- within Technology topic(s)

- in European Union

- with readers working within the Media & Information industries

- within Technology topic(s)

- in European Union

- in European Union

- in European Union

- with readers working within the Media & Information industries

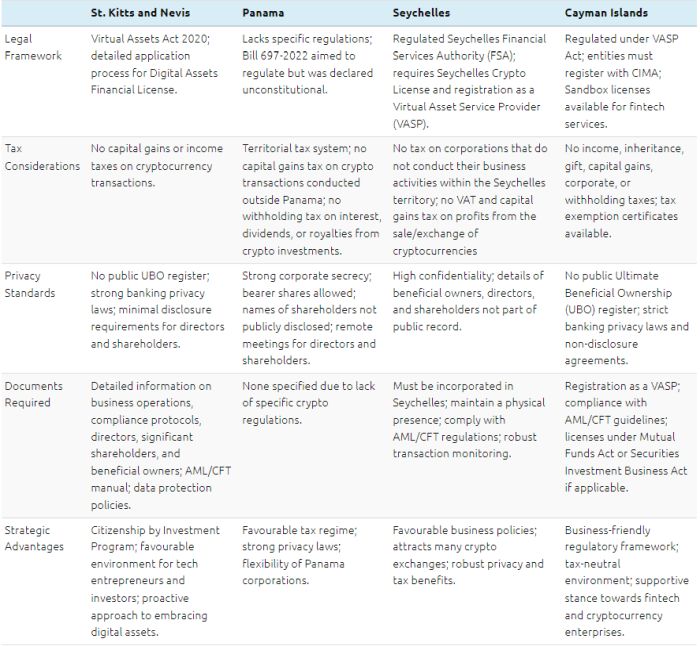

Joeline Barbara provides an insightful overview of the current state of cryptocurrencies in key offshore jurisdictions. The article explores St. Kitts and Nevis, Panama, Seychelles, and the Cayman Islands, each offering unique regulatory frameworks and advantages for cryptocurrency investors. As the cryptocurrency landscape evolves, understanding these jurisdictions is essential for optimizing investment strategies and ensuring compliance in a complex regulatory environment. By examining these regions, investors can make informed decisions and navigate the complexities of the global crypto market.

St. Kitts and Nevis

Legal Framework

St. Kitts and Nevis has positioned itself as a premier destination for crypto investors through the enactment of the Virtual Assets Act 2020, which was further refined in 2021. This progressive legislation facilitates the seamless operation of cryptocurrency businesses by eliminating bureaucratic hurdles.

The Act allows citizens and residents to engage in a variety of activities related to virtual assets, including:

- Exchanging between virtual assets and fiat currency.

- Exchanging between different virtual assets.

- Transferring virtual assets.

- Safeguarding or managing virtual assets or instruments that provide control over digital assets.

- Providing financial services related to the issuance, sale, and exchange of digital assets.

This legal framework underscores St. Kitts and Nevis' commitment to economic and individual freedom, allowing global investors to leverage blockchain technology effectively.

St. Kitts and Nevis

Tax Considerations

St. Kitts and Nevis is its favourable tax regime. The jurisdiction does not impose capital gains or income taxes on cryptocurrency transactions. This tax advantage extends to structures such as LLCs and Nevis multipurpose trusts, making it an ideal environment for long-term investment and business operations. Additionally, the current legislation permits the initiation of initial coin offerings (ICOs) and the establishment of crypto exchanges, further enhancing its appeal to tech entrepreneurs and investors.

St. Kitts and Nevis

Privacy Standards

Privacy is a cornerstone of the business environment in St. Kitts and Nevis. The jurisdiction does not maintain a public Ultimate Beneficial Ownership (UBO) register, ensuring high levels of confidentiality for investors. This robust privacy protection is complemented by strong banking privacy laws, minimal disclosure requirements for company directors and shareholders, and rigorous data protection policies. These measures make St. Kitts and Nevis a secure haven for crypto investors who prioritise confidentiality.

St. Kitts and Nevis

Obtaining a Digital Assets Financial License

MiCA Regulation, effective since June 2023, will apply to issuers of ARTs from June 30, 2024. The Malta Financial Services Authority (MFSA) has introduced a new application form for individuals and entities wishing to offer ARTs to the public or admit them to trading in Malta, seeking authorization under Article 18 of the MiCA Regulation.

Prospective applicants should consult the MFSA's Authorisations Process Service Charter, which details the application process stages and the Authority's expectations.

