A. INTRODUCTION

On the 13th of March 2012, the Cyprus VAT Authority has launched a scheme making Cyprus one of the most attractive EU jurisdictions for yacht registration. According to this scheme, a Cyprus company can enter into a lease-sale agreement of a yacht with a third party, paying VAT only on a considerably reduced VAT rate than the standard rate which is 19% (as from 13/01/2014), calculated on a percentage of the time that the yacht is deemed to sail within EU waters as is analytically explained below. The effective VAT rate through the use of this scheme can be as low as 1,9%, which is increased to 2,42% when taking into account the required profit condition as it will be explained below.

B. INTERPRETATION OF TERMS - VAT TREATMENT

A lease-sale agreement of a yacht is a contractual arrangement calling for the lessee (user) to pay the lessor (owner) for use of a yacht. In addition, the lessee has the option to acquire ownership of the yacht by the end of the lease agreement at a percentage of the original price.

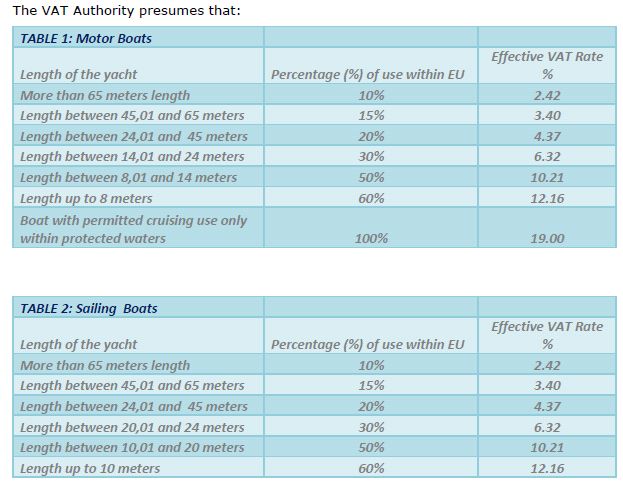

The leasing of a yacht for VAT purposes is considered to be a provision of a service. This kind of service is subject to the standard VAT rate of Cyprus (19%) but only to the extent the lease is taking place within EU waters (please refer to tables 1 and 2 in section D). It should be noted that the lessor of the yacht should be a Cyprus tax resident company registered with the Cyprus Registrar of Companies, whilst the lessee can be any person or company irrespective of their place of residence or establishment.

C. CONDITIONS

In order for the aforementioned VAT treatment to be applicable, ALL the following conditions should be met:

1. The yacht should actually put at the disposal of the customer in Cyprus.

2. The lease-sale agreement of the yacht should be made between a Cyprus company (lessor) and a person or company irrespective of their place of residence or establishment (lessee).

3. The yacht should sail in Cyprus within one month from the date the lease-sale agreement of the yacht becomes effective. An extension to this deadline can only be given by the Cyprus VAT Authority. It is to be noted that the extension cannot exceed the period in which the lessee can exercise his option to buy the yacht.

4. The lessee should initially pay the lessor at least the 40% of the value of the yacht.

5. The lease payments should be made on a monthly basis and the lease agreement should not be less than 3 months and not more than 48 months period.

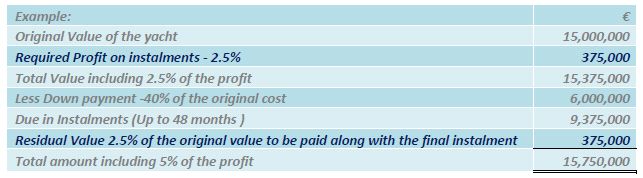

6. The lease agreement should result in profit for the lessor amounting at least to 5% of the yacht's original value. Thus, at the inception of the lease agreement, the total amount of the lease payments on which the VAT is accounted, is increased by the half of the profit i.e. 2.5%. The remaining 2.5% of lessor's profit will be paid along with the final instalment.

7. The lease agreement will grant the lessee the option to buy the yacht at the end of the lease period at a price which must be not less than 2.5% of the original value of the yacht. The last payment made by the lessee to the lessor is subject to VAT 19%.

