- within Corporate/Commercial Law topic(s)

- within Real Estate and Construction topic(s)

1 Deal structure

1.1 How are private and public M&A transactions typically structured in your jurisdiction?

BVI company legislation provides a flexible and non-prescriptive foundation which enables a variety of M&A structures to be utilised. As it currently stands, BVI law does not distinguish between private and public companies, and therefore statutorily prescribed structures may be utilised in both the private and public context.

Mergers and consolidations: Mergers and consolidations both involve the target and purchasing entity merging into one single surviving entity. A statutory merger results in one of the constituent companies being the surviving entity; whereas a statutory consolidation results in the target and the purchasing entity being consolidated into a new company.

Schemes and plans of arrangement: A scheme of arrangement is a statutory process which requires the sanction of the BVI court and the approval of a majority in number of shareholders representing 75% in value present and voting. Once approved by the court, the scheme is binding on all shareholders of the company, which makes a scheme an attractive option in a recommended takeover situation. A plan of arrangement also requires the sanction of the BVI court, but can be proposed to the court only with the prior approval of the directors of the company (and not the shareholders). The court will then prescribe to whom notification must be made and from whom consent must be obtained.

Share sales and asset sales: The most common form of private M&A structure type in the British Virgin Islands is a share sale where the current shareholder(s) sell, and the purchaser(s) purchase, the target's shares. Less common is an asset sale, which involves the purchaser(s) acquiring certain assets from the target rather than assuming all assets and liabilities of the target.

Tender offer (accompanied by a squeeze-out): A tender offer can be used in negotiated or unsolicited transactions. There is no prescribed form that a tender offer must take under BVI law. A purchaser may make a tender offer to shareholders with the squeeze-out of any remaining minority. Subject to the constitutional documents of the company (ie, the memorandum and articles of association), shareholders holding 90% of the outstanding shares entitled to vote may direct the company, in writing, to redeem the shares held by the remaining shareholders. The company must comply with such direction, irrespective of whether the remaining shares are redeemable and irrespective of whether the directors agree with their approach.

1.2 What are the key differences and potential advantages and disadvantages of the various structures?

Mergers and consolidations: With regard to a merger or consolidation, there is a great deal of flexibility as to how the shares of the target can be treated upon merger or consolidation, including the ability to exchange the target shares for shares in the purchaser or debt obligations, or to cancel the target shares in exchange for payment. Shares of the same class can also be treated differently. Subject to the company's constitutional documents, a merger or consolidation can be approved by director and shareholder resolutions typically requiring a simple majority. Shareholders that vote against the merger will be entitled to have their shares repurchased for fair market value in accordance with their statutory dissent rights (please see question 6.3 for further information on dissent rights).

Schemes and plans of arrangement: A scheme of arrangement requires a lower percentage of votes of shareholders than the compulsory redemption (squeeze-out) structure. Once a scheme of arrangement is approved, it is binding on all members, providing certainty in the sense that the dissent rights of shareholders apply only if expressly permitted by the court. The applicable statutory provisions do not prescribe the threshold of shareholder votes which must approve the plan of arrangement, which enables the directors of the BVI company to submit to the court a threshold which they think is appropriate. Given that both a scheme and plan of arrangement are court-sanctioned processes, obtaining court approval can significantly lengthen the process; but it also mitigates the risk of the transaction being subsequently challenged.

Share sales and asset sales: If the company has a large number of shareholders, structuring the transaction as a share sale and purchase does not carry the benefit that a scheme of arrangement carries in the sense of binding all shareholders to the sale. In the case of an asset sale, any disposal by a BVI company of more than 50% of its assets requires shareholder approval (by a simple majority) and shareholders are entitled to dissent from such a disposal (further discussed in question 6.3), unless the relevant BVI statutory provisions have been disapplied pursuant to the constitutional documents of a BVI seller or the sale is carried out in the ordinary course of business.