To operate legally in St. Kitts and Nevis, entities involved in virtual assets must obtain a Digital Assets Financial License. The following information must be provided:

- The name and address of the applicant's registered office.

- The address of the person's place of business in St. Kitts and Nevis.

- A statement explaining the nature and scope of the business activity. This should include, but is not limited to:

- Date of commencement of operations.

- Website address.

- The countries in which the applicant trades or intends to trade cryptocurrencies.

- Details of the address and any person authorized to represent the applicant in St. Kitts and Nevis.

- The name and address of any affiliated companies within and outside St. Kitts and Nevis.

- The names and addresses of directors, significant shareholders and beneficial owners.

- The anti-money laundering and combating the financing of terrorism manual.

- The name and qualifications of the compliance officer.

- Data protection, security and confidentiality policies and procedures.

- The protection of cybersecurity.

- A sample of the initial prospectus offered.

- A risk assessment of the services and products to be offered.

In addition, the application shall be accompanied by the following:

- Proof of payment of the application fee.

- Certified copies of the by-laws.

- Proof of registration of the company in St. Kitts and Nevis.

The Financial Services Regulatory Commission may require additional information to approve the license. The Commission needs to ensure that all officers, executives, significant shareholders, beneficial owners, directors or managers are fit and proper to perform their functions. To ensure this, it will require:

- Financial solvency.

- Academic qualifications or experience in the virtual asset business.

- Capacity to offer virtual assets with knowledge, equity and ethics.

- Reputation, financial integrity and probity.

- Clarification as to whether the interests of a client of the applicant will be threatened by any director, officer or shareholder.

- Clarification as to whether any of the above are engaged in improper or deceptive business practices

St. Kitts and Nevis

Strategic Advantages

St. Kitts and Nevis also offers a highly attractive Citizenship by Investment Program, which has drawn numerous high-profile investors. This program, combined with the jurisdiction's progressive stance on crypto regulation, creates a favourable environment for tech entrepreneurs and investors. The ability to operate without paying income or capital gains tax on cryptocurrency-related activities further solidifies St. Kitts and Nevis as a top destination for crypto investments.

Panama

Legal Framework

Panama has long been known as a hub for financial services and corporate structuring due to its favourable tax regime, robust banking system, and strong privacy laws. However, the landscape for cryptocurrency and digital assets in Panama is currently in a state of flux. While there is significant interest in the cryptocurrencies space, the lack of clear regulatory framework presents both opportunities and challenges for investors and businesses.

Panama currently lacks specific regulations governing cryptocurrencies and digital assets. Efforts to regulate the market, such as Bill 697 of 2022 (Bill 697-2022), have faced significant hurdles. Bill 697-2022 aimed to provide a comprehensive legal framework for the use and holding of crypto-assets, virtual asset service providers, and issuers of virtual assets. It sought to promote financial inclusion, foster innovation in financial services, and ensure regulatory and fiscal certainty.

Key objectives of Bill 697-2022 included:

- Legal and Regulatory Certainty: Establishing clear guidelines for the use and holding of crypto-assets and the operation of virtual asset service providers.

- Financial Inclusion: Enhancing access to financial services for underserved populations through the use of digital assets.

- Innovation and Competition: Encouraging the development of a robust ecosystem for financial services innovation and increasing competition among service providers.

Despite these goals, the bill was ultimately declared unconstitutional by the Supreme Court of Justice in October 2022. Consequently, Panama remains a grey market for cryptocurrencies, with no clear regulatory framework. Both the Superintendence of Banks of Panama (SBP) and the Superintendence of the Securities Market (SMV) have stated that they do not supervise cryptocurrencies, leaving crypto exchanges and wallets without a designated regulator.

Panama

Tax Considerations

Panama operates a territorial tax system, meaning that only income generated within Panama is subject to taxation. This presents significant advantages for cryptocurrency investors and businesses, as earnings from crypto activities conducted outside Panama are not taxed.

Key tax benefits include:

- No Capital Gains Tax: Profits from the buying and selling of cryptocurrencies are not subject to capital gains tax if the transactions occur outside Panama.

- Exemption on Offshore Income: Income earned from crypto activities outside Panama is exempt from local taxation.

- No Withholding Tax: There is no withholding tax on interest, dividends, or royalties earned from crypto investments.

These tax advantages make Panama an attractive jurisdiction for international crypto investors looking to optimise their tax strategies.