8. An application along with a certificate determining the value of the yacht the purchase invoice and the lease agreement, should be given in advance to the VAT Authority, requesting approval of the yacht's value and the applicable percentages of its use within the EU.

D. COMPUTATION OF THE PERCENTAGE OF THE LEASE TAKING PLACE IN EU WATERS

Due to the practical difficulties in calculating the exact time the boat sails within EU waters and the time that it sails outside EU waters, the VAT Authority has determined that the percentage of the lease taking place in EU waters will depend:

- upon the type of yacht involved e.g. sailing yacht, motor yacht, and

- upon the length of the yacht concerned

E. VAT PAID CERTIFICATE

Once the lessee becomes the owner of the yacht and VAT thereon has been paid in full, the VAT Authority will issue a Yacht VAT paid certificate in the name of the lessee indicating that VAT has been paid in full.

F. HOW THE SCHEME CAN WORK

By making use of this scheme the effective vat charge payable on the yacht's increased value (including lessor's profit) instead of 19%, can be reduced as low as 2,42%.

For example, if a person would like to buy a motor boat of more than 65 meters length for EUR 15.000.000, in order to take advantage of the scheme the following steps should be taken:

1. He proceeds with the incorporation of a Cyprus company which will buy the yacht in its name.

2. He transfers EUR 15.000.000 for the purchase of the yacht to the Cyprus company i.e. in the form of a shareholder loan.

3. The Cyprus company to enter into a lease agreement (at the capacity of the lessor), for a period up to 48 months with the interested person to use the yacht (the lessee) which in this case can also be the shareholder of the company.

4. Application to the VAT Authority accompanied by documentation supporting the value of the yacht, the purchase invoice and a copy of the lease agreement concluded between the two parties, as prior approval of the yacht's value and the applicable percentages of its use within EU needs to be obtained by the VAT Commissioner.

5. The yacht should sail in Cyprus within one month from the date the lease-sale agreement of the yacht becomes effective.

6. The yacht should actually put at the disposal of the customer in Cyprus.

7. In this case, as the lessee will be the shareholder who provided the original funding for the purchase, the initial deposit of 40% plus the monthly instalments can be set off against the loan. The only real additional cash outflows would be the actual VAT liabilities.

8. The Cyprus company will be liable to pay the Cyprus VAT Authority the VAT amount designated by the VAT Authority as VAT on initial contribution (€228.000) which is due at the inception of the agreement and VAT on monthly instalments (€3,711) which is due on a monthly basis.

9. The lessee may purchase the yacht at the end of the lease period (48 months) for a final consideration of not less than 2.5% of the value of the yacht which will be subject to 19% VAT, thus the effective VAT rate at the end of the lease period is 2.42%.

G. OTHER TAXES

- Stamp Duty Tax

In order to be able to obtain the approval of the VAT Authority to use the above scheme, the lease agreement must be duly stamped.

Stamp duty is calculated on the value of the agreement at 0.15% for the first €170.860 and at 0.2% thereafter, having as ceiling the amount of €17.086 per agreement. The due date for such stamp duty payment is within 30 days from the day of the signing of a document which is considered to be subject to stamp duty.

- Income Tax

The Cyprus company acting as the lessor will need to account for at least 5% profit on the value of the boat. This profit will be taxable at the normal corporation tax rate of 12.5%.

H. CONCLUSION

The proposed scheme provides a very tax competitive and efficient method of owning and enjoying yachts within European Union. Cyprus's ideal location and well developed infrastructure in combination with the favourable tax regime is able to become the most attractive EU jurisdiction for yacht registration.

We are ready to discuss all the aforementioned with you, and provide support for the implementation of the scheme by:

- Incorporating and administrating the Cyprus legal entity which will acquire the boat,

- Drafting the relevant lease agreement,

- Completing and submitting the relevant application with the VAT Authority along with the necessary documentation,

- Completing and submitting the subsequent VAT Reporting,

- Arranging for the relevant VAT payments,

- Communicating with the VAT Authority for any further requirements it may have.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.