Tender offer (accompanied by a squeeze-out): In a tender offer accompanied by a squeeze-out, the BVI company must comply with the compulsory redemption on instructions from the shareholder holding 90% of the issued shares by giving written notice to each shareholder whose shares are to be redeemed; but the statutory provisions do not specify any further requirements for the redemption. This flexible procedure means that once the 90% threshold is met, complete control can be transferred relatively quickly. Shareholders can exercise dissent rights (further discussed in question 6.3), but this will not delay the point at which ownership of the remaining shares is transferred.

1.3 What factors commonly influence the choice of sale process/transaction structure?

Key factors that influence structuring in the BVI include:

- whether the BVI company is listed on a stock exchange or held privately;

- the number of shareholders in the BVI target and their willingness to sell;

- regulatory/licensing considerations where the target is regulated in the British Virgin Islands;

- tax efficiency;

- timing considerations; and

- applicable approvals and/or consents required.

2 Initial steps

2.1 What documents are typically entered into during the initial preparatory stage of an M&A transaction?

Documents typically entered into during the initial preparatory stage of an M&A transaction will generally follow standard onshore protocols. Depending on the transaction structure, a non-disclosure agreement may be entered into to protect the confidentiality of the transaction and the target's business and lock-up agreements. Also depending on the structure, a ‘heads of terms' may be agreed among the parties together, which outlines the key terms and conditions of the transaction.

2.2 Are break fees permitted in your jurisdiction (by a buyer and/or the target)? If so, under what conditions will they generally be payable? What restrictions and other considerations should be addressed in formulating break fees?

Break fees are permitted and not restricted under BVI law. The conditions in which break fees are payable follow onshore trends (and the exchange rules on which the shares of the BVI company are listed, if applicable).

2.3 What are the most commonly used methods of financing transactions in your jurisdiction (debt/equity)?

The method of financing M&A transactions varies depending on a number of factors, including the value of consideration and the purchaser's circumstances. Cash, debt and/or equity are all commonly used forms of consideration in M&A transactions involving a BVI target. However, if the BVI company is a regulated fund under the Securities and Investment Business Act, 2010, consideration must be in cash unless the BVI Financial Services Commission has consented in writing or where permitted under the regulatory code issued by the BVI Financial Services Commission.

2.4 Which advisers and stakeholders should be involved in the initial preparatory stage of a transaction?

Save for a hostile situation, we suggest that the legal, accounting and financial advisers be involved in the initial preparatory stages of an M&A transaction in order to advise on the most appropriate structuring from the outset. The key stakeholders involved depend on the structure type and confidentiality of the deal, but we would typically see the seller and purchaser in a share or asset sale context, and the bidder and target in the context of a recommended bid in a takeover situation.

2.5 Can the target in a private M&A transaction pay adviser costs or is this limited by rules against financial assistance or similar?

There is no prohibition under BVI law on a BVI target giving assistance for the purchase of its own shares. Subject to the directors' fiduciary duties and the directors acting in the best interests of the BVI target, it is possible for the BVI target to give financial assistance and pay adviser fees in connection with the transaction.

3 Due diligence

3.1 Are there any jurisdiction-specific points relating to the following aspects of the target that a buyer should consider when conducting due diligence on the target? (a) Commercial/corporate, (b) Financial, (c) Litigation, (d) Tax, (e) Employment, (f) Intellectual property and IT, (g) Data protection, (h) Cybersecurity and (i) Real estate.

(a) Commercial/corporate

Buyers should conduct the usual diligence of the target's:

- constitutional documents, including its memorandum and articles of association and statutory registers, and any shareholders' agreements; and

- commercial contracts entered into by the target to check for any change of control provisions.

One point which buyers should be aware of is that the register of members of BVI companies is prima facie evidence of the matters set out therein (ie, the register of members will raise a presumption of fact on the matters set out therein unless rebutted), and a shareholder registered in the register of members shall be deemed, as a matter of BVI law, to have legal title to the shares as set against its name in the register of members. The register of members is not publicly available for a BVI company and will need to be provided by the target as part of the due diligence process, which would be highly unlikely to be provided on a hostile bid.

(b) Financial

There are no BVI-specific points relating to financial due diligence and buyers should conduct the usual checks in this regard.

(c) Litigation

Searches of the BVI courts are routinely carried out as part of the due diligence exercise to determine whether the BVI target has been involved in any local litigation (past or ongoing cases).

