- within Technology topic(s)

- with readers working within the Media & Information industries

- within Antitrust/Competition Law and Intellectual Property topic(s)

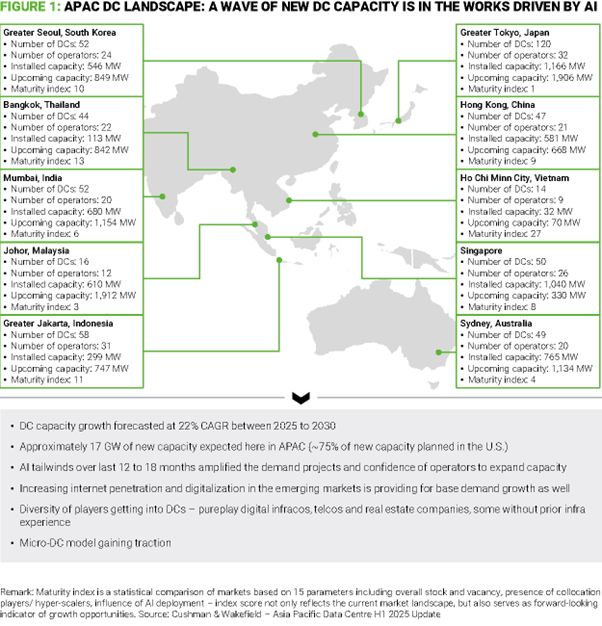

There are a number of reasons to be excited about the Asia Pacific Data Center (DC) market. Capacity has been growing at15% CAGRsince 2020, and isforecast to grow at 22% CAGR between 2025 and 2030. APAC hosts 62.18% of world's population and has markets like India where GDP growth is forecast to be 6.6% in 2025, citing a strong economic performance. Internet penetration is now at 70.4% and the APAC population is increasingly exposed to digital platforms such as e-commerce, fintech, and social media. In addition, governments are seeking to gain parity on innovation by encouraging digital infrastructure builds. No wonder, then, that there are number of players entering the DC market here—real estate players, telcos and pureplay digital infrastructure players. Across the top 10 markets, there have been both capacity additions and new players coming on board as shown in Figure 1.

However, even with these tailwinds, there are a number of challenges that are making the path to monetization uncertain for the APAC DC players.

Key monetization challenges faced by DC operators in APAC:

- Demand supply imbalances:Asian markets are facing long Build to Cash cycles. In top markets like Japan, the problem has been a shortage of General Contractors (GCs). In other markets such as India or Malaysia, it has been due to the time it takes to secure permits prior to starting construction. This results in DC players frontloading capacity when they factor in the interim growth. Further, due to such uncertainty, capacity doesn't come into the market in a predictable manner—a sudden arrival and glut in capacity will put margins under pressure.

- AI uncertainty:As much as AI has been a tailwind for DC operators, forecasting its demand for APAC has been challenging. This unpredictable demand means that operators must plan for rack density of 50-120kW versus typical cloud services at 15-30 kW and enterprises at 10-15kW. The substantial spike in rack density needed for AI has second order design implications on floor loading capacity, cooling systems (liquid vs. air cooling), and back-up systems.

- Geo-political implications: The rising political tensions between China and the U.S. / aligned West is manifesting in markets like Malaysia where we see parallel infrastructure being set up to service respective customer groups. This leads to higher upfront capex and sub-optimal utilization. Further, access to cutting edge GPUs are currently limited to hyperscalers and even if other DC operators are able to secure them to offer AI-as-a-Service (AIaaS), the compliance requirements could be onerous.

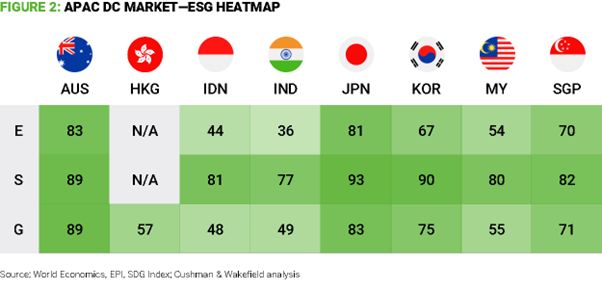

- ESG concerns:A number of markets in APAC face

water stress and power shortages—the current ESG heatmap in

major markets is shown below in Figure 2. Particularly during the

summer months, the issues are acute. Further, DC builds are

becoming dense, from 1000 sqm per MW capacity to just 285 sqm per

MW (estimated from the recent Singapore government allocation of 20

hectares for a DC park). Providing ESG infrastructure (renewable

power sources, water treatment plants etc.,) in such high-density

developments becomes extremely challenging.