Panama

Privacy Standards

Privacy is a cornerstone of Panama's financial and corporate environment. Panama corporations offer several privacy features that are particularly appealing to crypto investors:

- Bearer Shares: Panama corporations can issue shares in bearer form, allowing for enhanced anonymity as the ownership is not recorded.

- Confidentiality: The names of shareholders are not publicly disclosed, and only the Articles of Incorporation are filed publicly.

- Remote Meetings: Directors and shareholders can hold meetings anywhere in the world, including digitally, ensuring privacy and convenience.

Seychelles

Legal Framework

Beyond its appeal to tourists, Seychelles is a fast-emerging centre for cryptocurrency businesses. This transformation is largely fuelled by favourable business-oriented policies that encourage growth and innovation. Approximately 20% of all crypto exchanges in the industry are now incorporated in the country, with prominent players like HTX (formerly Huobi), BitMEX, and KuCoin among them.

The Seychelles Financial Services Authority (FSA) oversees non-bank financial institutions and has introduced the Seychelles Crypto License. This license allows crypto firms that meet specific criteria to operate within the country. Prospective companies must be incorporated in Seychelles, maintain a physical presence, comply with Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) regulations, and have robust transaction monitoring systems.

To obtain a Seychelles Crypto License, companies must also register as a Virtual Asset Service Provider (VASP) with the FSA. The Seychelles has 4 types of licenses issued to VASPs depending on their business models and services:

- Virtual Asset Wallet Providers – categorised into Custodial and Non-Custodial

- Custodial Services include the transfer and safekeeping of virtual assets, initial coin offerings (ICOs), and non-fungible tokens (NFTs) on behalf of clients.

- Non-Custodial Services focus on the management and facilitation of client control over these instruments without directly holding or storing them.

- Virtual Asset Exchanges – includes Transfer, Conversion and Exchange

- Undertake the transfer, conversion and exchange of virtual assets, ICOs, NFTs and fiat currencies on behalf of clients.

- Virtual Asset Broking – includes Intermediary and Facilitation

- Facilitate the exchange and safekeeping of virtual assets, ICOs, NFTs and fiat currencies through virtual asset exchange and virtual asset wallet providers on behalf of clients.

- Virtual Asset Investment Providers – involves Investment and Funds management and Advisory services.

- Manage client portfolios and providing investment advice on virtual assets, ICOs, NFTs and fiat currencies.

To apply for a Seychelles Crypto License, one must provide:

- Business Plan: Provide a business plan detailing the scope of virtual asset activities and services offered.

- Corporate Documentation: Information on corporate structure, including directors, shareholders, and ultimate beneficial owners, along with certified identification and proof of address.

- AML/CFT Compliance: Demonstrate adherence to Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) guidelines with an AML/CFT manual and related policies.

- Data Protection Policies: Outline measures for data protection and cybersecurity.

- Financial Documentation: Provide evidence of sufficient financial resources, including audited financial statements or other proof of capital.

- Fit and Proper Test: Pass a suitability assessment for key persons, including background checks and qualification verification.

- Local Presence: Establish a registered office or physical presence in Seychelles.

- Ongoing Compliance Commitment: Commit to ongoing compliance with Seychelles regulations, including regular reporting and adherence to updates.

Seychelles

Tax Considerations

Seychelles imposes no tax on corporations that do not conduct their business activities within the Seychelles territory. On the other hand, Corporate taxes on companies operating in Seychelles range from 15% on the first one million Seychellois rupees (€69,749) to 25% for returns exceeding this amount. Notably, Seychelles does not impose VAT and capital gains tax on profits from the sale or exchange of cryptocurrencies.

Seychelles

Privacy Standards

The International Business Company Law, shortly known as the IBC Act, is the main documents which provides for confidentiality with respect to the following:

- Name of shareholders in a Seychelles company

- Name of company directors

- Company's documents

- Minutes of company meetings

- Register of member

- Register of directors

The only documents which are registered with the Companies Registrar and available for the public are the memorandum and articles of association. The financial records of a Seychelles company are confidential, as the country did not sign any agreement related to exchange of tax information and it is not a member of the EU Savings Tax Directive.

Apart from the legislation which provides for confidentiality upon the creation of a company in Seychelles, there are also other ways in which its confidentiality can be established. Among these are nominee services which ensure the protection of the shareholders and directors of a company in Seychelles. Nominee shareholders can be appointed in order to ensure the confidentiality of the beneficial owner of a local company, while nominee directors can be appointed in order to have a local director for the company.