(d) Tax

The British Virgin Islands currently has no income, corporate or capital gains tax, and no estate duty, inheritance tax or gift tax. Other than stamp duty, there is no registration, documentary or any similar taxes or duties of any kind payable in the British Virgin Islands in connection with the signature, performance or enforcement by legal proceedings of any BVI law-governed documents.

(e) Employment

The Labour Code 2010 is the key law governing the terms and conditions of employment in the British Virgin Islands and employment contracts for any local employees must comply with minimum levels of protections provided under this law.

(f) Intellectual property and IT

The Trade Marks Act establishes a BVI Register of Trade Marks and the Patents Act provides for a BVI Registry of Patents.

(g) Data protection

There is no formal legislation regulating data protection in the British Virgin Islands. The BVI government has pledged that comprehensive data protection legislation based on internationally recognised standards will be enacted in the near future. Draft legislation is currently in circulation. BVI courts recognise and subscribe to the common law duties of confidentiality and privacy, and English common law is persuasive, although not binding, in the British Virgin Islands. As a result, while there is no overriding personal data protection legislation in the British Virgin Islands, all entities that manage and maintain personal data will be subject to the common law duty of confidentiality described above.

(h) Cybersecurity

The Computer Misuse and Cybercrime Act, 2014 prohibits, among other things, the unauthorised access and use of data held on a computer or any computer service, and the knowing disclosure of passwords or other means of access to a computer, with a view to causing loss or gain, or for any unlawful purposes. Neither this legislation nor any other legislation in the British Virgin Islands contains any mechanism or requirement to report data security breaches. However, notification is recommended where there is a risk of harm to the data subject as a result of the breach, not least from a relationship management perspective.

(i) Real estate

Title to real estate is evidenced by registration at the BVI Land Registry, which is open to public inspection and is the primary source of information on any real estate due diligence in the British Virgin Islands.

3.2 What public searches are commonly conducted as part of due diligence in your jurisdiction?

The following public searches are commonly conducted as part of due diligence in the British Virgin Islands:

- the public records on file and made available for inspection at the office of the Registrar of Corporate Affairs in the British Virgin Islands; and

- the record of proceedings on file with, and made available for inspection at, the High Court of Justice, Road Town, Tortola, in respect of the BVI company of each of the Civil Index Book and the Commercial Book, maintained by the British Virgin Islands High Court Registry.

3.3 Is pre-sale vendor legal due diligence common in your jurisdiction? If so, do the relevant forms typically give reliance and with what liability cap?

Pre-sale vendor legal due diligence is common in the British Virgin Islands. Reliance on legal due diligence and liability caps generally follow onshore standards.

4 Regulatory framework

4.1 What kinds of (sector-specific and non-sector specific) regulatory approvals must be obtained before a transaction can close in your jurisdiction?

Certain statutory provisions found in the Securities and Investment Business Act must be considered. For example, if a BVI regulated fund is involved in M&A activity, prior written approval from the BVI Financial Services Commission is required before a person owning, holding or acquiring a significant interest in a BVI regulated fund can sell or dispose of its interest in a regulated fund. A BVI regulated fund requires the prior approval of the BVI Financial Services Commission before acquiring a subsidiary. Similar provisions apply under the Insurance Act, 2008 in respect of a BVI company carrying on insurance business. A BVI bank or trust company licensed under the Banks and Trust Companies Act, 1990 must also comply with statutory provisions; for instance, no shares in a bank or trust company can be disposed of without the prior approval of the BVI Governor in Council.

4.2 Which bodies are responsible for supervising M&A activity in your jurisdiction? What powers do they have?

There is currently no body responsible for supervising M&A activity in the British Virgin Islands. The BVI Business Companies Act 2004 (as amended) (BCA) is the primary statute that governs BVI companies. The BVI Business Companies (Amendment) Act, 2012 permits the Cabinet of the British Virgin Islands (on the advice of the BVI Financial Services Commission) to make regulations concerning the application of the BCA to BVI companies listed on foreign exchanges. There is no stock exchange located in the British Virgin Islands and there is no BVI takeover code applicable to BVI companies listed on foreign exchanges. The British Virgin Islands is a member of the International Organisation of Securities Commission and the Growth and Emerging Markets Committee.