- Rising Capex and Opex:As such, DC construction costs are high, and factoring in AI workloads will increase the costs substantially. The Capex increase (about 20% higher) for high-density racks is not proportionately seen in rentals (only a premium of 15%). Therefore, operators will need to revisit or harden their business cases for achieving the balance between Capex, Opex, and revenue.

Tenable path to monetization and shareholder returns

Clarifying the path to monetization and improving ROI comes down largely to having a clear strategy up front. We have outlined a few opportunities that need to be explored during the early strategy setting and design phases for DCs. However, even if the DC is operational, we believe there is a need to revisit and re-vector along the growth, operations, and financial engineering for improved business outcomes.

- Differentiate for sustained growth:As soon as the initial or pent-up DC demand is met in a market, the next wave of value capture comes from strategic differentiation. Currently, the hyperscalers take up the base demand at a number of locations. However, these hyperscalers are also highly demanding customers for DCs in terms of custom builds (reducing the reuse value after), rental discounts, contract flexibility, and ESG compliance. In addition, hyperscalers are constantly evaluating build versus lease options in the markets. Therefore, DC operators will need to build a credible source of revenues from local enterprises, local government and public sector segments. This requires a different kind of product development, marketing and sales model. DC operators cannot simply build the racks; rather, they must think about a broader role as digital infrastructure partners as these segments work through their choices of on-prem versus hybrid versus cloud versus sovereign cloud. Further, taking a greater role and accountability in delivering industry-specific use cases (in BFSI, Manufacturing, for example) will help build a more assured and growing stream of services revenues. DC operators are not currently setup for capabilities to target these segments—therefore, they should seek to partner with telcos and SIs for faster time to market.

- Drive operational excellence:DC operators in APAC are aware of or have mostly squeezed out the value from traditional cost levers of, for example, PUE optimization or better chillers. The next frontier of value creation we see is around form factor and operating model choices. For instance, a number of DC players are focusing on Tier 1 locations within a market—for instance, Mumbai (India) or Johor (Malaysia). While there are benefits of an ecosystem and connectivity, it becomes costly to build and, operationally, expensive to run. An alternate operating model here can be to focus on Tier 2 locations within a market, especially if target customer workloads are latency tolerant. In some markets, an economically viable set of industries and customers may still be present in Tier 2 locations. Secondly, getting access to better layout and securing permits may be easier, as distributed DCs put less strain on the power grid. Further, building modular DC blocks versus a large complex one has its advantages. The reliability (which increases both Capex and Opex for higher grades) can be custom-provided with better segmentation of workloads. For instance, AI training / backup workloads can run on best effort reliability blocks while critical / core applications run on Tier 3+ reliability blocks. Modularity also comes in another form, where heat is extracted more efficiently from containerized server blocks rather than cooling entire giant rooms. There are also operational improvements that can be made in partnership with the customer, such as GPU-aware cooling and load scheduling.

- Engineer financial outcomes:Capital efficiency and risk mitigation are key pillars that DC operators focus on. Modular builds help drive up the productive use of infrastructure and capital. An ROI-focused pricing mechanism that helps promote early / at-scale commitments (such as anchor tenancy, zero capex migration etc.) with menu options for the granular functionality and features helps improve the yield. Operators are also advised to take yield management approaches similar to airlines or hotels, where there is a pricing model that adapts with the ecosystem density. Further, there is also a phased window where some services are provided as "loss leaders" and pricing leverage is exercised as customer stickiness improves. During the strategy phase, it is key to have a clear exit strategy, with the triggers well laid out—particularly for the smaller players. Finally, for those DC operators who seek a multi-location portfolio, it is key to test the option of sale and lease back. This helps free up capital, even as operational scale is achieved.

Conclusion

DC operators in APAC are facing a new reality—demand is rising but monetization is becoming harder. The region's digital momentum is undeniable, but so are the challenges that come with it, from AI-driven complexity to rising sustainability pressures. Success in this evolving market will hinge on how well DC operators, big and small, can adapt—by rethinking their growth models, embracing modular and efficient designs, and engineering the finances smarter. Those that look beyond the race for capacity and focus instead on creating differentiated and reality-aligned operating models will be the ones to survive and truly unlock the promise of APAC's digital decade.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.