mr. Richard Briggs, in his presentation - Financial crime in the aftermath of the Arab Spring - focused on the connection between financial crime and political changes in Government, especially with regards to the Arab Spring Jurisdictions.

Mr. John Scicluna and Dr. Paula Galea Farrugia delved into the Risks to banks and financial institutions - how they are ex-posed to financial crime and what they can do to reduce the risks. Dr. Galea Farrugia two interesting issues/ risks, that is, virtual/ cyber money and Stored Value Cards (SVCs). Mr. Scicluna focused more on the ways to reduce such risks for instance, that the intensity with which Customer Due Diligence (CDD) is conducted must be adjusted to the perceived risk.

Ms. Karen O'Neill discussed High Yield Investment Scams - Recent perspectives. She also delved into the role and services of the FIB, that is, to conduct enquiries and investigations into matters associated with money laundering, fraud and suspect documents.

Mr. Bernd Klose, in his presentation From Pump and Dump to Ponzi - the Boiler Room is calling, examined how a boiler room scam works and introduced a Maltese victim of such scam, who emphasised a very important principle: we tend to view such victims as 'fools' or people who are very naïve, while the reality is completely the opposite. The people behind such scams are highly experienced and qualified persons with a background in financial services, thus making them extremely capable in the art of scamming people.

Mr. Peter Lowe's in his presentation Spotting the Tell-Tale Signs, mentioned a number of Tell-Tale signs such as: "Love bombing" - constant attention, emails and phone calls and Lies/gaps in his/her story.

The Challenges of Compliance: Overcoming the challenges of compliance from a national perspective was delivered jointly by John Howell and David Artingstall, Senior Advisers at John Howell & Co Ltd. The session examined the challenges of compliance from a national perspective - regulated versus the regulator. Supervision issues were discussed including the use of resources available which may not always be sufficient to enforce compliance particularly where the regulated is too big to fail, too big to jail and too easy to blame.

Washing the Profits: Are Offshore Locations Vulnerable? delivered by Costas Stamatiou of Andreas Neocleous and Co LLC focused largely on the AML measures in Cyprus. Refer-ence was made to the recently published MoneyVal and Deloitte audits and distortion by Troika summary of the Mon-eyVal and Deloitte reports which reportedly makes inference when no reference to or indication of systemic deficiencies and omits strengths of the strengths both in the Cypriot AML framework and in the effective implementation of customer due diligence by Cypriot banks.

Various remedies available under Cypriot law which allows victims of fraud to trace, freeze and recover assets including awards of damages, restitution, specific performance, constructive trust and injunctive relief as well as interim orders in the form of interlocutory injunctions, all of which couples with AML measures adopted, make fraudsters and money launderers vulnerable in Cyprus.

A Regulator's Perspective: the changing landscape of customer due diligence delivered by Dr Manfred Galdes, Director at FIAU Malta. The speaker examined current trends in Malta and the general response seen to the risk-based approach which continues to find resistance as subject persons continue to adopt a tick-box approach.

Recovering Assets: Tracking and attacking the proceeds of fraud was delivered by Andrew Witts of Lawrence Graham LLP, London. Consisted in a proposed team structure for recovering of assets with team work and effective communication and leadership. Fraud litigation being often international in character requires a specialised multi-disciplinary and multi-jurisdictional team made up of lawyers and accountants and with a lead lawyer. The team would function as a single unit re-porting to a single lead lawyer having the overall responsibility for establishing and implementing a legal strategy with all team members acknowledging no place for egos.

Following the Trail and Crunching the Numbers: How crunching the numbers and following their trail can reveal and recover stolen assets delivered by Kevin Hellard of Grant Thorton discussed trends and issues modern fraud and financial crime making reference to increasing sophistication and complexity of fraud which arise as a result of financial products such as trusts and group and ownership structures and different nature of asset / business /nationality / other case characteristics across jurisdictions.

Internet Investigation: Using 'in-depth' internet intelligence as an investigative tool deliver by Max Vetter of the ICC-Commercial Crime Services gave a detailed overview of the internet tools available and various techniques in carrying out searches - internet as an investigative tool explaining and trails left by searches.

The last session entitled Prevention and Control from the Front Line was given by Ben Roberts of the Citigroup who discussed loss of public trust / reputational damage, legal fines, loss of new or existing customers, loss of ability to attract or retain good employees, damage to share price, financial loss and management time. Reference was also made to the fraud triangle consisting of opportunity, motivation/pressure and rationalization. Recommendations were made on breaking fraud triangle by removing opportunity through internal controls and knowing your employees - internal threats - importance of creating a safe reporting of fraud.

Compensation Schemes - Publication of reports and financial

statements for 2012

The Depositor Compensation Scheme and the Investor Compensation Scheme have published the reports on the discharge of their functions and operations during 2012, together with their respective audited financial statements for year end 31 December 2012.