4.3 What transfer taxes apply and who typically bears them?

As a tax-neutral jurisdiction, the British Virgin Islands operates a zero-rated income tax regime for all entities incorporated in the British Virgin Islands. There is no capital gains tax payable on any gains realised with respect to any shares, debt obligations or other securities for a BVI company. The transfer of shares in a BVI company will attract BVI stamp duty only where that entity holds, directly or indirectly, real estate situated in the British Virgin Islands.

5 Treatment of seller liability

5.1 What are customary representations and warranties? What are the consequences of breaching them?

Warranties and representations relating to power, authority and title are typically regarded as fundamental and a seller would be hard pressed not to include such warranties in a sale and purchase agreement. Business warranties are generally included as a result of issues encountered vis-à-vis the due diligence process.

Damages are the usual remedy for a breach of warranty; such damages are calculated on a contractual basis and aim to put the claimant in the position it would have been in if the warranty had been true. A claim for misrepresentation may also be brought in the event of a breach of a representation; the remedies for such claim include rescission of the contract and damages. It is common for the purchase agreement to impose caps and/or hurdles on a seller's liability for warranty claims.

5.2 Limitations to liabilities under transaction documents (including for representations, warranties and specific indemnities) which typically apply to M&A transactions in your jurisdiction?

Common mechanisms in which a seller will seek to limit its liability include:

- a maximum value cap on liability for breach of warranty;

- a minimum value in which a purchaser can claim for breach of warranty and an aggregate value in which a purchaser can claim for breach of warranty;

- a limit on the timeframe within which a purchaser can bring a claim for breach of warranty; and

- seller-friendly disclosure.

5.3 What are the trends observed in respect of buyers seeking to obtain warranty and indemnity insurance in your jurisdiction?

Trends observed in respect of buyer warranty and indemnity insurance in the British Virgin Islands generally follow onshore trends.

5.4 What is the usual approach taken in your jurisdiction to ensure that a seller has sufficient substance to meet any claims by a buyer?

Financial guarantees, holdbacks and escrow arrangements are common mechanisms to support a seller's obligation to meet warranty and indemnity claims made by a buyer.

5.5 Do sellers in your jurisdiction often give restrictive covenants in sale and purchase agreements? What timeframes are generally thought to be enforceable?

Restrictive covenants such as non-solicitation and non-compete covenants may feature in the sale and purchase agreement, depending on the commercial nature of the transaction. Timeframes generally thought enforceable in the British Virgin Islands with respect to enforceability of restrictive covenants follow English common law principles.

5.6 Where there is a gap between signing and closing, is it common to have conditions to closing, such as no material adverse change (MAC) and bring-down of warranties?

Conditions to closing are common on transactions where there is a gap between signing and closing. However, we are increasingly seeing these conditions limited to fundamental matters such as regulatory and shareholder approval. In line with the increasing onshore trend, we often see MAC clauses being heavily negotiated.

6 Deal process in a public M&A transaction

6.1 What is the typical timetable for an offer? What are the key milestones in this timetable?

Mergers and consolidations: The timetable for a merger or consolidation will be dictated by the approval and notice requirements set out in the BVI company's constitutional documents. Once approved by the directors and shareholders of the BVI company, the articles of merger or consolidation, along with the plan of merger attached, are then signed by each constituent company and filed with the Registrar of Corporate Affairs (together with the amended memorandum and articles of association, if any, in the case of a merger, or the proposed new memorandum and articles of association in the case of a consolidation). If the Registrar of Corporate Affairs is satisfied that the requirements of the Business Companies Act (BCA) have been complied with, the Registrar will then register the articles of merger or consolidation and issue a certificate of merger or consolidation. For a premium filing fee of $500, the Registrar of Corporate Affairs will process the filing within four hours. Otherwise, the processing can take two to three business days. The effective date of a merger or consolidation is the date on which the articles of merger or consolidation are registered by the Registrar of Corporate Affairs or such later date as may be specified in the articles of merger or consolidation not exceeding 30 days after the date of registration.

