Following the adoption of the transfer pricing legislation by Cyprus on 30 June 2022, the Cyprus Government has published, in the Official Gazette, the notification with the content of the local and master files as well as the table of summarised information.

This leaflet provides a summary of the main parts that are required to be included in the reporting files (local file, master file and table of summarised information).

Local file content*

Part I. Local entity

- A description of the management structure of the local entity, a local organisation chart, and a description of the individuals to whom local management reports and the jurisdiction(s) in which such individuals maintain their principal offices;

- A detailed description of the business and business strategy pursued by the local entity;

- Key competitors

Part II. Controlled transactions

- A description of the controlled transactions and the context in which such transactions take place, including amounts of transactions;

- An identification of associated enterprises involved in controlled transactions, and the relationship amongst them;

- A detailed comparability and functional analysis of the taxpayer and relevant associated enterprises with respect to each documented controlled transaction;

- An indication of the most appropriate transfer pricing method, the reasons for selecting that method and important assumptions made in applying this transfer pricing method;

- A list and description of selected comparable uncontrolled transactions (internal or external), including a description of the comparable search methodology and the source of such information;

- A description of the reasons for concluding that relevant transactions were priced on an arm's length basis based on the application of the selected transfer pricing method.

Part III. Financial information

- Annual local entity financial accounts for the fiscal year concerned. Information and allocation schedules showing how the financial data used in applying the transfer pricing method may be tied to the annual financial statements.

Applies to

- Cypriot tax resident persons; and

- Permanent establishments of non-tax resident entities.

Due date

Should be prepared up to the submission day of the income tax return of the local entity and should be updated annually

Master file content *

Applies to

The ultimate or surrogate parent entity of a multinational group with annual consolidated revenue EUR 750 million

Due date

Should be prepared up to the submission day of the income tax return of the parent entity and should be updated annually

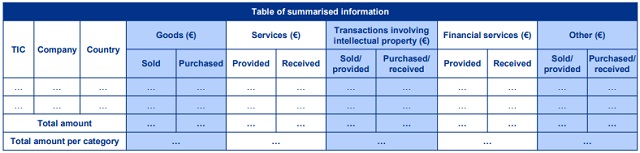

Table of summarised information*

The table of summarised information is illustrated below. It should be prepared and submitted up to the submission day of the income tax return of the local entity and should be updated annually.

The official notification published in the Government Gazette can be found here.

Footnote

* Limited overview of the main sections of the reporting files (local file, master file and table of summarised information) are included in this leaflet. Full requirements to the reporting files are published in the Official Gazette of the Republic of Cyprus on 29 July 2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.