Furthermore, the Protection and Compensation Fund published the Fund's audited financial statements for 2012.

These reports are available on: www.mfsa.com.mt/compensationschemes .

The Depositor Compensation Scheme is a rescue fund for depositors of failed banks which are licensed by the Malta Financial Services Authority (MFSA). This Scheme is based on the EU Directive 94/19 on deposit-guarantee schemes.

The Investor Compensation Scheme is a rescue fund for customers of failed investment firms which are licensed by the Malta Financial Services Authority (MFSA), and is based on the EU Directive 97/9 on investor-compensation schemes.

Each scheme is a separate and distinct entity from the other. However, both schemes are managed by a single Management Committee which is appointed by the MFSA. This Committee is made up of persons representing the MFSA, the Central Bank of Malta, investment firms, the banks and customers. Each Scheme is intended to promote confidence not only in licensed institutions, but more importantly, in the financial system as a whole. The two schemes are in fact financed by the banks and investment firms respectively. This means that the consumer will not be asked to contribute to these schemes.

The Protection and Compensation Fund is regulated by the Protection and Compensation Fund Regulations 2003 issued under the Insurance Business Act (Cap. 403). The has two main purposes: to pay for any claims against an insurer which have remained unpaid because the insurer became insolvent (these claims must be in respect of protected risks situated in Malta or protected commitments where Malta is the country of commitment) and to compensate victims of road traffic accidents in certain specified circumstances. A Management Committee appointed by the MFSA is responsible for the administration and general control of the Fund.

Links:www.compensationschemes.org.mt, http://mymoneybox.mfsa.com.mt/pages/viewcontent.aspx?id=125

EIOPA's Annual Report for 2012 published

The European Insurance and Occupational Pensions Authority (EIOPA), established in consequence of the reforms to the structure of supervision of the financial sector in the European Union, has earlier this month published its Annual Report for 2012.

EIOPA is part of a European System of Financial Supervisors that comprises three European Supervisory Authorities, one for the banking sector, one for the securities sector and one for the insurance and occupational pensions sector, as well as the European Systemic Risk Board.

2012 is the second year of EIOPA's work as a European Supervisory Authority. In the course of this year, EIOPA continued its work in its seven core areas: regulatory tasks; supervisory tasks; consumer protection and financial innovation; creation of the common supervisory culture; financial stability; crisis prevention, management and resolution; external relations.

Key highlights of EIOPA's activities in 2012, of which further details are provided in the report, include:

Solvency II: The key insurance project to be delivered by EIOPA during 2012 continued to be Solvency II. Whilst 2012 was marked by the continuing negotiations between the European Parliament, the Council and the Commission on the Omnibus II Directive, EIOPA has been active in developing the regulatory provisions to support the Solvency II regime, as well as in supporting national supervisors and insurers to prepare for the new framework.

In 2012, EIOPA continued to contribute to the global effort to improve the quality of the EEA supervisory framework, and particularly of the Colleges of Supervisors. In the course of the year, EIOPA contacted all 91 Colleges which are currently active in Europe, and managed to present best practices in 75 Colleges of Supervisors. These exchanges led to lively discussions on macro and micro-economic risks, and the Authority provided summaries of EIOPA's Financial Stability Reports, and the EIOPA Risk Dashboard. The Authority provided feedback to 17 Group Supervisors on how their Colleges were functioning.

Consumer protection lies at the heart of EIOPA's 'DNA' and it is therefore seen as a high priority for EIOPA in the area of insurance and occupational pensions. The first set of Guidelines issued by EIOPA was precisely in the area of consumer protection. More specifically, in November 2012, EIOPA issued Guidelines dealing with complaints-handling by insurance undertakings. These Guidelines establish consistent, efficient and effective supervisory practices and ensure common, uniform and consistent application of EU law. Furthermore, EIOPA conducted several studies and produced reports on various relevant topics.

Creation of a common supervisory culture: During 2012, EIOPA continued to build up a common supervisory culture in the European Union, through technical training with a strong focus on building common supervisory skills and approaches. The topics covered in the training events mirror the work of EIOPA, whereby Solvency II is one of the main drivers, followed by Financial Stability, Occupational Pensions, Consumer Protection and Convergence of supervisory practices.

Financial stability: EIOPA's financial stability work in 2012 continued to focus on the early identification of adverse trends, potential risks and vulnerabilities for the insurance and occupational pensions sectors arising from micro and macro-economic developments. In addition to the surveillance of market conditions, EIOPA carried out regular financial stability assessments in the form of quarterly Risk Dashboards and semi-annual EIOPA Financial Stability Reports. During the course of 2012, EIOPA also examined a number of specific financial stability issues including the significance of insurance in shadow banking, the liquidity swap activities of insurers, and alternative risk transfer techniques in insurance.

The report can be found on the EIOPA's website.

To view this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.