Schemes and plans of arrangement: An indicative timetable setting out the major steps is set out below:

- Day 1: File draft petition/summons for directions.

- Day 21: Directions hearing (depends on court availability).

- Day 25: Despatch composite plan or scheme document.

- Day 55: Shareholder meeting to approve the plan or scheme.

- Day 56: File chairman's report of the meeting.

- Day 66: Petition hearing to sanction the plan or scheme.

- Day 69: Effective date – file court order with Registrar of Corporate Affairs.

Share sales and asset sales: The timetable for a share sale or asset sale will be dictated by the approval and notice requirements set out in the BVI company's constitutional documents and, in the case of any regulated entities, any other requisite regulatory approvals. A transfer of shares is effective upon the date entered in the BVI company's register of members. As there are no corporate filing or notice requirements for unregulated companies, a share transfer can be affected on a same-day basis.

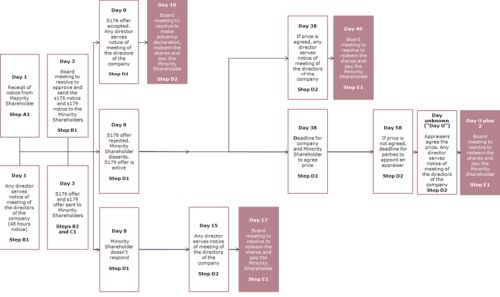

Tender offer (accompanied by a squeeze-out): BVI law does not specify a timetable that must be followed on a tender offer. Below is an indicative timeline of the steps of a compulsory redemption (showing best and worst-case outcomes) for a BVI company whose memorandum and articles of association provide for 48 hours' notice of redemption.

6.2 Can a buyer build up a stake in the target before and/or during the transaction process? What disclosure obligations apply in this regard?

Stake building is not restricted under BVI law. In general, and before announcing a bid, the BVI law does not impose any disclosure requirements or restrictions prior to the announcement of the bid. If the BVI target is regulated, however, then certain approvals may need to be sought under the Securities and Investment Business Act 2010, the Banks and Trusts Companies Act, 1990 or the Insurance Act, 2008.

6.3 Are there provisions for the squeeze-out of any remaining minority shareholders (and the ability for minority shareholders to ‘sell out')? What kind of minority shareholders rights are typical in your jurisdiction?

As mentioned in questions 1.1 and 1.2, compulsory redemption or squeeze-out is permitted pursuant to Section 176 of the BCA where a shareholder (or shareholders acting in concert) holding 90% of the votes of the issued shares in the target instruct the target to redeem the remaining 10%. Once that demand is made, the target must redeem the shares on the terms set by the majority shareholder(s). The majority shareholder(s) can exercise this power at any time and it applies irrespective of whether the shares are, by their terms, redeemable.

As touched upon in question 1.2 and pursuant to Section 179 of the BCA, upon a squeeze-out, shareholders are entitled to dissent and claim fair value for their shares. Shareholders are also entitled to dissent and claim fair value:

- in the context of:

-

- a merger (where the shareholder is a shareholder of the absorbed entity); or

- an arrangement (where permitted by the BVI court); or

- where a BVI company disposes of more than 50% of its assets (subject to certain exceptions).

The dissent process is relatively quick and finite; and upon formal notice of a shareholder's intent to dissent, the shareholder ceases to have shareholder rights, save for the right to be paid fair value for its shares by the BVI company. There is a prescribed statutory timeframe in which such fair value is to be agreed between the shareholder(s) and the BVI company; but if there is no agreement, the value is to be determined by joint appointed appraisers.

6.4 How does a bidder demonstrate that it has committed financing for the transaction?

Bidder financing arrangements generally follows onshore trends.

6.5 What threshold/level of acceptances is required to delist a company?

The threshold/level of acceptances required to delist a BVI company will be subject to the rules imposed by the relevant stock exchange on which the shares of the BVI company are listed.

6.6 Is ‘bumpitrage' a common feature in public takeovers in your jurisdiction?

Trends such as ‘bumpitrage' will be influenced by the location of the stock market on which the shares of the BVI company are listed.

