- within Transport topic(s)

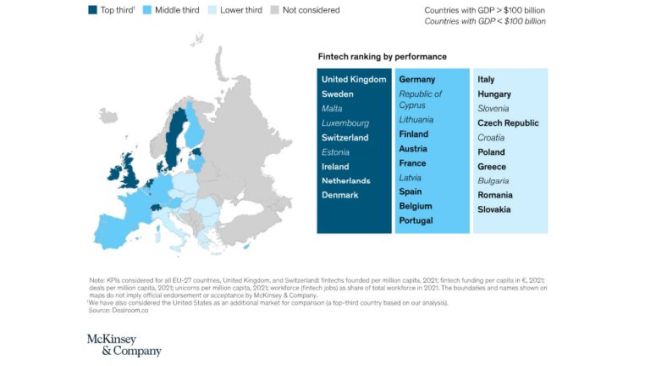

Malta's FinTech sector has been ranked among the top performers by global management consulting firm McKinsey & Company.

The 2022 report looked at three key aspects of the FinTech sector: founding; funding; and scaling. The analysis showed that FinTech activity was growing in all the European countries, describing the growth in "comparatively small economies such as Estonia, Luxembourg and Malta" as being "unexpected pockets of strength".

The report also analysed the potential economic impact if all the European countries were to converge with the countries in the top third – and if they in turn were to reach the level of performance of the United Kingdom. Jobs would increase by a factor of 2.7, while funding would grow by a factor of 2.3.

McKinsey noted that there remained overarching challenges, including market maturity, access to capital, forward-looking regulatory and legal frameworks, talent mobility, scalability across borders, and customer openness.

Click here to download the full report

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.