Cayman Islands

Legal Framework

The Cayman Islands is a prominent global financial centre, known for its stability, legal ties to the United Kingdom, tax neutrality, and well-regulated financial services industry. These attributes make it an attractive destination for sophisticated and institutional investors. The jurisdiction's favourable conditions extend to fintech and digital assets businesses, fostering a supportive environment for fund vehicles investing in digital assets, cryptocurrency exchanges, initial coin offerings (ICOs), and decentralized finance (DeFi) protocols.

In May 2020, aligning with the Financial Action Task Force's (FATF) international standards, the Cayman Islands introduced the Virtual Asset (Service Providers) Act, 2020 (the VASP Act). This legislation, phased in two parts, focuses initially on anti-money laundering (AML) regulations and VASP registration, with the second phase addressing licensing and additional matters.

According to the VASP Act, a "virtual asset" broadly refers to a digital representation of value traded or transferred digitally for payment or investment purposes. This definition excludes digital representations of fiat currencies and "virtual service tokens" that lack transferability or exchangeability with third parties.

All entities providing virtual asset services must either obtain a license or register with the Cayman Islands Monetary Authority (CIMA), secure a waiver, or hold a sandbox license. A "VASP" refers to an entity incorporated or registered in the Cayman Islands that provides virtual asset services as part of its business activities. The scope of "virtual asset services" includes:

- Exchange between virtual assets and fiat currencies.

- Exchange between different forms of convertible virtual assets.

- Transfer of virtual assets.

- Custody services involving the safekeeping or administration of virtual assets.

- Financial services related to virtual asset issuance or sales.

According to the VASP Act, a VASP must ensure that its beneficial owners receive approval from CIMA as fit and proper individuals to exercise control or ownership. Except for publicly traded companies, ownership interests or voting rights constituting 10% or more in a VASP cannot be issued or transferred voluntarily without prior approval from CIMA, barring possible exceptions.

VASPs registered or licensed under the VASP Act will need to:

- Prepare audited accounts annually and submit them to CIMA.

- Obtain prior approval from CIMA for the appointment of senior officers or AML compliance officers.

- Provide specific notices to CIMA confirming compliance with AML Laws and data protection laws, ensuring the accuracy of all communications related to the virtual asset service.

- Conduct audits of their AML systems and procedures upon CIMA's request.

- Notify CIMA of any license or registration in another jurisdiction, the opening of an office or establishment of a physical presence in another jurisdiction, or the holding/acquisition of a controlling interest in another entity engaged in virtual asset service.

Cayman Islands

Investment Funds and SIBA

Entities operating as investment funds issuing digital assets may fall under the Mutual Funds Act or the Private Funds Act, requiring registration or licensing. Additionally, under the Securities Investment Business Act (SIBA), entities dealing, arranging, managing, or advising on the acquisition or disposal of digital assets may need to register or obtain a license from CIMA if the digital assets are classified as "securities."

Cayman Islands

Sandbox Licenses and Special Economic Zone

The VASP Act introduces sandbox licenses for innovative fintech services, allowing temporary flexibility and evaluation by CIMA. The Cayman Islands also promotes the Special Economic Zone (SEZ), offering expedited processes for fintech businesses to establish operations, including simplified work permits and office space allocation.

Cayman Islands

Tax Considerations

The Cayman Islands Government does not impose income, inheritance, gift, capital gains, corporate, or withholding taxes related to the issuance, holding, or transfer of digital assets. Entities can obtain a tax exemption certificate, confirming that no future laws will impose taxes on the entity's operations for a specified period, typically 20 to 50 years.

Cayman Islands

Privacy Standards

The Cayman Islands maintains robust privacy protections with no public Ultimate Beneficial Ownership (UBO) register. Public records disclose basic company details like name, incorporation number, and status, but do not reveal shareholder or director identities. Companies can enhance their privacy further by using nominee directors and shareholders. There are no requirements for annual meetings and company documents can be stored outside the jurisdiction.

Concluding Remarks

Offshore Jurisdictions

The offshore jurisdictions of St. Kitts and Nevis, Panama, Seychelles, and the Cayman Islands provide distinct opportunities and challenges for cryptocurrency investors and businesses. Their varied regulatory frameworks, tax benefits, and privacy measures make them important destinations in the global crypto landscape.

For those involved in the digital asset space, staying informed about these regions is crucial for optimising strategies and ensuring compliance. As the industry grows, these jurisdictions will continue to be key players, offering significant advantages while requiring careful navigation of their respective legal environments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.