6.7 Is there any minimum level of consideration that a buyer must pay on a takeover bid (eg, by reference to shares acquired in the market or to a volume-weighted average over a period of time)?

There are no BVI laws applicable. Minimum levels of consideration may be subject to the rules imposed by the stock market on which the shares of the BVI company are listed.

6.8 In public takeovers, to what extent are bidders permitted to invoke MAC conditions (whether target or market-related)?

We are not aware of MAC conditions being tested in the British Virgin Islands (in the context of public takeovers), but it is likely that the approach adopted by the Takeover Panel in the United Kingdom would be followed in the British Virgin Islands. The Takeover Panel's recent refusal to allow Brigadier Acquisition Company Limited to rely on a MAC condition when the impact of the COVID-19 pandemic became apparent after Brigadier's announcement of a firm intention to make an offer for Moss Bros Group PLC confirms that MAC conditions continue to be very difficult for bidders to invoke in the United Kingdom, with such approach likely to be followed in the British Virgin Islands.

6.9 Are shareholder irrevocable undertakings (to accept the takeover offer) customary in your jurisdiction?

There are no restrictions under BVI law on obtaining prior irrevocable undertakings from shareholders to commit to a transaction.

7 Hostile bids

7.1 Are hostile bids permitted in your jurisdiction in public M&A transactions? If so, how are they typically implemented?

Hostile bids are permitted and typically implemented by way of a merger. Due to the need for cooperation of the BVI target for the majority of the acquisition structures listed in question 1.1, they are not common with respect to BVI companies (eg, the consent of the target board is required on both a merger and scheme of arrangement). In practice, the purchaser would likely need to rely on the squeeze-out mechanism in order to implement a hostile bid on a BVI target.

7.2 Must hostile bids be publicised?

Whether a hostile bid needs to be publicised will depend on the rules imposed by the stock market on which the shares of the BVI company are listed.

7.3 What defences are available to a target board against a hostile bid?

The defences available to the target board of a BVI listed company are subject to the rules of the applicable exchange. Examples of defences that the target board may utilise include:

- seeking a ‘white knight', where a third party makes an alternative offer for the BVI target; or

- the current shareholders utilising a poison pill mechanism. It is notable that there is no prohibition on the inclusion of poison pill mechanisms in a BVI company's constitutional documents.

8 Trends and predictions

8.1 How would you describe the current M&A landscape and prevailing trends in your jurisdiction? What significant deals took place in the last 12 months?

M&A activity slowed as a result of the effects of COVID-19 during mid to late 2020. Considering the factors of investors with a pent-up demand for investment opportunities, prevailing low interest rates, significant dry powder held by private equity funds and deal-making opportunities arising in the post-COVID-19 environment, we expect to see a rebound in M&A activity in 2021 and into 2022.

8.2 Are any new developments anticipated in the next 12 months, including any proposed legislative reforms? In particular, are you anticipating greater levels of foreign direct investment scrutiny?

The BVI Financial Services Commission circulated a consultation paper in March 2021 (with a 23 March 2021 deadline for comments) in relation to proposals required to ensure full compliance with recommendations made by the Global Forum on Transparency and Exchange of Information for Tax Purposes in relation to the British Virgin Islands' legislative regime affecting issues of taxation and cooperation in effectively exchanging information. This is in addition to ensuring full compliance with the Financial Action Task Force 40 Recommendations. The BVI Financial Services Commission has proposed amendments to the BCA in relation to:

- struck-off companies;

- maintenance of records and underlying documentation; and

- issuing of bearer shares.

While there has been discussion around the introduction of public company regulations, at the time of writing no other relevant legislative reforms in the British Virgin Islands are anticipated for the next 12 months.

9 Tips and traps

9.1 What are your top tips for smooth closing of M&A transactions and what potential sticking points would you highlight?

We recommend engaging local BVI stakeholders (including legal counsel and registered agents) early in the process. The registered agent of the BVI company typically holds the registers of the company (including the register of members). Particularly in share sales, we recommend engaging with the BVI registered agent as soon as possible prior to completion of a share sale involving a BVI target, in order to clear ‘know your client' procedures and ensure the timely release of updated registers on completion of the share sale.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.