- within Employment and HR topic(s)

- with readers working within the Pharmaceuticals & BioTech industries

In practice, we have noticed that the existing deposit requirement for assignments to Switzerland in various sectors is also an aspect that is sometimes somewhat neglected. The competent authorities have gained a great deal of experience in this area since its introduction in January 1, 2018.

Foreign companies posting employees to Switzerland who are subject to a generally binding collective labour agreement (CLA) are required to pay a deposit. The basis for the existing deposit obligation in Switzerland is the Federal Council Decree declaring the collective labour agreement of the individual sectors generally binding and the Federal Act on Accompanying Measures for Posted Workers and on the Control of Minimum Wages Regulated in Normal Contracts of Employment (Posted Workers Act).

Why does such a deposit have to be made? The deposit is intended to ensure that all claims of the Joint Professional Commission (PBK) under the collective employment contract, in particular contractual penalties, control and procedural costs, as well as contributions to further training and enforcement costs, are paid.

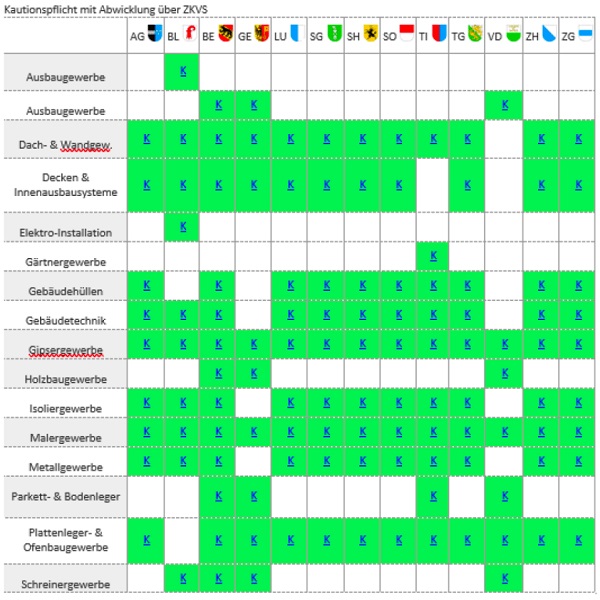

In the table on the next page you can see in which sector and in which canton such a deposit obligation exists. On the homepage of the ZKVS (Zentrale Kautions- und Verwaltungsstelle Schweiz) http://www.zkvs.org you can also download the corresponding information sheets according to the branch.

The deposit must be paid only once. This means that if a deposit has already been made for an order, and if the order has already been completed but the deposit has not yet been repaid, it can be credited.

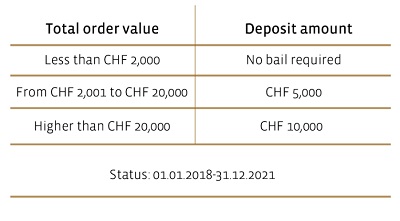

The amount of the deposit is determined by the provisions of the collective labour agreement applicable to the sector in question and the total value of the contract per calendar year. If the total contract value exceeds CHF 2,000, a deposit is payable. As a rule, the amount of the deposit is as follows:

If no proof of the effective amount of the order can be provided, the highest deposit is always due. The deposit can be made either by means of a guarantee certificate or in cash. The deposit paid will be subject to interest at the applicable bank rate and will be paid out after release of the deposit and after deduction of the administrative costs. If the deposit is to be made by means of a guarantee certificate, an irrevocable guarantee declaration must be provided by a bank or insurance company subject to the Swiss Financial Market Supervisory Authority (FINMA). The ZKVS (Central Bonding Administrative Office Switzerland) may, in exceptional cases, also allow guarantee statements from other banks. However, this must be requested in writing. The guaranteed bond must be subject to Swiss law and the place of jurisdiction must also be in Switzerland. The place of jurisdiction is determined by the seat of the joint professional commission.

The deposit must be made before the work begins.

Extract: Deposit obligation with processing via ZKVS website: http://www.zkvs.org

Failure to pay or late payment of the deposit is punishable by a contractual penalty, as it is a violation of the CLA. In addition, failure to comply with this deposit obligation may result in an administrative sanction or a suspension of services.

If a deposit is claimed, or if the total contract value increases, the foreign enterprise must, within 30 days or before starting new work within the scope of the collective agreement, increase the deposit to the original or a higher amount or make a new submission. However, if the deposit is not usedand the total value of the order does not change, no new deposit is required.

The deposit paid can only be refunded if the following conditions are met cumulatively:

- The claims under the collective bargaining agreement such as contractual penalties, control and procedural costs, as well as contributions to training and enforcement costs are duly paid;

- PBK has not found any violation of GAV provisions and all control procedures have been completed.

The earliest date of application for the deposit refund is 6 months after completion of the contract for work. If an application is submitted before the expiry of these 6 months, it will not be processed by the competent body. However, these applications will not simply be deferred and processed ex officio after 6 months. In these cases, the application for restitution must be filed again after expiry. The refund must always be requested in writing.

Example:

to install their chilled ceilings. For the installation of the ceilings, 2 workers have to travel to Zurich for 10 working days.The contract value of the cooling ceilings is CHF 25,000 material costs and CHF 8,000 installation costs. What does the French company have to do for this?

Solution:

1. Retrieving an A1:To use the 10 days in Switzerland, an A1 must be obtained from the French social security authorities for each of the two assembly workers. This confirms that the two employees are still subject to the French social security system during their deployment in Switzerland.

2. Calculation of the Swiss comparable salary

After entering the personal details of the two employees at http://www.gate.bfs.admin.ch/salarium, this gives the comparable Swiss salary. The decisive factor for both persons is the salary of the lower quartile of Swiss men. This salary is CHF 5,200 per month. The Swiss salary will tend to be higher than the French salary, so there will be a salary adjustment. The French gross salary converted into CHF on the basis of 12 monthly salaries is CHF 2,800.

CHF 2'800 French monthly salary

– CHF 5'200 Swiss comparable salary= CHF 2'400 Salary

adjustment

For the 10 days a compensation of CHF 2,400 / 21.66 days x 10 days = CHF 1,108.03 would now have to be paid per person. This involves dividing the salary compensation per month by 21.66 days, which is the average number of working days per month, and multiplying it by the number of effective working days in Switzerland.

3. Obligation to notify

The 10 working days in Switzerland must be reported in accordance with the reporting procedure. The notification must be made 8 calendar days before the first day of operation. It is important that only those days are reported which the persons are working effectively. It must also be noted that the French company and the two employees, each have only 90 days in the calendar year on which the reporting procedure can be used.

4. Working on weekends / night work

In the event that the employees have to work either at night or on Sunday, a separate notification or corresponding authorisation would have to be obtained.

5. Obligation to pay a deposit

In the canton of Zurich, companies belonging to the ceiling and interior finishing systems industry are subject to a collective employment agreement. Consequently, the French company is subject to a deposit obligation. Due to the total contract value of CHF 33,000, the French company must pay a deposit of CHF 10,000 to the Paritätische Berufskommission des Schweizerischen Gewerbes für Decken- und Innenausbausysteme before the two employees start work.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.